Cash flow loans are a type of short-term financing used to cover day-to-day operational expenses when timing or revenue gaps disrupt working capital. Many business owners turn to cash flow financing to manage payroll, purchase inventory, or cover overhead costs without having to put up real estate, equipment, or other business assets as collateral.

In this guide, you'll learn how cash flow loans work, the different types available, key eligibility factors, how various lenders compare, and tips for choosing the right loan based on your specific business needs.

What Are Cash Flow Loans?

Cash flow loans are a type of business financing that provides fast access to capital based on your company's projected future cash flow rather than its physical assets. Unlike traditional secured loans, cash flow loans are unsecured, meaning you don't need to pledge real estate, inventory, or equipment as collateral. Instead, lenders focus on the strength of your revenue stream, your historical cash flow performance, and your ability to repay from upcoming income.

Small businesses often turn to cash flow loans when immediate needs arise. Here are some common examples of when you might use one:

Covering payroll during slow sales periods (ensuring employees are paid even if cash inflows are delayed)

Purchasing inventory for seasonal demand (stocking up ahead of busy periods without draining your working capital)

Paying for operational expenses like rent or utilities (keeping the business running smoothly despite short-term cash flow gaps)

Managing temporary disruptions (handling unexpected expenses or delays in customer payments)

Since repayment typically comes from future cash flow, these loans are designed to be short-term solutions, often with repayment terms between six and eighteen months. Their speed and flexibility make them a popular choice for business owners who need working capital without waiting weeks for traditional bank approvals.

How Cash Flow Loans Work

Cash flow loans work by providing funding based on the projected income your business is expected to generate in the near future. Instead of evaluating your physical assets or collateral, lenders focus on your company's annual revenue trends, profit margins, and bank activity to assess creditworthiness. This makes cash flow financing especially appealing for small businesses that need quick access to capital but may not have significant assets on hand.

When reviewing your application, lenders typically request business bank statements, recent tax returns, and your average monthly revenue. These documents help them determine the loan amount you qualify for, as well as the repayment terms and pricing. The stronger and more consistent your cash flow, the better your rates and terms are likely to be.

Repayment is usually structured over a short-term period — often six to 18 months — with fixed daily, weekly, or monthly payments. Some lenders may also require a personal guarantee, which holds the business owner personally responsible for repayment if the business can't cover the balance.

While cash flow loans offer fast funding, they also come with potential risks. Interest rates are generally higher than traditional loans, especially if your credit score is low or your revenue is inconsistent. Short repayment windows can strain your day-to-day operations, and prepayment or late fees may be included in the disclosures. Understanding the full cost of the loan — including total repayment, not just the rate — is essential before signing an agreement.

Types of Cash Flow Loans

There are several types of cash flow loans available to small business owners, each designed to meet different business needs. Whether you need a flexible credit line or a lump sum of working capital, it's important to choose the right type of loan based on your cash flow patterns and growth goals.

Here are the most common types of cash flow loans:

Business lines of credit provide flexible access to capital, allowing businesses to draw funds as needed and only pay interest on the amount used.

Short-term loans offer a lump sum of capital that is repaid over a short period, typically six to eighteen months, with fixed payment schedules.

Merchant cash advances (MCAs) advance a lump sum in exchange for a percentage of future credit card sales or daily sales receipts.

Invoice financing provides cash based on the value of outstanding customer invoices, helping to bridge cash flow gaps between billing and payment.

Term loans provide a lump sum amount with a structured repayment plan over a set term, often with slightly lower rates than other short-term options.

Here's a quick comparison of loan features:

| Loan type | Funding speed | Repayment terms | Documentation needed | Pros | Cons | Ideal use case |

|---|---|---|---|---|---|---|

| Business line of credit | As fast as 24 hours | Revolving, interest-only | Basic financials, credit score | Flexible access to funds | Requires strong cash flow history | Managing variable expenses |

| Short-term loan | As fast as 24 hours | 6–18 months | Bank statements, tax returns | Fast funding, lump sum available | Higher rates, quick repayment required | Covering one-time expenses |

| Merchant cash advance | As fast as 24 hours | Until advance is repaid | Daily sales data, merchant statements | Easy to qualify, very fast | Very high costs, daily repayment impact | Emergency cash needs, bad credit |

| Invoice financing | 24–48 hours | Upon customer payment | Outstanding invoices | Good for cash flow from slow-paying clients | Depends on customer reliability | Bridging receivables cash flow gaps |

| Term loan | 2–5 days | 1–5 years | Strong financials, tax returns | Lower rates than short-term options | More documentation needed | Larger, planned investments |

Eligibility Requirements for Cash Flow Loans through Clarify Capital

When applying for cash flow loans, lenders want to know that your business generates consistent revenue and can manage short-term repayments. Because cash flow loans are unsecured, approval depends more on financial performance than on physical assets.

Here's what most lenders (including Clarify Capital) usually look for during underwriting:

Monthly revenue. Steady monthly revenue is important, typically starting at $10,000 or more.

Business age. Your company should be operating for at least six months.

Credit score. A personal credit score of 500 is often enough, with better credit opening the door to lower rates.

Bank account. You'll need an active business bank account showing consistent deposits and responsible management.

Cash flow history. Lenders review your cash flow trends to make sure you have reliable income and healthy financial habits.

For business owners with bad credit or limited time in business, MCAs and online short-term loans are often the easiest financing options to qualify for. However, they usually come with higher interest rates and faster repayment schedules, so it's important to weigh the tradeoffs before moving forward.

SBA Loans vs. Cash Flow Loans

Both SBA loans and cash flow loans can help small businesses access working capital, but they differ in speed, requirements, and overall structure. SBA loans, issued through traditional banks and backed by the U.S. Small Business Administration, require a more detailed application process, including full financials, tax returns, and a business plan. While SBA loans offer some of the lowest interest rates available, they can take significantly longer to secure.

By comparison, cash flow loans move much faster. At Clarify Capital, businesses can often get approved the same day and funded within 24 hours, making them a strong choice when timing matters.

Here's a quick side-by-side look:

| SBA loans | Cash flow loans through Clarify Capital | |

|---|---|---|

| Approval time | 4–12 weeks | Same-day approval possible |

| Funding speed | May take weeks after approval | As fast as 24 hours after approval |

| Documentation | Extensive (business plan, full financials) | Streamlined (bank statements, revenue proof) |

| Interest rates | Roughly 12% to 15% | As low as 7% for the strongest borrowers |

| Risk | Lower (longer repayment terms) | Higher (shorter repayment periods) |

| Application process | Thorough and time-consuming | Fast, online, no heavy paperwork |

| Prepayment penalties | Possible, depending on lender | Less common, but varies |

SBA loans are harder to qualify for and take longer to process, but they offer excellent long-term value if you meet the requirements. Cash flow loans are built for speed and flexibility, making them a better fit when you need fast access to working capital to manage operational expenses or take advantage of new opportunities.

Pros and Cons of Cash Flow Loans

Cash flow loans can be a powerful tool for small business owners — but like any financing option, they come with both benefits and risks. Understanding the financial and operational trade-offs can help you decide if this type of loan fits your business needs.

Pros:

Quick access to funding. Many cash flow loans are approved the same day and funded within 24 hours, helping you move fast.

No collateral required. Unlike asset-based lending options, cash flow loans are unsecured loans, so you don't have to risk personal or business assets.

Good for covering short-term cash flow gaps. They provide working capital to manage operational expenses during revenue slowdowns or growth periods.

Cons:

Potentially higher interest rates than traditional loans. Because these loans are based on cash flow rather than collateral, rates may be higher.

May require a personal guarantee. Some lenders require a personal guarantee, making the business owner personally responsible for repayment.

Fast repayment can impact day-to-day operations. Short repayment terms and daily or weekly payments can tighten your cash flow if not managed carefully.

Tips To Improve Your Approval Odds

If you're applying for a cash flow loan, preparation can make all the difference in getting approved quickly and securing better terms. Small business owners with strong financial profiles stand out to lenders.

Here are practical steps to improve your approval odds:

Improve your credit score. Pay down existing debts, resolve any errors on your credit reports, and stay current on all obligations.

Maintain clean financials. Organized bank statements, profit and loss statements, and tax returns show lenders that your business is stable and well-managed.

Submit complete bank statements. Lenders want to see consistent deposits and a healthy cash flow history, so make sure you provide full, recent statements.

Choose the right type of financing. Matching your loan application to the stage and needs of your business, such as a short-term loan for quick cash flow gaps, improves your chances of approval.

Work with reputable online lenders or providers. Trusted providers like Clarify Capital can help you find funding options that fit your business model and cash flow patterns.

Understand disclosures. Always review loan application terms, repayment schedules, and total costs before signing to avoid surprises later.

Choosing the Right Loan for Your Business

Choosing the right small business loan starts with understanding your cash flow needs and repayment ability. Cash flow loans can offer fast access to working capital, but they're not one-size-fits-all, and taking on the wrong financing option can hurt your bottom line.

Small business owners should always compare loan options carefully, think through repayment timelines, and make sure the financing supports their overall growth strategy.

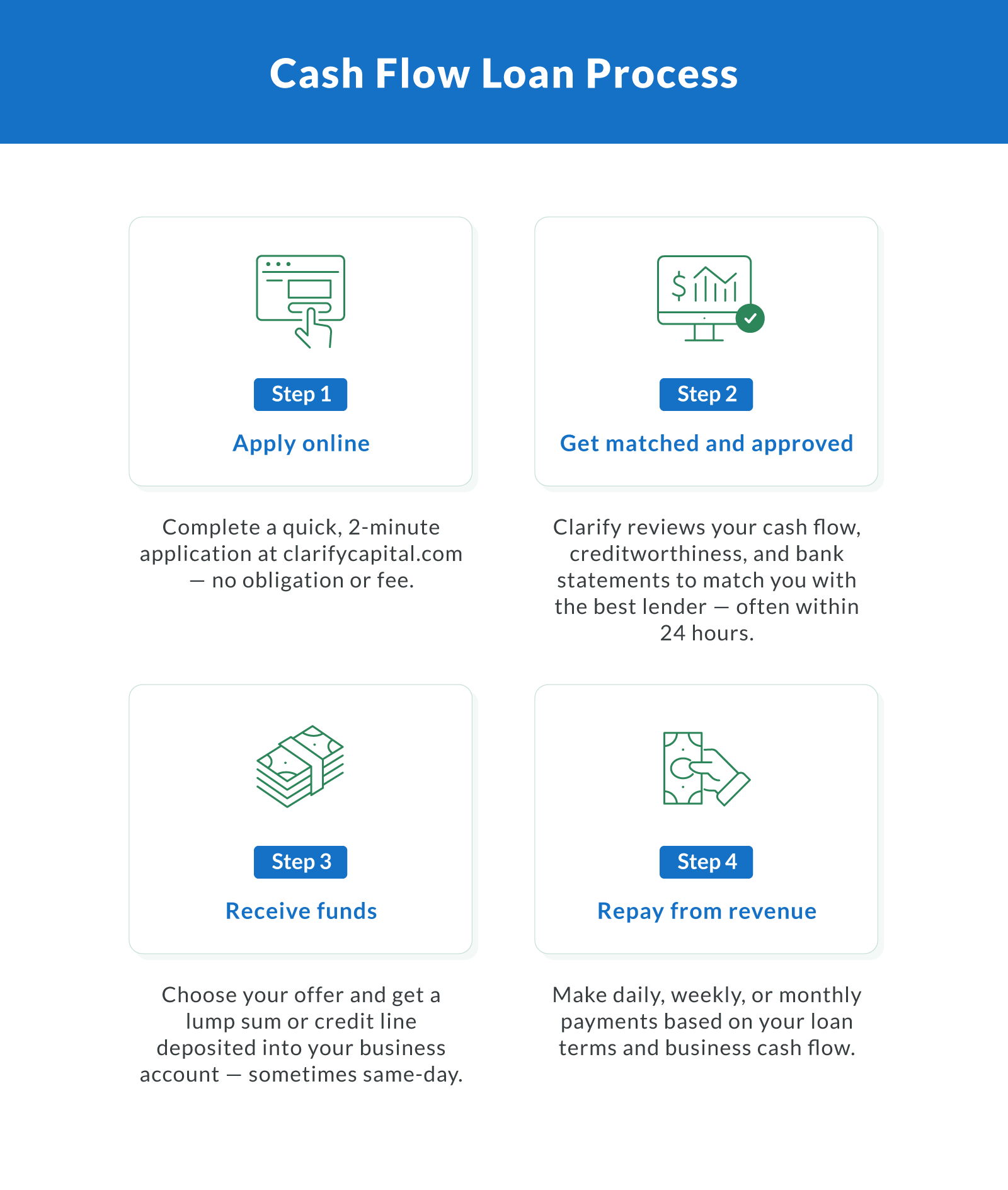

If you're ready to explore cash flow loans or other small business financing solutions, apply through Clarify Capital today.

It only takes two minutes to get matched with funding options, and your dedicated Clarify advisor will help you every step of the way.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts