Running a dental practice today takes more than clinical expertise — it requires financial planning, business strategy, and a clear understanding of your practice's market value; for many dentists and practice owners, growing or selling a practice hinges on knowing its true worth. Whether you're preparing for practice sales, expanding, or transitioning ownership, an accurate dental practice valuation is essential.

Building a dental practice could cost anywhere from $350,000 to $500,000 on average, making it a significant investment. The increasing cost of dental education has also made it difficult to get into dentistry. As a result, it's important to plan carefully to make sure your practice thrives. You shouldn't have to tap into your savings — the right loan can help you improve your operations, help you cut costs, and improve the value of your practice.

But the value of a dental practice goes beyond upfront costs. It depends on factors like financial performance, patient base, practice location, and broader dental industry trends. Valuation experts and lenders use this data to assess fair market value and guide the valuation process, ensuring that both buyers and sellers are making informed decisions.

Key Factors That Determine the Value of a Dental Practice

Several core elements influence the value of a dental practice, and understanding them is key for owners looking to sell, merge, or expand. These include both measurable assets and harder-to-quantify indicators like reputation and patient loyalty.

Tangible assets. Equipment, dental chairs, computers, and any owned real estate all contribute directly to the practice's value.

Intangible assets. Goodwill, brand reputation, patient trust, and the value of existing systems all play a major role in shaping long-term worth.

Patient base and demographics. A loyal and growing patient base, especially in areas with favorable demographics, increases a practice's appeal to buyers.

Practice location. Urban vs. rural markets, regional competition, and visibility all affect how much a practice is worth.

Practice management and financial metrics. Strong leadership, organized systems, and performance indicators like collections, overhead, and production numbers help define the valuation.

Market trends. The state of the dental industry, demand for services, and economic factors all impact how the market views a particular practice's potential.

Each of these factors plays a role in determining how much a practice can sell for — and how it's positioned for long-term growth.

Valuation Methods: How To Calculate the Worth of a Dental Practice

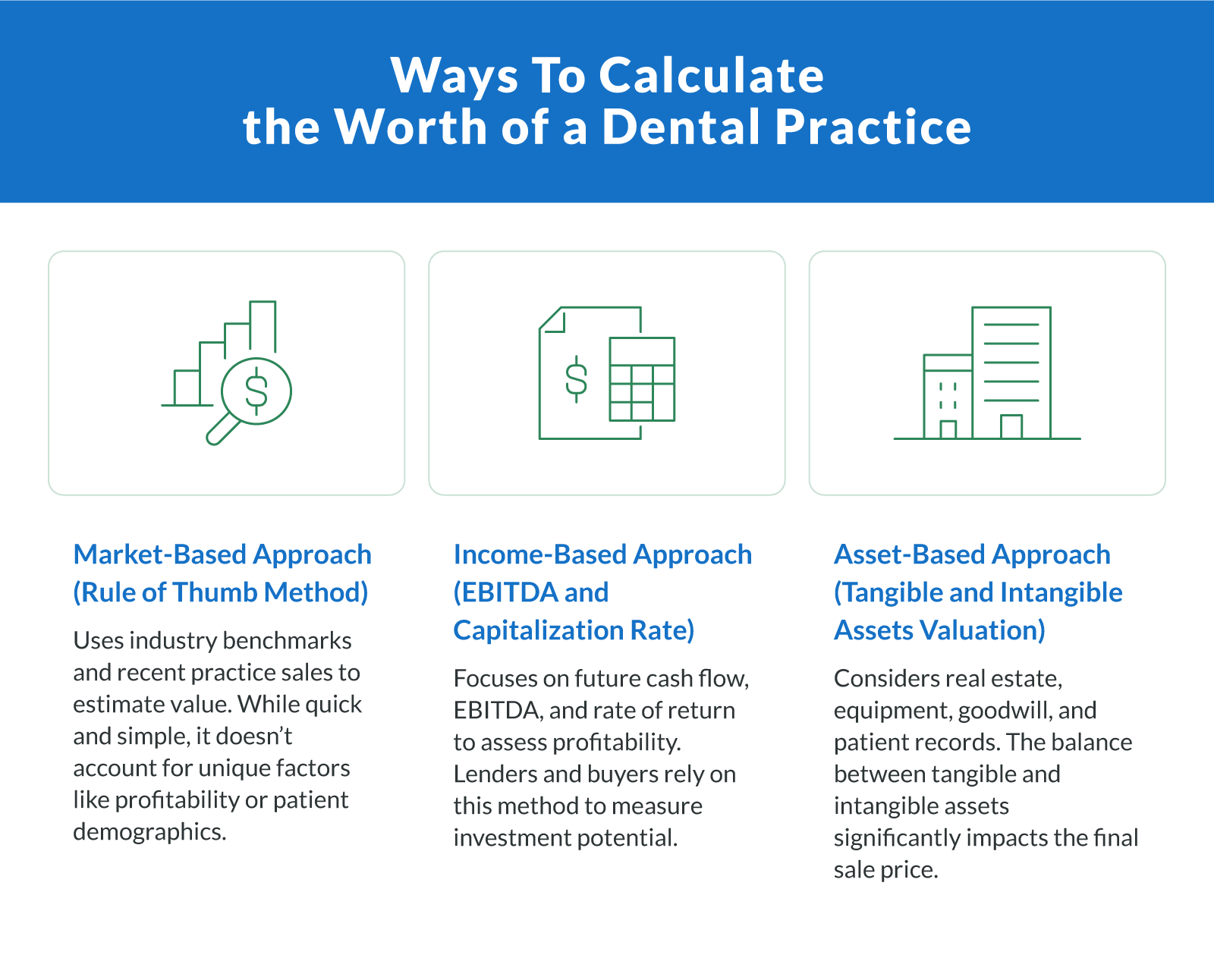

There's no one-size-fits-all approach when it comes to determining the worth of a dental practice. Instead, valuation experts rely on a combination of established valuation methods to create a realistic and data-driven estimate. Understanding these approaches is essential for both buyers and sellers to ensure a fair and informed dental practice valuation. Each method offers a different lens for evaluating a practice's performance, risk, and future potential.

Market-Based Approach (Rule of Thumb Method)

The market-based approach, often referred to as the rule of thumb method, estimates a practice's value by comparing it to recent practice sales in the same region or specialty. It uses industry benchmarks — such as a percentage of gross revenue or collections — to create a ballpark valuation.

While it's a quick starting point, this method has limitations. It doesn't account for the specific financial performance or unique attributes of a practice, such as patient loyalty or exceptional staff. This approach is most useful for getting a general idea of value in early-stage planning but should not be the sole method used in a full business valuation.

Income-Based Approach (EBITDA and Capitalization Rate)

The income-based approach focuses on the practice's ability to generate future cash flow and profitability. It often uses EBITDA — earnings before interest, taxes, depreciation, and amortization — as a core measure of performance. The capitalization rate is then applied to convert this income into a present-day value, reflecting expected risk and return.

This method is commonly used by lenders, buyers, and investors because it provides a clear picture of financial viability. It helps assess whether the net income and cash flow are strong enough to justify the investment. Among the practice valuation methods, this one is most aligned with how financial institutions evaluate deals.

Asset-Based Approach (Tangible and Intangible Assets Valuation)

The asset-based approach determines value by totaling a practice's tangible assets (such as equipment, supplies, and real estate) and intangible assets (like goodwill, patient records, and reputation). This method is especially helpful in transitions where asset ownership needs to be clearly defined.

Practices with significant investment in property or high-value equipment may see a higher valuation through this lens. However, a strong intangible asset portfolio — such as loyal patients and an established brand — can also add substantial value. The balance between tangible and intangible assets often influences the final sale price.

Understanding Financial Metrics

Beyond valuation models, key financial metrics provide insight into a practice's day-to-day performance and long-term outlook. These numbers help buyers understand the strength of the business and how likely it is to maintain or grow revenue over time.

Gross revenue reflects the total income before expenses, while net income reveals what's left after operational costs.

Cash flow shows how much money is actually available to pay bills, reinvest, or distribute to owners.

Profit margins indicate how efficient practice management and profitability are.

Annual revenue growth is another critical indicator. Buyers are more likely to invest in practices showing consistent increases in revenue, as it suggests a stable or expanding patient base.

These metrics help ensure an accurate valuation and give all parties a realistic view of future earnings and risks.

The Role of Real Estate and Lease Agreements in Dental Practice Valuation

Whether a practice owns or leases its office space has a direct impact on its valuation. Ownership of real estate can significantly boost the value of a dental practice, particularly in high-demand or urban locations. On the other hand, lease agreements play a major role in determining flexibility, long-term costs, and potential risks.

If the practice's location is in a desirable, high-traffic area with favorable lease terms, it can positively affect the sale price. However, long or restrictive lease agreements may reduce appeal for buyers who are concerned about overheads or relocation limits. During practice transitions, it's crucial to evaluate real estate and lease details to ensure they align with the overall goals of the dental practice transition.

How Much Should You Sell Your Dental Practice For?

If you're a practice owner planning to sell, setting the right sale price is critical. Too high, and you may scare off potential buyers. Too low, and you risk leaving money on the table. The best way to determine dental practice worth is through careful financial planning and guidance from valuation experts.

Practice owners can increase their value by improving patient retention, streamlining operations, and presenting strong financial records. Working with a CPA, consultant, or dental-specific broker during the valuation process helps ensure the sale price aligns with fair market value.

Before listing your practice for sale, it's essential to organize documentation, review key performance indicators, and address any operational inefficiencies. With expert guidance, practice owners can confidently navigate practice sales and secure the best possible outcome.

How Much Do You Make Owning a Dental Practice?

Owning a dental practice can be financially rewarding. According to ZipRecruiter, the average income for private practice dentists is $374,999 per year, but earnings can vary significantly depending on how the practice is run.

Several factors impact long-term profitability:

Practice location. Practices in high-demand, accessible areas tend to generate more patient traffic and command higher valuations than those in remote or oversaturated markets.

Patient volume and demographics. A steady flow of patients, especially from favorable age groups or income brackets, contributes to more consistent revenue and long-term growth potential.

Operational costs. Managing overhead expenses — like staffing and supplies — efficiently improves profit margins and boosts the overall financial health of the practice.

Effectiveness of practice management systems. A well-organized system streamlines scheduling, billing, and patient communications, enhancing productivity and supporting higher earnings.

Dentists who take an active role in financial planning, marketing, and growth strategies see higher net income and higher future earnings. Sound business practices combined with a strong patient base help drive long-term success and improve business valuation over time.

Why an Accurate Valuation Matters for Buyers, Sellers, and Lenders

An accurate valuation is essential to every stage of the dental practice transition process. Buyers rely on reliable numbers to determine whether the investment is worthwhile. Sellers need a clear understanding of their practice's true worth to avoid undervaluing or overpricing it. Lenders use valuation reports to evaluate financing risk and structure loan offers accordingly.

Without an accurate valuation, the entire transaction can be compromised. Overvaluation may scare off buyers or result in financing issues. Undervaluation may lead to financial losses for the seller. Dental professionals, lenders, and advisors all depend on a structured valuation process grounded in future cash flow, financial performance, and expert guidance.

Maximizing the Value of Your Dental Practice

Determining the value of your practice involves more than checking a few financial boxes — it's a detailed process that accounts for performance, assets, market trends, and growth potential. Understanding the valuation methods, financial metrics, and impact of real estate can help practice owners plan strategically and sell confidently.

Whether you're preparing for a transition or just starting to assess your dentistry practice value, accurate business valuation supported by expert guidance is essential. It ensures a fair sale price, protects long-term interests, and helps you make smarter decisions about your future. Knowing the dental practice's worth can also support funding opportunities and practice transitions at the right time.

Ready to unlock the full value of the practice you run or secure growth funding? Apply now at Clarify Capital.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts