For many new doctors of osteopathic medicine (DOs), launching a career in health care comes with a hefty price tag. With 90% of osteopathic physicians graduating with medical student debt and an average balance of $254,987, finding the right loan options for physicians is a critical step in long-term stability and practice success.

Whether you're starting residency, planning to open a private clinic, or looking to consolidate debt, physician loans offer flexible financing tailored to the realities of osteopathic physicians. These programs often feature lower interest rates, deferment, and access to higher loan amounts than traditional small business or consumer credit products.

In this guide, we'll break down the most effective ways DOs can manage medical student debt, finance a new practice, or access capital to grow. From federal programs to private lenders, you'll find clear explanations, eligibility tips, and smart strategies to protect your cash flow while advancing your medical career.

Why Osteopathic Physicians Need Specialized Loans

While DOs and MDs share similar training, the career paths for osteopathic physicians often diverge, particularly when it comes to practice models and financial demands. Many DOs gravitate toward community-based care, primary care, or integrative wellness approaches, which can lead to unique billing structures and revenue cycles. For those pursuing private practice, the upfront investment is steep. Opening a DO clinic can cost up to $500,000, factoring in everything from commercial space and medical equipment to staffing and regulatory compliance.

Yet fewer physicians today are choosing to go independent. According to the AMA, just 42% of physicians remain in private practice as of 2024, often due to the financial barriers to entry. That's where specialized financial solutions come in.

Tailored practice financing helps medical professionals like osteopaths fund a new clinic, expand services, or refinance existing obligations. These loans for osteopathic physicians are designed to support long-term growth while addressing the heavy debt burdens many DOs carry early in their careers. With more autonomy often comes more financial risk, making the right lending partner essential for success.

Top Loan Types for Osteopathic Doctors

Whether you're just finishing residency or preparing to open a private clinic, the right physician loan can support your professional goals without putting a strain on your finances. From personal loans for short-term needs to full-scale practice loans for expansions and acquisitions, osteopathic doctors have access to a wide range of funding options.

Here's a breakdown of the most common loan types, including average interest rates, funding ranges, and what to expect when applying:

Personal Loans for Medical Professionals

These unsecured loans offer quick access to capital, often with minimal documentation. They're ideal for early-career osteopathic physicians who need startup capital, emergency funds, or working capital for relocations. While convenient, rates can be higher than other loan types. Expect APRs between 5% and 30%, depending on creditworthiness.

Practice Loans

Designed specifically for acquiring or expanding a medical practice, these loans come with longer terms and higher limits, often ranging from $25,000 to $5 million. You can opt for a fixed rate for predictability or a variable structure if you anticipate early payoff. These typically require strong financials and credit approval.

Home Loans for Doctors

Some lenders offer special mortgage terms for DOs through doctor loan programs. These often feature low down payments and no private mortgage insurance (PMI), recognizing the long-term earning potential of medical professionals despite their high student loan debt.

Refinancing Programs

If you're already carrying debt from federal student loans, private loans, or a previous practice loan, refinancing can reduce monthly payments or lower your overall interest burden. Many osteopaths refinance once their income stabilizes post-residency or post-acquisition.

The right loan depends on your goals and career stage, whether you're purchasing equipment, consolidating debt, or launching a new clinic. With flexible terms and specialized underwriting, physician lending is built to support the complex needs of today's DOs.

Business Loans for DOs Starting a Practice

Opening a private osteopathic clinic comes with significant upfront costs, often $400,000 to $500,000 in your first year, according to startup cost estimates. A practice loan can help cover:

Buildout and real estate

Medical equipment purchases

Hiring and payroll

Marketing and branding

Most loan programs offer terms of five to 10 years, with monthly payments structured around projected revenue. Some SBA loans require a down payment, while private lenders may offer no-collateral alternatives with faster approvals.

Clarify Capital connects new DOs with funding options built for their practice goals, including equipment financing, SBA-backed term loans, and unsecured working capital lines.

Refinancing and Consolidation Options for DOs

If you're one of the 43% of doctors who owe more than $250,000 in medical school debt, you're not alone. Many osteopathic physicians start their careers carrying six-figure student loan debt, plus additional loans from setting up their clinics.

Refinancing gives you a way to streamline that burden into one manageable monthly payment, often with better terms and a lower interest rate. You can also consolidate equipment loans, practice financing, and lines of credit, simplifying cash flow management as your clinic grows.

Most refinancing lenders evaluate:

Credit history

Annual income

Debt-to-income ratio

Practice revenue (if applicable)

Whether you're looking to lower your monthly payments or free up funds for growth, Clarify can help match you with refinancing options tailored to DOs.

Comparison of 2025 DO-Friendly Loan Providers

With roughly 149,000 osteopathic physicians practicing in the U.S., access to tailored financing is more crucial than ever. The right lender can make a significant difference in your practice's financial health, especially when it comes to loan terms, interest rates, and eligibility requirements. Below is a side-by-side comparison of the top 2025 physician loan providers for DOs, highlighting Clarify as the leading option for medical professionals seeking transparent disclosures and competitive offers.

Compare loan details from a variety of lenders to get an idea of your options.

DO-Friendly Lender Comparison

| Lender | Loan terms and limits | Interest rate (APRs) | DTI requirement | Eligibility and disclosures |

|---|---|---|---|---|

| Clarify Capital | Up to $5 million, flexible terms | As low as 5% (varies by product) | Flexible; case-by-case | D.O.s, MDs, dentists, vets; fast approval, no collateral required; clear fee disclosures |

| BMO Bank, N.A. | Up to $2 million | Varies by state/product | Flexible | D.O.s, MDs, DDS, DMD; 0-10% down; no PMI; employment contract accepted |

| First Horizon Bank | Up to $2.5 million | Competitive, fixed/ARM | Low as 670 credit score; flexible DTI | D.O.s, MDs, DPM, OMS; 0-10% down; no PMI; H-1B eligible |

| Huntington Bank | Up to $2 million | Competitive, fixed/ARM | DTI up to 50% | D.O.s, MDs, DDS, DMD, DPM, DVM; 0-10% down; excludes deferred student loans from DTI |

| Old National Bank | Up to $2 million | Competitive, fixed/ARM | Min. credit score 700 | D.O.s, MDs, DDS, DMD, DPM, DVM; 0-10% down; no PMI; employment contract accepted |

Key Terms To Know for Osteopathic Physician Loans

Before applying for a physician loan, it's important to understand a few essential financial terms. These factors can influence your approval odds, repayment plan, and long-term loan costs.

APRs (annual percentage rates). Rates typically range from 5% to 30% depending on your credit score, loan type, and chosen lender. Lower rates are generally offered to borrowers with strong financials or collateral.

Debt-to-income ratio (DTI). Many loans for osteopathic physicians include flexible DTI calculations. Deferred student loans are often excluded, which is a major advantage for DOs carrying significant medical school debt.

Eligibility requirements. Most lenders require proof of a medical degree (DO, M.D., etc.), an employment contract or business plan, and a minimum credit score, often between 670 and 700.

Disclosures to watch. Look for lenders that offer transparent fee structures, no private mortgage insurance (PMI) on home loans, and no penalties for early repayment.

Why Clarify Capital Stands Out for Osteopathic Physicians

Clarify Capital is uniquely positioned to support DOs with tailored financial solutions for every stage of their career, from residency to private practice ownership.

Here's what makes Clarify a top choice for osteopathic physicians:

Fast approvals with funding in as little as 24-48 hours

Flexible loan amounts up to $5 million, ideal for practice loans, equipment purchases, and working capital

No collateral required for unsecured loans

Dedicated advisors who understand the financial path of medical professionals

Clear eligibility requirements and no hidden fees

Whether you're expanding into new markets or looking to refinance existing debt, Clarify delivers a simplified process with access to multiple loan options, so you can focus on patient care, not paperwork.

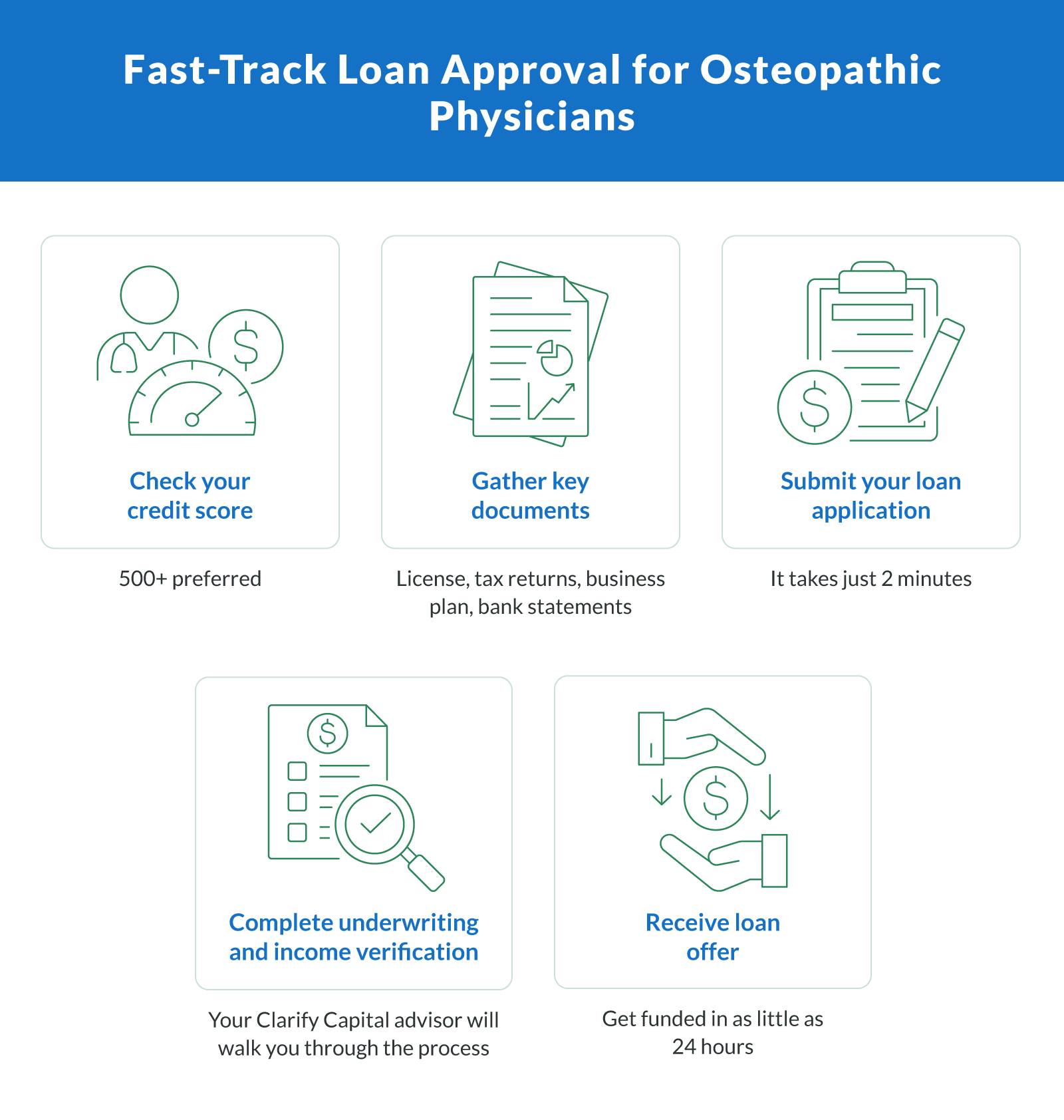

Loan Application and Approval Process for DOs

Applying for a physician loan as a DO doesn't need to be complicated, especially if you know what to expect at each stage of the application process. Having your documents and financials ready can help you secure faster credit approval and better terms.

Here's a step-by-step overview of how to apply for loans for osteopathic physicians:

1. Check Your Credit Score

Most lenders look for a credit score of 670 or higher, though some alternative lenders may approve applicants with slightly lower scores depending on other strengths (such as cash flow or employment status).

2. Gather Financial Documentation

You'll typically need to submit:

Proof of DO degree or current license

Tax returns (last one to two years)

Business plan (for practice loans)

Employment contract (if W-2) or revenue projections (if self-employed)

Personal and business bank statements

3. Submit the Loan Application

Once your documents are ready, you can submit your full loan application online or through a Clarify advisor. Expect soft underwriting during the initial pre-approval phase to determine eligibility and potential terms.

4. Go Through Underwriting

If you meet initial criteria, lenders will conduct a deeper analysis: verifying income, debt obligations (DTI), and reviewing your business or practice model.

5. Receive Offer and Funding

After credit approval, most physicians receive their offers within a few days. With Clarify, funding can happen in as little as 24-48 hours, ideal for time-sensitive opportunities.

Federal and Institutional Repayment Assistance for DOs

With 91% of osteopathic medical students graduating with debt and the total cost of private Colleges of Osteopathic Medicine (COMs) reaching over $371,000, many DOs need more than traditional repayment options to stay financially stable. Fortunately, several federal and institutional programs can reduce your loan repayment burden, especially if you work in underserved areas or primary care.

Here are major payment options and loan forgiveness paths worth exploring:

National Health Service Corps (NHSC)

NHSC offers up to $75,000 for a two-year full-time commitment to working in Health Professional Shortage Areas (HPSAs). Eligibility includes being licensed, working full-time in primary care, and having qualifying educational debt. Learn more via the NHSC Loan Repayment Program.

Public Service Loan Forgiveness (PSLF)

PSLF forgives federal loans after 120 qualifying payments while working in nonprofit or government health care. Make sure your loans are Direct Loans and enroll in an income-driven repayment (IDR) plan to remain eligible.

State-Based Incentive Programs

Many states offer repayment assistance or bonuses to DOs who practice in rural or underserved regions. For example, New York and California have competitive state-run forgiveness programs tailored to financial needs in local health care systems.

Professional Associations and Institutions

Some osteopathic associations and COMs offer institutional financial assistance or scholarships tied to service, research, or academic performance. Check with your financial aid office to explore local opportunities.

These loan forgiveness and assistance programs are valuable tools for DOs balancing their calling in primary care with the realities of medical education debt.

Choosing the Right Physician Loan in 2025

For osteopathic physicians navigating high medical school debt, practice startup costs, or career transitions, choosing the right physician loan in 2025 is more important than ever. With so many loan options, from SBA practice loans to refinancing and repayment assistance programs, it's essential to select a solution tailored to your unique goals and career stage.

Whether you're a new graduate looking to consolidate debt or an experienced DO opening your own clinic, access to flexible capital can shape your long-term success. But beyond competitive rates, the right lending partner should understand the distinct financial pressures DOs face, including private practice trends, educational loan burdens, and reimbursement models.

Clarify Capital makes it easy to compare lenders and find the best-fit loan options fast. You'll work with an advisor who understands the needs of osteopathic physicians, helping you avoid delays and get funding when it counts.

Explore Clarify's physician loan matching service to get pre-qualified and see which options align with your professional and financial goals.

FAQs About Loans for Osteopathic Physicians

If you're a DO weighing your financing options, these frequently asked questions can help clarify the best path forward.

What's the Difference Between a Physician Loan and a Conventional Mortgage?

A physician mortgage is specifically designed for medical professionals, including DOs. Unlike conventional mortgages, these loans often require no private mortgage insurance (PMI), accept higher debt-to-income (DTI) ratios, and allow for lower down payments. They also consider future earning potential, making them more flexible for borrowers with a limited credit history or substantial student debt. For osteopathic physicians launching their careers, this can be a strategic way to buy a home without delaying other financial goals.

Can DOs Get Physician Loans While in Residency?

Yes, many lenders offer physician loan programs to medical residents, including doctors of osteopathic medicine. These loans typically require proof of graduation, an employment contract, and sometimes a co-signer, depending on your financial needs and credit history. It's an option that helps residents secure housing or refinance private student loans even before they've reached full earning capacity.

How Much Can You Borrow With a Medical Practice Loan?

Loan amounts vary, but medical practice loans for osteopathic physicians can range from $25,000 up to $5 million, depending on the borrower's eligibility, revenue projections, and use case. Whether you're financing equipment, acquiring a practice, or building a new facility, lenders typically assess your business plan, credit profile, and collateral (if applicable) before determining your maximum loan amount.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts