Starting or running a restaurant involves juggling countless priorities, but one of the most significant hurdles for restaurant owners is affording essential equipment. From ovens and mixers to walk-in refrigerators and point-of-sale systems, purchasing or leasing this equipment often requires significant financial resources.

Fortunately, there are numerous restaurant equipment financing options available to help you equip your business without derailing your cash flow. This article will guide you through the best financing solutions, how to choose the right lenders and strategies to secure the financing you need.

Why Restaurant Equipment Financing Is Essential

For most small business owners in the restaurant industry, paying for equipment outright is unrealistic. Kitchen equipment like freezers, ovens, and mixers can quickly add up to tens of thousands of dollars. Realizing these costs is especially challenging for startups and new restaurant owners, who often have limited working capital and face other major expenses like rent and staffing.

Financing allows business owners to acquire the tools they need while spreading costs over a manageable period of time. This injection of cash flow ensures that your business runs while preserving cash flow for daily operations.

Restaurant equipment financing is not just for startups — it can also help established businesses upgrade to new equipment, replace outdated tools, or expand into additional locations. By securing financing, restaurant owners can stay competitive in a fast-paced industry.

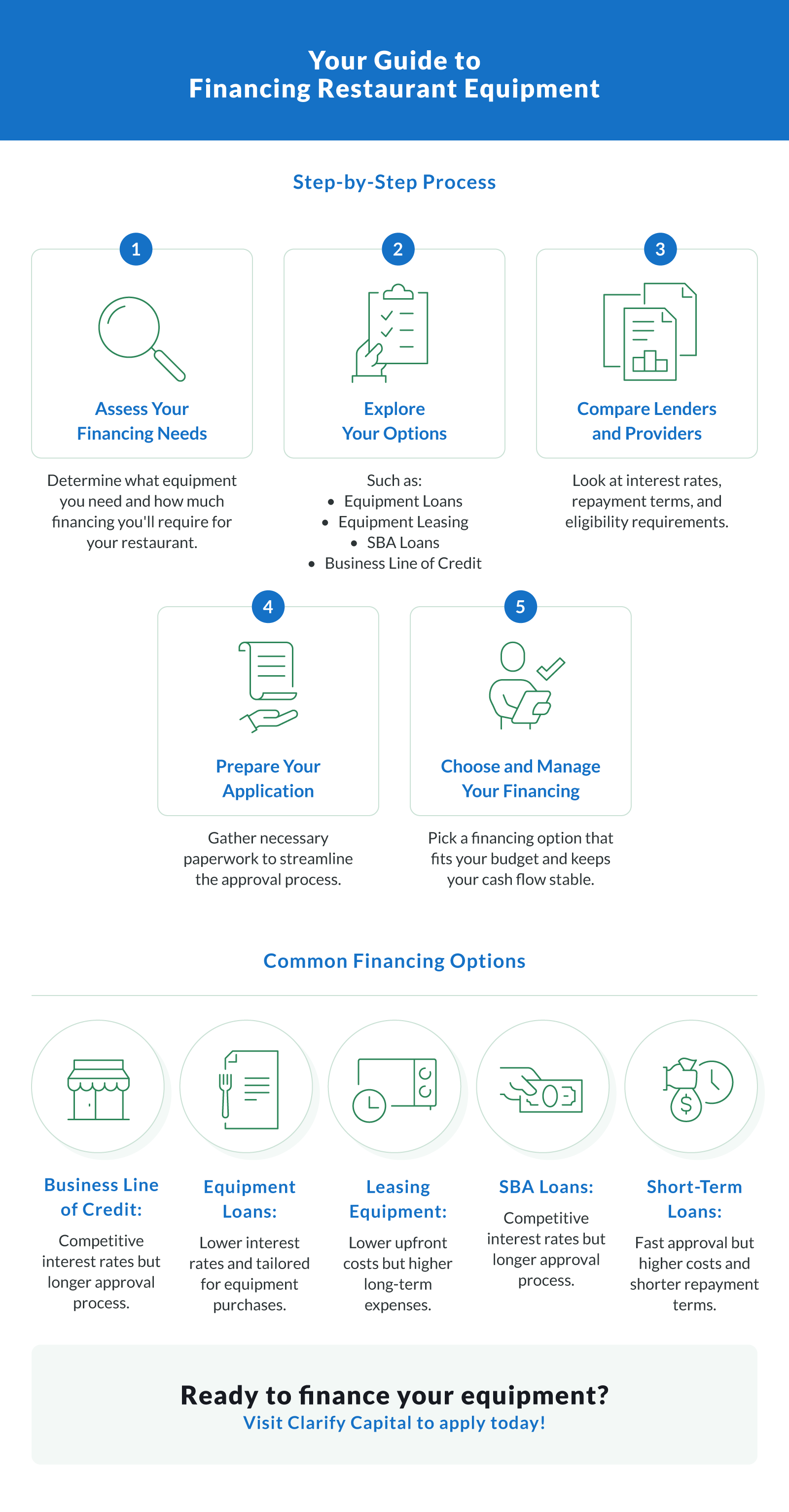

Exploring Restaurant Equipment Financing Options

Different types of financing are tailored to different needs. Whether you’re purchasing a single piece of equipment or outfitting an entire kitchen, there’s a type of financing that can work for your financial situation.

Equipment Loans

How it works: Equipment loans are designed specifically for purchasing restaurant equipment. You receive a loan amount to cover the cost of equipment purchases and repay it over time with monthly payments. These loans often require a down payment and have fixed repayment terms.

Best for: Business owners with good credit who want to purchase high-cost equipment like refrigerators or walk-in freezers

Pros:

- Lower interest rates compared to credit cards or alternative loans

- Equipment serves as collateral, reducing risk for lenders

- Payments may be tax-deductible

Cons:

- Requires a down payment

- Not ideal for borrowers with bad credit or low annual revenue

Equipment Leasing

How it works: Instead of purchasing equipment outright, leasing allows you to rent it for a set period of time. At the end of the lease agreement, you may have the option to purchase the equipment.

Best for: Startups, small businesses with limited cash flow, or borrowers with bad credit

Pros:

- Lower upfront costs

- Flexibility to upgrade to newer models at the end of the lease

- Preserves working capital for other expenses

Cons:

- Higher long-term cost compared to buying

- Lease terms may include penalties or restrictions

SBA Loans

How it works: SBA loans are backed by the Small Business Administration and offered by traditional banks. They come with favorable interest rates and repayment terms.

Best for: Established small business owners with strong financial statements and a clear business plan

Pros:

- Lower interest rates and longer repayment terms

- Backed by government guarantees, reducing lender risk

Cons:

- Lengthy application process

- Requires a good credit score and proof of annual revenue

Business Line of Credit

How it works: A business line of credit provides access to a revolving credit limit. You can draw funds as needed and pay interest only on the amount you use.

Best for: Business owners who need flexible financing to manage cash flow or handle unexpected equipment purchases

Pros:

- Flexible use of funds for a variety of needs

- Only pay interest on what you borrow

Cons:

- Variable interest rates can make costs unpredictable

- Requires strong credit and financial statements

Short-Term Loans

How it works: Short-term loans provide quick access to funds with repayment periods typically ranging from a few months to a couple of years. Online lenders are a common source for short-term loans, offering fast approval and simplified application processes compared to traditional banks.

Best for: Business owners with bad credit or those needing fast financing for immediate expenses

Pros:

- Fast approval and funding

- Less stringent credit requirements compared to traditional banks

Cons:

- Higher interest rates than other financing options

- Shorter repayment terms can put pressure on cash flow

Factors to Consider When Choosing Lenders

Selecting the right lender is just as important as choosing the right type of financing. Here are the key factors to evaluate:

Interest rates. To minimize your overall costs, look for lenders offering lower interest rates. Compare rates from traditional banks, online lenders, and equipment financing companies.

Loan terms. Choose repayment terms that align with your financial situation. Short-term loans often have higher monthly payments, while long-term loans spread costs over more time.

Eligibility requirements. Review the credit score, annual revenue, and down payment requirements. Startups or businesses with bad credit may need to focus on alternative lenders or leasing options.

Reputation and support. Work with financing companies known for good customer service and transparency.

Preparing for the Application Process

Before applying for restaurant equipment financing, gather all the necessary documentation to streamline the process and improve your chances of approval.

Financial statements. Include profit and loss statements, balance sheets, and annual revenue reports.

Business plan. Outline your goals, operations, and how the financing will be used.

Credit score. Be prepared for lenders to review both personal and business credit. Work to improve your score if necessary.

Equipment details. Provide quotes or invoices for the equipment you plan to purchase, whether it’s a single piece of equipment like an oven or a full kitchen setup.

Tips for Managing Your Financing

Once you’ve secured financing, careful management is key to ensuring your investment pays off.

Budget for monthly payments. Plan your cash flow to accommodate loan or lease payments without stretching resources too thin.

Explore tax benefits. Many equipment purchases are tax deductible, helping to reduce your costs.

Avoid overborrowing. Only finance what you truly need to minimize repayment obligations.

Common Pitfalls to Avoid

Navigating restaurant equipment financing can be tricky, and avoiding common mistakes is just as important as choosing the right financing option. Even small missteps can lead to financial strain or unexpected setbacks for your business. By being aware of these pitfalls upfront, restaurant owners can make smarter decisions and protect their bottom line.

Taking on high-interest loans. Avoid financing options with unreasonably high interest rates that can lead to financial strain.

Neglecting lease terms. Always read the fine print of lease agreements to avoid penalties or restrictions.

Ignoring credit impact. Poor personal credit or business credit can limit your options or increase your costs.

Equip Your Restaurant for Success

Securing financing for restaurant equipment can make all the difference for small business owners. By understanding your options and choosing the right lenders, you can get the equipment you need while protecting your cash flow and setting your restaurant up for long-term success.

Ready to explore your financing options? Apply today with Clarify Capital and take the next step toward equipping your business for growth!

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts