Running a dental practice comes with unique financial challenges. Whether you're upgrading x-ray machines, buying commercial real estate, or managing cash flow, the right financing options can help.

For dentists just starting out, securing funding can be tricky, especially with the burden of dental student debt and low initial revenue. Established practices often need additional funds for real estate upgrades, new equipment, or even refinancing existing loans to secure lower interest rates. No matter your situation, understanding dental practice loans is the first step to choosing the right option to meet your needs.

If you're a dentist looking to expand, upgrade equipment, or manage day-to-day cash flow, this 2025 guide to dental practice loans breaks down the best loan options for expanding or upgrading practices. We've refreshed this content with the latest lender info, rates, and tips to help dental professionals grow their practices with confidence.

Why Dentists Need Tailored Financing

Dentists face significant expenses that other industries don't. For example:

Expensive equipment. X-ray machines, dental chairs, and tools require constant updates to keep up with patient needs and technology.

Real estate needs. Whether leasing or buying a dental office, real estate loans are often necessary for expansions or new locations.

Cash flow management. Covering operating expenses like staff salaries, utilities, and supplies is crucial for running your practice smoothly.

Rising interest rates and shifting patient expectations post-COVID are making it more important than ever for dentists to secure affordable financing. Many lenders are tightening underwriting standards, so having updated financials and a strong credit profile can improve your odds of approval.

Additionally, dental professionals must overcome unique challenges like managing student loans or building creditworthiness, making it important to look for financing options tailored to the dental industry. Before applying for financing, it's smart to focus on improving your dental practice credit score to qualify for better terms.

What Types of Loans Do Dentists Qualify For?

Dentists have access to a variety of financing options depending on their credit, business stage, and funding needs. Common loan types include:

SBA 7(a) loans. Best for purchasing or expanding a dental practice with long-term and low rates.

Equipment financing. Covers dental tools and technology; the equipment serves as collateral.

Term loans. Fixed lump-sum loans are ideal for renovations, marketing, or hiring.

Business line of credit. Revolving funds are used to manage cash flow or short-term expenses.

Startup loans. Tailored for new dental practices with limited history or recent graduates.

Real estate loans. Used to buy, build, or renovate dental office space.

Choosing the Right Dental Loan for Your Practice

Each of these loan types serves a different purpose, and the right fit depends on your goals, credit approval, and practice stage. Below, we break down how each loan program works, who it's best for, and what to expect in terms of rates, repayment, and approval timelines. Understanding these loan structures will help you make an informed decision.

SBA Loans

Small Business Administration (SBA) loans are a popular option for dental professionals. Backed by the SBA, these small business loans are ideal for borrowers seeking long-term financing with low interest rates.

How it works. SBA loans are issued by lenders like traditional banks or approved online lenders, with the SBA guaranteeing a portion of the loan amount. Funding options like the SBA 7(a) loan cover a wide range of uses, including real estate and working capital. Most borrowers will see a range of 10.5%–15.5% in 2025.

Best for. Dentists or dental business owners with strong credit and established, existing dental practices.

Pros.

Lower interest rates than most traditional bank loans

Long repayment terms, reducing monthly payments

Flexible uses, from equipment financing to real estate loans

Cons.

Lengthy application process

Requires a detailed business plan and strong creditworthiness

Equipment Loans

Dental equipment financing is specifically designed to help dental professionals purchase or upgrade equipment like x-ray machines, dental chairs, and sterilizers.

How it works. The loan amount is tied to the cost of the equipment, with the equipment itself serving as collateral.

Best for. Practices looking to invest in new equipment or replace outdated tools.

Pros.

Quick approval process

Often easier to qualify for since the equipment serves as collateral.

Cons.

Limited to equipment purchases.

May require a down payment upfront

Business Line of Credit

A business line of credit offers revolving access to funds, giving you flexibility for short-term needs.

How it works. Borrowers are approved for a credit limit and can withdraw funds as needed, paying interest only on what is used.

Best for. Covering unpredictable cash flow or emergency expenses.

Pros.

Only pay interest on the amount you withdraw

Quick access to funds

Cons.

Can have higher interest rates than term loans

Requires strong credit for favorable terms

Term Loans

Term loans provide a lump sum of cash that is repaid in fixed monthly installments. These loans are great for large projects.

How it works. Borrowers receive a set loan amount upfront and repay it over a predetermined term with fixed rates.

Best for. Dentists with specific funding needs, like expansions or major purchases.

Pros.

Predictable repayment terms and monthly payments

Available from both traditional and alternative lenders

Cons.

May require strong credit or collateral

Less flexible than a line of credit

Real Estate Loans

Real estate loans help dental professionals purchase or renovate office spaces.

How it works. Similar to a mortgage, these loans are secured by the property you're purchasing or renovating.

Best for. Dentists who are looking to expand or buy their first dental office.

Pros.

Long repayment terms reduce monthly payments

Builds equity in commercial real estate

Cons.

High upfront costs, including down payments and closing fees

Lengthy approval process

Startup Loans

Startup loans are tailored for dentists opening a new practice, often fresh out of dental school. New practices should also consider strategies for maximizing practice valuation early on, especially if you plan to seek long-term financing or eventual sale.

How it works. These loans provide upfront capital to cover startup costs, including equipment, leasing, and marketing.

Best for. New dental practices with limited cash flow and revenue history.

Pros.

Access to funding despite minimal business history

Helps overcome the hurdle of student debt

Cons.

Higher interest rates due to increased risk

Requires a detailed business plan and proof of creditworthiness

Compare Top Loans for Dentists (2025 Update)

Not all lenders offer the same terms, speed, or experience when it comes to dental financing. Below is a comparison of three dental-friendly lenders that stand out in 2025 based on their loan products, approval speed, and borrower requirements.

| Loan Type | Interest Rates (July 2025) | Repayment Terms | Approval Time | Best For | Pros | Cons |

|---|---|---|---|---|---|---|

| SBA 7(a) (via SBA.gov / Live Oak Bank) | 10.5%–15.5% | Up to 25 years | Weeks to months | Practice acquisition, working capital | - Competitive, relatively low interest rates - Long repayment terms - Flexible use (acquisition, capital, etc.) - Lower down payments | - Lengthy approval and documentation - Requires strong credit - Personal guarantee often required - Collateral may be needed |

| SBA 504 (via SBA.gov / Live Oak Bank) | ~3.00% (can go higher) | Up to 25 years | Weeks to months | Equipment, real estate purchase | - Very low, fixed interest rates - Long repayment terms - Low down payment - Payment stability, no balloon - Ideal for property/equipment | - Limited to asset purchases - Extensive paperwork - Prepayment penalties/fees - Not for fast funding |

| BHG Money Business/Personal Loans | 11.96%–27.87% APR | 3–12 years | As few as 5 days | Fast funding, all credit tiers, flexible use | - Quick funding (3–5 days) - Long terms up to 12 years - Flexible approval - No collateral in many cases | - High maximum interest rates - Lower max loan amount ($500k) - Less transparency on fees - Mixed customer reviews |

| Live Oak Bank Practice/Term Loan | 11.5%–16.5% APR | Up to 25 years | Weeks | Established dentists, large loan amounts | - Experienced dental lending - Industry expert guidance - Flexible loan structures - Fast SBA approvals possible - Cash flow lending focus | - 2+ years in practice required - Not for small loans - Online-only lender - Financial or operational history required |

Last updated: July 2025

Expert Tip: Your Clarify Capital advisor can help compare offers across 75+ lenders, including these, to find the best rate and loan type for your practice needs.

Note: Rates and terms vary based on credit profile and loan details. Please consult each lender to confirm the latest offers.

How To Choose the Right Loan

Selecting the right dental practice loan depends on your needs and financial situation.

Assess your practice's needs. Are you looking to purchase equipment, manage cash flow, or buy real estate? Understanding your specific goals will narrow down your loan options.

Understand your financial standing. Lenders will evaluate your credit score, annual revenue, and creditworthiness. If you have strong credit, you'll likely qualify for lower interest rates and better terms.

Compare loan offers. Look at interest rates, repayment terms, loan amounts, and fees from multiple lenders. Don't forget to consider both traditional banks like Bank of America and online lenders for faster approval.

Most lenders prefer borrowers who've been in practice for at least two years and generate $300,000 or more in annual revenue. Associate dentists may qualify for lower loan amounts, while practice owners with equity and higher collections will unlock better terms.

How One Dentist Used a Loan To Expand Their Practice

Dr. Patel, a general dentist in Phoenix, wanted to open a second location after outgrowing her original office. With a strong patient base and steady cash flow, she knew it was time to scale, but needed capital to make it happen.

After comparing several financing options, Dr. Patel chose a $250,000 SBA 7(a) loan due to its competitive interest rate (currently, rates for loans of this size typically range from 10.5% to 13.5% as of July 2025), along with a long repayment term (10 years) and flexibility in use. She worked with her loan advisor to gather the necessary documentation, including:

Three years of personal and business tax returns

A detailed business plan with financial projections

Lease agreements and equipment quotes for the new location

A personal credit score of 720+

Her strong credit profile and well-prepared application helped her get approved in just 45 days, which is on the faster end for SBA-backed loans in 2025.

The funds covered construction, equipment purchases, and initial staffing costs. Within six months of opening the new location, Dr. Patel increased her revenue by $35,000 per month, hired two new associates, and expanded her patient base by 40%.

Today, she credits that SBA loan, with its competitive rate and flexible use, with giving her the financial confidence to grow without compromising the quality of care.

Note: The interest rate cited reflects 2025 SBA 7(a) guidelines for loans in this range; actual rates are based on borrower profile and prevailing rates at application time.

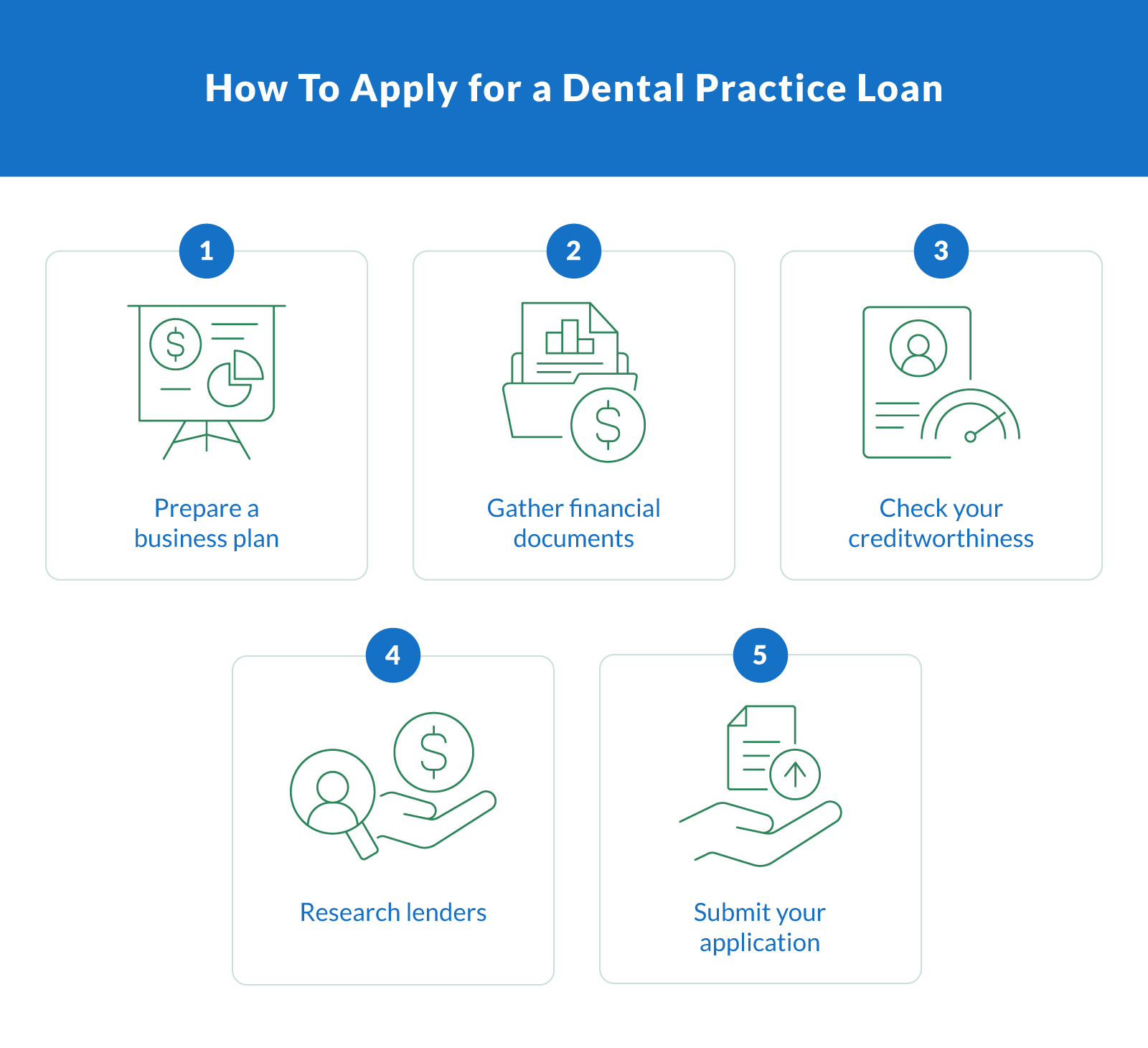

Steps To Apply for a Dental Practice Loan

The application process for dental practice loans can feel overwhelming, but breaking it into steps simplifies things.

Prepare a business plan. Include details about your dental practice, financial projections, and how you plan to use the loan.

Gather financial documents. These might include bank account statements, tax returns, and proof of annual revenue.

Check your creditworthiness. Review your credit score and resolve any errors on your credit report before applying.

Research lenders. Compare providers like traditional banks, online lenders, and alternative lenders to find the best fit.

Submit your application. Ensure your loan application is complete and error-free to avoid delays.

Need help getting documents ready? Your Clarify advisor will walk you through the prep step-by-step.

FAQs About Dental Practice Loans

When it comes to securing financing for your dentistry business or dental practice, it's natural to have questions. Understanding your options, eligibility, and how loans work can make the loan process much smoother. Below, we answer some of the most common questions dentists have about dental practice loans.

What Are the Best Dental Practice Loans for Startups?

Startup loans and SBA loans are excellent options for new dental practices. Startup loans provide upfront funding for equipment, leasing, and marketing, while SBA loans offer long repayment terms and lower interest rates, making them ideal for building a strong financial foundation.

Can I Refinance an Existing Loan?

Yes, refinancing is a great way to secure better terms on an existing loan. Many lenders offer refinancing options for dental and healthcare professionals looking to lower interest rates, reduce monthly payments, or change their repayment schedules.

How Does My Credit Score Affect My Eligibility?

Your credit score is one of the most important factors lenders consider when reviewing your loan application. A higher credit score indicates good creditworthiness, which can help you secure lower interest rates and better repayment terms. If your credit score needs improvement, take time to address it before applying.

What Credit Score Do Dentists Need?

Most dental practice lenders look for a credit score of 680 or higher, though some alternative lenders will approve scores as low as 600. The better your credit, the lower your interest rate and the more loan options you'll qualify for.

Are Alternative Lenders a Good Option?

Alternative lenders can be a great option for dentists who need fast funding or have difficulty qualifying for traditional loans. While they may have higher interest rates, these providers often offer more flexible loan terms and a faster application process, making them ideal for short-term or urgent financial needs.

Can I Get 100% Financing for Dental Equipment?

Yes, some lenders offer 100% equipment financing to qualified dentists, especially for established practices with strong credit. Others may require a down payment or use the equipment as collateral.

Are SBA Loans Ideal for Purchasing a Dental Practice?

Yes. SBA 7(a) loans are one of the most popular ways to finance the purchase of an existing dental practice. They offer low interest rates, long repayment terms, and can be used for acquisition, equipment, and working capital.

Unlock Growth with the Right Loan

Whether you're expanding your dental office, upgrading equipment, or managing cash flow, the right financing option can help you reach your goals.

Ready to explore dental practice financing? Apply now with Clarify Capital to take the next step.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts