Owning a box truck business can be a profitable venture, but getting started requires careful financial planning. Whether you're launching a delivery service, contracting with major carriers, or running independent freight operations, securing the right funding is essential. The costs of purchasing or leasing a commercial vehicle, handling maintenance, and managing fuel expenses can add up quickly.

Understanding your financing options — from truck loans to leasing and working capital solutions — can make all the difference in maintaining cash flow and keeping your business profitable. Many new business owners struggle with credit requirements, down payments, and lender expectations, but with the right knowledge, you can position yourself for success.

This guide will cover the essential steps to launching a box truck business, the best financing solutions available, and how to secure the most favorable loan terms. Whether you're a first-time entrepreneur or an experienced trucking professional, you'll gain insights on how to fund and grow your business effectively.

How To Get Started in the Box Truck Business

Starting a box truck business involves careful planning, legal compliance, and securing consistent work. One of the first steps is determining whether you need a commercial driver's license (CDL), as some larger box trucks may require one based on weight regulations.

Many entrepreneurs choose to register their business as an LLC to protect personal assets and establish credibility with clients and lenders. A solid business plan is also important since it outlines key factors such as startup costs, revenue projections, and target markets. Finding reliable contracts or joining a trucking network is also crucial for securing steady loads.

Consider ongoing expenses as well, such as insurance, fuel, and maintenance, to ensure long-term profitability.

How To Find Loads for a Box Truck Business

Securing consistent loads is essential for running a profitable box truck business. Whether you're an independent owner-operator or managing a fleet, finding steady work ensures stable revenue and long-term success.

There are several ways to connect with shippers and freight providers who need delivery services for their goods:

Work with freight brokers. Freight brokers connect box trucks with businesses that need deliveries, helping to secure regular contracts.

Join load boards. Online load boards list available freight jobs, allowing trucking business owners to find loads that fit their routes and availability.

Partner with delivery services. Companies like Amazon, FedEx, and UPS often contract independent truck operators for local and regional deliveries.

Build relationships with local businesses. Establishing connections with retailers, wholesalers, and manufacturers can lead to repeat business and steady income.

Network within the trucking industry. Attending industry events and joining trucking associations can help business owners connect with potential clients.

Box Truck Financing Options

Purchasing a box truck is a significant investment, and business owners need to explore different financing options to determine the best fit for their financial situation. Whether you choose a business loan, leasing, or equipment financing, each option comes with its own advantages and impact on financial obligations.

Business loans. Offered by lenders like Clarify Capital, business loans provide a lump sum for purchasing a box truck. These loans come with fixed repayment terms and are ideal for business owners with strong credit profiles.

Leasing options. Leasing allows businesses to use a truck without committing to full ownership. This option can reduce upfront costs and may include maintenance coverage. At the end of the lease, business owners may have the option to purchase the truck.

Equipment financing. Clarify Capital offers equipment financing that helps cover the cost of purchasing box trucks while allowing flexible repayment terms. This option is useful for businesses that want to own the truck outright but need structured payments.

The right financing solution depends on a business's financial needs, credit history, and long-term goals. Comparing financing options ensures business owners choose a plan that aligns with their cash flow and overall business strategy.

How Does Commercial Truck Financing Work?

The commercial truck financing process helps business owners purchase box trucks without paying the full cost upfront. Instead of using personal funds, borrowers work with lenders to secure financing that allows them to make manageable monthly payments.

Lenders assess applications based on factors such as creditworthiness, financial stability, and business history. A down payment is often required, with higher amounts leading to better loan terms. Financing terms vary depending on the lender, the borrower's credit profile, and the loan structure.

Commercial vehicle financing differs from traditional bank loans in that the truck itself often serves as collateral, reducing risk for lenders. While a traditional bank may have stricter requirements and longer approval times, specialized truck financing lenders offer more flexible options.

Choosing the right lender and understanding the repayment structure is essential for managing cash flow and maintaining financial stability.

Eligibility Requirements for Box Truck Financing

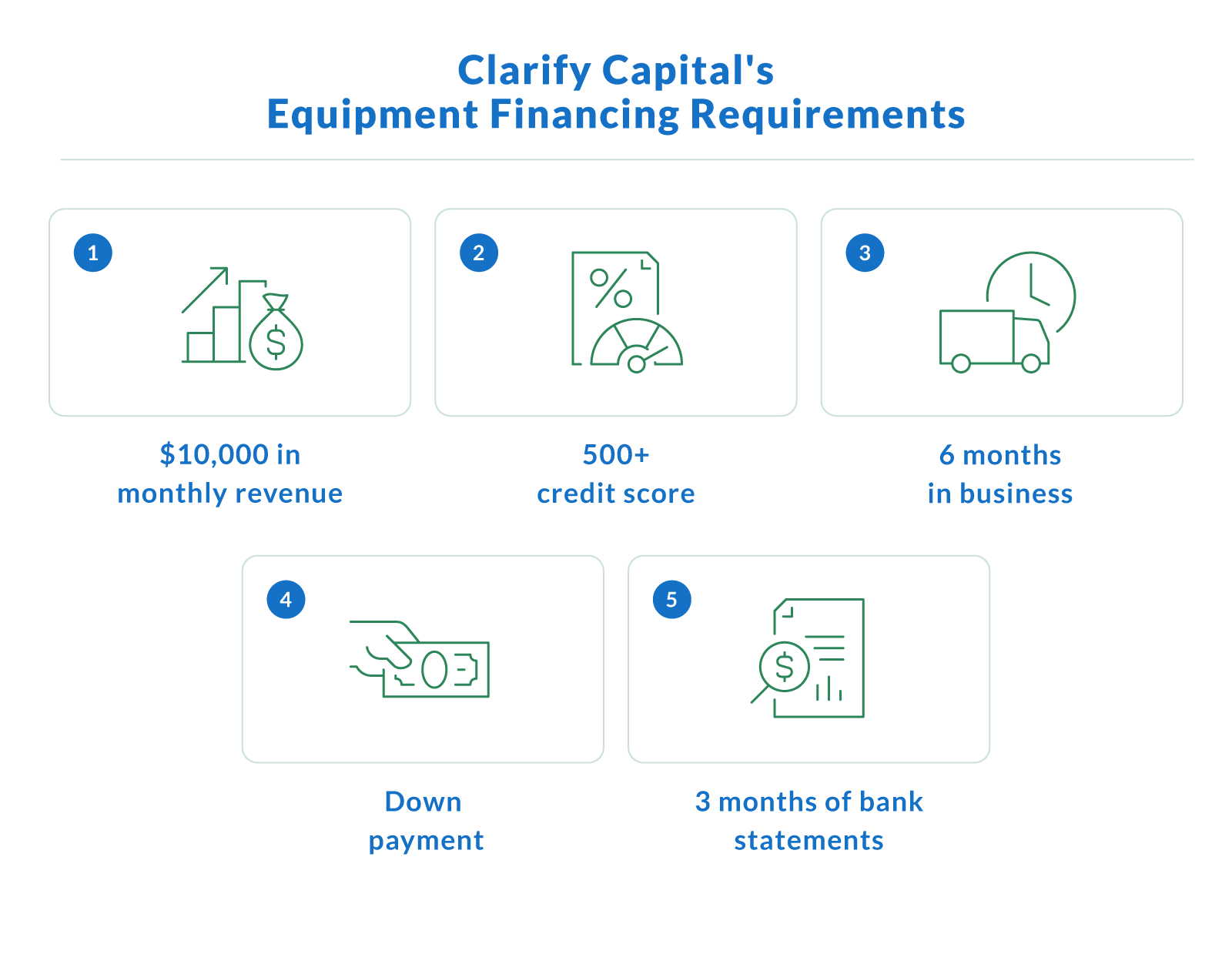

Lenders consider several factors when approving financing for box trucks. Borrowers who meet these eligibility requirements are more likely to secure competitive interest rates and flexible terms:

$10,000 in monthly revenue. Your business must be earning at least $10,000 per month, on average.

500+ credit score. A higher credit score improves the chances of approval and may result in lower interest rates. Clarify Capital suggests a credit score of at least 500 for a loan, but don't let that stop you from applying — our advisors will work with you to find the best option for your needs.

6 months in business. You need to have been in business for at least six months.

Down payment. Many lenders require an upfront payment, typically ranging from 10% to 25% of the truck's cost.

3 months of bank statements. A history of strong financial management can demonstrate the ability to handle loan payments. Clarify asks for three months of recent statements from your business bank account.

Borrowers with solid financial histories may qualify for better rates, reducing overall borrowing costs. Clarify Capital offers interest rates as low as 7%. Some lenders also offer customized repayment plans based on cash flow and business needs.

Can You Get Box Truck Financing with Bad Credit?

Financing a box truck with bad credit is possible, though it may come with challenges. Lenders evaluate credit history to determine a borrower's risk level. Those with lower credit scores may still qualify, but they often face higher interest rates and stricter terms. One way to improve approval chances is by offering a larger down payment, which reduces the lender's risk.

Working with credit unions or alternative financing providers can also increase the likelihood of securing a loan. These lenders, including Clarify Capital, often have more flexible approval requirements than traditional banks. While bad credit financing solutions exist, improving creditworthiness over time by making timely payments and reducing outstanding debt can lead to better financing opportunities in the future.

Box Truck Leasing vs. Financing: Which Is Better?

Choosing between leasing and financing depends on a business's financial situation and long-term goals. Each option has its advantages and trade-offs, detailed in the table below:

| Category | Leasing | Financing |

|---|---|---|

| Financing terms | Typically shorter terms, often 2-5 years | Loan terms range from a few years to a decade |

| Upfront costs | Lower upfront costs may not require a down payment | Requires a down payment, typically 10-25% |

| Tax benefits | May provide tax deductions but no depreciation benefits | Allows businesses to claim depreciation along with deductions |

| Best for | Businesses needing lower initial costs and flexibility | Businesses looking for long-term growth and asset ownership |

Financing a truck may be the better option for businesses looking for long-term growth, tax benefits, and asset ownership. Commercial vehicle financing allows businesses to build equity in the vehicle while maintaining control over how it is used.

Those needing lower upfront costs and more flexibility may benefit from leasing. At the end of a lease, businesses may have the option to purchase the truck or return it and lease a newer model.

The Application Process for Box Truck Financing

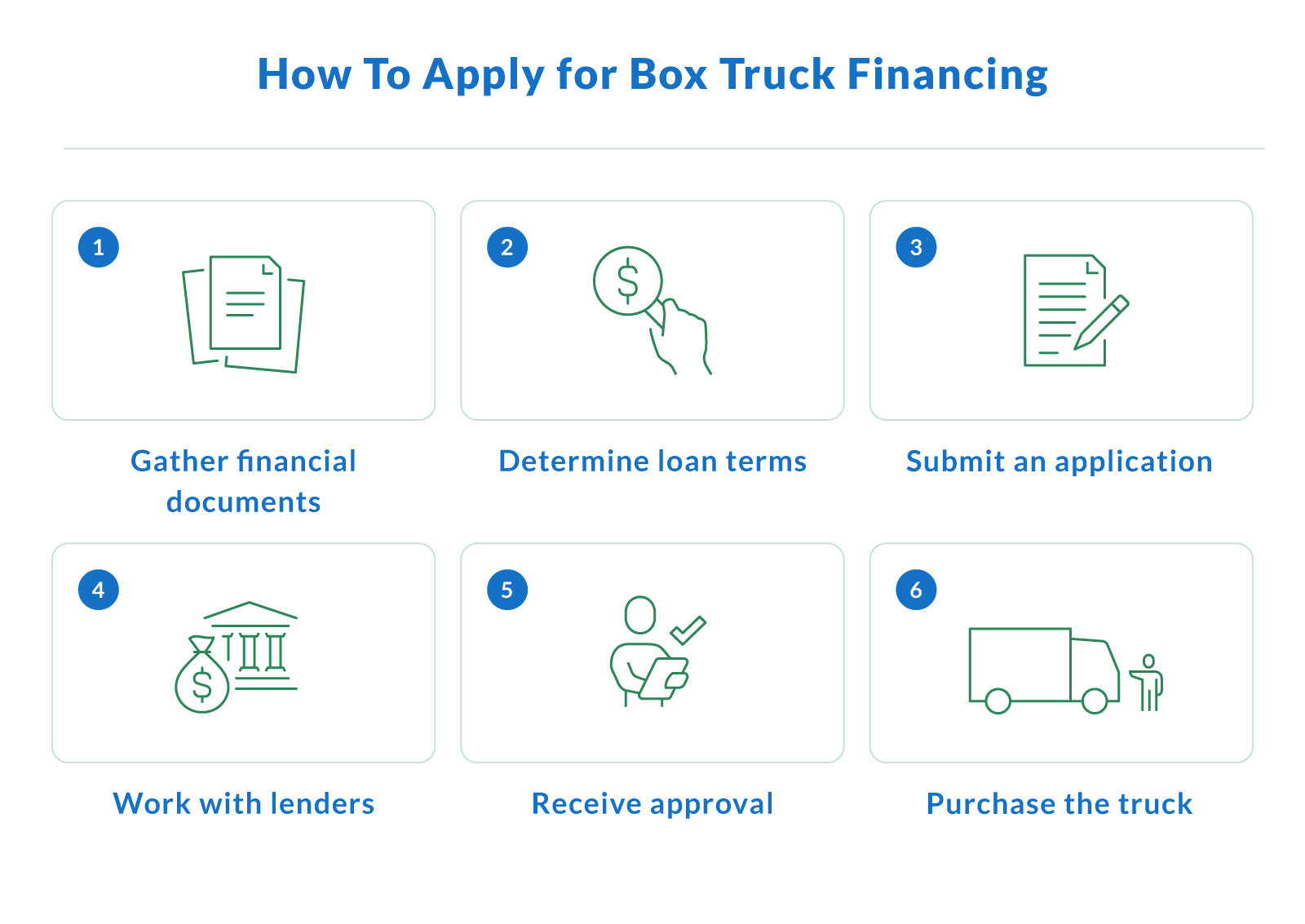

The application process for securing box truck financing involves several key steps. Preparing the necessary documents and making a few assessments in advance can improve approval chances and help business owners secure the best loan terms:

Gather financial documents. Lenders require tax returns, bank statements, and financial records to assess creditworthiness.

Determine loan terms. Decide on the loan amount, repayment period, and type of financing that best suits your business needs.

Submit an application. The financing process begins with filling out an application detailing business and financial information.

Work with lenders. Lenders review applications and evaluate factors such as credit score, income stability, and business history.

Receive approval. Once approved, the lender provides loan terms, interest rates, and repayment details.

Purchase the truck. After finalizing the loan, funds are disbursed, and the borrower can complete the truck purchase.

Working with reputable lenders ensures a smooth financing process and helps business owners secure favorable loan terms.

Choosing the Right Box Truck Financing for Your Business

The best box truck business financing options depend on your business needs, credit standing, and long-term financial goals. Lenders will evaluate your creditworthiness, financial history, and down payment ability to determine loan terms and interest rates.

Comparing lenders and exploring various business financing options — such as equipment financing, leasing, or traditional loans — ensures businesses secure terms that align with their budget and growth strategy. While long-term success depends on responsible financial management, choosing the right funding at this early stage sets the foundation for stability and profitability. Carefully review terms, assess your repayment ability, and partner with lenders like Clarify Capital, that offer transparent and flexible solutions.

Ready to secure the funding you need for your box truck business? Explore financing solutions tailored to your business needs and get competitive loan terms. Apply now with Clarify Capital and take the next step toward a successful business venture.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts