When payroll hits tomorrow, and your biggest client suddenly pushes payment out two weeks, you can't sit around waiting on a bank.

Cash-flow gaps, resulting from late invoices, seasonal dips, or a sudden rush of orders, can quickly throw your operations out of balance. Access to working capital isn't a nice perk. It's what keeps your business moving every day.

That's where fast online business loans help. A fast business loan provides short-term funding with a simple process and quick turnaround, often within 24 to 72 hours. Online lenders usually review applications with more flexibility than traditional banks, so you can still qualify even if your credit isn't perfect.

However, speed shouldn't push you into a bad deal. Every lender sets its own terms, rates, and fees. Compare offers to avoid overpaying or end up with a loan that doesn't meet your needs.

This guide explores six business loans that will get you the quickest funding and explains their benefits to help you decide how to fund your growth and handle unexpected expenses.

| Fast Business Loan Comparison: Which One Is Right for You? | |||||

|---|---|---|---|---|---|

| Loan type | Approval speed | Collateral required? | Best use cases | Repayment terms | Cost impact |

| Short-term business loan | 1–3 days | No |

| 6-month to 2-year term length | Medium |

| Business line of credit | Same day to a few days | No |

| Flexible, revolving credit | Low – medium |

| Invoice financing | Same day | Yes (invoices) |

| Varies by invoice terms | Medium |

| Equipment loan | 1–5 days | Yes (equipment) |

| Depends on equipment life | Low – medium |

| SBA microloan | 30–90 days | Yes |

| 5- to 25-year term length | Low |

| Merchant cash advance | Same day | No |

| Daily or weekly payments | High |

Best Quick & Easy Business Loans for Small Business Owners

In this video, you'll learn how fast business loans work and which loan programs are best for different business needs. It covers six types of loans, including short-term loans, lines of credit, invoice financing, and equipment loans, and explains how each can help with emergencies, payroll, inventory, and cash flow gaps. Find out which one fits your business situation:

Whether you need capital to take advantage of profitable business opportunities, repair a crucial piece of equipment, or cover operating expenses, we have you covered. When you partner with Clarify, your advisor will help you choose a loan based on your needs and goals.

Let's explore some of the best fast business loans you can apply for through Clarify Capital. If you need to get a business loan quickly, look no further than these loan product options:

1. Short-Term Business Loan

Best for: Retail, construction, food service, and seasonal businesses managing urgent or short-term cash needs

Short-term business loans provide a lump sum of working capital with repayment terms ranging from six months to two years. These loans are a go-to option for small business owners who need quick cash for urgent expenses, like launching a new product or covering supplier cost increases.

| Pros | Cons |

|---|---|

| Fast approval and funding timeline | Higher interest rates than long-term loans |

| Fixed monthly payments simplify budgeting | Shorter repayment periods mean larger monthly payments |

| Unsecured — no collateral required |

2. Business Line of Credit

Best for: Retailers, e-commerce, service businesses, and managing fluctuating cash flow

A business line of credit offers flexible, revolving access to capital. Borrowers draw what they need and only pay interest on the amount used. It's a fast funding solution for ongoing or unpredictable expenses, like restocking inventory or covering late client payments.

| Pros | Cons |

|---|---|

| Only pay interest on the funds you use | May have lower maximum loan amounts than term loans |

| Can reuse the credit line after repayment | Some providers charge annual maintenance or draw fees |

| Fast approval and loan process through many online lenders |

3. Invoice Financing

Best for: B2B companies, construction, logistics, and professional services with long invoice terms

Invoice financing lets businesses convert unpaid invoices into immediate cash. This is one of the most accessible, easy loans for business owners with unpaid receivables. You get up to 100% of the invoice value up front and repay it (plus a fee) once your customer pays.

| Pros | Cons |

|---|---|

| Great for businesses with bad credit; based on accounts receivable | Factor rates can be higher than traditional loan interest rates |

| No need to wait 30–90 days for customer payments | May involve handing off collections to a third party |

| No personal credit check in many cases |

4. Equipment Loan

Best for: Manufacturing, construction, restaurants, salons, and any business investing in machinery or tech upgrades

Equipment financing gives you funds to purchase machinery, vehicles, or tech, using the equipment itself as collateral. This arrangement reduces the lender's risk and may result in lower interest rates or more lenient credit score requirements.

| Pros | Cons |

|---|---|

| Can finance up to 100% of the equipment cost | Can only use funding for equipment |

| Lower interest rates due to a collateral-backed structure | You may owe the loan even if the equipment breaks or becomes obsolete |

| No personal guarantee or prepayment penalties with many providers |

5. SBA Microloan

Best for: Solopreneurs, home-based businesses, and entrepreneurs needing smaller loan amounts

Offered through U.S. Small Business Administration-approved nonprofit lenders, SBA microloans range from $500 to $50,000 and are designed for small businesses needing affordable capital.

| Pros | Cons |

|---|---|

| Competitive interest rates and flexible repayment terms | Requires collateral or a personal guarantee |

| Backed by the SBA, lowers the risk for lenders | Application process and underwriting can take longer than other fast loans |

| Can be used as a working capital loan or for equipment, etc. |

6. Merchant Cash Advance (MCA)

Best for: Retail, e-commerce, and seasonal businesses with strong sales volume and urgent capital needs

A merchant cash advance gives you a lump sum of capital in exchange for a percentage of your future debit or credit card sales. It's one of the fastest funding options available, often providing same-day funding.

| Pros | Cons |

|---|---|

| No collateral or strong credit score needed | Higher costs than most other types of financing (factor rates apply) |

| Fast approval and funding, often within 24 hours | Daily or weekly repayments can strain cash flow |

| Repayment adjusts based on daily sales volume |

Fast Business Loans: What They Are and How They Work

A fast business loan is short-term financing that deposits funds into your account within 24 to 72 hours. These loans are typically offered by online lenders and are built for speed, with streamlined applications, quick underwriting, and rapid approvals.

They're especially useful for small business owners who can't afford to wait weeks for a traditional bank loan. Whether you're covering a short-term cash gap or jumping on a time-sensitive opportunity, fast business loans provide working capital when you need it most.

Fast doesn't mean careless, though. These loans often have higher interest rates or shorter repayment terms, so it's important to review disclosures and choose one that fits your immediate needs and your ability to repay.

Common Use Cases

Consider a fast business loan when you need funding for:

Cash flow gaps. Cover everyday operating expenses when income slows down.

Payroll. Make sure your team gets paid on time — even if a client's check is late.

Inventory purchases. Stock up quickly when demand spikes or a supplier offers a deal.

Unexpected repairs. Handle equipment breakdowns or emergency fixes without draining your reserves.

Best Loans by Industry

Every business faces unique financial challenges. Whether you need to purchase equipment, manage seasonal dips, or cover late client payments, there's a fast loan solution that fits your industry:

Fast business loans for restaurants. Restaurants and bars often deal with fluctuating sales and time-sensitive expenses. Merchant cash advances and short-term business loans are ideal for fast funding — letting you cover payroll, restock inventory, or handle emergencies with minimal delay.

Business loans for contractors. Contractors need capital to purchase equipment and handle up-front job costs. Equipment loans help fund large purchases, while invoice financing frees up cash tied to unpaid project invoices.

Retail and e-commerce loans. Online retailers face shifting inventory needs and advertising costs. A business line of credit offers flexible access to funds as needed, while merchant cash advances provide quick cash flow boosts based on sales.

Health care and dental practice loans. Practices often need capital for new equipment or to manage operating costs. Equipment loans let you finance medical devices or upgrades with manageable terms, while short-term loans support staffing or supply expenses.

Transportation and trucking loans. Fleet owners and independent operators can benefit from equipment loans for vehicle purchases and invoice financing to stay afloat while waiting for client payments.

Salon and spa business loans. From remodeling to product inventory, short-term loans and equipment financing help salons grow and stay current with trends and services.

Fitness and gym loans. Opening a new location or upgrading workout equipment? Equipment loans can cover large investments, while short-term business loans help with payroll or marketing pushes during slower months.

Looking for a fast loan tailored to your business type? Clarify Capital helps match you with the right product — so you get funding quickly and with confidence.

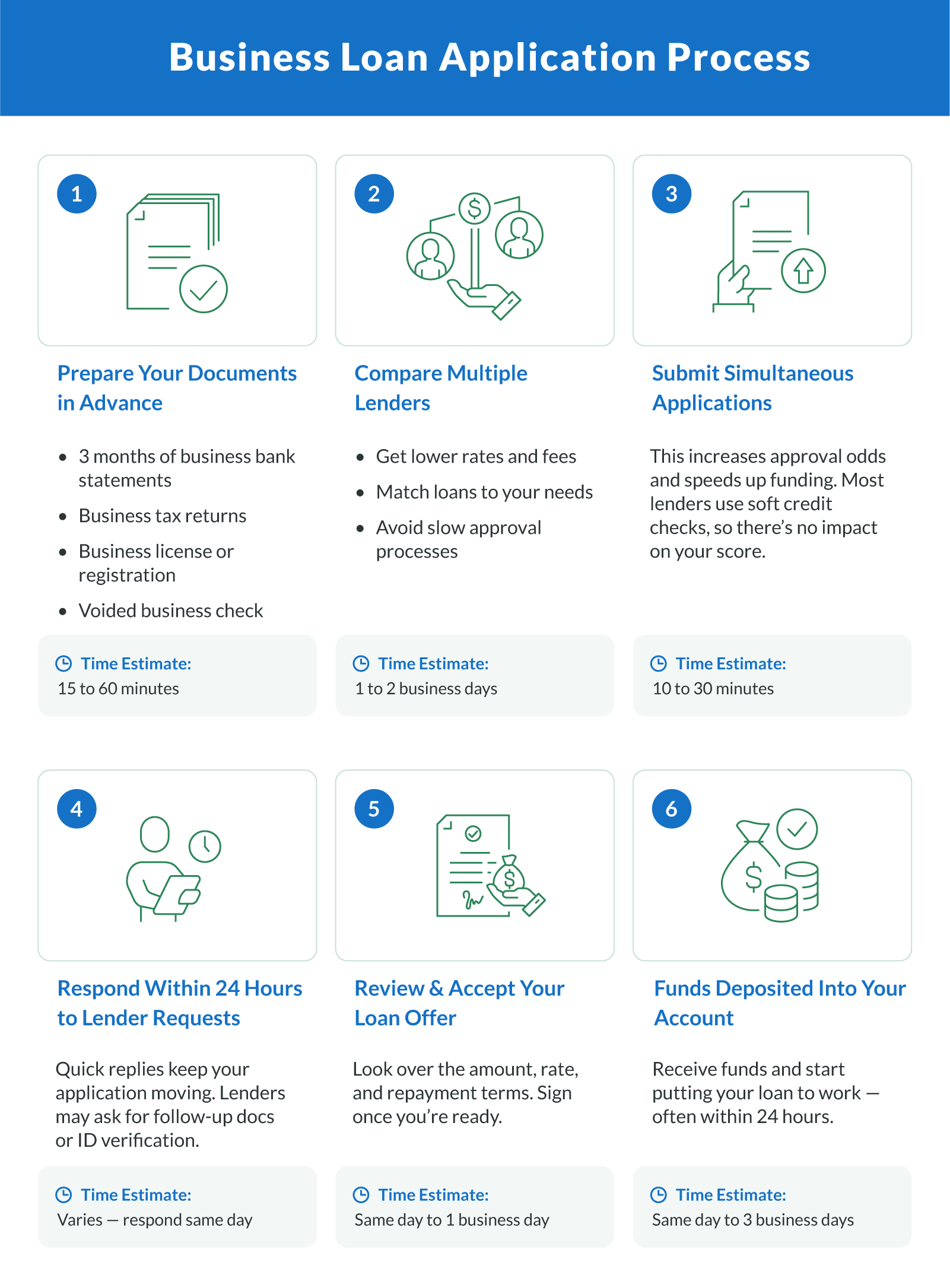

How To Apply for Fast Business Loans and Get Funded Quickly: Step-by-Step Guide

Speed matters when you're applying for fast business loans. Whether you're covering payroll or jumping on a time-sensitive opportunity, the best way to get funded quickly is to be proactive and organized. Follow these four steps to streamline the process and boost your approval odds.

Step 1: Prepare Your Documents in Advance

Before you apply, gather all the required documentation. Having everything ready to go will help you move through underwriting faster and avoid delays.

Here's what most lenders ask for:

Three months of bank statements from a business bank account

Business tax returns

Business license or registration

Voided business check

Most lenders will want to verify annual revenue and identity. Getting these docs lined up early keeps the process moving.

Step 2: Compare Multiple Lenders

Not all lenders offer the same rates, terms, or funding timelines, especially for fast business loans. Comparing multiple options helps you:

Find lower interest rates and fees

Match loan types to your specific needs (e.g., working capital, equipment, or inventory)

Avoid providers with slow or complicated approval processes

Comparing multiple offers through Clarify Capital helps you secure fast funding at competitive rates with 75+ vetted lenders, without wasting time shopping around.

Step 3: Submit Simultaneous Applications

Applying to multiple lenders at once (instead of waiting to hear back from one) increases your odds of approval and speeds up your path to funding. Most online lenders use soft credit pulls during prequalification, so this won't hurt your credit score.

When you apply through Clarify Capital, your dedicated advisor sends your profile to the lenders best matched to your credit, revenue, and goals, all at once. That means faster quotes and more competitive offers in less time.

Step 4: Respond Within 24 Hours to All Lender Requests

Once your applications are in, lenders may ask for follow-up documents, clarification, or identity verification. Responding quickly, ideally within the same business day, keeps your application at the top of the queue and helps you close the deal faster.

Delays in communication are one of the top reasons same-day funding falls through. If you're ready to act fast, your lender will be too.

How Different Financing Options Affect Your Business Over Time

This chart helps borrowers understand the impact of various business loan options on their cash flow, ensuring they make strategic borrowing decisions:

| Financing Option Comparison | |||

|---|---|---|---|

| Type of financing | Best for | Impact on cash flow | Typical funding time |

| Business line of credit | Managing working capital and short-term needs | Flexible, only pay interest on the amount used | Same-day funding to a few days |

| Short-term loans | Quick funding for unexpected expenses | Lump sum with fixed monthly payments | One to three business days |

| Merchant cash advance | Businesses with debit cards and credit sales | High-cost option with daily/weekly repayment deductions | Same-day funding |

| Equipment loan | Purchasing new equipment or expanding services | Moderate impact; assets act as collateral | One to five business days |

| Invoice factoring | Businesses with unpaid invoices | Improves cash flow but reduces total receivables | Same-day funding |

| SBA loans | Expanding business or securing real estate | Lower impact due to longer repayment terms | 30-90 days |

Fast Business Loan Eligibility Requirements

Qualifying for fast business funding is easier than getting approved through a traditional bank, but lenders still review a few key factors. Here are the typical loan eligibility requirements:

Credit Score Requirements

Most online lenders look for a personal credit score of 600 to 650 or higher. A stronger credit history helps you access lower interest rates and better repayment terms. That said, not all loan types require perfect credit.

Clarify Capital works with small business owners who have credit scores as low as 500. Since we match you with a network of 75+ lenders, we can find options even if your credit isn't ideal — especially for financing like invoice factoring or merchant cash advances.

Time in Business & Monthly Revenue

Most fast business loan providers require at least 12 months in business and $10,000 or more in monthly revenue. Having a solid foundation shows lenders that your business is stable and generates consistent cash flow.

However, there are exceptions. For example, merchant cash advances and invoice financing often approve newer businesses based on sales or accounts receivable, rather than the time in business.

Clarify Capital only requires six months of business experience. That opens the door to funding for startups and new businesses that need small business loans to grow.

Required Documents

You won't need a mountain of paperwork to get approved, but most lenders will ask for a few standard documents:

Three months of bank statements

Business tax returns

Business license

Voided business check

Some lenders offer low-doc or no-doc business loans, which skip most of the paperwork in favor of reviewing sales or deposit history. These are ideal for fast funding when time is tight, or your documents aren't fully organized yet.

Estimate Your Loan Payments Instantly

As your go-to partner for business advice, we're always ready to help you make the best choice for your business.

Use our Interactive Loan Calculator to see what your monthly payments could look like before you apply. Just enter your desired loan amount, interest rate, loan type, and term length, and get an instant estimate of your total repayment.

Ready to move forward with funding? Apply online in under two minutes and get matched with loan offers from 75+ top lenders, no fees, no obligation, just fast business financing built around your goals.

Pros and Cons of Fast Business Loans

Fast business loans are a helpful solution for covering urgent expenses, but they may not always be the right fit for every situation. Before applying, it's important to weigh the benefits against the potential trade-offs.

| Pros | Cons |

|---|---|

| Approvals within hours | Higher interest rates |

| No collateral required | Daily or weekly repayments |

| Simple online applications | Lower loan amounts |

Fast funding can be a game-changer when timing is critical, but it's smart to evaluate your cash flow and repayment ability before committing.