For small business owners, access to quick and flexible funding can mean the difference between surviving a challenging season and thriving during unexpected growth. A merchant cash advance (MCA) offers a way to get a lump sum up front in exchange for a portion of future sales, typically from credit card and debit card transactions. While this type of financing solution can be a lifeline, it is important to understand the details, from the application process to repayment mechanics, so you can decide whether it fits your cash flow and risk tolerance.

This guide explains how cash advances work for businesses, how repayment and remittance actually happen (daily vs. weekly), the real costs to watch for, and the risks that can show up when the advance becomes a last resort instead of a planned tool.

What Is a Business Cash Advance?

A business cash advance, commonly referred to as a merchant cash advance, is a short-term financing option that provides businesses with a lump sum of working capital up front. Instead of fixed monthly payments like traditional loans, repayment is tied to a share of daily credit card sales or receivables, allowing for flexible repayment terms that adjust with the ebb and flow of business income.

Key Features of a Merchant Cash Advance

These are the key features of the merchant cash advance:

Up-front funding. Businesses receive a lump sum based on their sales volume and receivables.

Repayment through sales. A percentage of daily credit card or debit card transactions is automatically applied toward repayment.

Factor rate. Repayment amounts are determined by a factor rate, not traditional interest rates, resulting in a set total repayment amount.

Short-term financing. MCAs are designed to address immediate funding needs, often for working capital or unexpected expenses.

While MCAs provide quick access to funding, they come with higher total repayment costs than many other business loans.

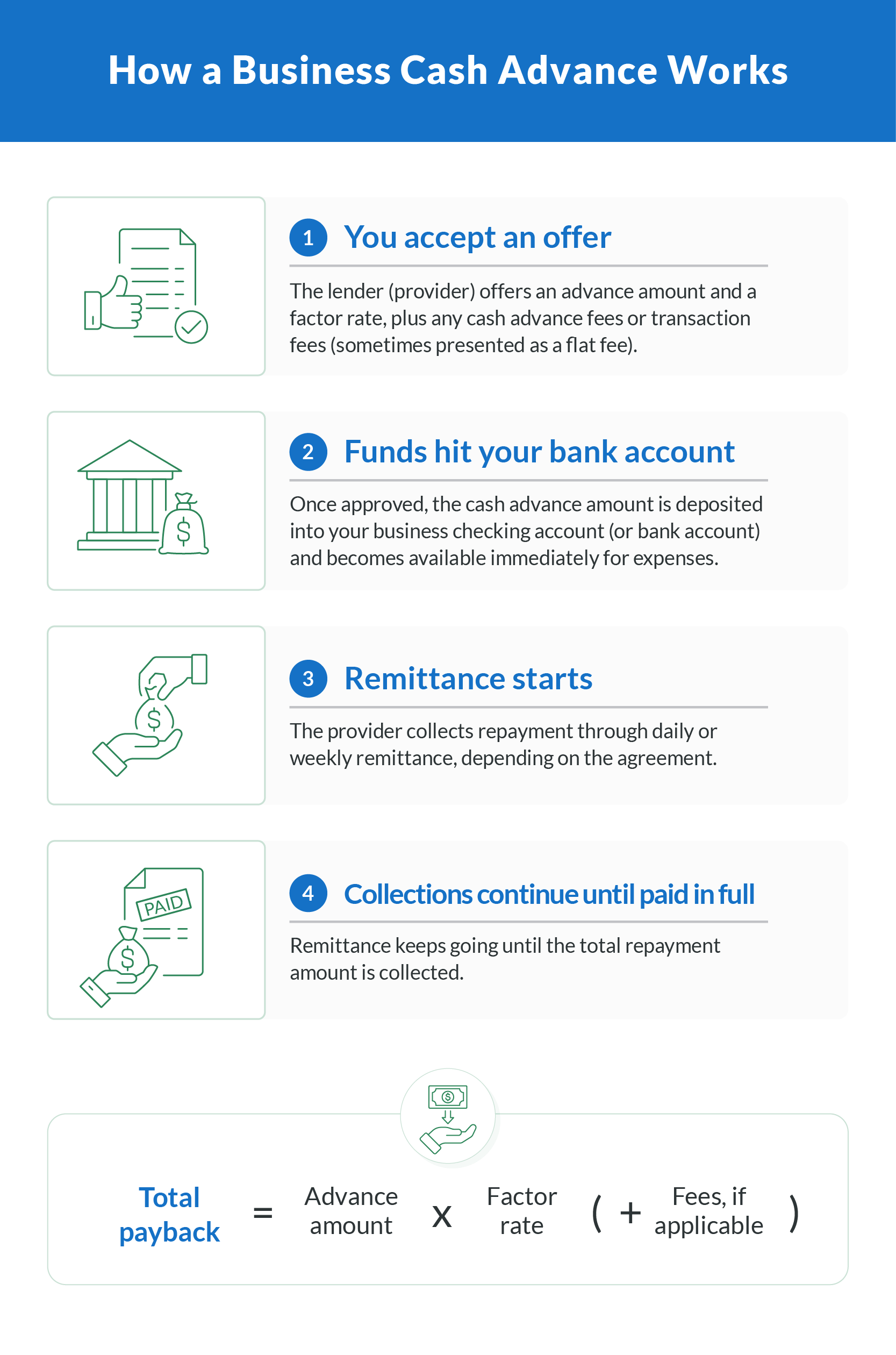

How Does a Business Cash Advance Work?

At a high level, an MCA is a purchase of future receivables. You receive an advance amount today, then the provider collects repayment by taking an agreed-upon share of your sales until the total payback is satisfied. There is usually no traditional due date, no amortization schedule, and no grace period like you might see with credit card purchases.

How Repayment Works

MCA repayment terms are tied directly to your sales volume, which is what makes this type of financing unique and flexible.

The key components of repayment include:

Holdback percentage. A predetermined portion of daily credit card sales is automatically allocated toward repayment.

Factor rate. Unlike traditional interest rates, MCAs use a factor rate to calculate the total repayment amount up front.

Repayment period. The time it takes to repay the advance depends on your daily credit card transactions and overall sales volume.

Daily vs. Weekly Remittance

With an MCA, there is either daily or weekly remittance.

With daily remittance, the provider collects repayment every business day from your bank account, often via ACH. Some providers use a percentage of card sales, while others calculate a fixed daily amount based on your revenue history.

With weekly remittance, repayment is collected once per week, usually from your business checking account. The weekly amount may still be based on your sales performance, but it is batched into a single withdrawal instead of daily pulls.

Pros of Flexible Repayment Terms

There are two primary benefits to these flexible repayment terms. First, payments decrease during slow sales periods, easing the strain on cash flow. Second, repayment adjusts automatically with daily credit card processing, requiring no manual effort.

Do Not Confuse MCAs With Credit Card Cash Advances

A merchant cash advance is not the same as a credit card cash advance. A credit card cash advance is taken by a cardholder from an ATM, in person at a bank, or via convenience checks, and it is limited by your cash advance limit and available credit within your credit limit.

Those transactions usually come with an up-front cash advance fee, a potential ATM fee or foreign currency fee, and a higher interest rate that starts accruing immediately as interest charges on your credit card account. The cash advance APR may differ from the annual percentage rate on regular purchases, and it shows up on your credit card statement alongside your credit card balance and credit utilization ratio.

By contrast, an MCA is a business financing product tied to sales, and it is repaid through remittance rather than a credit card minimum payment or a monthly payment schedule.

How Business Cash Advances Compare to Traditional Loans

Traditional business loans and merchant cash advances differ significantly in structure, eligibility requirements, and repayment terms. These differences make each suitable for different types of business needs.

Differences Between MCAs and Traditional Loans

MCAs and traditional loans differ in the following ways:

Repayment structure. Traditional loans have fixed monthly payments, while MCAs adjust repayments based on daily credit card sales.

Credit requirements. Traditional bank loans often require good or perfect credit, whereas MCAs are accessible to businesses with poor credit or limited credit history.

Speed of funding. MCAs offer quick access to capital, often within days, compared to the lengthy approval process for SBA loans or traditional loans.

Cost. MCAs tend to have higher total repayment amounts due to the use of factor rates.

Why Choose an MCA Over a Traditional Loan?

An MCA is ideal for small business owners who:

Experience seasonal or fluctuating sales.

Need cash flow to address immediate business needs.

Have been denied traditional bank loans due to poor credit or a lack of business credit history.

The Application Process for a Merchant Cash Advance

The MCA application process is designed to be straightforward and fast, making it a popular choice for businesses needing quick access to funding.

Steps To Apply for an MCA

When you're ready to apply, here's what you'll need to do:

Gather financial documents. These documents include bank statements, credit card processing records, and proof of daily credit card sales.

Submit your application. Provide details about your business, including sales volume, business bank account information, and other financial data.

Wait for MCA provider review. The lender evaluates your eligibility based on your sales history and receivables.

Get approval and funding. If approved, the advance amount is deposited into your business bank account, often within one to three business days.

Factors MCA Providers Consider

In reviewing your application, providers consider the following:

Sales volume. Consistent daily credit card transactions demonstrate repayment ability.

Business history. Most lenders require businesses to be operational for at least a few months.

Bank statements. A clear financial history can improve approval odds.

Credit score. While not a primary factor, your credit score may still play a role in determining the terms of the MCA.

Understanding MCA Costs and "APR Equivalents"

MCAs typically do not use an annual percentage rate in the way traditional lenders do, but you can still estimate an APR equivalent to compare options. You can learn more about how to calculate the true cost of an MCA.

Common cost components to look for include:

Factor rate. This determines your total payback.

Fees. Watch for origination fees, underwriting fees, and other cash advance fees presented as a flat fee.

Transaction fees. Some providers add ongoing transaction fees tied to processing or remittance.

Faster payoff, higher effective cost. Because collections happen quickly, the effective borrowing cost can feel like a higher interest rate when you convert it into an APR-style comparison.

Benefits of a Business Cash Advance

Merchant cash advances offer several advantages, especially for small business owners and entrepreneurs who need funding fast.

Quick access to funds. The approval process is fast, with funds often available within days.

No fixed monthly payments. Repayment amounts adjust based on sales volume, providing flexibility during slower periods.

Bad credit-friendly. Businesses with poor or limited credit history can qualify.

Simplified application process. Minimal documentation compared to traditional business loans.

Drawbacks To Consider

While MCAs are convenient, they come with potential downsides that business owners should consider carefully.

Higher costs. Factor rates and total repayment amounts are significantly higher than traditional loans.

Repayment tied to sales. Businesses with inconsistent or low sales may find it challenging to meet repayment requirements.

Short-term nature. MCAs are not a long-term funding solution and may not suit all business needs.

Risks To Know Before You Sign

Before you apply for an MCA, consider the following risks:

Stacking risk. Taking a second cash advance before the first is paid off can create a debt spiral where multiple providers are pulling funds from the same checking account.

Cash-flow pressure. Daily remittance can drain working capital, especially if you have payroll, rent, inventory, or tax payments hitting the same bank account.

Overreliance during unexpected expenses. If you use an MCA repeatedly instead of building an emergency fund or leaning on a line of credit, the compounding cost can crowd out healthier financing later.

Bank account volatility. Frequent withdrawals increase the odds of overdrafts, missed vendor payments, and general operational strain.

If you are already juggling multiple obligations, consider alternatives like a credit union small business product, a revolving line of credit, or restructuring expenses before treating an MCA as a last resort.

Comparing MCAs to Other Financing Options

An MCA is just one of many financing options available to small business owners. Here is how it stacks up against other forms of financing.

SBA Loans

These government-backed loans are designed for businesses that can qualify for longer terms and lower borrowing costs.

How it works. Long-term loans guaranteed by the Small Business Administration.

Best for. Businesses needing large amounts of capital at low interest rates.

Pros. Low-cost financing, favorable terms.

Cons. Lengthy approval process, high credit requirements.

Business Line of Credit

This option gives you flexible access to working capital, which can be useful when cash flow needs change month to month.

How it works. A revolving credit line that businesses can draw from as needed.

Best for. Businesses needing flexible, ongoing funding.

Pros. Pay interest only on what you use, reusable credit.

Cons. Requires strong credit and steady income.

Term Loans

This is a straightforward loan structure that works well when you want predictable payments for a defined expense.

How it works. A fixed funding amount is repaid in regular monthly installments.

Best for. Large one-time expenses or investments.

Pros. Predictable repayment terms, lower costs than MCAs.

Cons. Requires good credit, less flexibility.

Traditional Bank Loans

These loans can offer strong rates and larger amounts, but they typically come with stricter underwriting and slower approvals.

How it works. Banks offer long-term loans for various business needs.

Best for. Established businesses with strong credit.

Pros. Low interest rates, large funding amounts.

Cons. Stringent application process, slow approval times.

When To Consider a Business Cash Advance

A business cash advance is best suited for businesses that need quick cash flow for short-term needs. Common scenarios include:

Covering unexpected expenses, like equipment repairs or inventory restocking

Supporting a startup or small business without established business credit

Managing seasonal revenue fluctuations or slow sales periods

Choosing the Right MCA Provider

Not all MCA providers are created equal. Finding a reputable provider is critical to securing favorable terms and a positive experience.

Tips for Selecting an MCA Provider

Make sure to consider:

Transparency. Look for clear terms regarding factor rates, repayment amounts, and holdback percentages.

Customer reviews. Research the experiences of other small business owners with the provider.

Customer service. Choose a lender that is responsive and willing to answer questions.

Is a Business Cash Advance Right for Your Business?

Business cash advances offer speed and flexibility for small business owners who need immediate cash flow. However, their higher costs mean they are not the best fit for every situation. Carefully consider your business's financial needs and repayment ability before proceeding.

If you are ready to explore your funding options or to apply for a business cash advance, visit Clarify Capital to get started today.

FAQ

Below, we'll answer some common questions that arise about business cash advances.

Does an MCA Have a Grace Period or a Due Date?

Usually, no. Many MCAs begin remittance quickly after funding and do not operate like credit card companies or credit card issuers with a statement cycle, due date, and grace period.

Do MCAs Require a Credit Check?

Some do, but many focus more on time in business, sales consistency, and bank account activity than on credit score alone.

Can I Repay an MCA Early?

Some providers offer discounts for early payoff, while others do not. Confirm the terms before signing to ensure you understand what "repayment" really means in your agreement.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts