Meeting payroll is essential for business owners, but challenges like slow cash flow, unexpected expenses, or unpaid invoices can make it difficult. When this happens, small business loans provide the financial support needed to cover payroll and keep operations running smoothly. If payroll is due soon, funding speed matters. While the Paycheck Protection Program (PPP) provided temporary relief, many small business owners now rely on payroll loans to meet their ongoing needs.

With options ranging from short-term loans to business lines of credit, you can choose between a lump-sum payroll loan for urgent needs or revolving access to funds for week-to-week gaps.

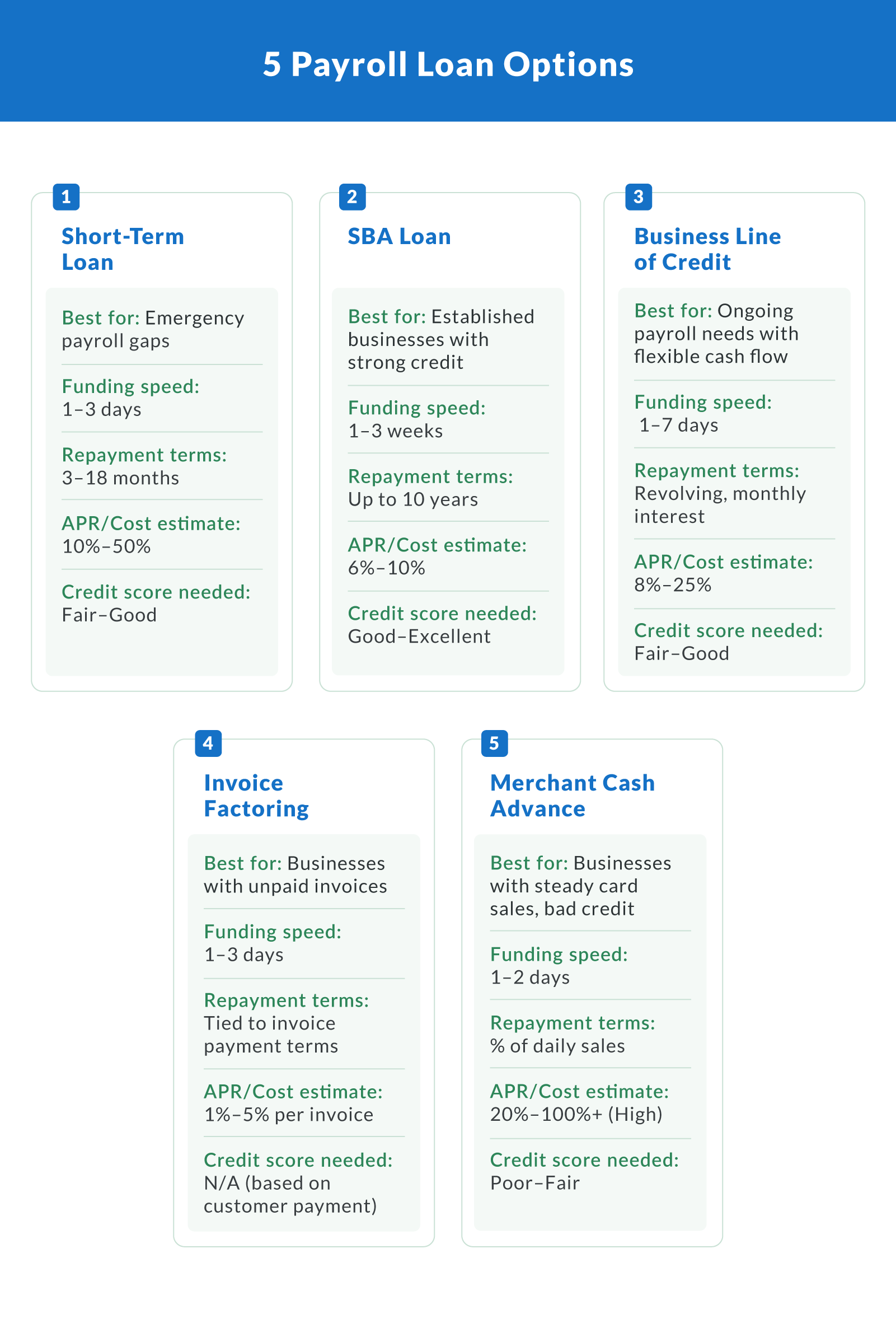

| Top Payroll Loans for Businesses | |||||

|---|---|---|---|---|---|

| Loan option | Best for | Funding speed | Repayment terms | APR/cost estimate | Credit score needed |

| Short-term loan | Emergency payroll gaps | 1–3 days | 3–18 months | 10%–50% | Fair–Good |

| SBA loan | Established businesses with strong credit | 1–3 weeks | Up to 10 years | 10%–15% | Good–Excellent |

| Business line of credit | Ongoing payroll needs with flexible cash flow | 1–7 days | Revolving, monthly interest | 8%–25% | Fair–Good |

| Invoice factoring | Businesses with unpaid invoices | 1–3 days | Tied to invoice payment terms | 1%–5% per invoice | N/A (based on customer payment) |

| Merchant cash advance | Businesses with steady card sales, bad credit | 1–2 days | % of daily sales | Factor rate of 1.1 to 1.5 | Poor–Fair |

What To Consider Before Choosing a Payroll Loan

Choosing the right loan requires a clear understanding of your business needs and the available financing options. Factors like interest rates, repayment terms, and credit score requirements can determine what type of loan is best for you. It also helps to factor in payroll deadlines and payroll taxes, since timing can limit your options.

Evaluate Your Business Needs

Before applying for a payroll loan, assess your financial situation and funding requirements.

Assess cash flow. Identify whether current revenues can cover payroll and other business expenses.

Calculate annual revenue. Lenders often use this figure to determine the maximum loan amount.

Identify specific business needs. Decide whether you need a lump sum for immediate funding or a credit line for ongoing payroll expenses.

Understand Loan Types and Features

Learning how different loan options work will help you select the most suitable financing option.

Repayment terms. Loans with shorter terms may have higher monthly payments, while long-term loans offer smaller payments but accrue more interest.

Interest rates. Compare rates to find the best small business loans for your budget.

Credit score requirements. A strong credit history or personal credit score can lead to lower rates and better terms.

Loan amount. Select a loan amount that aligns with your payroll needs without borrowing more than necessary.

Top Loan Options for Covering Payroll

Different loan options fit different needs. If payroll is due soon, prioritize funding speed and payment terms you can handle. Below, we cover the most popular choices to help you decide.

Short-Term Business Loans

Short-term business loans can help you cover payroll fast with a single lump sum.

How it works: Borrowers receive a lump sum up front and repay the loan over a short period, usually three to 18 months. Example: borrow $30,000 and repay in fixed weekly payments for 12 months.

Best for: Businesses that are facing temporary cash flow issues or unexpected expenses.

Pros of a short-term business loan include:

Fast funding for immediate needs

Simple loan application process

Flexible use of funds

Cons of a short-term business loan include:

Higher interest rates compared to long-term loans

May include prepayment penalties

Fixed payments can squeeze cash flow during repayment.

SBA Loans

SBA loans, such as the SBA 7(a) program, are government-backed loans offered through traditional banks or credit unions.

How it works: The Small Business Administration guarantees a portion of the loan, reducing the lender's risk and providing lower interest rates for borrowers.

Best for: Established businesses with a strong credit history and steady revenue that can wait out the application process.

Pros of an SBA loan include:

Lower interest rates and favorable repayment terms

Long-term loans are available for larger funding needs

Suitable for various business expenses, including payroll

Cons of an SBA loan include:

Lengthy application process

Requires a minimum credit score and a personal guarantee

Business Lines of Credit

A business line of credit is a revolving option for ongoing payroll costs.

How it works: Borrowers access funds up to a set limit and pay interest only on the amount used. Funds become available again once repaid. Example: Draw $10,000 for payroll, repay it, then redraw later.

Best for: Businesses with ongoing payroll expenses and fluctuating cash flow.

Pros of a business line of credit include:

Flexible borrowing with no need to reapply

Pay interest only on the borrowed amount

Useful for managing recurring expenses

Cons of a business line of credit include:

Higher interest rates than traditional loans

May include maintenance or draw fees

Invoice Factoring

Invoice factoring provides immediate cash by selling unpaid invoices to a factoring company.

How it works: A factoring company advances a portion of your receivables' value and collects the full payment from your customers. It can turn unpaid invoices into payroll funding while you wait on customer payments.

Best for: Businesses with outstanding invoices and immediate payroll needs. This is ideal if you have significant accounts receivable but need cash fast.

Pros of invoice factoring include:

No reliance on creditworthiness for approval

Fast funding to address payroll gaps

Cons of invoice factoring include:

Reduced profits due to invoice discounting

High fees compared to other financing options

Merchant Cash Advances

Merchant cash advances (MCAs) offer fast funding in exchange for a portion of future sales.

How it works: Businesses receive a lump sum and repay it through automatic deductions from daily credit card sales.

Best for: Businesses with steady sales but bad credit that need short-term financing.

Pros of a merchant cash advance include:

No fixed repayment schedule

Accessible for businesses with poor credit history

Cons of a merchant cash advance include:

Higher interest rates and fees

Daily deductions can strain cash flow and complicate payroll planning

Alternative Lenders

Online lenders like Clarify Capital provide fast and convenient funding options.

How it works: Borrowers complete a digital loan application and receive funding within days.

Best for: Entrepreneurs who need fast funding, working capital loans, or fast business loans when a bank loan can't move quickly enough. Compare total cost and repayment terms before you sign.

Pros of alternative lenders include:

Simplified application process

Quick approval and funding

Cons of alternative lenders include:

Higher interest rates than traditional banks

May include origination fees

Ready to cover payroll without dragging out the process? Clarify Capital helps small business owners compare business loans and payroll funding options so you can cover payroll quickly and keep operations moving.

Apply now to see what you may qualify for and what repayment could look like before you commit.

How Interest Rates and Market Conditions Impact Payroll Loan Choices

In today's economic environment, rising interest rates and rising inflation are making short-term financing more expensive for small business owners. Payroll loans, which are often used to handle immediate needs, can become significantly more costly if you focus on speed and ignore the full price of borrowing.

Fixed-rate loans may provide predictable monthly payments, but short-term loans from online lenders or alternative providers often carry variable rates that increase with market conditions.

Here's a simple example: On a $20,000 loan over 12 months, a jump from 12% to 18% can raise the monthly payment by roughly $55–$60. That kind of change hits cash flow fast when you're trying to cover payroll and other business expenses.

Before committing, ask your lender whether your loan has a fixed or variable interest rate and how changes in the market could affect repayment. Also, ask how often the rate can change and whether there's a cap. This simple step can help protect your business from unexpected financial strain.

Key Factors in Choosing the Right Loan

Choosing the right loan to cover payroll requires more than just comparing headline interest rates. It's essential to evaluate factors like repayment terms, eligibility requirements, and overall costs so the loan fits your business needs without creating a new cash flow problem.

By understanding these key aspects, business owners can make informed decisions and avoid potential small business financing pitfalls. Think of this section as a quick checklist before you accept an offer.

Compare Interest Rates and Fees

Understanding the true cost of borrowing starts with a close look at rates and fees.

Interest rates. Lower rates save money over the repayment period, but eligibility may depend on your credit score and credit history.

Origination fees. Some loans include up-front costs that reduce what you actually receive.

Prepayment penalties. Confirm whether early payment lowers your total cost or triggers extra fees.

Check Credit Score Requirements

Lenders evaluate your creditworthiness based on both your personal credit score and business credit history.

Improve your credit history. Pay off outstanding debts and address any errors in your credit report.

Minimize credit inquiries. Multiple applications can lower your credit score, so apply selectively.

Evaluate Repayment Terms and Compliance Timing

The length and structure of your loan impact both cash flow and total repayment cost.

Repayment cadence. Daily or weekly pulls can be harder to manage than monthly payments, especially during slower weeks.

Payroll taxes and employee benefits. Make sure the payment schedule still leaves room for payroll taxes and any employee benefits you cover.

Short-term vs long-term. Short-term loans provide immediate funds but require quicker repayment, while long-term loans spread payments out but increase total interest.

Payroll Loan Options for Startups and Bad Credit

Some lenders offer specialized funding solutions for new businesses or those with less-than-perfect credit. If you're a startup, keep in mind that many lenders want to see revenue history and time in business, so options can be more limited.

Funding for New Businesses

Startups often face challenges due to a lack of established credit history.

Microloans. Designed for smaller funding needs with flexible repayment terms.

Some online lenders. May consider newer businesses, but approval usually depends on basics like consistent revenue and a business bank account, not just a quick application.

Overcoming Bad Credit

Businesses with bad credit can still access funding through specific options.

Merchant cash advances. Accessible to businesses with low credit scores, but often involves higher costs.

Invoice factoring. Approval is based on receivables rather than credit history, which can help if you have unpaid invoices.

Credit improvement. Focus on correcting credit report errors and lowering balances, since both can move your credit score faster than opening new accounts.

When a Line of Credit or Credit Card Is Better Than a Payroll Loan

Not every payroll challenge requires a loan. Sometimes, using a business line of credit or business credit card is a more flexible and cost-effective solution.

Business line of credit. Perfect for short-term payroll expenses that fluctuate. You draw funds as needed and only pay interest on what you use. Example: Draw $8,000 for this week's payroll, repay it, then redraw later if another gap shows up. It's a great fit for managing cash flow week to week.

Credit cards. For smaller payroll gaps or covering payroll taxes, a business credit card can help. Many cards offer cash-back or points, and minimum payments allow for breathing room. Just watch the APR, since carrying a balance can get expensive fast.

These tools also avoid locking you into rigid loan terms. If your needs are short-lived or variable, flexible repayment options could be the smarter financial move.

Real-World Scenarios: How Small Businesses Use Payroll Loans

Payroll loans aren't one-size-fits-all. Here are real examples of how small business owners use different types of payroll loans to keep their teams paid:

Restaurant facing off-season slump. A short-term loan provides working capital to cover payroll costs during the slow winter months. Repayment aligns with projected spring revenue.

E-commerce startup with unpaid invoices. They use invoice factoring to convert accounts receivable into immediate cash, helping them meet payroll without taking on more debt.

Retail shop preparing for a holiday rush. A merchant cash advance helps fund temporary staff hiring in anticipation of increased sales. Repayment happens automatically through credit card transactions.

These examples show how payroll financing can address cash flow gaps when it's matched to the situation and repayment pace.

The Loan Application Process

Understanding the application process can improve your chances of approval and help you get funded faster.

Steps To Apply

A clear application process can improve your chances of approval and speed up funding.

Determine the type of financing. Decide whether short-term loans, credit lines, or another option fits your business needs.

Prepare documentation. Include your business plan, proof of annual revenue, and bank account details. Many lenders will also ask for recent bank statements to confirm cash flow and eligibility.

Submit your application. Apply online, through traditional banks, or via credit unions. Online lenders may fund within one to a few business days, depending on underwriting and the documents you provide.

Documents You'll Need

Most lenders require standard paperwork to verify your business's financial health and plans.

Business plan. Demonstrates your financial goals and repayment strategy.

Revenue proof. Includes receivables and bank account statements.

Credit history. Both your business and personal credit scores may be required.

Who Payroll Loans Are Best For

Payroll loans are designed to help small business owners keep their teams paid during short-term cash flow disruptions. They can be useful when you need to cover payroll on schedule, including payroll taxes, even if customer payments are late. They're often a fit for:

Startups with seasonal income or limited reserves. Payroll funding provides quick relief when cash flow dips.

Established businesses that are facing short-term disruptions. Delayed payments or unexpected expenses can create payroll gaps that a short-term loan can cover.

Industries with high payroll demands. Retail, hospitality, and service businesses often have large or fluctuating payrolls. Having access to fast financing helps manage those swings.

If you need to cover payroll expenses quickly, without waiting for unpaid invoices to clear or revenue to normalize, a payroll loan could be the right type of financing for you.

FAQ About Payroll Loans

Choosing the right business payroll loan can raise many questions, especially for first-time borrowers. From understanding how different types of loans work to determining eligibility requirements, these answers will help clarify your options.

What's the Difference Between a Loan and a Credit Line?

A loan provides a lump sum with fixed repayment terms, while a business line of credit lets you borrow as needed and pay interest only on what you use.

Can I Use My EIN Number To Get a Loan?

Yes. Many lenders can issue a no-document loan, which uses your EIN to review business credit history, but approval still depends on revenue, time in business, and your credit score.

Can I Get a Payroll Loan With Bad Credit?

Yes. Options like merchant cash advances, invoice factoring, and alternative lenders may work for borrowers with bad credit, but they usually come with higher interest rates, fees, or faster repayment.

How Do I Get Money To Cover Payroll?

Start by estimating payroll expenses and payroll taxes, then compare a short-term loan or a revolving credit line. Apply with basic documents like recent bank statements to speed up a decision.

Secure the Right Payroll Loan for Your Business

Covering payroll is a critical responsibility for business owners, and having the right financing in place can make all the difference. From short-term business loans to business lines of credit and SBA loans, there are many options to meet your specific business needs. At Clarify Capital, we help connect small business owners with payroll funding and working capital options to manage payroll and other business expenses. We work with a network of trusted loan providers to support fast decisions when timing matters.

Once you've compared your options, choose the repayment terms you can manage and move quickly to keep payroll on track. Apply now and explore tailored financing options to keep your business running smoothly.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts