Entering new markets can open doors to greater revenue, broader customer bases, and long-term business resilience. In fact, U.S. e-commerce sales surpassed $1.18 billion in 2024, showing just how vast the digital opportunity can be for growth-focused companies. But expansion isn't without its risks — roughly 20% of new businesses don't make it through their first year.

This guide offers a strategic look at how to expand into new markets confidently, while managing risk and aligning with long-term business goals. Whether you're a small business owner eyeing e-commerce or planning your next market expansion strategy, these insights can help you move forward with clarity and purpose.

Why Expanding Into New Markets Matters

Growing into new markets fuels scalability, creates diversification across customer segments, and unlocks access to new talent pools and technology hubs. Businesses that expand geographically or into new customer demographics reduce dependence on a single source of revenue, building resilience and agility.

Today, market expansion is heavily shaped by digital acceleration, changing customer expectations, and the rapid evolution of global demand patterns. Embracing this shift is essential for long-term business growth, especially when targeting international expansion or tapping into fresh opportunities across industries.

Strategic Frameworks for Market Expansion

Before entering new markets, businesses need to evaluate their options through proven strategic lenses. These frameworks help assess risk, competitive advantage, and growth potential based on both product and market dynamics.

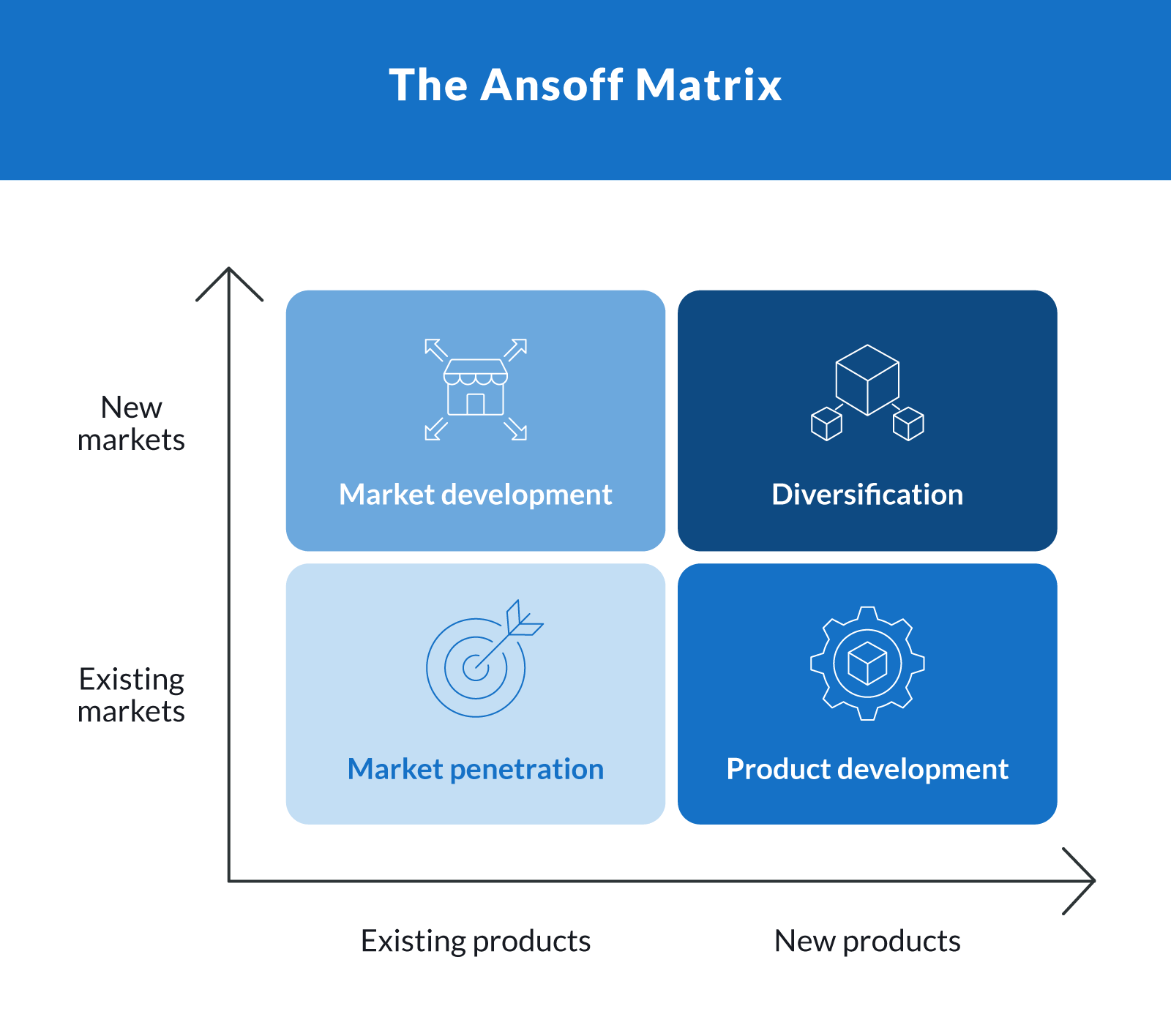

The Ansoff Matrix

The Ansoff Matrix is a simple way to think through your growth options by asking two questions: Are you targeting existing or new markets? And are you offering existing or new products?

Each quadrant in the matrix represents a different type of growth strategy:

Market penetration. Selling more of existing products to customers in existing markets to increase market share.

Market development. Introducing existing products into new markets, either by geography, audience, or distribution channel.

Product development. Creating new products to serve your current market more effectively.

Diversification. Launching new products in entirely new markets — typically the riskiest but potentially most rewarding strategy.

These options help companies align their growth plan with their current capabilities across both existing products and market development initiatives.

To use the matrix, locate where your plan fits based on the chart's axes:

Look at the vertical axis to identify if you're targeting existing markets (bottom) or new ones (top).

Then look at the horizontal axis to decide if you're working with existing products (left) or developing new ones (right).

Your chosen strategy will land in one of the four boxes, which helps you understand the level of change and risk involved and plan accordingly.

Porter's 5 Forces for Competitive Readiness

Porter's 5 Forces framework is a helpful lens for understanding the current market and evaluating whether a company can maintain a competitive advantage in a new space. It considers the profitability and pressure points within an industry:

Competitive rivalry. How many players exist in the market and how aggressive they are.

Threat of new entrants. How easily new competitors can break into the space.

Threat of substitutes. The risk of customers switching to alternative products or services.

Bargaining power of buyers. How much influence customers have over pricing and terms.

Bargaining power of suppliers. The control suppliers have over costs and availability.

Analyzing these forces helps businesses enter new markets with realistic expectations around pricing, competition, and differentiation.

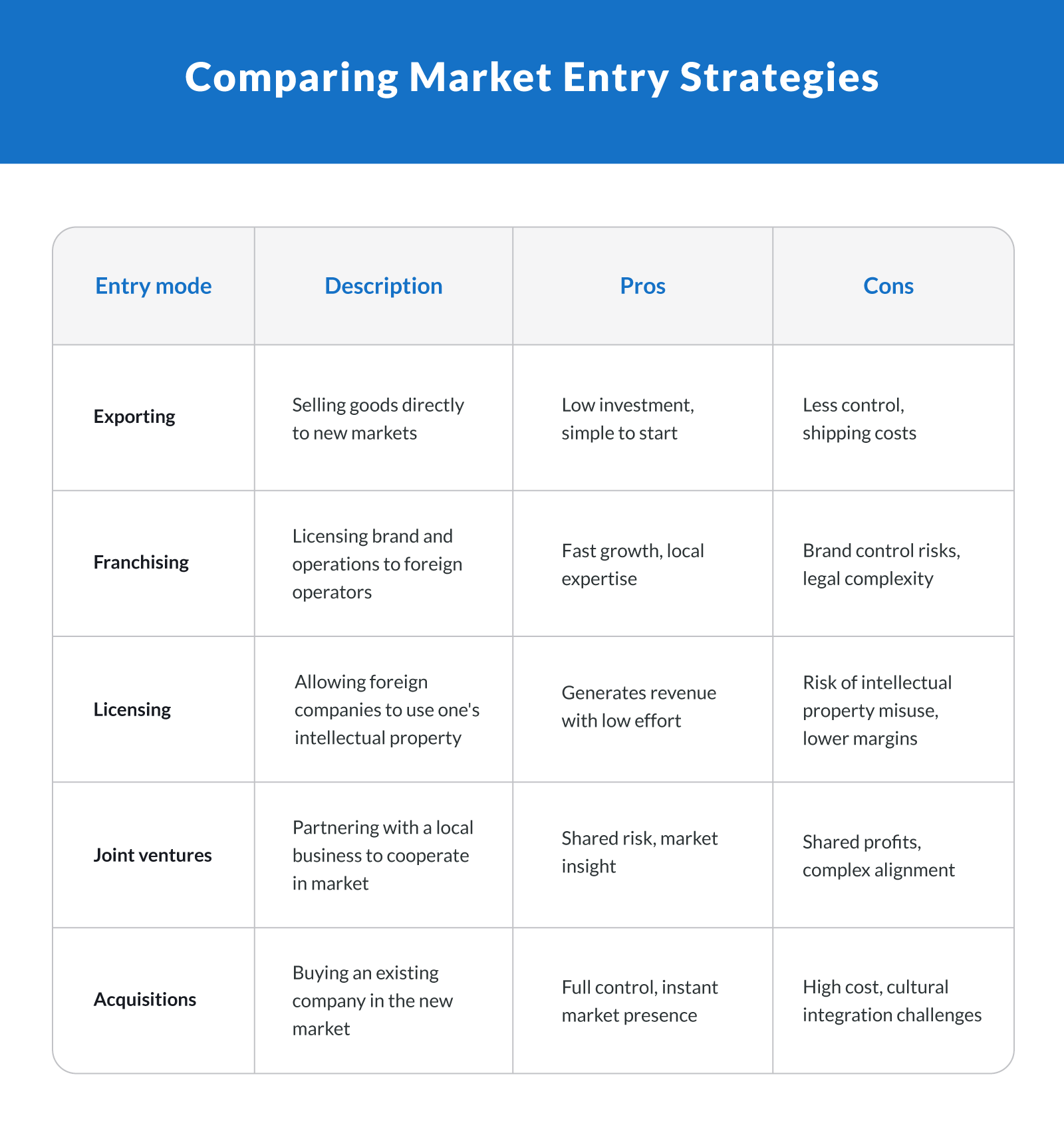

Choosing the Right Entry Strategy for New Market Expansion

Choosing the right entry strategy is essential for balancing control, risk, and speed when targeting new markets. Below is a breakdown of common entry strategies and their typical trade-offs:

These partnerships and structures can support diverse goals — from cautious testing to aggressive scaling — depending on the business’s resources and timeline.

7-Step Market Expansion Process

Successful expansion involves a sequence of calculated steps that align goals, validate opportunity, and minimize risk. This process outlines how to move from idea to execution while setting up the infrastructure to grow confidently in new markets. Here's how to do that.

1. Conduct a Market Readiness Audit

Before launching into a new market, it helps to step back and evaluate whether your business is truly ready. Clarify Capital's Market Readiness Audit Tool is a practical, self-guided checklist that helps you assess your preparedness across six key areas, from financial planning to marketing execution.

The tool walks you through:

Strategic objectives. Are your goals clear, measurable, and aligned with broader business priorities?

Financial readiness. Do you have accurate forecasting, identified revenue streams, and access to funding?

Market research. Have you segmented your audience, validated demand, and assessed legal or competitive risks?

Entry strategy. Have you chosen the right model for your business — like exporting, licensing, or partnerships?

Marketing and GTM planning. Is your messaging localized, your campaigns targeted, and your sales process in place?

Operational scalability. Can your team support a phased rollout without overextending resources?

Each section includes five key questions rated on a 1-5 scale. You'll total your score and use the results to identify where you're solid — and where you need to refine your approach.

📥 Download the market readiness audit tool (PDF) to get started.

2. Define Clear Objectives (SMART Goals)

Before entering any market, businesses need clear goals tied to outcomes they can measure. SMART goals are a proven framework for aligning efforts with results and tracking KPIs (key performance indicators) at every stage.

Here's what SMART means:

Specific. Define exactly what you want to achieve — not just “grow,” but “increase revenue by 15% in a new region.”

Measurable. Use metrics to track progress, like the number of new customers or the average order value.

Achievable. Set realistic goals based on available resources and current capabilities.

Relevant. Make sure each goal supports broader business priorities and aligns with your market expansion strategy.

Time-bound. Attach a deadline or time frame to create urgency and structure.

Defining these goals early creates the benchmarks you'll use to assess ROI and justify continued investment.

3. Perform In-Depth Market Research

Every successful market entry begins with a deep understanding of the target audience and business environment. Effective market analysis looks beyond surface-level trends to capture nuances in demographics, purchasing habits, competitive dynamics, and legal requirements.

Here are the key steps to perform strong market research:

Segment your potential customers. Break down the market by demographic factors, behaviors, and needs.

Study competitors. Analyze their positioning, pricing, and market share.

Understand demand drivers. Look at economic conditions, local trends, and emerging customer pain points.

Check regulatory fit. Identify any licensing, tax, or operational constraints that could impact entry.

Validate with data. Use surveys, third-party research, and industry reports to reduce assumptions.

This data will help refine your customer segments, product positioning, and expansion plan.

4. Choose the Right Entry Mode

Selecting how you'll enter a market is one of the most important strategic choices. The right market entry model depends on your goals, budget, timeline, and risk tolerance. Whether you go it alone or partner with a local player, the business model you choose should align with your long-term growth strategy.

Here are common paths and how to evaluate them:

Exporting. Best for companies testing the waters with minimal upfront investment.

Franchising or licensing. Offers fast market access with local knowledge but requires strong brand controls.

Joint ventures. Share ownership and resources with a local partner to reduce risk and gain expertise.

Direct investment. Build or buy your way in for maximum control and upside, but also higher cost and commitment.

Weigh these options based on how much control you need, what kind of resources you can commit, and the complexity of the target market.

5. Build a Go-To-Market Plan

Once you've chosen your entry mode, it's time to execute a clear and adaptable go-to-market (GTM) plan. This plan outlines your marketing efforts, sales approach, and positioning strategy across every channel.

Elements of an effective GTM plan include:

Define your messaging. Tailor your value proposition to match the local audience's priorities and concerns.

Localize content. Adapt website copy, visuals, and materials to reflect cultural and language norms.

Leverage influencers or partnerships. Use local networks or creators to build credibility and reach.

Run targeted marketing campaigns. Combine paid ads, SEO, and email to drive awareness and lead generation.

Set up sales and support infrastructure. Train teams or set up regional partners to handle leads and conversions.

A GTM plan ensures your product not only reaches the market but also resonates and converts.

6. Budgeting and ROI Modeling

Before launching, build a financial model that forecasts your expansion's profitability and returns. Market Entry ROI includes longer-term brand positioning and market foothold.

To model ROI:

Estimate upfront and recurring costs. Include staffing, marketing, operations, and legal setup.

Forecast revenue streams. Use your market research to estimate demand and pricing potential.

Define success metrics. Include quantitative KPIs like profit margin, acquisition cost, and payback period.

Consider intangible returns. Brand visibility, entry learnings, and future scaling potential all add long-term value.

This model will help you make data-backed decisions and allocate resources as you grow.

Ready to fuel your business expansion? Whether you're entering new markets or scaling up operations, access to flexible capital can make all the difference. Explore business expansion loan options with Clarify Capital and get funded fast.

7. Test, Learn, and Scale: Phased Market Entry Planning

Jumping into a new market all at once is rarely the best strategy. Instead, businesses can reduce risk and increase growth potential by using a phased rollout approach that incorporates real-time learnings.

Phased rollout steps can include:

Pilot in one region or channel. Start small to validate product-market fit and test messaging.

Collect feedback and iterate. Adjust your offer, pricing, or marketing based on early performance.

Expand in waves. Scale geographically or by customer segment based on initial wins.

Standardize operations. Once traction is proven, build repeatable systems and handoffs to support broader expansion.

Track timelines and milestones. Map your rollout against key performance benchmarks to measure effectiveness.

This phased approach keeps costs controlled and decisions agile while setting the stage for sustainable scale.

Case Studies: Lessons From Real Expansion Plays

Learning from companies that have already grown into new markets can help you avoid missteps and shape smarter expansion plans. These two examples — McDonald's and Mulberry — show how different strategies can work depending on your goals, resources, and customer base.

McDonald's: Aggressive Global Scaling with Digital Loyalty at the Core

McDonald's is ramping up for one of the biggest growth pushes in its history. The company plans to open about 10,000 new stores by 2027, with more than half in markets like China, India, Japan, and Brazil — especially China, where it recently gained more control over its operations.

At the same time, McDonald's is doubling down on its loyalty program — aiming to grow it from 150 million to 250 million users and double related sales to $45 billion. That kind of customer retention strategy helps boost revenue growth while reinforcing brand loyalty in both new and existing markets.

McDonald's is tying every part of the plan — from new locations to digital ordering tools — back to what customers want: fast, affordable food with a local feel. That clarity is key to growing market share in a way that sticks.

Mulberry: Refocusing Expansion on Profitability and Market Fit

Mulberry, the British handbag brand, is taking a different approach. Instead of stretching too thin globally, the company is focusing on what it does best — selling well-crafted products to customers who value “quiet luxury.”

After underwhelming results in Asia, Mulberry is shifting focus back to the UK and U.S. It's rebuilding its local wholesale network, growing online sales in North America, and closing stores in low-performing areas like China.

That focus is already paying off: While group revenue dipped overall in 2024, sales in the U.S. and Europe rose by 11.1%. The company is also cutting costs and investing in sustainable resale programs that attract younger buyers — all part of a strategy designed to rebuild profitability without chasing every market.

Need fast funding to support your next big move? Get a quick business loan with Clarify Capital and keep your momentum going.

Common Expansion Risks and How To Mitigate Them

Expanding into new markets offers exciting potential, but it comes with risk. In fact, nearly half of all businesses fail within five years, often because of planning gaps, poor fit, or unexpected market challenges, including regulatory and cultural missteps. That's why identifying and addressing potential risks upfront is so important.

Some of the biggest risks to consider include:

Cultural differences. Messaging, tone, or visuals that work in one place may fall flat in another — or worse, alienate your audience.

Local preferences. Even strong products can underperform if they're not tailored to regional tastes, habits, or expectations.

Regulatory requirements. From licensing and taxes to privacy laws, missing key compliance steps can delay or prevent market entry.

Economic volatility. Inflation, interest rates, or global events can disrupt pricing, supply chains, and customer behavior.

Lack of visibility. Without good systems in place, early warning signs of trouble — like high churn or low engagement — can go unnoticed and become major pain points.

A smart expansion plan includes built-in risk management, starting with identifying issues like cultural differences or compliance gaps early and often. This can reduce surprises and give your team the chance to pivot when needed.

Take the First Step Toward New Market Growth

No matter where you're headed next, growing into a new market is a powerful way to expand your customer base, increase brand awareness, and unlock long-term value. The key is to align your strategy with clear goals, reliable research, and scalable operations — while staying flexible to adjust as you learn.

Ready to start planning? Explore funding options with Clarify Capital and put your expansion strategy into motion.

Whether you're optimizing your value proposition, improving customer satisfaction, or reconnecting with existing customers, we're here to help make your next move count.

FAQs About Market Expansion

When planning to enter a new market, business owners often have similar questions — especially around how to match their expansion with customer needs, the right target market, and expectations for reaching new customers.

What Is a Market Readiness Audit?

It's a tool to help you self-assess how well your business is prepared to expand. A readiness audit looks at key areas like financials, marketing, operations, and strategy to identify strengths, gaps, and red flags before you commit to entering a single market or launching a full-scale campaign.

How Do I Know Which Entry Mode Is Best?

It depends on your goals, budget, and how much control you want. Exporting is low risk, while joint ventures or acquisitions give you more influence, but also require more resources. The right fit balances your resources with the needs of your target audience and local market conditions.

When Should I Localize My Marketing?

If your expansion involves a new region, language, or audience segment, localization should happen early. Tailoring your message to potential customers shows cultural understanding, builds trust, and increases your chance of success.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts