No-doc business loans are a type of financing that lets small business owners access capital without submitting traditional financial paperwork like tax returns, profit and loss statements, or balance sheets. Instead of requiring full documentation, lenders focus on high-level indicators to evaluate risk and accelerate access to capital.

These loans offer a streamlined path to funding by minimizing paperwork requirements and speeding up decision timelines, which can be helpful when cash flow needs are time-sensitive.

| What no-doc actually means | What lenders still check |

|---|---|

|

|

Because lenders are taking on more risk, interest rates are usually higher, and loan terms may be shorter or more restrictive than conventional financing options.

The table below lists the main types of business loans available with minimal paperwork, along with how each one works, documentation requirements, and links to apply today:

| No Doc Business Loan Options | |||

|---|---|---|---|

| Loan type | Description | Documentation level | Link to apply through Clarify Capital |

| Short-term business loan | Lump sum with fixed repayment over a short period | Low Doc or No Doc | Apply for a short-term business loan |

| Equipment financing | Capital to buy or lease equipment; typically doesn't require collateral | Low Doc | Apply for equipment financing |

| Merchant cash advance | Up-front cash in exchange for future sales; fast and paperwork-light | No Doc | Apply for a merchant cash advance |

| Business line of credit | Revolving credit up to a limit; interest only on what you use | Low Doc | Apply for a business line of credit |

| Invoice factoring | Sell unpaid invoices for immediate working capital | Low Doc | Apply for invoice factoring |

In this guide, you'll learn how no‑doc business loans work, what lenders actually look for, and how to decide whether fast, low‑paperwork funding is the right move for your business.

Low-Doc and No-Doc Business Loan Options From Clarify Capital

Small business owners who want to apply for a loan without all the documentation have lots of options. At Clarify, we keep things moving, so you don't have to wait for business financing.

We offer a variety of funding options to suit your needs, each with a unique type of financing structure. Our team also works with many different types of businesses, since we believe that every business owner deserves a chance to succeed.

Whether you own a restaurant, retail store, or even your own trucking company, you can count on Clarify Capital to get you the money you need to make your business grow.

Below is a brief overview of the popular funding types we provide:

Short-Term Business Loans

Also known as installment loans, short-term business loans are a type of loan that involves receiving a lump sum of money with a regular monthly payment schedule over a fixed period.

Unlike traditional bank loans that often require extensive paperwork, our short-term loans offer a streamlined alternative. They're the most common financial product used by borrowers wanting a no-doc or low-doc commercial loan.

Low-Doc Equipment Financing

Are you looking to buy or lease equipment? We've got you covered. With equipment financing, companies receive a certain amount of capital for renting or purchasing equipment.

Collateral isn't required. Small business owners can secure funds for equipment, including heavy machinery, with little documentation and disclosure.

Merchant Cash Advance

A merchant cash advance (MCA), or business cash advance, is a common financing type used to fill cash flow gaps. Businesses exchange a percentage of their future sales for instant access to working capital.

While these can come with high interest rates, they offer quick funding without extensive paperwork. Because the process can be done online, there's no need to fill out paper forms.

Low-Doc Business Line of Credit

Low-doc business lines of credit are another popular financing option. This revolving credit line allows small business owners to borrow up to a predetermined limit, paying interest only on the amount drawn.

They commonly use funds to pay for unexpected expenses at a lower interest rate than a business credit card. The application process is simple. All necessary information can be provided electronically, eliminating any need for pen-and-paper documentation.

Invoice Factoring

Also commonly referred to as accounts receivable financing, invoice factoring provides immediate working capital for small business owners. This form of invoice financing allows you to sell your unpaid invoices to a third party at a discount.

Rather than manage invoices independently, small business owners can work with a third party to collect payments directly from clients and customers. Outside of an initial application, which can be completed quickly, minimal paperwork is required.

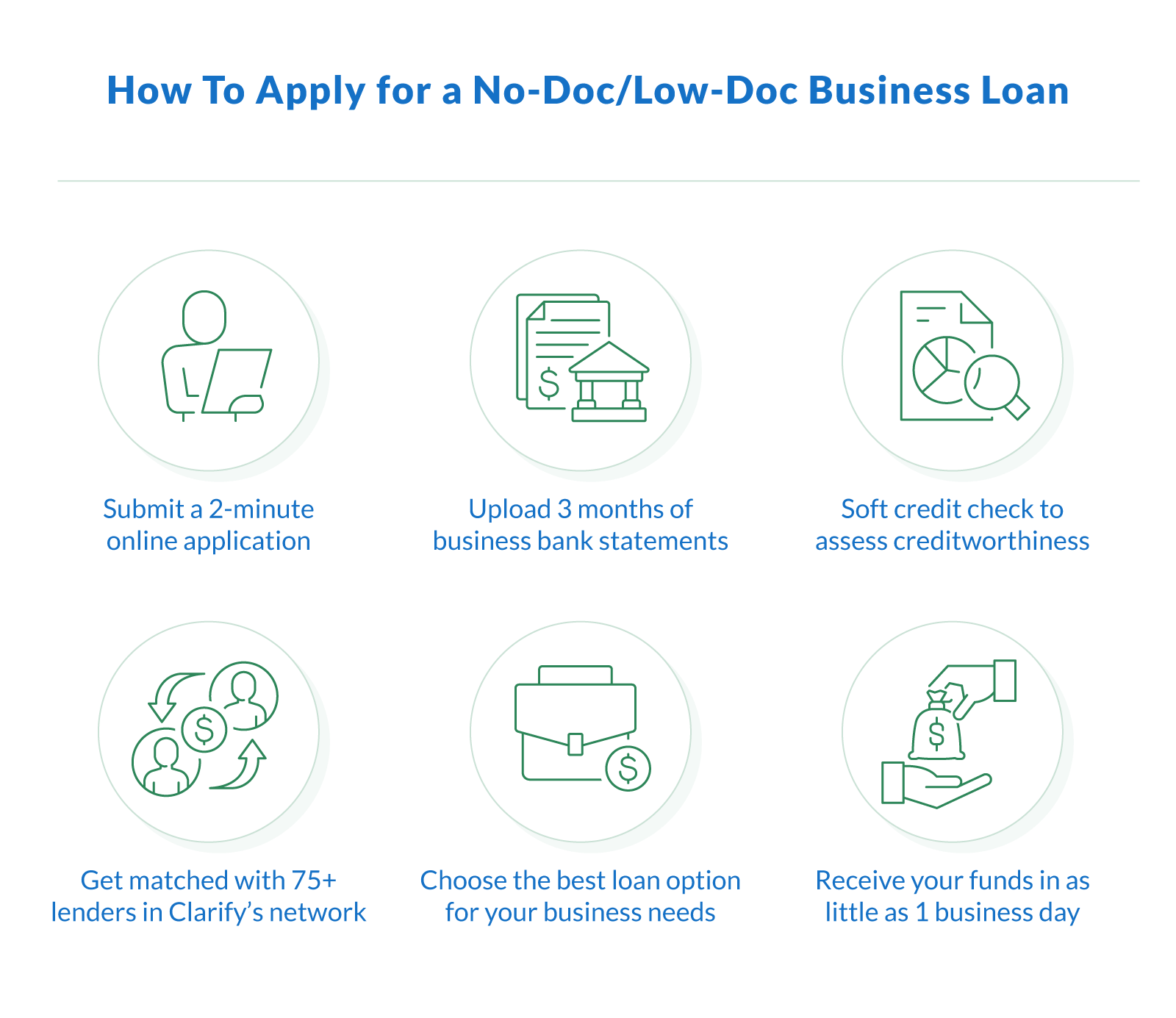

How To Get a No-Doc Business Loan

Many business lenders require borrowers to complete several forms, including bank statements, proof of assets, tax returns, balance sheets, and income verification, among others.

While an involved documentation process has its benefits, it's also quite time-consuming. Traditional banks tend to move slowly, leaving borrowers waiting a long time for their working capital.

What You Need To Provide

While no-doc and low-doc loans reduce the paperwork, lenders will still evaluate essential business factors, such as:

Time in business. Typically, we require at least six months of business operation.

Business revenue. A steady income is important for assessing your ability to repay.

Creditworthiness. A good credit score helps improve your chances of approval.

Although some borrowers inquire about using only their employer identification number (EIN) to apply, most funding options still require personal information and business income verification.