If you are searching for "small business loans near me," you probably have a local bank or credit union in mind. That makes sense for many business owners who want a familiar face and an in-person conversation. You also have strong online choices that let you compare business loans from multiple providers in minutes. With modern online banking, you can review financing options after hours and apply from your desk.

The real decision comes down to fit. Local lenders bring relationships and a steady approach to loan terms and service. Online lenders and marketplaces, on the other hand, bring speed, wide product variety, and easy side-by-side offers.

We'll show you how to weigh interest rates, loan terms, timing, and flexibility so your business financing supports growth and day-to-day operations. By the end, you will know when to keep it local, when to cast a wider net, and where to apply today.

Getting a Loan from a Local Lender

Local lenders include community banks and credit unions that serve your city or region. Many business owners like starting here because you can talk in person, build a relationship, and keep all your accounts under one roof. Whether you are in Chicago, Atlanta, or a small town, local help can be useful for everyday business loans and projects like commercial real estate.

Here's where local lenders can help:

Personal service. You can meet a banker who learns your goals and explains loan terms in plain language.

Local knowledge. Underwriters may understand your market, seasonality, and customer base.

Relationship value. Ongoing deposits and activity can support future credit requests, including a community bank small business loan.

There are tradeoffs to weigh before you apply:

Stricter eligibility. Many branches want higher credit scores, more time in business, and a steady revenue history.

Slower approvals. Committee reviews and document checks can extend the timeline from application to funding.

Fewer product options. Local menus can be narrower than national platforms, which can limit pricing and structure choices.

Proximity helps, yet the best offer is not always down the street. Consider local relationships while you compare options side-by-side.

Getting a Loan Online (No Matter Where You Are)

Online lenders and marketplaces connect you to online business loans from providers across the country. You complete a short application through online banking tools, upload a few documents, and compare offers in one place. It works well for quick working capital, a business line of credit, or a term loan with the loan amount that fits your plan.

Here's why many owners start online:

Fast applications. Digital forms take minutes, and you can prequalify without visiting a branch.

Same-day decisions. Most lenders can review your file quickly and move to funding when you meet the requirements.

Competitive rates. Side-by-side offers create pricing pressure and expose more financing options.

Convenience also matters. With an online loan, you can apply after hours, track the status on your phone, and keep daily operations moving while your file moves forward. That saves time during busy seasons when cash flow needs change quickly.

There are risks to watch as you compare offers:

Predatory pricing. Review APR, fees, and repayment details so the total cost matches the value you expect.

Opaque terms. Ask for a clear breakdown of payment timing, prepayment rules, and any origination charges.

Credibility checks. Verify that the provider is reputable, uses secure encryption, and shares real customer reviews.

Online options can open doors beyond your ZIP code. Cast a wide net, compare the details, and choose the offer that supports your plans with clear terms and predictable payments.

SBA Loans: Local vs. Online Access

Many business owners compare SBA options through a hometown branch and a national marketplace. A side-by-side view helps you match interest rates, loan amounts, eligibility, and repayment to your business needs and annual revenue. You can confirm current program rules with the Small Business Administration on the official government website at SBA.gov, including details for SBA 504 and SBA 7(a) type loans.

| SBA Access: Local Banks vs. Online Lenders | ||

|---|---|---|

| Criteria | Local banks and credit unions | Online lenders and marketplaces |

| Interest rates | Competitive pricing that can reflect relationships and local underwriting. | Competitive ranges are published upfront with broader comparisons across providers. |

| Loan amount | Access to SBA loan caps is sized by branch policy and risk appetite. | Wide discovery of lenders to match the target loan amount more precisely. |

| Eligibility | Often, higher credit thresholds and longer time-in-business expectations are required. | Clear, posted eligibility guidelines with flexible paths for qualified applicants. |

| Repayment terms | Standard SBA repayment schedules with in-person servicing available. | Standard SBA loan terms with e-sign, online servicing, and status tracking. |

| Process speed | More steps and committee timing can slow funding. | Faster prequalification and processing through digital intake. |

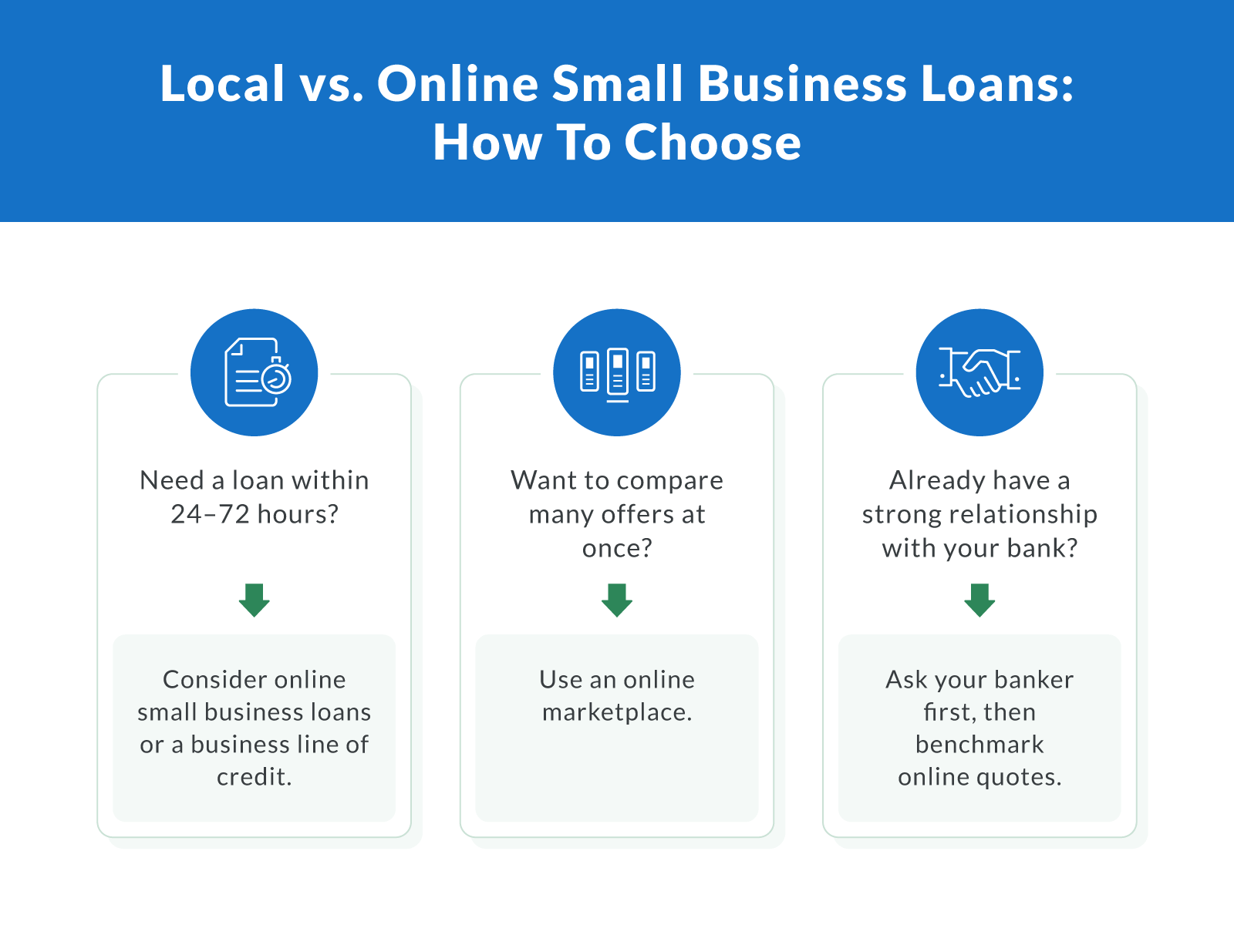

How To Choose Local vs. Online Small Business Loans

Choosing between local and online options starts with your business needs and timing. Local lenders fit complex projects and long relationships, like real estate loans tied to permits, or when years of deposits help with credit decisions.

Online business financing works well when entrepreneurs need speed, side-by-side financing options, and sharper pricing on small business loans for working capital, inventory buys, or a quick equipment upgrade. Whether you require a line of credit or a business loan, Clarify Capital helps you compare both paths with one application so you can pick the offer that fits today and supports tomorrow.

Smart Steps To Apply Successfully for a Business Loan

A clear process raises your odds of lender approval and keeps surprises to a minimum. It also helps business owners match business financing to real needs like day-to-day operations or growth. Start with the basics, then compare offers with total cost in mind.

Confirm minimum requirements. Aim for steady revenue, at least six months in business, and a business bank account.

Gather documents. Prepare three months of bank statements, proof of revenue, and a valid ID.

Define your loan amount. Size the request to purpose, whether working capital, inventory, or equipment.

Compare total cost. Review APR, fees, term length, and payment schedule before you choose.

Align purpose to product. Use a term loan for projects and a business line of credit for flexible needs.

Apply in minutes. Use Clarify Capital's 2-minute online application and target same-day funding when eligible.

Choosing the Best Loan for Your Business

Local lenders bring relationships, context, and steady guidance. Online providers offer speed, broader choice, and simple comparisons for small business loans. Both paths can work if you focus on total cost, timing, and how well the offer supports your business financing plan.

A search for "small business loans near me" is a smart starting point, yet the strongest terms may come from online business loans that you can review from your desk. Don't limit your options to one branch or one provider. Compare multiple offers, read the fine print, and pick the structure that gives you cash flow today with opportunities for growth in the future.

Skip the line at the bank and apply today with Clarify Capital to compare offers from lenders near you and nationwide.

FAQs for Local vs. Online Small Business Loans

Many borrowers want quick answers before they apply. These FAQs cover speed, safety, and how to compare offers so you can choose a loan that fits your plan and cash flow.

What Is the Easiest Small Business Loan To Get?

Online providers often move faster and require fewer documents, making the easiest small business loan an online option. Eligibility still depends on your credit score, annual revenue, time in business, and ability to manage the loan terms.

Can I Get a Business Loan from a Local Bank vs. Online?

A community bank small business loan helps when an in-person relationship matters. Online business loans give wider financing options and faster decisions. Compare interest rates, fees, and funding speed rather than proximity or local searches alone.

Are Online Business Loans as Safe as Local Banks?

Reputable providers clearly state APR and fees and follow federal and state rules. Before sharing data, check reviews, confirm the lender registration, and verify site encryption. You can validate program details on SBA.gov, the official government website, and compare interest rates across offers.

Where Can I Find Small Business Loans Near Me?

Start with local banks and credit unions in your area. Then compare online business loans with nationwide reach for broader financing options and potentially better pricing. Casting a wider net helps you find the best fit for your goals.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts