Running a small business takes ambition and determination. Small businesses comprise 99.9% of U.S. businesses, proving that entrepreneurs are the backbone of the American economy.

Still, getting a loan with bad credit can feel like an uphill battle. Traditional banks often rely heavily on personal credit scores, shutting out otherwise strong businesses. But that model is changing. Today, many lenders consider a broader picture, such as your business revenue, time in business, cash flow, other assets, and growth potential, rather than just your FICO score.

That shift opens up real opportunities for business owners who have faced past credit challenges. If your company earns steady income and has a clear plan for how to use the funds, you may be eligible for competitive financing even with a score below 600.

This guide breaks down how bad credit business loans actually work, which lenders offer the lowest rates, and how to improve your approval odds so you can compare options confidently and choose financing that supports long-term growth, not short-term stress.

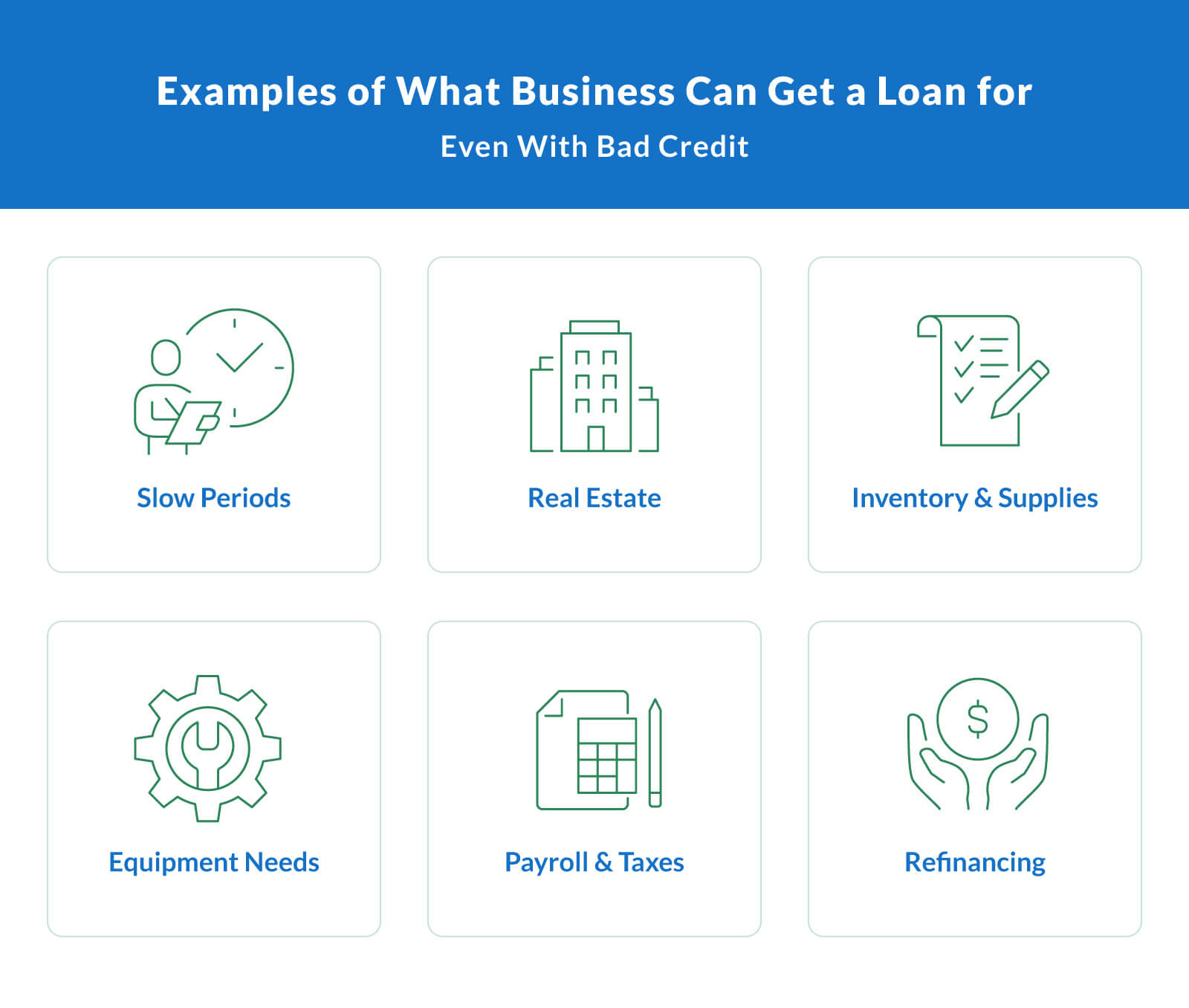

Whether you're trying to stabilize cash flow, purchase equipment, or cover payroll, this article will help you find a financing path that works, regardless of your credit score.

Best Business Loans for Bad Credit Scores

Bad credit doesn't have to block your access to business funding. While you may not qualify for traditional bank loans, several alternative financing options offer more flexible requirements — and faster access to capital. Below is a comparison table highlighting top bad credit business loan options, including rates, terms, and borrower requirements, to help you find the best fit.

| Bad Credit Business Loan Options | ||||

|---|---|---|---|---|

| Loan type | Interest rates | Repayment terms | Requirements | Best for |

| Short-term loan | 7%-30% | Six-24 months | Credit score 500+, $10K+ monthly revenue | Covering urgent expenses or working capital when you need fast approval |

| Business line of credit | 8%-25% | Revolving | Credit score 550+, revenue-based approval | Managing cash flow gaps or recurring short-term needs with flexible access to funds |

| Invoice financing | 10%-35% | Upon invoice payment | Outstanding invoices, credit rating of customers | B2B businesses waiting on unpaid invoices and needing immediate cash flow |

| Equipment financing | 6%-20% | Varies (based on equipment life) | Equipment as collateral, business revenue | Purchasing or upgrading equipment without paying upfront or using working capital |

| SBA loan | 5.75%-10% | Five to 25 years | Strong financials, time in business 2+ years | Established businesses seeking low-interest, long-term financing for major growth |

| Merchant Cash Advance | 15%-50% | Based on daily sales | High credit card sales, flexible credit requirements | Businesses with high daily credit card sales needing fast, flexible funding |

Best Business Loans For Bad Credit Scores

At Clarify, we believe that a low credit score shouldn't stop you from business success. We work with you to identify a loan product that suits your needs and unique cash flow requirements.

Here are the best types of loans for borrowers with less-than-stellar credit ratings.

Short-Term Business Loan

Term loans are a type of business financing that offers short repayment terms, typically ranging from six months to two years. You receive a lump-sum amount that you repay through fixed, regular payments. A short-term loan is an excellent option for new businesses or startups that may not qualify for funding from traditional lenders like banks or credit unions.

With Clarify, you can get short-term bad credit business loans with APRs as low as 7% without any collateral, so you don't have to risk your business or personal assets. Term loans also have low credit score requirements. As long as your business has been operational for at least six months and you can prove that you generate over $10,000 in monthly income or have at least $120,000 in annual revenue, we can get you pre-approved. Many lenders can even complete a credit check and provide funding within one business day.

Business Line of Credit

A line of credit works much like a business credit card. You receive a set credit limit, but you only make payments or incur interest charges for the amount you borrow. Unlike a credit card, a line of credit has a much lower interest rate and no prepayment penalties. It's also a great tool to improve your business credit score over time.

Most business owners use this type of funding to cover working capital, such as buying inventory or paying payroll. But the main advantage of a line of credit is its flexibility; you can use it however or whenever your business needs it.

Invoice Financing

Invoice financing allows businesses to borrow money using accounts receivable. If you have outstanding invoices, it's a smart funding option. The invoices serve as collateral, so your credit score isn't a factor in getting approved.

A factoring company assumes responsibility for collecting outstanding invoices, paying you up to 100% of the unpaid invoices and receivables upfront, and helping you avoid cash flow delays. Once the invoices are paid, the lender deducts fees automatically from the credited amount. It's similar to how credit card and debit transactions process payments. Invoice financing providers offer varying terms and rates to fit your business.

This might be the easiest loan to get if you have bad credit. Because approval is tied to the strength of your invoices, some invoice financing options even function with no credit check or only a soft pull, making them attractive for owners rebuilding personal credit.

Equipment Financing

Equipment financing provides capital to purchase the machinery, vehicles, or technology your business needs without upfront costs. Whether you're a trucker, restaurant owner, or construction company, this type of financing helps you grow, replace outdated assets, or expand operations.

With Clarify, you can borrow up to 100% of the equipment's value, often with APRs as low as 6%. Funding is typically available within one to two days, with minimal paperwork and monthly payment terms. The equipment itself serves as collateral, so even business owners with lower personal credit scores can qualify.

SBA Loans

SBA loans are business loans backed by the U.S. Small Business Administration. Because the SBA guarantees part of the loan, lenders are willing to offer lower interest rates and longer repayment terms than many traditional loans, although they can be more challenging to qualify for up front.

While these business loans are primarily designed for small businesses, certain SBA programs may also support nonprofit organizations looking for working capital or expansion funding. For smaller funding needs, an SBA microloan, which typically ranges up to $50,000, may be ideal for qualifying businesses seeking flexible financing.

How To Choose the Right Loan Type for Your Business Needs

Choosing the right loan depends on how you plan to use the funds and your business's financial profile. Here's a quick guide to help you match your needs with the right product:

Seasonal businesses. A business line of credit gives you flexibility to borrow only when needed, which is ideal for fluctuating cash flow.

Startups or new businesses. Short-term loans are often easier to qualify for and provide fast access to capital without long commitments.

B2B companies with outstanding invoices. Invoice financing lets you turn unpaid invoices into immediate cash, regardless of credit score.

Businesses with frequent equipment needs. Equipment financing helps you acquire essential tools and machinery without using working capital.

Established businesses with strong financials. SBA loans offer low rates and long repayment terms, but are best suited for those with two or more years in business.

Still unsure? Your Clarify advisor can help you compare options based on your specific goals.

Secured vs. Unsecured Business Loans

One major factor lenders consider is whether the loan is secured or unsecured. It's important to understand the difference before choosing a loan option:

Secured loans are backed by collateral such as major assets, inventory, or real estate. Because the lender has a claim on assets, interest rates are lower, and loan amounts can be higher. However, if you default, the lender can seize the collateral. These are used for larger purchases, expansion projects, or equipment financing.

Unsecured loans don't require collateral, which means you don't risk your business assets. Approval tends to be faster as well because lenders who offer this often focus more on revenue and cash flow than on credit score. That said, interest rates are usually higher, and approved amounts may be smaller.

If you don't have valuable assets or aren't comfortable using them as collateral, unsecured loans may be your best bet.

How To Improve Your Credit Score Before Applying for a Business Loan

Improving your credit score before applying for a business loan can help you qualify for better interest rates and loan terms. Here are key strategies to enhance your creditworthiness:

Review your credit report. Check reports from the major credit bureaus for errors or inaccuracies and dispute any discrepancies.

Make timely payments. Pay off outstanding debts and maintain consistent, on-time payments for all loans and credit cards.

Lower credit utilization. Keep your credit card balances low relative to your credit limit to improve your credit score.

Increase your business revenue. Lenders consider annual revenue when assessing eligibility, so demonstrating higher revenue can offset a poor credit history.

Build business credit. Open a business credit card or secure small credit lines with suppliers to establish a solid business credit history.

Work with alternative lenders. Online lenders and alternative financing options, such as invoice factoring or merchant cash advances, may offer better approval odds.