If you’re a business owner or entrepreneur, you probably understand the importance of choosing the right financing option, including equity financing.

Unlike debt financing, where you deal with loan repayments and interest payments, equity financing involves exchanging a part of your company’s ownership for funding. This can be particularly advantageous if you have a new business and may not have a substantial credit history or steady cash flow to get traditional bank loans from financial institutions.

Keep reading to learn what equity financing is and how it differs from other types of business financing, like debt financing and business credit lines. We also offer best practices for capitalizing on equity.

What Is Equity Financing?

Equity financing is the process of raising capital by selling shares of your company. When you opt for equity financing, you exchange a portion of your business’s ownership for investment.

This differs from debt financing, where you borrow money and repay it over time, typically with interest. Equity financing is an option when your creditworthiness might make qualifying for a traditional loan difficult.

Instead, with equity financing, you offer investors an ownership stake in your company. These investors are hoping your business will grow, increasing the value of their equity investment.

This form of financing can be particularly attractive if your business doesn’t have an extensive credit history or steady cash flow required for more conventional bank loans. A high credit score can indicate your ability to handle business finances, a factor that investors might consider.

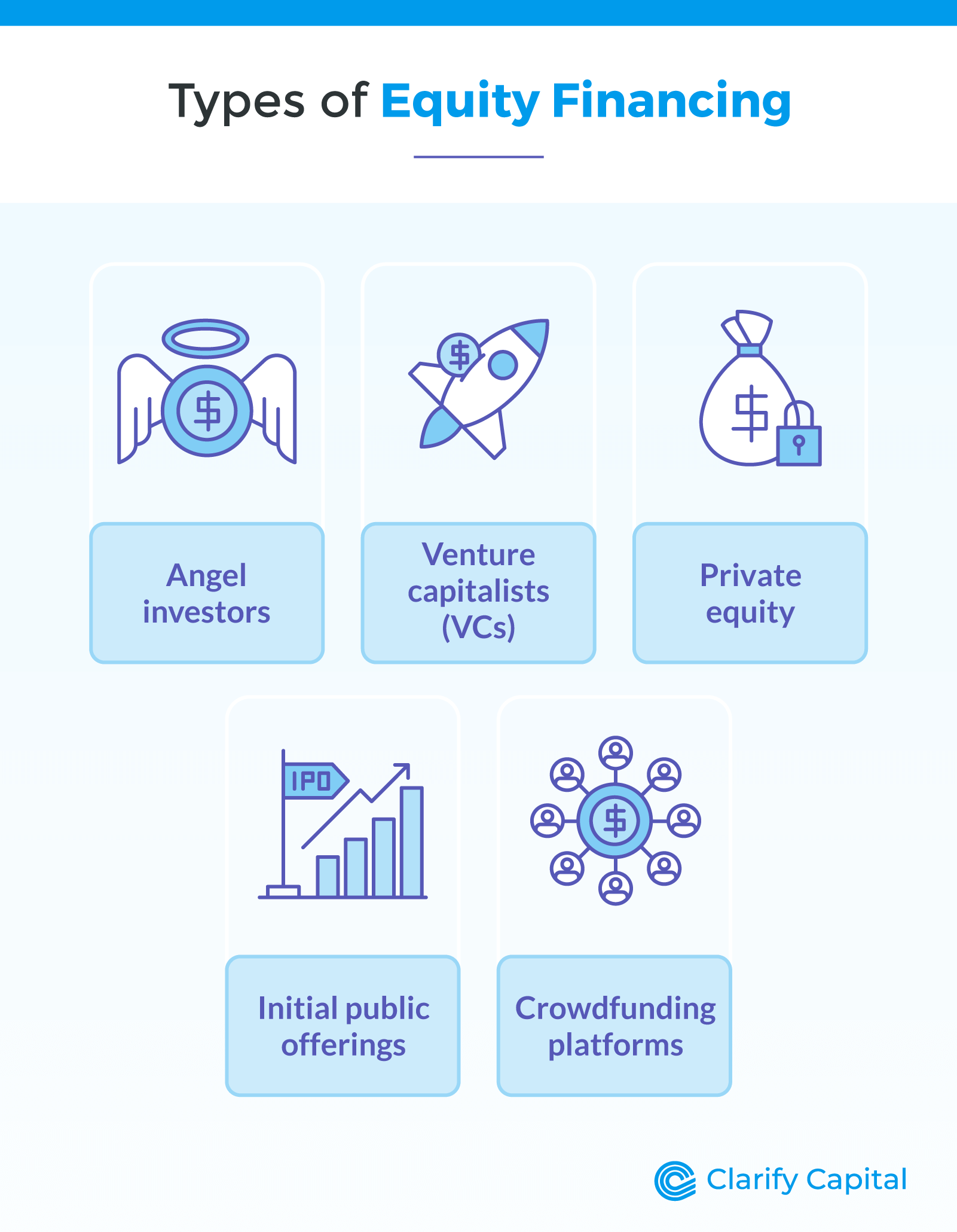

Types of Equity Financing

Equity financing comes in several forms, each with its unique characteristics and suitability for different types of businesses. Understanding these can help you identify the best fit for your company.

Angel investors

These are typically wealthy individuals who provide capital for startups, often in the early stages. Angel investors usually invest smaller amounts than venture capitalists. They’re ideal for startups that are too new to attract larger investors but show strong potential for growth.

Venture capitalists (VCs)

Venture capital firms typically invest in startups and small businesses with high growth potential. The investments from VCs are usually larger. In return, they usually want a significant equity stake. VCs are a good fit for businesses past the initial stage looking to scale up rapidly.

Private equity

Private equity firms invest in more mature companies, often through buyouts. They might invest in a struggling company to turn it around or in a successful one to boost further growth.

Initial public offerings (IPOs)

An IPO involves taking your company public by offering shares to the general public on a stock exchange. However, the process is complex, you’ll need to adhere to strict regulatory requirements.

Crowdfunding platforms

These platforms allow businesses to raise small amounts of money from a large number of people, typically via the internet. You can raise capital by tapping into the collective effort of friends, family, customers, and individual investors. Crowdfunding is versatile and can suit various stages of business, especially those with products or services that resonate well with the general public.

Pros and Cons of Equity Financing

Equity financing has advantages and drawbacks, just like any funding strategy. Understanding these can help you decide if it’s the right route for your business.

Pros of Equity Financing

No loan repayments. One of the biggest advantages of equity finance is the absence of loan payments. Even if the interest is tax-deductible, it’s money you must repay. No monthly loan payments can be a huge relief, especially for startups and small businesses with unpredictable cash flow.

Get expertise and networks. When you work with equity investors, you often have access to more than just funds. They might also offer mentorship. They can also help you with networking, so you can find new opportunities for your business.

Suitability for high-growth businesses. Equity financing can be an excellent option if your business has a high growth potential but lacks the assets or track record to get traditional loans. Investors often look for growth potential over current profitability.

Cons of Equity Financing

Loss of some control of the company. By selling a stake in your business, you’re also sharing the decision-making. This could mean less control over your company, depending on the size of the stake sold and the agreement terms with the investors.

Complexities in valuation. Determining the valuation of your business can be complex and subjective. A valuation that’s too high might put off investors, while a valuation that’s too low could mean giving away more of your business than necessary.

Challenges in finding suitable investors. Finding and pitching to the right investors can be time-consuming and challenging. It requires a solid business plan, a compelling pitch, and often a considerable amount of networking.

Equity financing can be great for businesses in their early stages or those with substantial growth prospects. However, carefully weighing these pros and cons is essential to determine if this type of financing aligns with your business goals and how you envision its future.

Best Practices for Capitalizing on Equity

When it comes to equity financing, consider these best practices to increase your chances of success.

Develop a Comprehensive Business Plan

Starting with a well-crafted business plan is key. This plan is a comprehensive guide that includes an in-depth analysis of the market, a clear explanation of your business model, detailed cash flow forecasts, and a snapshot of your growth potential. This plan can draw in investors and steer your business in the right direction with informed decision-making.

Understand Your Company’s Valuation

Valuation is a critical aspect of equity financing. It determines how much money you can raise and how much of your company you must give up in return. Familiarize yourself with different valuation methods commonly used by startups and small businesses, and take advantage of tools like online calculators.

Build Relationships With Potential Investors

Equity financing is as much about relationships as about capital. It’s important to build connections with potential investors, as they can often provide mentorship, industry knowledge, and valuable business connections beyond the capital they inject into your business.

Prepare for Diligence Checks by Investors

Investors will do their due diligence before they commit their funds. Be prepared with complete and accurate financial records, a clear business strategy, and proof of your growth potential. Being well-prepared for these checks increases your chances of securing funding and demonstrates your commitment and professionalism.

Evaluate and Select the Right Type of Equity Financing

Finally, consider the various types of equity financing available and determine which is most suitable for your business. This decision should be based on your company’s stage, industry, and specific financing needs. Compare angel investors, venture capitalists, crowdfunding, and private equity to find the best fit for your business growth and goals.

Financing Equity With Clarify Capital

While equity financing is a powerful tool for business growth, especially for high-potential startups, small businesses, and large real estate ventures, it’s not the only path. Different businesses have different needs — sometimes, you might need more immediate or flexible financing options.

This is where Clarify Capital steps in, offering a range of financing solutions tailored to your business’s unique needs. From small business loans like term loans to lines of credit and merchant cash advances (MCAs), Clarify Capital provides the support and resources to help your business thrive.

We set your business up for success by offering fast approval and funding, a quick application process, and access to experienced loan advisers. Find the perfect fit to fuel your business’s growth by applying today. With the right financial partner and strategy, the potential for your business is limitless.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts