Benefits of Small Business Line of Credit

Unlike a traditional loan, revolving credit lines allow you to borrow working capital in increments as needs arise, up to a pre-approved limit. A line of credit allows small business owners to keep operations running smoothly with the ups and downs of seasonal changes and occasional cash flow shortages. Here's why:

Interest only charged on funds used. You only pay interest on the amount you withdraw from the line of credit, and unused funds do not incur any interest. This makes having a flexible financing option critical for managing unexpected business expenses.

Competitive interest rates. Clarify Capital offers competitive APRs on business lines of credit starting at 6%. Both secured and unsecured lines are available, and an unsecured credit line does not require collateral.

Improves your credit score. A line of credit is an excellent way to build your credit rating. Having more credit available and not using it all helps demonstrate responsible credit behavior to reporting bureaus like Experian, Equifax, and TransUnion.

Transparent, clear terms. A business line of credit through Clarify Capital has no prepayment penalties. We walk you through the entire process, including terms, disclosures, and the payment schedule so you can make a well-informed decision.

High approval rate. Business owners in any industry and with any credit score (good or bad) can get approved for a line of credit. This type of funding is suitable for supplementing cash flow and paying for unexpected costs.

Access to funds when needed. You can maintain full control over your cash flow and manage unforeseen expenses. A revolving line of credit provides greater flexibility than a traditional bank loan, and the approval process typically takes only 24 to 48 hours.

Common Types of Business Lines of Credit

There are several types of business lines of credit to consider when looking for business financing. They include:

Secured Business Line of Credit

This type of LOC requires owners to pledge assets as collateral to secure the debt. If the business can't pay the line of credit, the lender will take ownership of the collateral as payment. Lenders may ask for personal or business property. Some lenders may even match the collateral to the type of debt.

For example, since a line of credit is a short-term liability, it might be secured with short-term assets, such as accounts receivable or inventory. As a result, lenders don't often require capital assets, like real estate or equipment, to secure a LOC. Collateral lowers the risk for the lender, so a borrower may get a lower interest rate.

Eligibility requirements: Requires collateral such as commercial real estate, equipment, or accounts receivable. Suitable for businesses with lower credit scores looking for lower interest rates.

Documentation needed: Includes business financial statements, business bank account details, collateral valuation reports, and business tax returns.

Unsecured Business Line of Credit

This type of LOC doesn't require assets as collateral, but most lenders will ask for a personal guarantee and a general lien. In addition, your business must be profitable, and you may need a strong credit history to qualify for an unsecured line of credit.

However, unsecured lines of credit are generally offered in smaller loan amounts with slightly higher interest rates. If you're a company operating for many years and have an excellent business credit rating, though, you may qualify for unsecured credit lines at reasonable rates.

Eligibility requirements: No collateral is required, but higher credit approval standards are required. It typically requires a strong business credit score and consistent annual revenue.

Documentation needed: Includes business credit report, personal credit history, proof of income, revenue statements, and business checking account details.

Real Estate Line of Credit

This type of LOC is a secured loan with real estate as collateral. It is beneficial to small business owners who are willing to offer property as collateral in exchange for better repayment terms and interest rates. The asset could be a commercial property, a farm, or personal property like a home.

Some lenders also accept built-up equity in a real estate asset as collateral, similar to a home equity line of credit (HELOC). The lender will have a claim to that portion of the asset's equity if the business defaults on its loan.

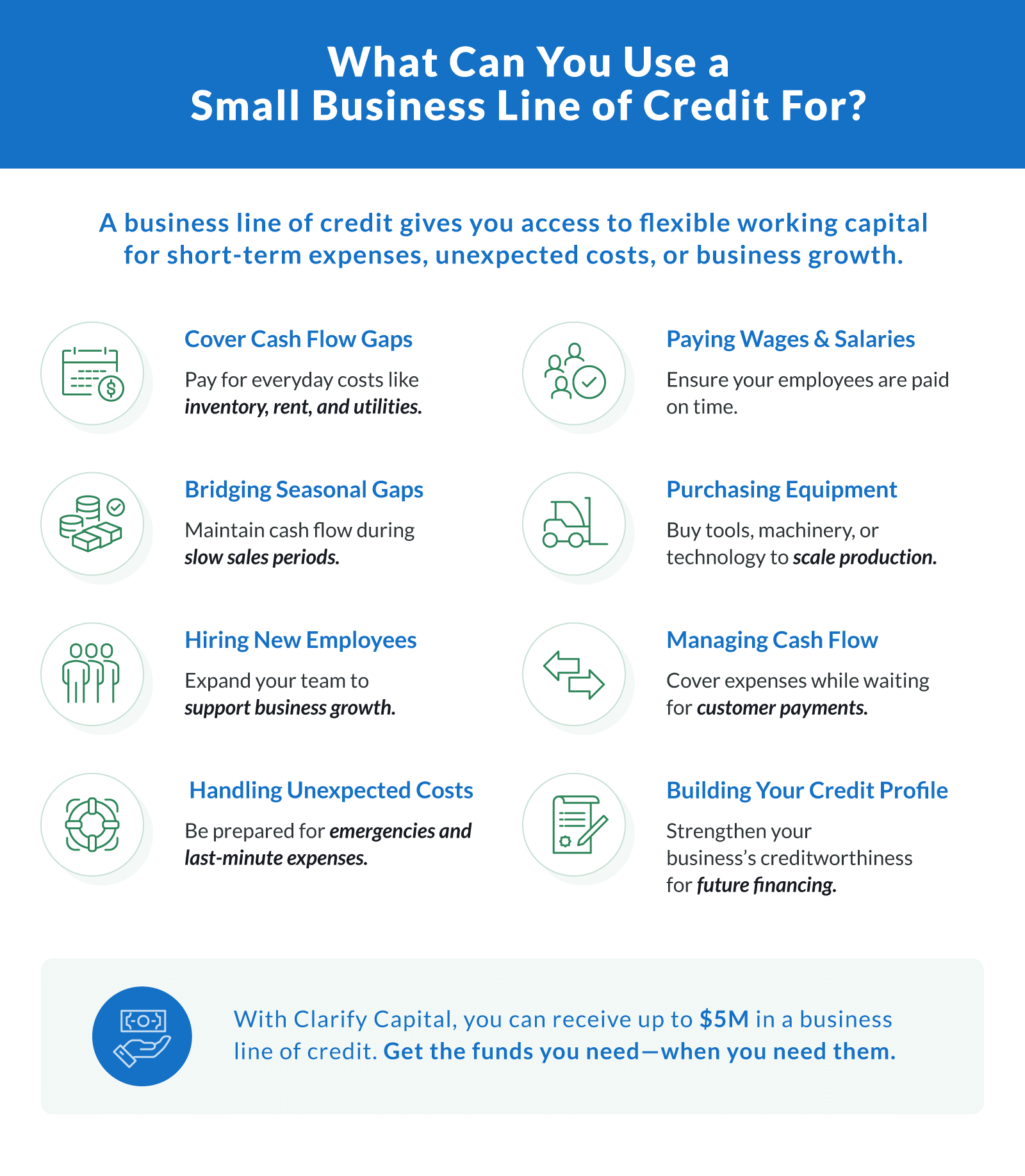

What Can You Use a Small Business Line of Credit For?

Most companies open a business line of credit to have easy access to short-term working capital. Business owners might use the credit to cover operational expenses like buying inventory or paying wages and salaries. For instance, seasonal businesses often use their lines of credit to stay afloat during low sales seasons.

The great thing about a line of credit is its flexibility. You're free to use it for any business purpose, whether it's to manage your cash flow or to expand your operations.

With Clarify Capital, you can receive up to $5M in a business line of credit. Use it to buy a piece of equipment to help you manufacture more products or hire new employees if that's what your business needs to expand.

If you're a small business owner or a new business owner, this type of financing also provides an opportunity for you to build your credit profile. It also gives you access to funds that you can use in case of unexpected expenses. You can even use it to cover gaps in your cash flow when customers don't pay on time. It's a win-win-win.

Strategic Use Cases

A small business line of credit can be more than just a fallback for emergencies. Here are a few high-impact ways to put it to work:

Manage seasonal cash flow fluctuations. Businesses with variable monthly revenue — like retailers or service providers — can use credit during slower seasons to stabilize cash flow.

Bridge accounts receivable gaps. A line of credit can cover expenses while waiting for customer payments to arrive, keeping operations running smoothly.

Finance short-term projects. Use funds to ramp up inventory, cover marketing pushes, or hire temporary staff for new opportunities.

Support startups. New businesses often face uneven revenue early on. A revolving line of credit can offer flexibility without committing to a large lump sum loan.

Using your credit line with intention keeps costs low and ensures that borrowed capital drives business growth.

How To Use a Business Line of Credit Strategically for Growth

A business line of credit isn't just a tool for covering temporary cash flow gaps. It can also be leveraged for strategic growth. Not having enough cash is one of the biggest mistakes that any small business owner could make.

Here's how to make the most of business lines of credit:

Seasonal inventory purchases. Retailers and wholesalers can use credit lines to purchase inventory before peak sales periods, ensuring they have enough stock to meet demand.

Marketing campaigns. Investing in digital advertising, promotions, or a business credit card rewards program can boost brand visibility and attract more customers.

Hiring and payroll flexibility. Expand your workforce or manage payroll during slow months without disrupting operations.

Equipment upgrades. Instead of depleting cash reserves, use a revolving line of credit to upgrade business assets such as office equipment or machinery.

Business expansion. Whether you're opening a new location, renovating, or expanding service offerings, a business line of credit provides flexible financing.

How Does a Small Business Line of Credit Work?

A small business line of credit (LOC) gives your company access to a set amount of funds that you can draw from as needed. It works similarly to a credit card but is tailored for business expenses. Here's how it typically works, step by step:

You apply and get approved for a set credit limit. The lender evaluates your business and assigns a maximum borrowing amount based on your qualifications.

You draw funds as needed. You can withdraw cash, use a linked credit card, write checks, or transfer money to your business bank account — up to your available credit limit.

You repay what you use. As you repay the borrowed amount, those funds become available to use again. Just be sure to make on-time payments and stay within your limit.

You pay interest only on what you borrow. Interest applies only to the amount you draw, not your full credit line. Rates may be fixed or variable, depending on your agreement.

You receive monthly account statements. These statements show your current balance, payments, interest charges, and available credit.

You follow the lender's repayment schedule. Repayment terms vary by lender — some may require weekly or monthly payments, while others offer grace periods or interest-only payment options during the draw period.

You review fees and terms. Some lines of credit may include annual fees, draw fees, origination fees, or inactivity charges. Understanding the fine print helps avoid surprises.

At Clarify Capital, we believe that success begins with being prepared financially. This is why we offer solutions to help you keep your operations running smoothly. Speak to a dedicated advisor today and see how a business line of credit can help you manage occasional cash flow shortages.

How Interest Rates Work on a Business Line of Credit

Interest on a business line of credit typically accrues only on the amount you draw, not the total credit limit, making it a flexible, cost-effective tool. For example, if you draw $50,000, your monthly payment will depend on whether your lender requires interest-only payments or principal plus interest on the amount used.

There are two types of interest rates you might see:

Fixed interest rate. This rate stays the same over your draw or repayment period. It makes budgeting easier, but it can be slightly higher upfront.

Variable interest rate. This rate may change based on market conditions or prime rate fluctuations. You might get a lower initial rate, but future payments can vary.

What can affect your rate:

Credit score. A stronger personal or business credit profile usually qualifies for better rates.

Time in business. Lenders often reward well-established businesses with lower APRs.

Revenue and cash flow. Higher, more consistent income signals lower risk and may reduce your rate.

Collateral. Secured credit lines tend to offer lower interest rates compared to unsecured ones.

Understanding how your rate is determined helps you compare offers and avoid unnecessary interest costs.

Costs and Fees

A business line of credit can be an affordable financing option, but it's important to understand the associated costs before applying.

Beyond interest rates, lenders may charge additional fees that affect your total repayment amount. These can include:

Draw fees. Some providers charge a small fee each time you withdraw funds from your credit line.

Origination fees. This one-time fee is often based on your loan amount and is charged when the credit line is first opened.

Payment processing fees. If you make payments using a debit card or a non-automated method, you may incur extra charges.

Prepayment penalties. While many online lenders do not charge penalties for early repayment, some traditional banks or credit unions may.

Understanding these potential charges helps business owners, especially startups, avoid surprises and select the right provider for their needs.

Who Should Consider a Small Business Line of Credit?

A small business line of credit is a smart option for many entrepreneurs. It offers peace of mind and flexibility, especially for those who want access to cash without the pressure of a lump-sum loan. Here are some examples of who should consider it:

Business owners who want a financial safety net. A line of credit offers backup cash for unexpected expenses or slow seasons.

Entrepreneurs who manage fluctuating cash flow. It helps smooth out income gaps between invoices, projects, or seasonal sales.

Founders who are planning to grow. You can use it to fund inventory, hire staff, or invest in marketing at the right moment.

Owners who prefer flexible financing. Unlike term loans, you only pay interest on what you borrow, and can use funds again as you repay.

Operators who want quick access to capital. With an open credit line, you can act fast on opportunities without reapplying for new funding.

Common Mistakes To Avoid When Using a Business Line of Credit

Using a business line of credit can be a powerful tool for managing cash flow, but business owners should be mindful of common pitfalls that could lead to financial strain.

Overusing the credit line. Treating a line of credit like a term loan and consistently maxing out the available funds can lead to high monthly payments and financial stress.

Not planning for repayment. Even though the repayment terms are flexible, failing to plan for repayment can result in accumulating debt and potential cash flow issues.

Ignoring interest rate changes. Some credit lines have variable interest rates, meaning your cost of borrowing could rise over time. Keeping track of changes ensures you don't end up with unexpectedly high costs.

Using credit for long-term investments. A business line of credit is best for short-term expenses, not large purchases like real estate or long-term expansion.

Failing to monitor credit utilization. A high utilization ratio can negatively impact your business credit score, potentially making it harder to secure future business loans or financing.

Business Line of Credit vs. Other Financing Options

| Comparison of Business Financing Options |

|---|

| Financing option | Key features | Pros | Cons |

|---|

| Business line of credit | Revolving credit with interest only on drawn funds; terms range from 6 to 18 months | Flexible access, fast funding, no prepayment penalties | May have lower limits than loans; requires discipline to manage |

|---|

| Business term loan | Lump sum repaid over a set period with fixed or variable interest | Predictable payments, good for large, one-time expenses | Less flexible; interest applies to the full amount |

|---|

| Merchant cash advance (MCA) | Upfront cash in exchange for a percentage of daily sales | Fast approval; no fixed payment schedule | High factor rates; daily repayments can strain cash flow |

|---|

| Business credit card | Revolving credit is typically used for small or recurring expenses | Easy to use; may earn rewards | High APRs; lower credit limits |

|---|

| Invoice factoring | Advance based on unpaid invoices; the lender collects from your customers | Helps unlock tied-up revenue quickly | Can affect customer relationships; dependent on AR volume |

|---|

A business line of credit isn't the only way to secure working capital, but it's one of the most flexible. Here's how it compares to other popular financing solutions:

Line of credit vs. business loan. A term loan provides a lump sum repaid over time, often with a fixed interest rate. A line of credit lets you borrow what you need, when you need it, with interest only on the amount used.

Line of credit vs. merchant cash advance. An MCA offers quick capital but with higher factor rates and daily repayments. A line of credit has lower costs and more manageable terms.

Line of credit vs. credit card. Credit cards can help with small recurring expenses, but they tend to carry higher APRs and limited flexibility. Lines of credit usually offer higher limits and lower interest rates.

Line of credit vs. invoice factoring. Factoring gives you cash based on unpaid invoices, which is useful if your revenue is tied up in AR. A line of credit works more like a reusable safety net, not tied to customer payments.

Choose the best option based on how much business funding you need, how soon you need it, and whether you want a one-time lump sum or revolving access to capital.

The Difference Between a Line of Credit and a Credit Card

As mentioned, a line of credit works similarly to a business credit card. However, there are several key differences, such as:

Business lines of credit tend to have much lower interest rates than credit cards.

Some lenders also offer longer payment terms for lines of credit, other than the monthly payment schedule of a credit card.

A line of credit provides a higher credit limit because it can be secured by collateral.

A borrower can withdraw cash from a line of credit, while credit cards charge additional fees for balance transfers and cash advances.

A line of credit is best used for larger expenses, while a credit card works best for smaller ongoing expenses.

Some business credit cards may offer rewards or cashback on purchases, while lines of credit often allow for direct debit payments from your business bank account.

The Difference Between a Line of Credit and a Term Loan

A line of credit and a term loan are both considered short-term liabilities (i.e., current liabilities that need to be paid within one year).

However, one can be a better option than the other, depending on your business goals. Take a look at some of their key differences:

With short-term loans, you receive a lump sum amount at a fixed interest rate within a defined repayment period.

With a line of credit, you get access to a revolving credit that you can use, repay, and withdraw from again repeatedly.

A short-term loan requires you to make equal monthly payments over a specific term until the loan is paid off.

With a line of credit, you only pay interest on the amount you borrow.

Lines of credit are best used for unexpected business expenses, while a term loan is ideal for one-time projects, like buying equipment or machinery.