A dental equipment loan is a means of small business financing for dental professionals. It's intended to help purchase high-cost tools like X-ray machines, sterilization systems, and dental chairs. These loans are specifically designed for dental practices, whether you're starting a new practice or expanding your existing dental office.

Equipment costs can often run well into six figures, so choosing the right lender is critical for preserving working capital, keeping a steady cash flow, and securing favorable financing options. A poor lender match can lead to longer repayment timelines, higher interest rates, and application delays.

This guide breaks down the best dental equipment loan providers for 2025. It also offers a look into how these loans work and compares top lenders on key features.

What Is a Dental Equipment Loan and How Does It Work?

A dental equipment loan is a financing solution that helps dentistry practices acquire essential tools and technology without draining their cash reserves. These loans typically cover new and used equipment, including X-rays, sterilization units, dental chairs, and even advanced imaging or treatment systems.

Unlike general business loans, dental equipment loans are a type of financing often tailored for the dental industry. Repayment terms, loan amounts, and monthly payments are structured to match day-to-day health care operations. Some lenders offer longer loan terms, while others prioritize quick access to funds or lower barriers to entry.

Most lenders will look for a credit score of at least 550-600 to finance dental equipment, but that is not the only requisite. Business revenue, time in business, and debt obligations can also sway your eligibility. Some traditional banks may require collateral, but many online lenders offer unsecured financing options focused on projected cash flow and overall creditworthiness.

Top Dental Equipment Lenders for 2025

The best dental equipment lenders in 2025 are fast and flexible. Here are the top options for dental professionals to consider:

Clarify Capital. Known for same-day funding, approvals for credit scores as low as 550, and no collateral requirements.

Bankers Healthcare Group (BHG). Offers high loan limits and terms up to 10 years, designed for licensed health care professionals.

Live Oak Bank. A top SBA lender offering specialized loan programs for dental practices with low down payment options.

Taycor Financial. Offers lease-to-own structures and flexible terms for new and growing dental offices.

Each lender brings something different, from faster applications to longer repayment terms. Up next, we'll compare their features side by side to help you find the best fit.

Comparing Top Dental Equipment Loan Providers

To help you compare your options, we've evaluated the best dental equipment lenders for 2025 based on the most important criteria: speed, APR, and accessibility. Use the following chart to get a quick feel for each lender's loan terms.

| Top Dental Equipment Lenders | ||||

|---|---|---|---|---|

| Lender | APR | Loan term range | Credit score required | Funding speed |

| Clarify Capital | 6%-18% | Six to 24 months | 550+ | 24-48 hours |

| BHG | 8%+ | Up to 10 years | 660+ | Three days |

| Live Oak Bank | SBA rates (5%-15%) | 10-25 years | 650+ | Several weeks |

| Taycor Financial | 5%-40% | Two to 84 months | 550+ | Two to three days |

Looking for more financing options? Check out the best equipment financing companies and loan options for 2025 to compare lenders that fund everything from dental tools to heavy machinery.

Which Lender Fits Your Needs?

The best lender depends on your current business situation, whether you're launching a new practice, buying new equipment, or growing an established dental business. Here's a breakdown of which provider best fits each use case.

Use case: New practice

For dentists launching a brand-new practice, there are three options:

Taycor Financial. An approachable option with loans that require a credit score of 550 or higher. Term lengths are flexible from two months to seven years. This lender's lease-to-own option also allows new owners to conserve cash while still acquiring vital equipment.

BHG. Provides loan terms stretching up to 10 years. While it requires a stronger credit score of 660 or above, it delivers health care-specific financing designed for licensed professionals.

Live Oak Bank. Supports new practices through SBA-backed programs. That means borrowers should be prepared for collateral requirements and slightly longer funding timelines, though they benefit from low down payments and repayment periods of up to 25 years.

Use case: Major equipment purchase

When the goal is buying an expensive piece of equipment, speed and loan size become top priorities.

Clarify Capital. Offers same-day funding for those with a credit score over 550. There are also no application fees, and loan amounts can reach as high as $5 million, with APRs starting at just 6%.

Taycor Financial. This lender does not require time in business for equipment financing, and its lease-to-own option offers an alternative to buying new equipment.

Use case: Practice upgrade

For established practices planning upgrades, the best lender depends on how quickly you need to move.

Clarify Capital. The best choice for those who want immediate access to funds. Plus, short loan terms of six to 24 months are ideal for financing quick improvements without long-term debt.

BHG. Another option for relatively fast funding (three to five days), BHG provides up to $500,000 for dental business loans.

Each lender supports different stages of growth, whether preserving working capital or investing in business financing. Match your needs to their strengths for a smoother funding experience.

How To Qualify for a Dental Equipment Loan

Most lenders have standard requirements to determine creditworthiness, though these thresholds will vary. Here's what business owners typically need to qualify:

FICO score. 550+ for online lenders, 660+ for SBA or bank loans.

Monthly revenue. At least $10,000.

Time in business. Minimum six months (note: startup funding is limited).

Business bank account. Must be active and in good standing.

Down payment. Some lenders may require 10%-20% upfront, especially for large loan amounts.

U.S. incorporation. Business must be based or registered in the United States.

Borrowers with lower credit scores still have options through alternative lenders like Clarify Capital or Taycor, which focus more on business cash flow than FICO scores alone.

Required Documents To Apply for a Dental Equipment Loan

Lenders ask for basic documentation to review your financial stability and determine loan approval. Being prepared can speed up your application process significantly.

Here's a checklist of documents that are often required for underwriting:

Three months of business bank statements. Verifies income and cash flow.

Business tax returns (one to two years). Shows overall financial health.

Personal identification. Driver's license or passport.

Business license or incorporation docs. Confirms legal structure.

Equipment quote or invoice. Details what you're financing.

Business plan (optional). Often requested for newer practices.

Want to see how much your dental equipment loan might cost each month? Try Clarify Capital's equipment loan calculator to estimate payments and compare financing options side by side.

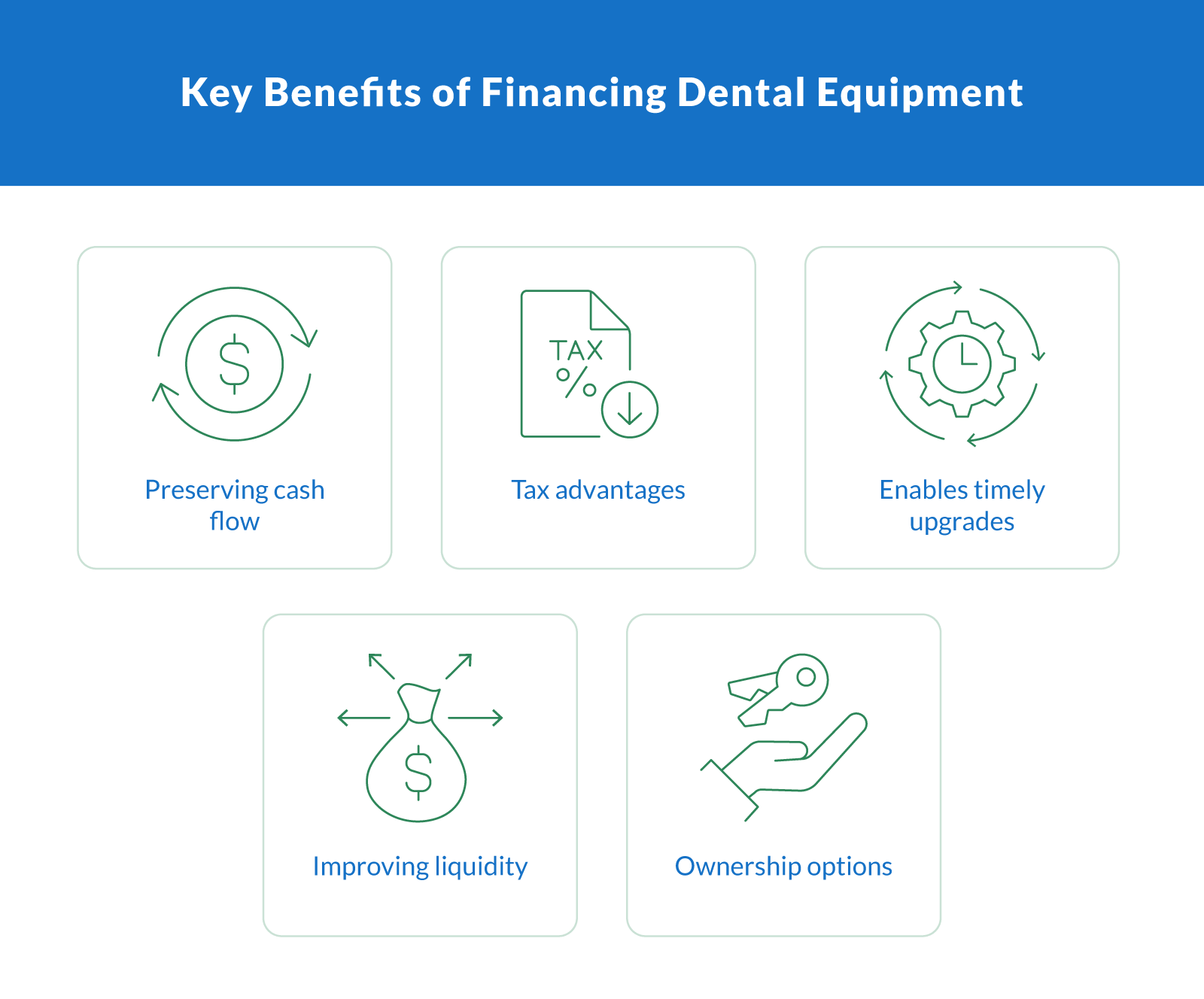

Benefits of Dental Equipment Financing

Instead of tying up your cash with an upfront purchase, dental equipment financing lets you buy essential tools while preserving your working capital. It also comes with long-term financial and operational benefits.

Here's how financing compares to paying upfront:

Paying upfront strains cash flow. Financing preserves capital for marketing, hiring, or unexpected expenses.

Upfront purchases limit tax benefits. Financing may qualify for Section 179 deductions, helping reduce taxable income.

Upfront costs delay equipment upgrades. Financing allows you to access new equipment when you need it.

Purchasing outright reduces liquidity. Financing spreads out expenses with predictable monthly payments.

Buying grants immediate ownership. Financing may include flexible buyout or lease-to-own options.

Financing helps dental professionals who need to purchase equipment modernize their practices without compromising financial stability, improving operations, and patient care.

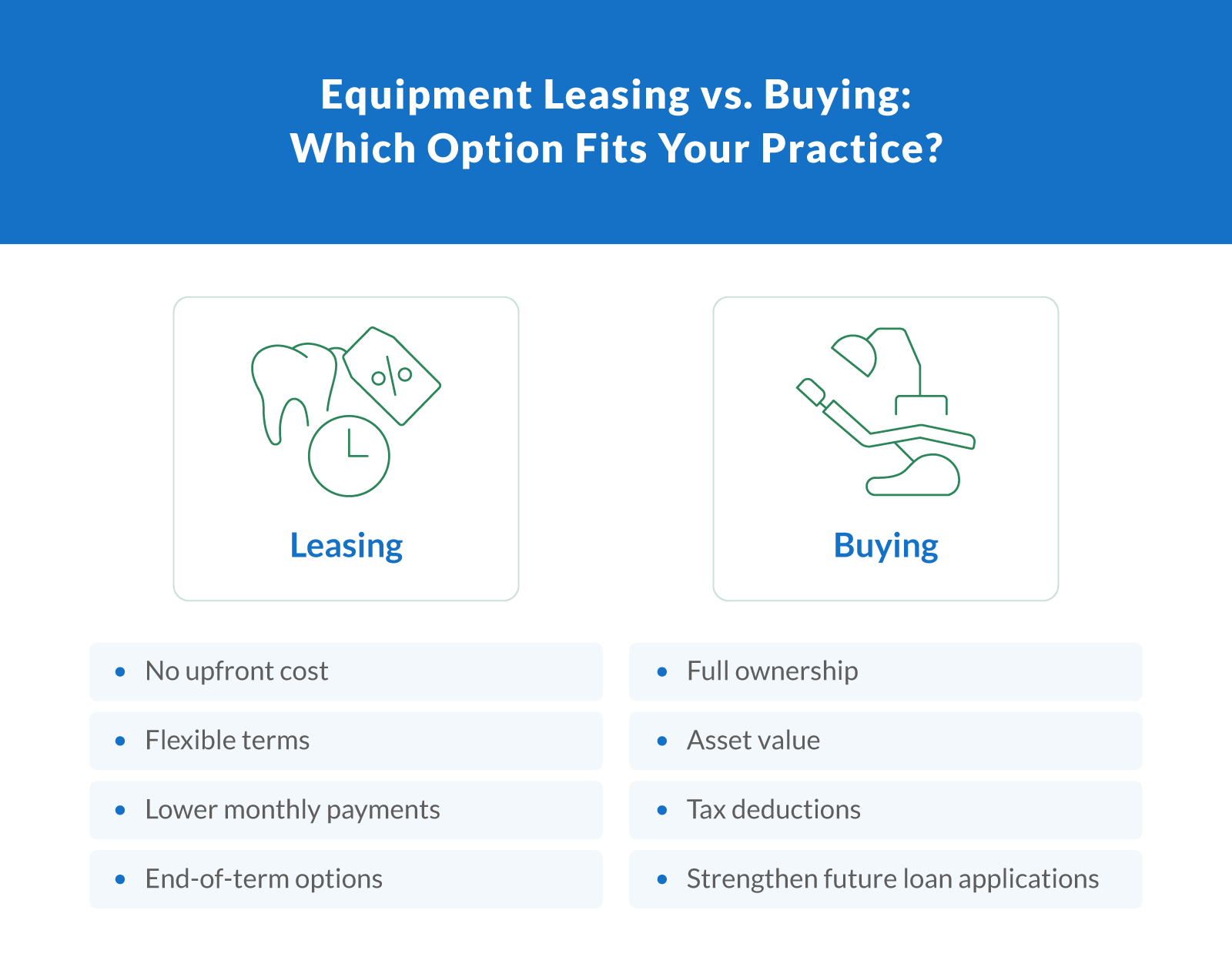

Equipment Leasing vs. Buying: What's Right for Your Practice?

Both leasing and buying can be sound options. It all depends on your cash flow and business maturity.

Leasing:

No upfront cost. Ideal for newer practices that want to conserve capital.

Flexible terms. Easier to upgrade equipment every few years.

Lower monthly payments. Leasing programs often come with fixed costs and shorter commitments.

End-of-term options. Choose to purchase, return, or renew the lease.

Buying:

Full ownership. You own the asset outright after you're done financing it.

Asset value. May be depreciated or resold later.

Tax deductions. Qualifies for Section 179 and other deductions.

Real estate implications. Owned equipment can strengthen business loan applications, especially if applying for dental practice loans or real estate financing.

For practice owners planning long-term investments, buying might make more sense. If you're early in the business lifecycle or frequently upgrade, dental equipment leasing offers flexibility without having to make a large financial commitment.

Funding With Clarify Capital

Whether you're starting a new dental office or growing an existing practice, having the right financing in place can make a big difference. With dental equipment loans, you can upgrade your tools, run your practice more smoothly, and deliver better patient care without putting too much strain on your cash flow.

As you consider your goals, assess your likelihood of credit approval, equipment needs, and whether leasing or purchasing best supports your growth. Gathering the right documents ahead of time can help you act quickly when you're ready.

If you're looking for fast approvals, flexible terms, and funding up to $5 million, apply today with Clarify Capital.

FAQs About Dental Equipment Loans

Still have questions about dental equipment financing? These answers cover the most common concerns of dental professionals and business owners planning their next investment.

What Credit Score Do You Need for a Dental Loan?

Most lenders look for a credit score of at least 550-600 for basic approval, though stronger credit opens up better rates and terms. Subprime borrowers (550-649) typically qualify through alternative lenders like Clarify Capital, while prime borrowers (680+) may access lower APRs, longer terms, or larger loan amounts.

Your credit score directly affects your interest rate, total repayment, and likelihood of credit approval, making it one of the most important qualifying factors for a dental equipment loan.

What Are the Interest Rates for Dental Equipment Loans?

For 2025, interest rates on dental equipment loans typically range from 5% to 40%, depending on the lender and loan structure. Borrowers with excellent credit and high revenue may qualify for rates near the lower end, while those with riskier profiles will see higher rates.

Key factors that influence your rate include:

Credit score

Length of loan term

Type of lender (bank, SBA, online)

Fixed-rate loans have steady, predictable payments. Variable-rate loans, on the other hand, may start with lower repayments but can fluctuate with market conditions. Make sure you understand the loan structure when comparing financing terms.

What Is a Personal Guarantee for a Business Loan?

A personal guarantee is a legal promise that you, as the business owner, will repay the loan personally if your business cannot. Lenders often require this for small business loans, especially if the company has limited credit history or assets.

Signing a personal guarantee means your personal credit, income, or property could be at risk if the business defaults. While this increases lender confidence and approval chances, some borrowers may prefer non-recourse financing or work with lenders focusing more on revenue-based underwriting.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts