The freight and logistics market has shown consistent business growth and is projected to reach $24.46 billion by 2030, but the trucking industry can be a financially intensive venture. To tap into this growth, it's important to maintain a working fleet of trucks and have emergency capital available for unforeseen expenses.

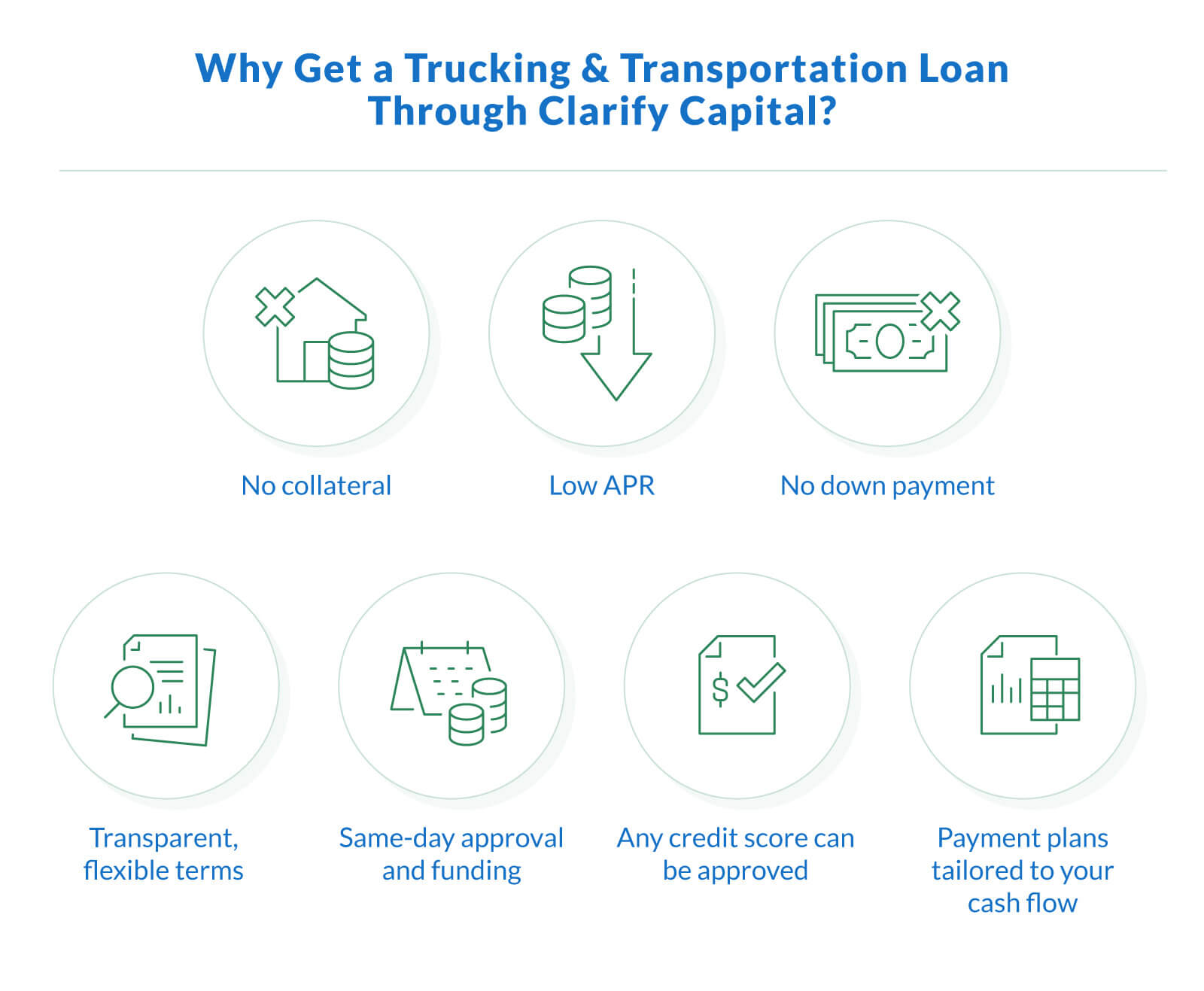

That's where transportation business loans from Clarify can help. Our vast network of over 75 lenders provides the trucking business loans necessary for all aspects of running a top-notch transport business, all on your terms.

Our mission is to help truckers pursue the American dream. Whether you have good or bad credit, we can provide business financing to withstand seasonal business expenses and trends, buy new trucks and logistics tools, maintain your fleet, and hire more trained drivers.

Whether you're launching a new trucking company or scaling an existing fleet, this guide breaks down the best financing options to keep your business moving forward.

| Trucking Business Loan Options: At-a-Glance Comparison of Terms, Uses, and Requirements | |||||

|---|---|---|---|---|---|

| Loan type | Loan amount | Interest rates | Repayment terms | Best for | Eligibility requirements |

| Equipment financing | Up to 100% of equipment cost | 6%–20% | One to seven years (depends on equipment life) | Buying or leasing trucks, trailers, or tools | Proof of revenue, equipment quote, or invoice |

| Short-term loan | $10,000–$500,000 | 7%–30% | Six to 24 months | Emergency repairs, fast working capital | 500+ credit score, $10K+ monthly revenue |

| Business line of credit | $10,000–$5,000,000 | 8%–25% | Revolving | Managing seasonal dips, flexible recurring expenses | 550+ credit score, revenue-based approval |

| Invoice financing | Up to 100% of the invoice value | 10%–35% | Upon customer payment | B2B trucking companies are waiting on invoices | Strong receivables, invoice documentation |

| SBA loans (7a/micro) | Up to $5,000,000 | 5.75%–10% | Five to 25 years | Expansion, working capital, and real estate | Strong credit, two years or more in business, documentation |

| Merchant cash advance | $5,000–$500,000+ | Factor rate of 1.1–1.5 (equivalent to ~15%–50% APR) | Based on daily sales | Unpredictable cash flow or urgent needs | Consistent sales volume, 500+ credit score preferred |

6 Best Business Loans for Trucking and Transportation

Having funded over 10,000 companies, we know that a traditional loan isn't for everyone. We've found the following six financing options to work best for small business owners in trucking and transportation.

Our advisors will walk you through the pros and cons of each loan program to help you identify the best fit for your unique business needs.

1. Equipment Financing for Trucking Companies

An equipment loan is a great fit for transportation business owners seeking to buy or replace trucks and trailers. You can finance up to 100% of the cost of equipment leasing or buying. With competitive rates and minimal paperwork needed, you can secure business funding quickly.

There are no prepayment penalties or collateral requirements apart from the vehicle itself. The structure of the financing is similar to that of consumer car loans.

2. Short-Term Loan for Trucking Companies

When you think of a small business loan in the traditional sense, you are thinking of a term loan. You borrow a fixed amount of money at a specific interest rate that you pay back based on the loan term length.

You don't need any collateral or personal guarantee to get approved for a short-term loan. This type of financing is the most popular option for trucking business loans among transport businesses.

3. Business Line of Credit for Trucking Companies

A business line of credit is a flexible funding option that provides working capital when needed. Lines of credit have competitive interest rates and are structured similarly to a business credit card. You have a maximum limit from which you can withdraw funds and only pay interest on the amount of money you use.

4. B2B Invoice Financing for Trucking Companies

If you run a B2B commercial trucking business, you likely have outstanding invoices that are yet to be paid. Invoice financing, also called invoice factoring, allows you to get up to 100% of the invoice value from a lender as a lump sum payment.

What if your business is not B2B, though? In that case, we recommend equipment financing, term loans, or a business line of credit.

5. SBA Loans for Trucking Companies

The Small Business Administration provides financing backed in part by the agency. The two most popular SBA loan options are the 7(a) and microloan programs. Among all trucking business loans available for transportation companies, SBA 7(a) loans have the longest time to be approved.

This is due to the massive amount of paperwork and credit score requirements by the SBA and its approved lenders and providers. If you need qualifications for an SBA loan, Clarify's advisors can help you streamline the application process.

6. Merchant Cash Advance

A merchant cash advance (MCA) is a flexible financing option that can provide trucking companies with quick access to working capital. Unlike traditional loans, an MCA is structured around your future sales.

You receive a lump sum of cash upfront and repay it through a percentage of your daily credit card transactions or bank deposits, making it ideal for businesses with fluctuating monthly revenue.

How To Get a Trucking Business Loan

Securing trucking business loans requires understanding the application process, meeting eligibility requirements, and choosing the right type of loan for your business needs. Whether you're an owner-operator, expanding your fleet, or covering operational expenses, here's how to improve your chances of getting approved:

1. Determine Your Loan Needs

Identify what you need the loan for — new trucks, equipment financing, working capital, or cash flow management. Different loan options cater to different business needs.

2. Check Your Credit Score and Financials

Most lenders evaluate both personal credit and business credit scores. A strong credit history, steady monthly revenue, and well-maintained bank statements improve your chances of qualifying for low interest rates.

3. Gather Required Documentation

Most loan applications require:

Business plan outlining financial projections

Annual revenue reports and bank statements

Truck financing details if applying for equipment loans

Accounts receivable documentation if using factoring

4. Choose the Right Lender and Loan Type

Explore financing options like SBA loans, business lines of credit, and short-term loans. Some lenders specialize in financing for the trucking industry and offer tailored repayment terms.

5. Submit Your Loan Application

Apply through traditional banks, online lenders, or factoring companies. Some funding options provide same-day approval and funding within 24 to 48 hours.

By preparing in advance, trucking companies can improve approval chances and secure the best loan for their business needs.