Business Loans With Little or No Collateral

The following options may require collateral based on the loan amount or lender, but they're still viable for borrowers who don't want to risk high-value personal assets. In many cases, collateral can be limited to the financed item itself or waived for smaller loan amounts.

SBA Loan

The Small Business Administration (SBA) offers funding to small business owners through various loan programs, such as the SBA 7(a) program. The agency doesn't fund the money; instead, you borrow from an SBA-approved business lender.

Most SBA loans are secured. But if you're borrowing $50,000 or less, you may not need to put up collateral. With SBA loans, you get lower interest rates and favorable loan terms. It's a great choice if you need minimal funding and have time on your side because SBA lenders can take weeks to process the loan. The eligibility requirements are also stricter than those of other loan options.

Equipment Financing

Equipment financing provides funding to businesses that want to purchase machinery or vehicles. Pieces of equipment needed for production and day-to-day business operations are typically high-ticket items. And many new businesses can't afford to buy them without financing.

With equipment financing, the amount you qualify for depends on the purchase price of the machinery you're looking to buy. The repayment term also depends on the expected life of the asset. The equipment serves as collateral for the loan.

Repayment Structures by Loan Type

The table below illustrates repayment structures for various types of loans:

| Common Small Business Loan Types and How Repayment Works |

|---|

| Loan type | Repayment structure | Frequency | Additional notes |

|---|

| Short-term loan | Fixed-principal + interest | Monthly | Predictable monthly payments over six to 24 months |

|---|

| Merchant cash advance | % of daily/weekly credit card sales | Daily or weekly | Flexible, adjusts with your revenue |

|---|

| Business line of credit | Interest only on the amount drawn | Monthly (or ongoing) | Revolving credit: reuse funds without reapplying |

|---|

| Equipment financing | Fixed payments | Monthly or quarterly | Based on the equipment's useful life |

|---|

| Invoice factoring | No repayment; fee deducted up front | N/A | The lender collects from customers; fees reduce the payout |

|---|

| SBA microloan (≤ $50K) | Fixed-principal + interest | Monthly | Long-term repayment with lower interest rates |

|---|

No-Collateral vs. Secured Business Loans

When exploring business financing options, business owners must decide between no-collateral loans and secured loans. The main difference lies in the collateral requirements:

Secured loans. These require business assets like real estate, equipment, or inventory.

Unsecured business loans. These rely on factors such as credit score, annual revenue, and creditworthiness.

When choosing a business loan, understanding the trade-offs between secured and unsecured options is key. Here's more on how they differ:

| Secured vs. Unsecured Business Loans |

|---|

| Category | Secured business loans | Unsecured business loans (no collateral) |

|---|

| Collateral requirements | Requires business or personal assets as collateral. | No assets required, making them accessible for firms without equipment or property. |

|---|

| Approval process | More documentation, including business plans, credit checks, and asset appraisals. Often offered by banks and credit unions, with longer review times. | Faster review with fewer documents. Commonly offered by online lenders with quicker decisions. |

|---|

| Interest rates | Usually lower because the lender has collateral protection. | Often higher since the lender takes on more risk. |

|---|

| Loan amounts and repayment terms | Higher borrowing limits and longer repayment schedules. | Generally smaller amounts with shorter repayment periods. |

|---|

When To Choose a No-Collateral Loan Over a Secured One

Even though secured loans can offer lower interest rates, they're not always the right fit. Choose a no-collateral loan if:

You don't have assets to pledge. Startups, online businesses, or service-based companies often don't own expensive equipment or property. Unsecured loans remove that hurdle.

You need funding fast. No asset valuation means a faster approval process, often within 24 hours.

You want to keep personal property off the table. Not every business owner wants to tie loans to personal real estate or savings.

You're funding a short-term need. If you're covering a cash flow gap, quick hire, or restocking inventory, short-term unsecured funding is often a better fit than a long-term secured loan.

Many successful small businesses begin with modest capital needs and scale gradually. Economic research and practitioner experience shared in an AskEconomics Reddit thread highlight that service-based businesses, online companies, and consultancies often start with limited funding and reinvest profits before pursuing larger financing. This approach reduces downside risk while building the revenue history lenders want to see.

No-collateral loans put control in your hands, so you can access working capital without risking what you've built.

Strategic Ways To Use Collateral-Free Loans for Business Growth

Used with intention, collateral-free business loans offer fast, flexible capital that supports both immediate needs and long-term growth — all without risking your property or equipment.

Here are some smart, growth-focused ways to use unsecured financing:

Launch new revenue streams. Use funds to test new products, open a second location, or expand into a new market without draining your cash reserves. If the initiative succeeds, you can repay the loan with returns from your expansion.

Bridge cash flow gaps. Late customer payments, delayed shipments, or seasonal slumps can disrupt daily operations. A short-term loan or working capital loan can help cover expenses and maintain business continuity until revenue rebounds.

Fund marketing and advertising. Drive growth by reaching new audiences. Use unsecured loans to ramp up digital campaigns, run promotions, or hire a marketing agency, all without pledging assets.

Upgrade equipment affordably. Instead of tying up capital, use financing to purchase or lease upgraded equipment. This can improve efficiency and support business expansion while preserving your working capital.

Buy inventory and materials in bulk. Take advantage of supplier discounts and prepare for high-demand periods by using loan funds to stock up. This approach can improve margins and ensure you're ready to fulfill orders.

Cover tax payments. Avoid penalties or long-term payment plans by using a business loan to handle tax obligations in full. This helps you stay compliant without hurting your operational budget.

Maintain or grow your team. Staffing is often one of the largest expenses. Whether you're hiring for a busy season or covering payroll during a dip in revenue, payroll loans can help you meet obligations without disruption.

Build credit for future funding. Responsible borrowing and consistent repayment on unsecured loans can strengthen your business credit profile, making it easier to qualify for larger, longer-term financing in the future.

Expert Advice on Responsible Borrowing

Taking on an unsecured business loan or any type of financing should be a strategic decision based on business needs and repayment ability. While no-collateral loans provide quick access to working capital, responsible borrowing ensures financial stability.

Some best practices for borrowing responsibly include:

Only borrow what you need. While business lenders may approve a higher loan amount, borrowing more than necessary can strain cash flow and make repayment difficult.

Understand repayment terms. Before signing an agreement, review the loan terms, including interest rates, origination fees, repayment schedules, and any prepayment penalties.

Compare financing options. Consider alternative lenders, business credit cards, or invoice factoring before committing to a short-term loan with higher interest rates.

Monitor business finances. Regularly review credit history, business expenses, and accounts receivable to ensure you can meet loan repayments without financial strain.

Plan for unexpected costs. Keep a financial cushion to avoid late payments and damage to your credit score if your business revenue temporarily declines.

How Hard Is It To Get an Unsecured Small Business Loan Without Collateral?

It's not difficult to get an unsecured small business loan without collateral if your business shows strong financial health, but it can be challenging for companies with low revenue or weak credit. Because these loans rely on financial performance rather than assets, lenders may set shorter repayment periods or higher interest rates.

This challenge is especially common for startups with no operating history. Without collateral, revenue, or prior success, traditional banks have little data to price risk. In an AskEconomics discussion on Reddit, multiple contributors note that this is why early-stage founders are often steered toward bootstrapping, friends-and-family capital, or small unsecured products rather than large bank loans.

Before applying for an unsecured loan, review the full loan structure, including the payment schedule, total cost of borrowing, and any applicable fees such as origination charges or prepayment penalties. Understanding these details up front helps you compare offers and avoid surprises once repayment begins.

What Lenders Want Instead of Collateral

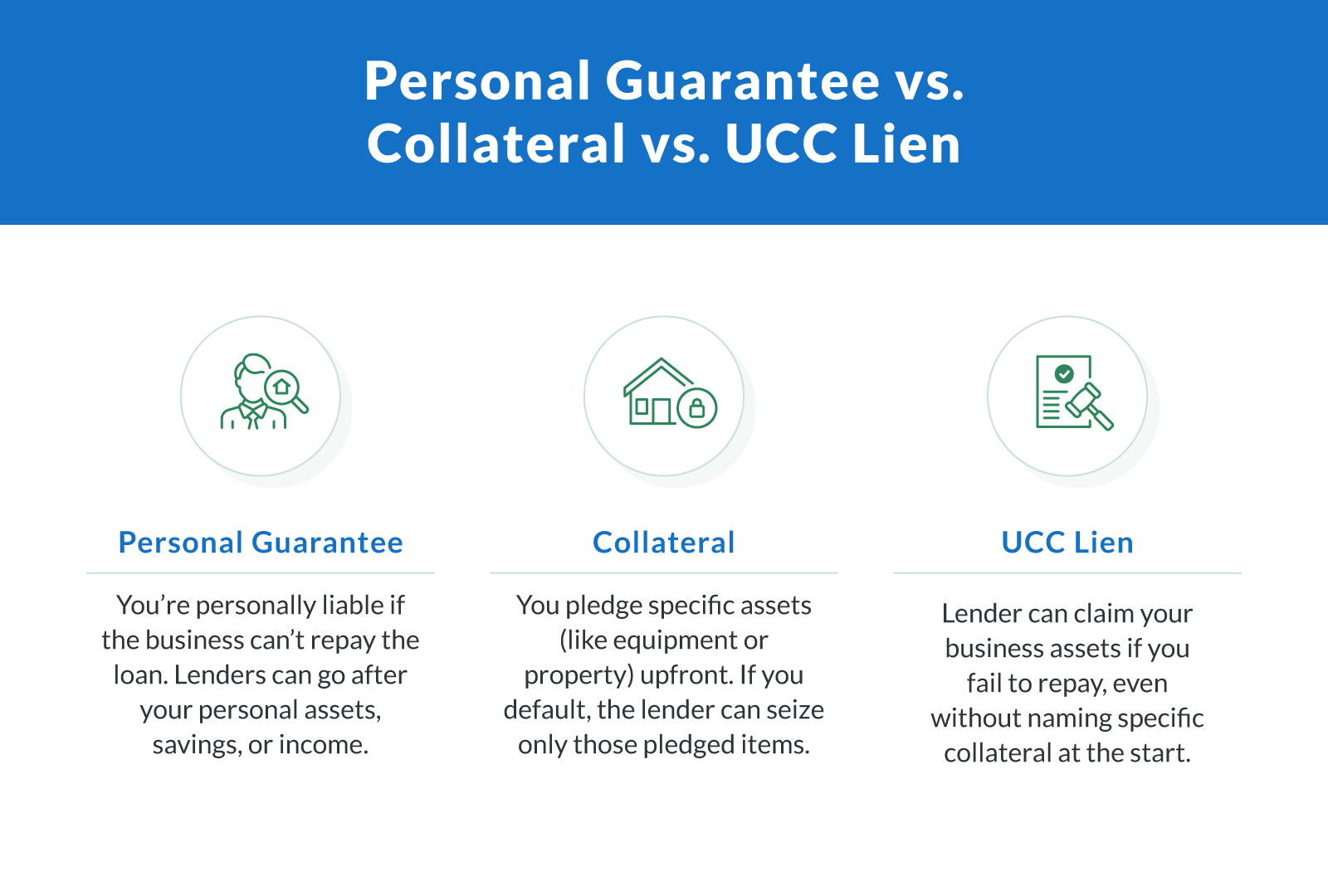

With unsecured loans, lenders often require alternative forms of security to protect their investment. You may be required to provide a personal guarantee. This means that your personal credit, income, or savings could be at risk, and lenders may take legal action to recover unpaid amounts. Alternatively, you may be subject to a UCC (Uniform Commercial Code) lien, which allows the lender to claim your business assets if the loan goes unpaid.

Understanding UCC Liens

A UCC lien is a legal notice that a lender can claim business assets only if you default. Unlike secured loans, you don't list specific property or hand over control. Instead, the lien is a general claim that protects the lender's interest if repayment fails.

Here's what business owners should know:

It doesn't impact daily operations. Your business keeps full use of assets unless you default on the loan.

It doesn't appear on your personal credit report. UCC liens are business-related and generally don't affect your FICO score.

It's common with unsecured loans. A UCC lien helps lenders reduce risk without requiring up-front collateral.

If you're concerned, your Clarify advisor can explain whether a UCC filing applies and what it means for your business.

How To Spot a Legitimate No-Collateral Lender

Fast business funding can be a lifesaver, but it can also attract shady offers. Here's how to make sure you're working with a trustworthy lender.

Look for these green flags:

Clear terms up front. Legitimate lenders provide full disclosure of APR, fees, repayment schedule, and loan structure, so you know exactly what you're signing.

No hidden charges. Watch for lenders that promote “easy approval” but tack on large origination fees or misleading rates.

No aggressive sales tactics. You should never feel pressured to sign immediately or hand over sensitive information before seeing the terms.

Verified lender network. Clarify Capital only works with vetted lending partners who follow fair, transparent practices, and your advisor walks you through everything before you commit.

When you borrow, clarity matters. The right lender gives you transparency from day one.