The SBA loan program, offered through the Small Business Administration, is one of the most accessible financing options for eligible business owners. With flexible terms, low interest rates, and partial government guarantees, it's intended to make small business loans more affordable and less risky for SBA lenders.

Understanding SBA loan requirements is the first step to a successful loan application. Each program has its own eligibility criteria: the popular 7(a) loan supports general business purposes, the 504 loan is geared toward real estate and equipment, and the Microloan program helps with smaller amounts of working capital.

This article breaks down the essentials of each program and outlines what you'll need to apply, helping you prepare before you meet with a lender. You'll also see how Clarify Capital simplifies the SBA loan process, saving you time and helping you get funding faster.

Download the SBA Loan Requirements Checklist

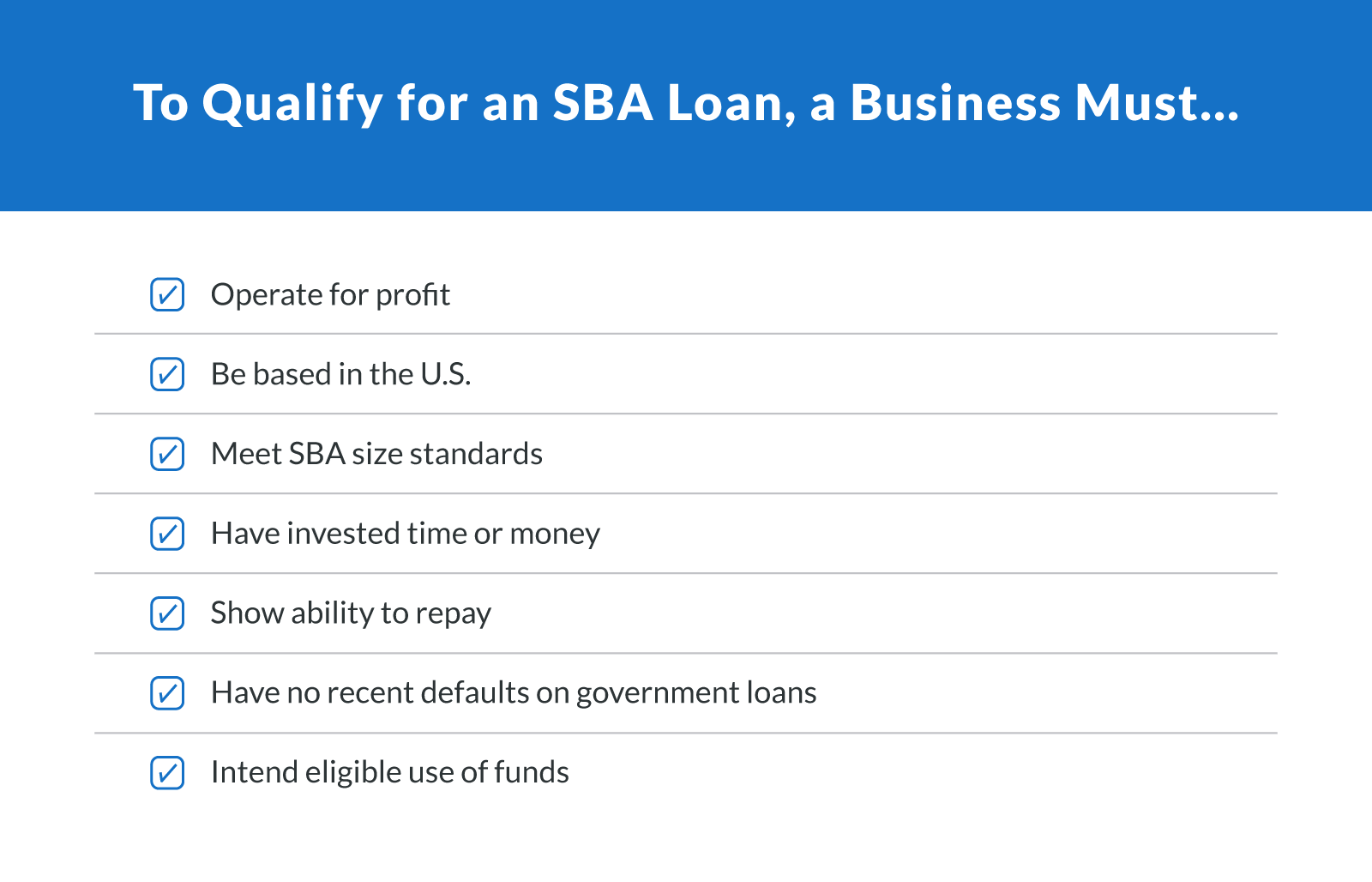

SBA Loan Requirements

Most SBA loan programs share common eligibility criteria, but the specifics — like credit score minimums, required documents, and use of funds — can vary depending on the program. This checklist covers the major SBA loan requirements to help business owners confirm eligibility before starting the loan application process:

Businesses must operate for profit. The SBA only lends to for-profit businesses. Nonprofits and other tax-exempt entities aren't eligible.

Must be based in the U.S. Your business must be physically located and operating in the United States or its territories.

Meet SBA size standards. To qualify as a small business, you must fall within the Small Business Administration's size guidelines, which vary by industry.

Owners must have invested time or money. The SBA requires that owners have made a reasonable equity investment into the business, either through capital or active involvement.

Must show ability to repay. SBA lenders will assess your cash flow, credit history, and financial projections to determine if you can repay the loan.

No recent defaults on government loans. If you've defaulted on a federal loan (like student loans or other government-backed loans) in the past, you may be disqualified.

Use of funds must be eligible. Funds must be used for approved purposes such as working capital, equipment purchases, real estate, or debt refinancing — not for passive investments or illegal activities.

Business Eligibility Criteria

To meet eligibility requirements for an SBA loan, a business must be for-profit, operate legally in the U.S., and meet the size standards set by the U.S. Small Business Administration. These eligibility criteria ensure that SBA-backed funding supports businesses that are financially viable and likely to repay.

In most cases, nonprofits and startups are not eligible. Clarify Capital does not fund startup ventures; your business must have an operating history and revenue.

There are also industry restrictions. Businesses involved in the following activities are typically ineligible for SBA loans:

Gambling or gaming operations (unless limited to less than one-third of revenue)

Real estate development or rental properties primarily for investment

Speculative investing, such as trading in stocks, bonds, or cryptocurrency

Businesses engaged in illegal activities, including cannabis or other federally restricted products

For a complete list of exclusions, you can refer to the SBA.gov site or consult directly with your lender to verify your business qualifies.

Minimum Credit Score Requirement

When applying for an SBA loan, your credit score and overall credit history are key factors that lenders use to judge your creditworthiness. While the Small Business Administration (SBA) doesn't publish a fixed minimum credit score for SBA loans, most lenders expect a personal credit score of around 650 for typical SBA 7(a) Loan applications. Some lenders may accept scores in the lower 620s in specific cases.

A higher credit score generally improves your chances of approval and can help you secure better terms (lower interest rates, longer repayment periods). If your business credit score or personal credit is weaker, you'll likely face tighter scrutiny or higher costs.

For borrowers with poor credit, such as a personal score closer to 550, traditional SBA‑backed financing may be difficult. At this point, alternative lending options might make more sense — these may not carry the exact SBA guarantee, but can serve working capital needs while you rebuild credit.

Consider Clarify Capital as one of your options for alternative lenders. Those with a minimum credit score of 550 can qualify for funding.

Time in Business and Revenue

For a business applying for a Small Business Administration (SBA) loan, the two key criteria — time in business and business revenue — show lenders that your enterprise is stable and capable of repayment. Most SBA lenders require a business to be operational for at least two years, with consistent and verifiable income.

On the revenue side, lenders typically look for an existing business generating sufficient cash flow — often monthly revenue at or above $10,000 or a similar threshold, especially for programs oriented toward working capital.

Meanwhile, through Clarify Capital, the minimum requirement is notably more flexible: business owners need at least six months in business, and a monthly revenue of $10,000+.

These streamlined criteria help emerging businesses access funding when traditional SBA lenders require a longer track record.

Down Payment and Collateral

When it comes to getting a loan under the Small Business Administration (SBA) programs, two important factors are the down payment (equity injection) and the collateral or secured assets. Here's how they typically work — plus how Clarify Capital offers a different path.

Down Payment/Equity Injection

Most SBA loans require a down payment or equity injection of at least 10%, though the exact amount can vary based on the loan type, business risk, and lender requirements.

For the standard SBA 7(a) loan program, many lenders and guides say a down payment of around 10% of the project cost is typical.

For the SBA 504 loan program (which focuses on fixed assets like real estate or equipment), the standard minimum down payment is about 10%, but it can rise to 15% or 20% for new businesses or special‑use properties.

In some cases, the exact percentage depends on loan size, purpose, borrower risk, lender policy, and whether the business has strong collateral.

Collateral

Lenders often expect collateral to back an SBA loan, especially when it's readily available — here's how it typically works:

Collateral means assets (business or personal) pledged to secure the loan. For SBA‑guaranteed loans, lenders typically expect collateral when available. For example: real estate, machinery, equipment, etc.

Under the 504 program, the financing of fixed assets (real estate, facilities, equipment) generally serves as collateral.

While the SBA sets broad policies, individual lenders may require additional collateral beyond the financed assets, depending on business risk and asset quality.

How To Strengthen Your Approval Chances

Lenders want to see signs that you can repay the loan and are fully invested in the business — here are key ways to improve your odds:

Demonstrate strong cash flow and working capital — this shows you're likely to repay, reducing the lender's risk.

Present clear documentation of your fixed assets and their value (for collateral) — e.g., valuations, appraisals, equipment lists.

Maintain a high level of business asset ownership (equity) so that your down payment is meaningful and signals commitment.

Clarify's alternative financing model means you don't need to follow the typical down payment + collateral rules of SBA‑guaranteed loans. Instead, a lower or different equity injection may be accepted. There's also revenue‑based financing, which allows approval even with fewer fixed assets pledged as collateral. This makes business financing more accessible for business owners who may not have large real estate holdings or equipment inventories.

Required Documentation

Gathering the right documents is key to a strong loan application under the Small Business Administration (SBA) programs — it gives lenders a clear view of your business's financial health and repayment capacity. Many of these items appear on the official SBA‑backed submission checklist:

Business plan. A detailed strategy document showing your business model, target market, revenue projections, and how you'll use the loan proceeds.

Tax returns (last two to three years). Filed federal business (and often personal) tax returns for the past two to three years, used to verify income and history.

Balance sheets. Up-to-date business balance sheets showing assets, liabilities, and equity, so lenders can assess the overall financial position accurately.

Profit and loss statements. Year‑to‑date and prior year income statements that display revenue, expenses, and net profit (cash‑flow ability).

Three months of bank statements. Recent deposit and withdrawal records from business bank accounts to verify current liquidity and working capital.

Debt service coverage ratio (DSCR) data. Documentation of cash flow relative to debt payments so lenders can compute the DSCR and evaluate your ability to service new debt.

Additional legal/organizational documents. These may include business licenses, articles of incorporation, ownership documentation, lease agreements, and any collateral schedules.

Popular SBA Loan Programs: Key Differences

The Small Business Administration (SBA) offers several loan programs tailored to different business goals — from flexible working capital to long-term real estate financing. Below is a comparison of three major programs to help you pick the right fit.

| Comparison of SBA Loan Programs | ||||

|---|---|---|---|---|

| Loan type | Loan amount | Approval time* | Collateral | Intended use |

| SBA 7(a) | Up to about $5 million. | Typically 60–90 days (can be faster for preferred lenders) | Required when available (especially for larger loans) | General business needs: working capital, equipment, expansion, debt refinance |

| SBA 504 | Up to about $5 million (or $5.5 million for certain projects) | Longer process (often months) | The financed asset (real estate or equipment) typically serves as collateral | Fixed‑asset financing: commercial real estate, major equipment purchases |

| SBA Microloan | Up to about $50,000 (varies by intermediary) | Generally fastest of the three (but intermediary‑based) | Collateral and personal guarantee usually required | Small‑scale working capital, inventory, supplies, startups/smaller businesses |

*Approval times vary widely by lender, program, and preparedness of documentation.

SBA 7(a) Loan

The SBA 7(a) loan program is the most popular and versatile option for business financing backed by the U.S. Small Business Administration. Designed for flexibility, it supports a wide range of business needs — from expanding operations to improving cash flow.

Loan amounts typically range from $50,000 to $5 million, making it suitable for both moderate and large funding needs. Borrowers can use 7(a) funds for working capital, refinancing existing debt, purchasing equipment, acquiring a business, or even some types of real estate.

To qualify, most SBA lenders require:

A 10% down payment (equity injection)

Strong credit history (typically a credit score of 650 or higher)

Sufficient cash flow to meet repayment terms

Collateral, especially for higher loan amounts or less established businesses

With long repayment terms — up to 10 years for working capital and up to 25 years for real estate — the 7(a) loan offers manageable monthly payments that help preserve cash flow.

SBA 504 Loan

The loan follows a “50-40-10” model — 50% from a private lender, 40% from an SBA-backed Certified Development Company (CDC), and at least 10% from the borrower (which can increase for new or special-use properties).

Here's what you need to know:

Eligible uses. Owner-occupied commercial real estate and long-life machinery or equipment (funds can't be used for working capital, inventory, or speculative real estate).

Collateral and guarantees. The financed assets serve as collateral. Personal guarantees are standard, and lenders expect strong credit and solid business fundamentals.

Key terms. SBA-backed portion includes up to $5 million ($5.5M for manufacturing or energy projects). Terms are typically 10, 20, or 25 years, based on asset type

The SBA 504 Loan program is purpose‑built for businesses looking to acquire major assets like commercial real estate or long‑lived equipment. It supports business growth and job creation through fixed‑asset financing rather than general working‑capital uses.

SBA Express Loan

The SBA Express loan is designed for speed and simplicity — giving small businesses quicker access to funding with less paperwork. As part of the 7(a) family, this short-term financing option allows lenders to offer expedited decisions, often within 36 hours, thanks to delegated lender approval authority.

Loan amounts typically go up to $500,000, and while the SBA guarantee is lower, that trade-off enables faster credit review and fewer documentation requirements. SBA-approved preferred lenders issue these loans and can make credit decisions without waiting for SBA review.

Due to the convenience and speed, SBA Express loans often carry higher interest rates than traditional SBA options. However, they remain a practical choice for business owners needing quick working capital or bridge funding without the complexity of a full loan package.

SBA Microloan

SBA Microloans are intended to help startups and microbusinesses access smaller small business loans through local nonprofit lenders. This type of loan provides up to $50,000, with the average loan size around $13,000, making it ideal for newer or very small businesses needing inventory, supplies, equipment, or working capital.

Unlike traditional SBA options, it's the community-based intermediaries focused on economic development who distribute microloans. These nonprofit lenders may also offer technical assistance, helping borrowers build financial literacy alongside funding.

Microloans typically have more relaxed credit standards and are more accessible for businesses that may not qualify for other financing options.

SBA Loan Repayment Terms: What To Expect

Repayment terms vary by SBA loan program, depending on the loan amount, purpose, and asset type. Longer terms can help reduce monthly payments and ease cash flow, while shorter terms may suit smaller or short-term financing needs.

To help compare your options at a glance, here's how the main SBA loan programs stack up in terms of loan size, repayment terms, and typical use cases.

| Repayment Terms Comparison | |||

|---|---|---|---|

| Loan type | Max loan amount | Typical term length | Ideal for |

| SBA Microloan | $50,000 | Up to six years | Startups, home-based businesses |

| SBA 7(a) loan | $5 million | 10–25 years | General working capital, growth |

| SBA 504 loan | $5.5 million | 10–25 years | Real estate or fixed assets |

While not ideal for large-scale expansion, SBA Microloans provide an accessible on-ramp to small business financing — especially for underserved or community-based entrepreneurs.

What Disqualifies You From an SBA Loan?

Even if your business meets basic eligibility requirements, certain factors can still disqualify you from receiving funding under an SBA loan program. Lenders assess not just your business plan, but also your financial standing, risk level, and compliance with federal standards.

Here are the most common disqualifiers:

Poor or limited credit history. Borrowers with consistently bad credit, recent bankruptcies, or unresolved defaults often fail to meet SBA creditworthiness standards.

Delinquent federal debt. If you've defaulted on previous federal obligations, such as student loans or tax debt, you may be ineligible (see full SBA disqualification criteria).

Non-U.S. incorporation. Your business must be physically located and legally registered in the U.S. to qualify.

Inadequate cash flow. SBA lenders require clear evidence that your business can meet repayment terms. Weak or inconsistent financials, especially with a low DSCR, can lead to rejection.

Ineligible business activity. Certain industries (e.g., gambling, speculative investing, cannabis) are excluded from SBA programs regardless of financial standing.

Clarify Capital offers alternative financing solutions for business owners who may not qualify for SBA loans. Whether due to bad credit, limited time in business, or cash flow challenges, Clarify helps match you with lenders who focus on flexibility — not just strict federal guidelines.

When To Consider Alternative Business Financing

While SBA loans offer excellent rates and long terms, they aren't always the right fit for every business. Some small business owners may need faster access to funds or may not meet the eligibility criteria. In these cases, alternative financing options can provide a more practical path forward.

You might want to consider other types of financing if:

You need working capital fast (within 24–48 hours).

You have a low credit score or limited credit history.

You run a new business with less than two years in operation.

You need a simpler application process with fewer documentation requirements.

Clarify Capital offers same-day business financing options — ideal for time-sensitive expenses like payroll, vendor payments, or emergency repairs. With streamlined underwriting and flexible terms, it's a reliable alternative to traditional business loans.

Comparing SBA loans vs. Clarify funding helps you weigh priorities like speed, paperwork, repayment flexibility, and qualification ease. For many growing businesses, using the right tool at the right time makes all the difference.

Ready To Apply for an SBA Loan?

Navigating SBA loan requirements can feel overwhelming, but you don't have to do it alone. With deep experience in the SBA loan program and access to a wide network of lenders, Clarify Capital helps small business owners find the right business financing based on their goals, qualifications, and timeline.

Whether you're looking for working capital, refinancing, or long-term growth funding, our team will guide you through each step — streamlining paperwork, checking eligibility, and increasing your odds of approval.

Clarify makes it easy to match your business needs with the most efficient and accessible small business loans available.

Apply today to see how Clarify Capital can help your business grow.

FAQs About SBA Loan Requirements

Got questions about SBA loan eligibility, approval timelines, or what lenders look for? This section covers the most common concerns small business owners have when navigating the SBA loan process. Whether you're applying for the first time or weighing multiple funding options, these answers will help clarify what to expect.

Can I Get an SBA Loan With Bad Credit?

Yes, but it's more challenging. Having bad credit doesn't automatically disqualify you from an SBA loan, but it does raise concerns about your creditworthiness. Most lenders want to see a credit score of at least 650, though some may consider lower scores if other factors, like strong cash flow or collateral, offset the risk.

If your score is below that range, take steps like paying down debt, disputing errors on your credit report, and improving your personal and business financing history.

In cases where SBA approval isn't realistic, Clarify offers alternative funding options with more flexible requirements, so bad credit doesn't stop your business from moving forward.

How Hard Is It To Get an SBA Loan?

Getting an SBA loan isn't easy — but it's achievable with strong preparation and complete documentation. Lenders assess your business plan, financials, credit profile, and repayment ability, with underwriting typically taking 30–90 days.

While approval rates vary, only 34% of applicants were fully approved for SBA loans in 2023, despite over 70,000 SBA 7(a) and 504 loans being approved in 2024. Many rejections stem from missing documents or weak financials. These numbers show that while many applications are submitted, a significant portion do not result in full approval — often due to missing documentation or weak metrics.

Understanding lender expectations and submitting well-organized materials can significantly boost your chances.

Do SBA Loans Require a Personal Guarantee?

Yes — SBA loans generally require a personal guarantee from any business owner who holds 20% or more of the company.

This guarantee means you're personally responsible for repaying the loan if the business can't. Lenders use it to assess credit risk and ensure owner commitment. While the guarantee doesn't automatically put your personal assets at risk, they can be pursued if the business defaults.

Owners with less than 20% may still be asked to sign, but SBA rules typically require it only for those with a 20%+ stake.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts