A line of credit can open up many opportunities for a business to grow and run smoothly. However, what if your credit isn't in the best shape? If you're worried about credit score requirements, there are still options to consider.

In this guide, explore our roundup of the best business lines of credit for bad credit, plus tips on how to secure a business line of credit to jumpstart your business.

Best for Small Businesses: Clarify Capital

Why it's a good choice: To assist you in finding the right loans for your needs, Clarify Capital has linked over 10,000 small businesses with a network of more than 75 reputable lenders and a group of knowledgeable funding experts. Clarify Capital supports a wide range of company models, from doctors and restaurants to IT companies. Additionally, applicants for business lines of credit with Clarify Capital can experience instant approval and funding within 24 hours.

Loan Amount Range: Up to $5 Million

Minimum Credit Requirements: 550+

Estimated APR: 6%

Pros:

- Interest is only charged on funds used

- Accepts businesses with poor credit scores

- High approval rate

- Transparent and clear terms

- Revolving line of credit

- No penalties on repayment

- Funded within 24-48 hours

Cons:

- Some states may not have some services and products available

- Shorter durations for consumers with lower credit scores

Loan details:

- Require at least $10,000 in monthly income

- Loan lengths range from six to three years

- Business must be in operation for at least six months to qualify

Best for Flexible Terms: American Express

Why it's a good choice: Americans Express Business Line of Credit is a good option for businesses who want flexible and fast financing. Businesses can choose between a 6, 12, or 18-month-term option and can draw funds without experiencing prepayment penalties.

Loan Amount Range: Up to $250,000

Minimum Credit Requirements: 660+ (Fair)

Estimated APR: Information not available

Pros:

- Quick application process

- No prepayment penalties

- Pay fees on the amount you use only

Cons:

- Monthly fees on balances that are unpaid

- Requires a personal guarantee

- Must have a PayPal account or online checking to confirm cash flow

Loan details:

- Business must be in operation for at least one year

- Average monthly revenue of the business must be at least $3,000

- Must have a business bank account

Best for Short-Term Lines: OnDeck

Why it's a good choice: With OnDeck, businesses can work directly with an expert loan advisor to help find the best loan option. This lender offers flexible repayment terms of 12, 18, or 24 months, which is ideal for businesses looking for a short-term loan.

Loan Amount Range: Up to $100,000

Minimum Credit Requirements: 625+ (Fair)

Estimated APR: 39.9%

Pros:

- Offers flexible repayment options

- Ability to choose weekly or monthly payments

- No hard credit pulls

Cons:

- Requires a high annual gross revenue for businesses to quality

- Only available in select states

- Does not lend to certain industries

Loan details:

- Businesses must earn a gross annual income of at least $100,000

- Must be in operation for at least one year

- Must have a business checking account

Best for Working Capital: Funding Circle

Why it's a good choice: This lender is ideal for businesses working to fund their working capital and those who need to refinance debt. They also specialize in providing various loans to small firms, but their long-term loans have terms ranging from six months to seven years and don't have a minimum income criterion.

Loan Amount Range: Up to $250,000

Minimum Credit Requirements: 660 (Fair)

Estimated APR: Information not available

Pros:

- No prepayment fees

- Only required to pay interest on funds that are withdrawn

- No monthly maintenance fee

Cons:

- Approval decision takes a minimum of 48 hours

- Not transparent about interest rates and terms upfront

- Doesn't help fund all industry types

Loan details:

- The average draw fee is 1.6%

- Late payments receive a fee of 5% of the past-due amount

Best for Unsecured Lines: Wells Fargo

Why it's a good choice: Wells Fargo's BusinessLine line of credit allows businesses to supplement their cash flow and cover unexpected expenses and is also a great choice for those who seek a brick-and-mortar experience. However, since it's a traditional bank institution, businesses may experience stricter eligibility requirements like minimum years in operation and longer approval times.

Loan Amount Range: Up to $150,000

Minimum Credit Requirements: 680+ (Good)

Estimated APR: Prime + 1.75% - Prime + 9.75%

Pros:

- For the first year after approval, businesses don't have to pay an annual fee

- Offers a free rewards program and businesses get automatically enrolled

- No foreign transaction fees

Cons:

- Requires a personal guarantee from someone who shares 25% ownership of the business

- Is not transparent upfront about interest terms like minimum annual revenue

- Could take up to two weeks for approval

Loan details:

- Annual fee of $95 after the first year

- Requires businesses to be in operation for 24 months

Best for Secured Lines: Bank of America

Why it's a good choice: Startups and newer businesses can get the working money they need and establish credit by using Bank of America's Cash Secured line of credit. Choosing this lender is also a great way to increase your credit while growing your business. You'll need to make an upfront cash deposit with this cash-secured line, starting at $1,000. The deposit will be returned following a positive review at the 12-month point.

Loan Amount Range: Starting at $1,000

Minimum Credit Requirements: 670+ (Good)

Estimated APR: Variable

Pros:

- The annual fee is waived in the first year

- No origination fees

- Ability to graduate to an unsecured credit line with responsible spending

Cons:

- Higher annual fee of $150 per year

- Does not state interest rates upfront

- The credit limit is based on the security deposit

Loan details:

- Business must be in operation for at least six months

- Must have a minimum annual revenue of $250,000

- A minimum deposit of $1,000 must be made

Best for Equipment Lines: Balboa Capital

Why it's a good choice: Businesses that require equipment financing could benefit from Balboa Capital's business line of credit. Equipment is utilized as capital, and loans can be approved for borrowers in as little as one hour. Businesses can also benefit from the financial advisors that help answer any questions and talk through different options.

Loan Amount Range: Up to $250,000

Minimum Credit Requirements: 620 (Fair)

Estimated APR: 4%-8%

Pros:

- Flexible terms available

- Approval decisions are made in one hour

- Same-day funding is available if approved

Cons:

- Can charge multiple fees for loans

- $300,000 in yearly income is required for short-term loans.

- Unless you complete the full application process, complete pricing information may not be accessible

Loan details:

- Short-term loan payback plan of daily or weekly terms

- A minimum annual revenue of $100,000 is required for equipment financing

- There are numerous loan possibilities, including SBA and franchise finance

Best for Newer Businesses: Fundbox

Why it's a good choice: With flexible access to funds through the Fundbox Line of Credit, businesses can manage their cash flow to pay for payroll, insurance, marketing initiatives, and more. Fundbox is a good choice for businesses since it accepts borrowers with as little as six months in business.

Loan Amount Range: Up to $150,000

Minimum Credit Requirements: 600 (Fair)

Estimated APR: 10.10%-79.80%

Pros:

- Can draw funds at any time once approved

- If approved, financing is available within 24 hours

- You can choose a repayment plan every time you draw funds

Cons:

- Higher APR and rates compared with traditional banks

- Could require a personal guarantee

- Requires weekly repayments

Loan details:

- Business must be based in the United States

- Business must be in operation for at least six months

- Must have a business checking account and make $100,000+ in annual revenue

Best for Fast Approval: Bluevine

Why it's a good choice: Bluevine is an online lender that helps businesses who are looking for fast approval with business lines of credit. Although approval can happen in as little as five minutes, there are strict guidelines to be approved. For example, businesses must be in operation for 24 months with a revenue of $40,000 a month, which is higher than competitors.

Loan Amount Range: Up to $250,000

Minimum Credit Requirements: 625+ (Fair)

Estimated APR: 20-50%

Pros:

- Approval decisions in as little as five minutes

- No fees for opening, maintaining, repaying, or closing your account

- The credit line replenishes every time you make a repayment

Cons:

- High revenue requirements

- Services are not available in every state

- Requires a personal guarantee

Loan details:

- Business must be in operation for at least two years

- Must make $40,000 a month in revenue

- Must operate or be incorporated in an eligible U.S. state

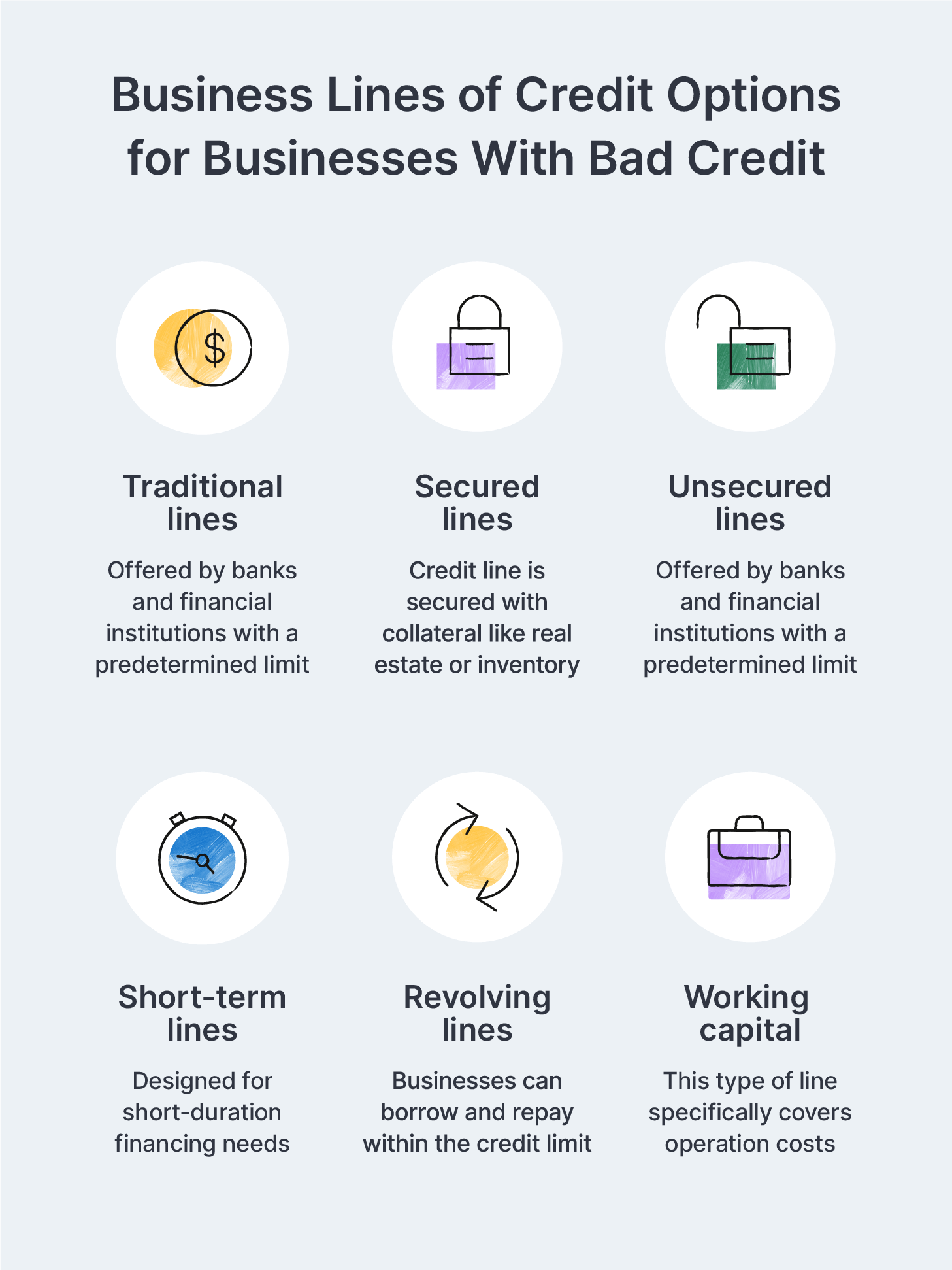

Types of Business Lines of Credit for Bad Credit

There are many different types of lines of credit for businesses, and each is beneficial for a variety of needs and situations.

Here's an overview of the different types of credit for bad credit:

Traditional: These are standard lines of credit offered by banks and traditional financial institutions. They provide a predetermined credit limit that businesses can draw from as needed.

Secured: In this type, you secure the credit line with collateral, such as real estate, equipment, or inventory. Because there's collateral involved, lenders may offer higher credit limits and lower interest rates, making it an attractive option for businesses with valuable assets.

Unsecured: Unsecured lines of credit don't require collateral. They rely primarily on your creditworthiness and finances. While they may have lower credit limits and higher interest rates than secured lines, they are accessible to businesses without substantial assets.

Short-term: Short-term lines of credit are designed for immediate, short-duration financing needs. They often have a repayment term of less than a year and are suitable for covering working capital gaps or taking advantage of time-sensitive opportunities.

Revolving: A revolving line of credit is a flexible credit arrangement where businesses can borrow, repay, and borrow again within the credit limit without needing to reapply for a new loan. Interest is charged only on the outstanding balance, making it a cost-effective option for managing cash flow.

Working capital: A working capital line of credit is a kind of finance that covers ongoing operational costs. This type of revolving line of credit gives businesses the flexibility to borrow money as often as they need to and return it up to the credit limit.

Each type of business line of credit has pros and cons, and the choice depends on your business's specific needs and financial circumstances.

Is a Line of Credit the Right Option for Your Business?

If your business needs a cash reserve for unexpected expenses like emergencies or expensive orders, business lines of credit may be a great fit.

A business line of credit works similarly to a business credit card — you can borrow and repay funds up to your credit limit as many times as your business needs cash, and you only pay back what you withdraw plus interest. In addition, lines of credit don't have origination fees or prepayment penalties like other business loans.

One of the main perks of a line of credit as a form of business financing is its flexibility. Unlike typical term loans, a business line of credit isn't designated for a specific purpose. So, small business owners have immediate access to cash to cover working capital expenses like:

- Employee salaries

- Inventory

- Rent

Also, with short-term loans, you'll receive a lump sum of cash upfront with regular repayment terms over a fixed period. With a line of credit, your loan payments won't start until you withdraw. If you don't use it right away, you don't need to start paying it back.

Most Common Uses of Business Lines of Credit

Unlike other types of financing, you don't have to use a line of credit for a specific purpose. This is why we repeat the flexibility of the credit line at every opportunity. You can use it to cover any business expense as you see fit, including:

Buying inventory and supplies: You can use a line of credit to purchase materials and products to make sure you can meet customer demands. Some businesses also use the cash to buy in bulk to take advantage of supplier discounts and save more money.

Equipment financing: You can also use a credit line to buy new or used equipment to increase your production or keep day-to-day operations going.

Payroll: Most businesses use a line of credit to bridge gaps in their cash flows. For instance, you can use the funds to pay salaries and wages while waiting for customer payments.

Taxes and rent: Like payroll, some expenses like taxes and rent can't wait until customer payments are deposited into the business bank account. That's why having a line of credit as a cash reserve is a life-saver for businesses.

Tips to Get a Business Loan With Bad Credit

We know from years of experience that you need significant revenue and your business must be operational for at least six months to qualify for a loan. Most lenders prefer that borrowers have good personal credit scores, but there are still loan options for business owners with bad personal credit.

At Clarify Capital, we exist to help small business owners like you get the funding you need to grow your company. That's why we make the application transparent, easy, and quick. Look at some helpful tips to help you apply for a loan with Clarify Capital.

Monitor Your Credit Score

It's important to monitor your credit reports to prepare for your line of credit application or know what's going on with your financial profile. Check your FICO score from the three credit bureaus — Equifax®, Experian®, and TransUnion®. You can also get a free copy of your credit report at AnnualCreditReport.com once every 12 months.

If your company has been operational for a while and has its own business bank accounts, it may have established a credit rating. You can get your business credit score from Experian, Equifax, and Dun & Bradstreet. By monitoring your credit score, you can identify areas where your business can improve and strengthen your score if it's on the lower end.

Gather Business Information

To make the application process easier, make sure you have the following documents on hand:

- Legal proofs, such as a driver's license, passport, federal tax ID, or employer identification number (EIN)

- Proof of income — three to 12 months of recent bank statements

- Financial statements, like profit and loss (P&L) statements and balance sheets

- A copy of your business license

- One to two years of business tax returns

- One to two years of personal tax returns

Establish a Relationship with the Lender

Establishing a good relationship with a lender before applying for a business line of credit can be highly beneficial. Building a positive relationship with a lender can enhance your credibility and increase your chances of getting approved for favorable terms when you eventually apply for a line of credit.

Consider Partners or Co-Signers

If you have a business partner or someone with a strong credit history willing to cosign the line of credit application, it can increase your chances of approval. Just be aware that defaulting on the line of credit will negatively impact both your and your co-signer's credit.

Demonstrate Responsible Use of Credit

If you have existing credit lines or loans, make timely payments and avoid maxing out your credit limits. Responsible credit use can improve your credit profile over time. Additionally, you can apply for a smaller line of credit at first — if approved, use it responsibly to build a positive credit history, and you can eventually request an increase in your credit limit.

Business Lines of Credit for Bad Credit FAQ

If you're looking for financing options despite a less-than-ideal credit history, there are various possibilities, challenges, and considerations involved in securing a business line of credit. Below are some frequently asked questions related to business lines of credit for bad credit.

How can bad credit impact your ability to get a business line of credit?

The most significant impact of having poor credit is that you may have to pay interest rates higher than the annual percentage rate (APR) you could get if you had good credit. Some lenders may also give you a lower credit limit.

However, depending on the amount you wish to borrow, some lenders may request a personal guarantee. With a personal guarantee, borrowers make a legal promise to repay the loan if their company can't afford to do so. Personal guarantees also help new businesses and startups secure loans even if they don't have qualifying income or a long credit history.

Can I get a business line of credit with bad or no credit?

Yes, there are options for business owners to secure a line of credit even if they have a less-than-stellar credit history. Traditional lenders like credit unions and banks typically require a minimum credit score of 580. However, many alternative lenders offer bad credit business loans.

Your credit score is just one factor that lenders look at when assessing your creditworthiness. They also consider your monthly revenue, business plans, and time in business. Online lenders also consider your desired loan amount and your company's cash flow when making decisions to provide business funding.

Can you get a business line of credit without a credit check?

Securing a business line of credit without a credit check is challenging with traditional lenders, but there are alternative options to explore. You might consider business cash advances, asset-based lending, or seeking assistance from community development financial institutions (CDFIs) that are more flexible in their credit requirements.

Online and alternative lenders may also be more lenient, focusing on factors beyond your credit score. However, be cautious of higher costs and thoroughly vet lenders to ensure transparency and legitimacy.

Why do lenders perform credit checks?

Lenders perform credit checks to assess a borrower's creditworthiness and determine the risk associated with lending. This evaluation helps them:

- Set appropriate interest rates and terms for loans

- Comply with legal regulations

- Mitigate potential financial losses

Credit checks also play a role in protecting consumers from taking on excessive debt and encourage responsible borrowing and lending practices, fostering a more stable financial ecosystem.

Can I get a business line of credit with a 500 credit score?

Obtaining a business line of credit with a 500 credit score can be challenging through traditional lenders like banks and credit unions. A score of 500 is considered poor credit, and many mainstream lenders have stricter credit requirements.

You can take steps to improve your credit score, and lenders like Clarify Capital can help businesses with scores as low as 600 receive business lines of credit.

Discuss Business Lines of Credit Opportunities With Clarify Capital Now

Many companies use a line of credit to cover business day-to-day expenses, such as buying inventory or paying payroll. But the main advantage of a line of credit is its flexibility — you can use it however or whenever your business needs it. If you want to prepare for unexpected expenses, a line of credit also gives you peace of mind.

If your business is embarking on the journey to improve its credit score but needs some extra help in the meantime, rest assured there are options available to secure a business line of credit. Speak with a Clarify advisor today to discuss your options.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts

![7 Best Equipment Financing Companies and Loan Options [2024]](/assets/blog/best-equipment-financing-companies/best-equipment-financing-companies-small-3874c9814fbefadd9f9419a140059f72e2893541ce88c7548a49986f0e852ee2.jpg)