When choosing the right business financing option, small business owners often compare two popular choices: a business line of credit and a business loan. A business line of credit gives you flexible access to funds you can draw on as needed, while a small business loan provides a lump sum with fixed repayment terms. Each serves a different purpose and offers unique benefits depending on your business needs, cash flow, and funding timeline.

This guide defines both financing options and compares costs, eligibility requirements, and best-fit use cases. Whether you're managing everyday expenses or planning a major investment, you'll find actionable insights here to help you make the right call.

What Is a Business Loan?

A business loan provides a lump sum of capital up front, which the borrower repays over time through scheduled installments. It's designed for specific business purposes, from purchasing equipment to funding long-term growth.

Loan structures vary widely. You'll find everything from short-term loans for working capital to large-scale, fixed-rate loans for commercial real estate. Each option comes with its own repayment schedule, interest rate, and documentation requirements.

Business loans typically feature predictable monthly payments, which can help business owners plan around a stable budget.

The following table outlines several common loan types, including traditional, government-backed, and alternative options:

| Types of Business Loans | |||

|---|---|---|---|

| Loan type | Typical loan amount | Interest rates | Repayment period |

| Term loan | $25,000-$500,000+ | 6%-30%+ | One to 10 years |

| SBA loan | Up to $5 million | 5%-15% | Five to 25 years |

| Equipment financing | Up to 100% of cost | 5%-30% | One to 10 years |

| Microloan | $500-$50,000 | 8%-13% | Up to six years |

| Merchant cash advance | Varies by revenue | Factor rates apply | Based on sales receipts |

| Commercial real estate | $100,000-$5 million+ | 5%-15% | Five to 25 years |

Best Uses for Business Loans

Business loans are best for large-scale investments that require up-front capital and deliver returns over time. Common use cases include:

Expansion and remodeling. Ideal for businesses adding new locations, staff, or equipment.

Buying real estate. Long-term commercial property investments align well with fixed repayment terms.

High-cost projects. Loans support endeavors with large up-front costs that may take time to generate revenue.

What Is a Business Line of Credit?

A business line of credit is a flexible form of revolving credit that lets businesses draw funds as needed up to a set credit limit. Unlike a loan, you only pay interest on the amount you use.

This type of financing is often used to manage short-term cash flow gaps or cover operating costs. Lines of credit may be secured or unsecured, and interest rates can vary based on your creditworthiness and lender policies.

Small businesses that deal with seasonal revenue, inventory restocking, or unexpected expenses often benefit the most. Unlike personal finance products, a business line of credit helps separate business and personal expenses while building your business credit history.

Secured vs. Unsecured Lines of Credit

Business lines of credit come in two main types, each with distinct approval processes and risk profiles:

Secured line of credit. Requires collateral, such as equipment or inventory. Usually offers lower interest rates but poses a greater risk if you default.

Unsecured line of credit. Does not require collateral. Typically easier and faster to access, but may come with higher interest rates.

Lenders often evaluate your credit score, cash flow, and business performance to determine eligibility.

Best Uses for a Business Line of Credit

A line of credit is ideal when you need ongoing access to capital without committing to a full loan. It's well-suited for:

Working capital needs. Smooth out cash flow dips, especially during slow seasons.

Seasonal expenses. Cover inventory purchases or marketing campaigns ahead of peak periods.

Emergencies and repairs. Access quick funds for urgent but essential fixes.

How a Business Line of Credit Works

Getting a business line of credit is a straightforward process, but careful preparation can improve your approval odds and help you secure better terms. Understanding each step, from application to repayment, ensures you're ready to make the most of this flexible business funding process.

Complete the Online Application

Before applying, gather essential documents and business details, including:

Business financials. Recent profit and loss statements, balance sheets, and revenue summaries.

Bank statements. Clarify Capital requires your last three months of business banking history.

Identification. Valid government-issued ID for verification.

Clarify Capital's online application takes just two minutes to complete. To avoid delays, double-check your information for accuracy and ensure all required fields are filled.

Undergo Credit and Financial Review

Once submitted, your application goes through a credit review process. Lenders evaluate your:

Credit score. A minimum score of 550 is required for same-day funding.

Annual revenue. You must earn at least $10,000 in monthly revenue.

Debt obligations. Existing loans or credit lines may impact approval odds.

A strong financial profile with consistent income and minimal debt boosts your creditworthiness and increases your chances of approval.

Receive Approval and Credit Limit Offer

If approved, you'll receive a personalized credit limit offer based on:

Revenue trends and cash flow

Credit history and payment track record

Business age and stability

Review the terms closely, especially interest rates, draw fees (if any), and repayment details, before accepting. Once accepted, you gain revolving credit access immediately.

Access Funds as Needed

Draw funds up to your approved limit whenever necessary. Most borrowers can access funds the same day they're requested, depending on the lender's processing timelines. This flexibility allows you to cover expenses in real-time without applying for a new loan each time.

Repay Only What You Use

You're only charged interest on the funds you draw, not the full credit line. Repayment typically involves:

Minimum monthly payments. Based on the outstanding balance.

Early repayment options. Pay off the full amount early to save on interest.

Each payment replenishes your available credit, keeping your repayment cycle active and manageable.

Repeat the Draw-Repay Cycle

As long as your account remains in good standing, you can continue drawing funds as needed. To make the most of your revolving credit, make sure to avoid maxing out the credit line and keep repayments consistent and on time. This ongoing access provides reliable funding options without reapplying each time.

Key Differences Between a Business Loan and a Business Line of Credit

Understanding how business loans and lines of credit differ can help you select the right tool for your business's financial strategy. Here's a side-by-side comparison to highlight the core differences:

| Business Loans vs. Business Lines of Credit | ||

|---|---|---|

| Feature | Business loan | Business line of credit |

| Funding method | Lump sum disbursed up front | Draw funds as needed, up to credit limit |

| Repayment | Fixed installments on full amount | Pay only on drawn amount; revolving |

| Interest rates | Usually fixed or tiered rates | Usually variable; based on draw amount |

| Flexibility | Lower — funds tied to specific use | High — flexible for ongoing expenses |

| Ideal use case | Long-term investments | Short-term working capital or emergencies |

Benefits and Drawbacks

Each financing option has its strengths and challenges. Below are some key pros and cons to consider:

Business loans offer predictability. Fixed repayment schedules make them ideal for large, planned investments.

Business lines of credit provide flexibility. They work well for covering variable or recurring expenses.

Credit lines can be harder to manage. Without careful planning, inconsistent repayments or overuse can lead to financial strain.

Choices by Industry

Financing preferences often reflect the specific demands of each industry. Here's how different sectors typically choose:

Real estate. This industry often opts for business loans to fund large, capital-intensive projects with predictable timelines.

Construction. Companies in this sector lean toward loans for the stability and fixed repayment structure needed for long-term investments.

Health care. Health care providers favor loans to support major expenses such as medical equipment or facility expansions.

Retail. Retail businesses prefer lines of credit to manage inventory purchases and seasonal cash flow changes.

E-commerce. These businesses use credit lines to handle fluctuating expenses and support rapid growth.

Service industries. Service-based companies often choose lines of credit for the flexibility to cover recurring operational costs.

Cost Structure Comparison

Understanding how each financing option charges interest and fees can help you choose the most cost-effective solution:

Business loans typically feature fixed interest rates, which offer predictable payments. Origination fees usually range from 1% to 5% of the total loan amount. Repayment starts immediately and follows a set schedule.

Business lines of credit often come with variable interest rates, which can fluctuate over time. Lenders may charge maintenance fees monthly or annually to keep the line open. Each withdrawal may also trigger a draw fee — a small percentage of the amount borrowed. Interest only accrues on the funds used.

Hidden Costs To Watch For

Even low-interest products can carry significant hidden fees. Origination fees, though one-time payments, can add to your overall loan total, while maintenance fees can be charged on open credit lines — even if they're unused. Late payments, or even early payments, may also trigger other fees that can add up quickly.

Example: A $50,000 loan with a 3% origination fee and 10% APR could cost $8,000+ in total interest and fees over three years.

To reduce costs, ask for full fee disclosures. It's also important to make payments on time and pay off high-interest debt quickly.

Eligibility and Approval Factors

Qualifying for business financing depends on a few key requirements. Here's what lenders look for:

550+ credit score for Clarify Capital; higher scores improve terms.

Annual revenue of at least $10,000 per month.

At least six months of business history.

Business bank account.

Three months of bank statements, business details, and ID.

Some lenders require collateral.

Industry type also plays a role. High-risk sectors may face more scrutiny or limited offers.

How To Improve Your Approval Odds

Boost your chances of approval with the following steps:

Raise your credit score. Fix bad credit by paying off debts, reducing utilization, and correcting credit report errors.

Prepare detailed financials. Keep updated profit/loss statements and bank records.

Build lender relationships. Connect with lenders before you need funding.

Plan ahead. Improvements may take three to six months — don't wait until funds are urgent.

Common Application Mistakes To Avoid

Many business owners unintentionally delay or damage their approval chances. Avoid these common errors:

Incomplete documentation. Missing bank statements or ID slows down the process.

Inaccurate revenue reporting. Leads to misaligned loan offers.

Unrealistic funding requests. Asking for too much can trigger rejections.

Overlooking terms. Accepting offers without understanding fees or repayment terms.

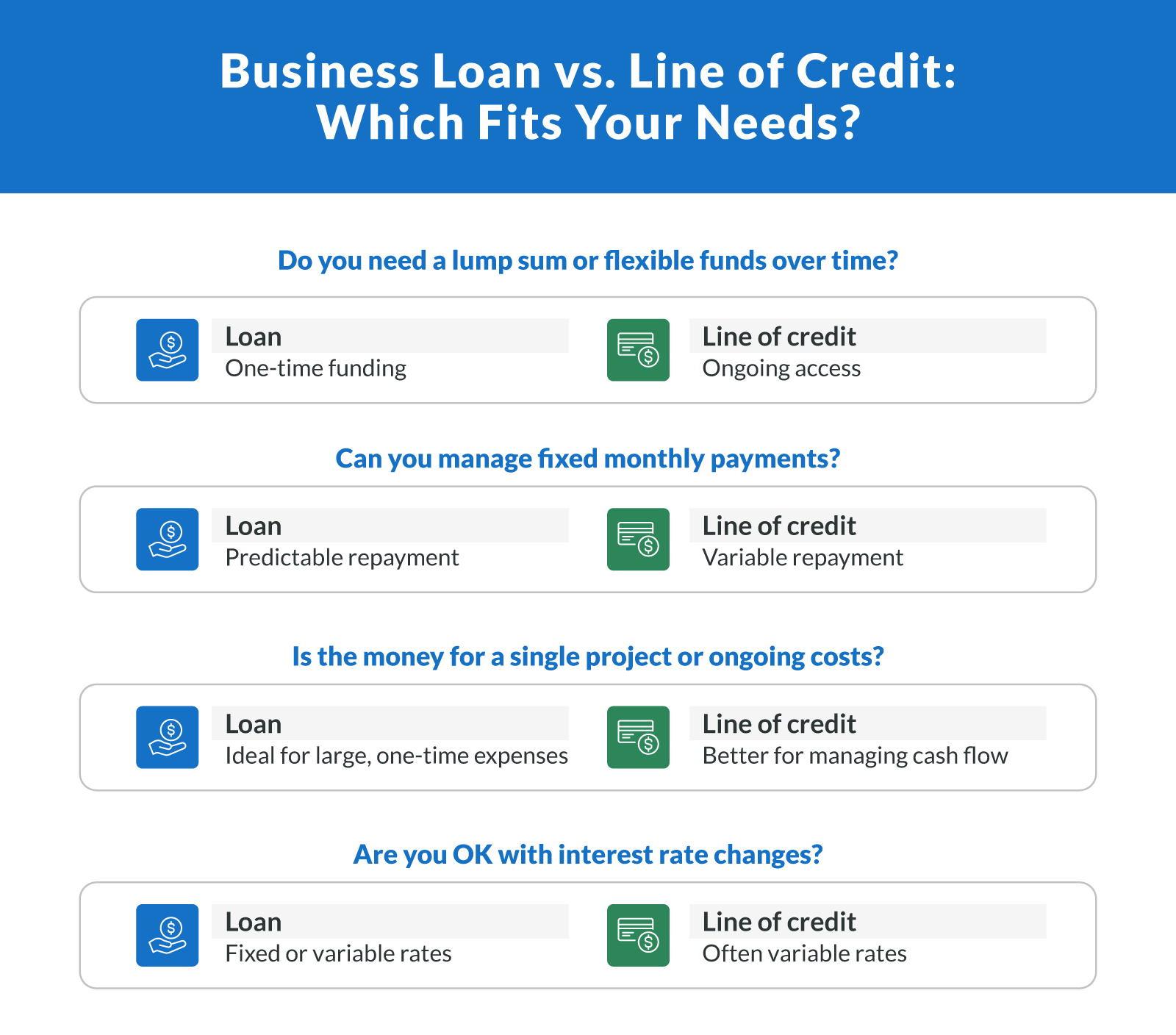

How To Choose Between a Business Loan and a Business Line of Credit

The choice comes down to aligning financing with your business's goals, risk tolerance, and cash flow rhythm. The following questions can help guide your decision:

Do I need a specific amount of money all at once, or flexible access over time?

Can my business handle fixed monthly payments, or is variable repayment more manageable?

Is this funding for a one-time project or recurring operating costs?

How quickly do I need access to funds?

Am I comfortable with the interest rate variability of a credit line?

Do I have documentation and revenue history that will meet approval requirements?

Borrowers should also assess their risk tolerance and future growth expectations. For some, predictable repayment terms reduce stress and simplify accounting. Others may prioritize repayment flexibility and revolving access to capital. When in doubt, it's smart to consult a financial advisor or lender directly.

When To Choose a Business Loan

A business loan is often the right fit when your financing needs are structured, high-value, and long-term. Consider a loan if you:

Plan a major property purchase. Real estate loans offer long repayment terms with fixed rates.

Need large equipment. Loans often finance heavy machinery or vehicles better than credit lines.

Are in a stable industry. Lenders favor predictable revenue and growth plans.

Also, if you're applying for SBA loans, you'll typically find better interest rates and longer terms.

When To Choose a Business Line of Credit

Choose a line of credit when your needs are flexible, short-term, or recurring. Ideal scenarios include:

Seasonal cash flow gaps. Retailers and hospitality businesses often face slow seasons when business expenses are harder to cover.

Working capital dips. Cover payroll, supplies, or marketing without a full loan.

Unexpected expenses. Repairs or sudden opportunities don't always justify a loan.

Remember: Interest only applies to funds drawn, not the entire limit, helping you control costs.

Use Cases by Business Stage

As businesses evolve, so do their financing needs. The right funding option often depends on your business's stage of maturity — whether you're navigating early growth, managing seasonal demand, or scaling operations.

| Funding Options by Business Stage | ||

|---|---|---|

| Business stage | Typical needs | Recommended product |

| Early stage | Working capital, basic inventory, marketing spend | Microloans, business credit cards |

| Growth phase | Expansion, hiring, equipment upgrades | Term loans, lines of credit |

| Seasonal business | Inventory purchases, payroll, operating costs | Business line of credit, short-term loans |

| Established business | Real estate, acquisitions, long-term projects | SBA loans, commercial real estate loans |

While Clarify Capital does not fund startups, early-stage businesses with several months of revenue history may still qualify for smaller funding options, such as business credit cards or microloans, especially if they meet minimum revenue and time-in-business thresholds.

As businesses move into the growth phase, funding needs become more complex, ranging from expanding physical space to onboarding new teams. In these cases, term loans offer structured support, while a business line of credit can offer needed flexibility.

Seasonal businesses, such as retail stores and tourism operators, often require fast-access funds for peak inventory or staffing needs. A credit line enables draw-as-needed flexibility without overcommitting on interest-bearing debt.

Established businesses, by contrast, often leverage long-term capital for real estate purchases or acquisitions. With a solid track record and strong financials, they can access larger loan amounts, lower interest rates, and longer installments.

Alternatives to Business Loans and Lines of Credit

In some cases, neither a traditional loan option nor a line of credit may be the best fit. Businesses with unique circumstances, cash flow patterns, or short-term capital needs may benefit from other options that serve a specific purpose. Each alternative has its own approval criteria, fee structures, and timelines, so it's important to evaluate them with care.

Invoice Factoring

Invoice factoring allows businesses to sell their outstanding accounts receivable to a third party — called a factor — in exchange for immediate cash. It's a common solution for businesses with delayed payments from clients.

Pros:

Improves short-term cash flow

Doesn't require a strong credit history

Fast access through online lenders

Cons:

Can be expensive (up to 5% fee per invoice)

May impact client relationships if the factor handles collections

Not ideal for businesses without significant invoicing volume

Crowdfunding

Crowdfunding involves raising funds from a large number of individuals, typically via an online platform. There are three main models:

Reward-based. Supporters contribute in exchange for a product or perk.

Equity-based. Investors receive a small ownership stake.

Donation-based. Contributors give without expecting returns.

Pros:

No repayment required for rewards/donations

Good for community-driven businesses or new products

Can double as marketing

Cons:

Uncertain success

Often requires months of campaign prep

Equity models dilute ownership

Small Business Grants

Small business grants are non-repayable funds awarded by government agencies or private organizations. They're highly competitive and typically geared toward specific industries, demographics, or innovation goals.

Pros:

No repayment or equity loss

Supports innovation and underserved businesses

Cons:

Long application cycles

Narrow grant eligibility

Intense competition and strict compliance requirements

Choosing the Right Option for Your Business

Deciding between a business loan, a business line of credit, or an alternative funding method comes down to understanding how each aligns with your goals, revenue model, and growth stage. Loans offer a fixed structure and are ideal for major investments, while lines of credit give you more control over timing and draw amounts.

Use the decision-making framework above to identify what best supports your operational goals and cash flow needs. Whether you're planning for long-term expansion or simply bridging short-term gaps, there's a business financing option that fits.

For personalized guidance or to explore funding tailored to your needs, apply today with Clarify Capital.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts