Here, we'll share six of the best small business loans we've found in 2023 and explain how various loans can suit different occasions.

Best for Small Businesses: Clarify Capital

Why it's a good choice: Clarify Capital has a proven track record of supporting over 10,000 small businesses across the United States. Restaurant owners, surgeons, auto shop owners, and entrepreneurs from many other industries have secured small business loans with Clarify Capital's assistance. A streamlined application process, a strong network of 75+ lenders, and flexible eligibility requirements are big draws.

Loan Amount Range: $10,000 to $5,000,000.

Minimum Credit Requirements: Minimum credit score 550 (Poor)

Pros:

- Loan APR rates can start at 7%

- Borrowers have access to a network of over 75 lenders

- Clarify Capital offers unsecured loans that do not require collateral

Cons:

- Certain products and services may not be available in every state

- Lower credit borrowers may have shorter repayment terms

Loan details:

- Need a minimum of $10,000 a month in revenue

- Loan terms range from 6-36 months

- At least six months in business to be eligible for loans

Best for SBA Loans: Small Business Administration

Why it's a good choice: The Small Business Administration (SBA) offers a wide selection of loans with low down payment requirements and capped interest rates.

Loan Amount Range: up to $5,000,000

Minimum Credit Requirement: 620-640 (Fair)

Pros:

- Generous loan repayment terms

- The SBA caps interest rates for loans

- A wide variety of loans are available for applicants

Cons:

- You will likely need collateral

- Loans have lengthy processing times

- Extensive documentation necessary to secure loans

Loan details:

- Applicants must demonstrate a need for funding

- Must use other assets before applying for an SBA loan

- Small business owners must provide an unlimited personal guarantee

Best for Long-Term Loans: Funding Circle

Why it's a good choice: Funding Circle has more than 10 years of experience working with businesses worldwide. They specialize in offering a wide selection of loans to small businesses, though special mention goes to their long-term loans — which range from six months to seven years and don't require applicants to meet a minimum revenue requirement.

Loan Amount Range: $25,000 up to $500,000

Minimum Credit Requirement: 660 (Fair)

Pros:

- Funding may be available in two business days

- Loan terms range from six months to seven seven years

- Applicants don't need to meet a minimum revenue requirement

Cons:

- Two years in business required for loans

- Applicants must agree to a personal guarantee

- Annual revenue requirement of at least $400,000

Loan details:

- Monthly repayments

- There are no prepayment penalties on loans

- 4.49% to 8.49% origination fee and a late fee of 5% for missed payments

Best for Fast Financing: Bluevine

Why it's a good choice: Bluevine is a well-respected online lender that excels at offering fast funding. Applicants willing to sign a personal guarantee can obtain loans with generous repayment terms in as little as 12 or 24 hours.

Loan Amount Range: $6,000 to $250,000

Minimum Credit Requirement: 625 (Fair)

Pros:

- Flexible loan term lengths

- Fast funding within 24 hours

- No prepayment penalties for loans

Cons:

- Personal guarantee required

- $40,000+ monthly revenue requirement

- Services may not be available in all states

Loan details:

- Terms range 6-12 months

- Need 24 months in business

- Weekly or monthly repayments

Clarify Capital can also provide fast business loans to borrowers within 24 hours. A personal guarantee isn't required, and applicants may be eligible for loans with 6% APR.

Best for Startups: Fundbox

Why it's a good choice: Due to its lenient credit score and time in business requirements, FundBox is a strong choice for startups. Applicants may be required to make weekly repayments for loans, but they can do so early without facing a prepayment fee. Funding is also available quickly, usually within one business day.

Loan Amount Range: $100 to $150,000

Minimum Credit Requirement: 600 (Fair Credit)

Pros:

- Can qualify for loans with six months in business

- Lower than average minimum credit score requirement (600)

- Fast access to cash — can receive funds within one business day

Cons:

- Doesn't build business credit

- Fast repayment terms (12 or 24 weeks)

- APR rates not disclosed until borrowers apply

Loan details:

- No prepayment fees

- Weekly repayment schedule

- The minimum annual revenue for eligibility is $100,000

Best for Equipment Financing: Balboa Capital

Why it's a good choice: Small businesses who need access to equipment funding may want to consider Balboa Capital. Equipment is used as capital, and borrowers can get loan approvals within an hour. Balboa Capital can also assign an account manager to help projects stay online and within budget.

Loan Amount Range: $20,000 to $250,000

Minimum Credit Requirement: 620 (Fair Credit)

Pros:

- Possible approval within an hour

- Monthly repayments for equipment financing

- Borrowers receive an experienced account manager

Cons:

- Loans may come with multiple fees

- Annual revenue requirement of $300,000 for short-term loans

- Full pricing information may not be available until you complete the application process.

Loan details:

- Daily or weekly repayment schedule for short-term loans

- $100,000 annual revenue requirement for equipment financing

- Loan options are varied, including SBA and franchise financing

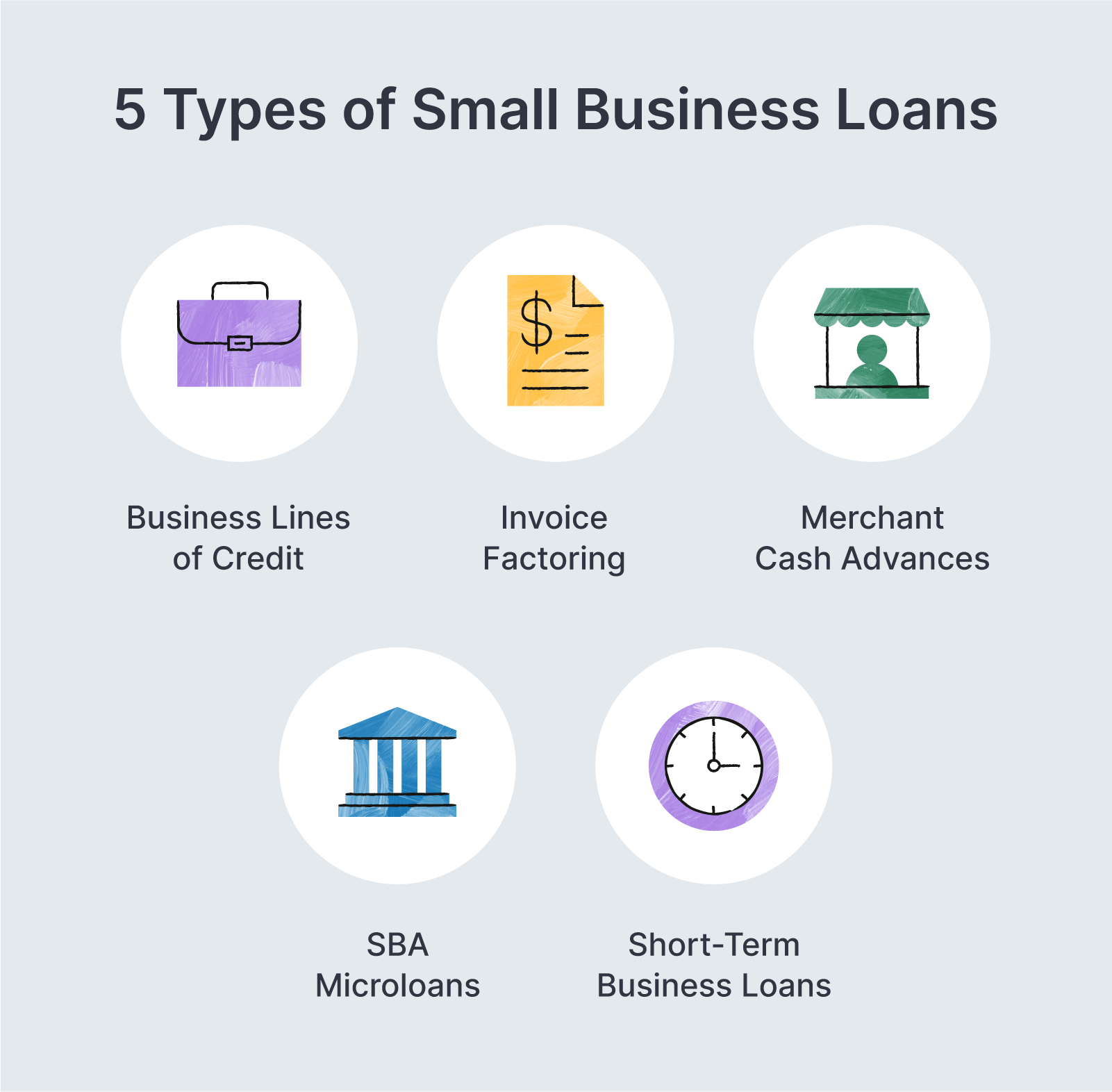

What Types of Small Business Loans Are Available?

Different types of loans exist to support different types of small businesses. Below, we'll explore 5 of the most common categories of small business loans you may be eligible for.

Business Line of Credits

A business line of credit provides borrowers with a revolving credit limit they can use for various transactions. These types of loans are functionally similar to credit cards, though borrowers will only pay interest for the amount they borrow.

Invoice Factoring

Invoice factoring is a unique type of loan that lets you use unpaid invoices as collateral in exchange for funds. Small businesses that offer products and services on credit may consider this option.

Merchant Cash Advances

A merchant cash advance (MCA) may be the right choice for your business if you're willing to pay a percentage of your future sales. Funding is often quick, and requirements are normally lenient.

SBA Microloans

The Small Business Administration (SBA) can offer microloans to qualifying lenders. SBA loans are government-backed, which can translate into low interest rates for borrowers. The caveat is that microloans inherently come in small sums.

Short-Term Business Loans

Short-term business loans normally have 6-month to 2-year repayment schedules. Lenders can provide a lump sum to qualifying borrowers with fluctuating interest rates.

Can I Use a Small Business Loan To Refinance Existing Debt?

The answer to this question depends on multiple factors, such as your lender's policies and even the reason you're looking to refinance your debt. Borrowers might try to refinance a debt because their monthly payments are too high or their current interest rate isn't satisfactory. If borrowers make on-time payments and practice good credit habits, they may have a higher likelihood of refinancing their existing debt.

Another factor that comes into play is the type of loan you're attempting to refinance with. For example, a borrower may be more likely to refinance their debt with an SBA 7(a) loan than with a microloan.

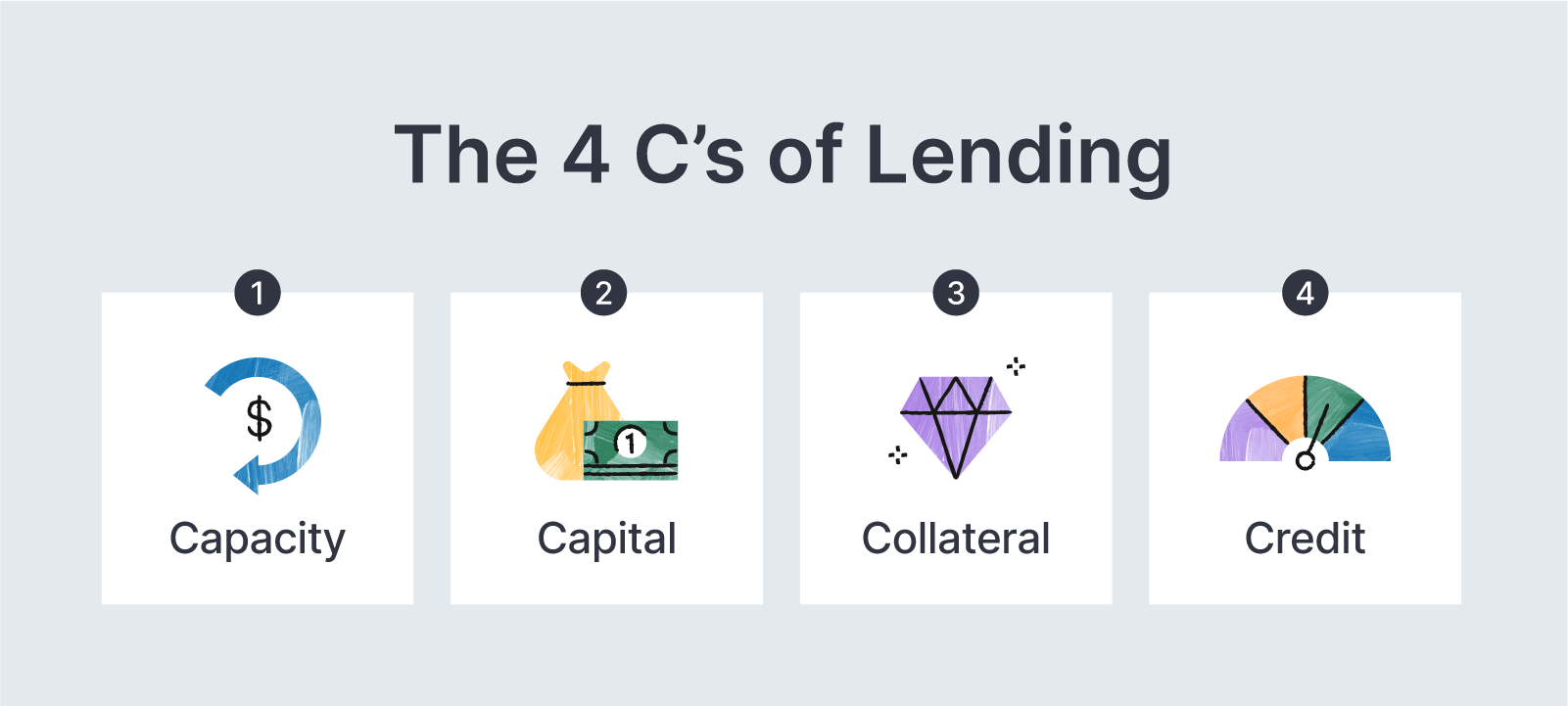

What Are the 4 C's of Lending?

Lenders rely on all sorts of information when considering whether a borrower can reasonably and reliably manage a loan. The “4 C's of Lending” refer to the four qualities lenders consider when assessing applicants.

Capacity: This refers to a borrower's ability to repay a loan within a set amount of time. This category considers an applicant's employment status and other income they might have access to.

Capital: Capital also considers an applicant's finances, though this category can be influenced if a borrower places a large down payment and has consistent cash flow.

Collateral: This refers to any property or possessions that a borrower may have to forfeit if they cannot repay a loan. Houses, jewelry, and equipment are some examples of collateral.

Credit: This category essentially assesses a borrower's likelihood to payback loans. Individuals with higher credit scores are often eligible for better loans because lenders won't perceive them as a financial risk.

Discover Small Business Loans With Clarify Capital

Small business loans are incredibly convenient, but it's easy to overborrow without the right guidance. Clarify Capital connects borrowers with a network of nationwide lenders and experienced in-house account managers.

Clarify Capital's streamlined application process helps borrowers qualify for small business startup loans within 24 hours. Repayment terms are very flexible, and collateral may not be a requirement to receive funding.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts

![Business Action Plan Template for 2025 Growth [Free]](/assets/blog/business-action-plan-template-2025/business-action-plan-template-2025-small-cda22747f8266c0ffbaec17daaaae20a84835bff0f9e94315070bb25a2d95f6b.jpg)