If you're a small business owner or entrepreneur seeking business financing without the headache of tax returns, financial statements, and a lengthy application process, you're not alone. That's where no-doc business loans come in — and more specifically, EIN-only loans that rely on your Employer Identification Number instead of your Social Security Number or stacks of paperwork.

A no-doc business loan using only your EIN (also called an EIN-only loan) is financing where lenders qualify you primarily on business performance data tied to your Employer Identification Number. While "no-doc" doesn't mean zero documentation, it typically means you won't need to submit tax returns, detailed financial statements, or undergo a personal credit check. Instead, lenders assess factors like cash flow, revenue patterns from your business bank account, or automated bank data.

In 2026, the lending climate has evolved. Traditional lenders and banks have tightened requirements, but alternative lenders, online lenders, and modern underwriting methods now offer no-doc business loan options that use bank statements, business bank account data, or revenue history instead of traditional documentation.

This article explains what EIN-only loans are, how to qualify, and how they compare to other options, so you can access fast, low-document funding while protecting your personal credit.

Reality check: True EIN-only, no-doc loans are rare. While you may not need tax returns or financial statements, most lenders still review your business bank activity and revenue. Some may also require a soft pull of your SSN or ask for a personal guarantee, especially if your business is new or has limited credit history.

Can I Get a Loan With Just My EIN Number?

Yes — in some cases, you can get business funding using only your EIN, but it depends on the lender and the type of loan. While true EIN-only loans with zero documentation are rare, many alternative lenders offer loan products with eligibility requirements that rely primarily on your business's performance, not your personal credit.

The most realistic loan types where using just your EIN is possible include:

Revenue-based financing. Lenders review your business bank account activity and monthly revenue instead of requiring tax returns or personal credit checks.

Invoice factoring. If your business has outstanding invoices, you can sell them to a lender for immediate cash — no personal credit involved.

Equipment financing. In some cases, the equipment itself acts as collateral, and the loan may be approved based on your EIN and business revenue.

Merchant cash advances. These are based on your daily or weekly credit card sales and typically require little to no personal documentation.

Keep in mind: Even for these funding options, lenders may still ask for limited verification, such as a soft credit pull, a business bank connection, or a personal guarantee, especially if your business is new or has weak revenue.

Clarify Capital: Your Best Option for EIN-Only Loans

Clarify Capital stands out as a top choice for EIN-only business loans because it simplifies the process while offering a wide range of flexible funding solutions — without relying on your personal credit.

Here's what makes Clarify Capital different:

EIN-only friendly. You can qualify based on your business performance — not your personal credit, so it's ideal for keeping business and personal finances separate.

Minimal documentation required. No tax returns, profit-and-loss statements, or lengthy paperwork. Just connect your business bank account for fast evaluation.

Multiple loan types in one place. Whether you need revenue-based funding, working capital, or invoice financing, Clarify Capital can match you with the right product.

Fast, straightforward approval. Most applications are processed in hours, not days, so you get access to capital quickly when you need it.

No hidden fees or rigid requirements. Transparent terms and flexible repayment options tailored to your business's needs and cash flow.

Clarify Capital combines the best of online lending, revenue-based evaluation, and asset-backed flexibility, making it the go-to choice for EIN-only financing.

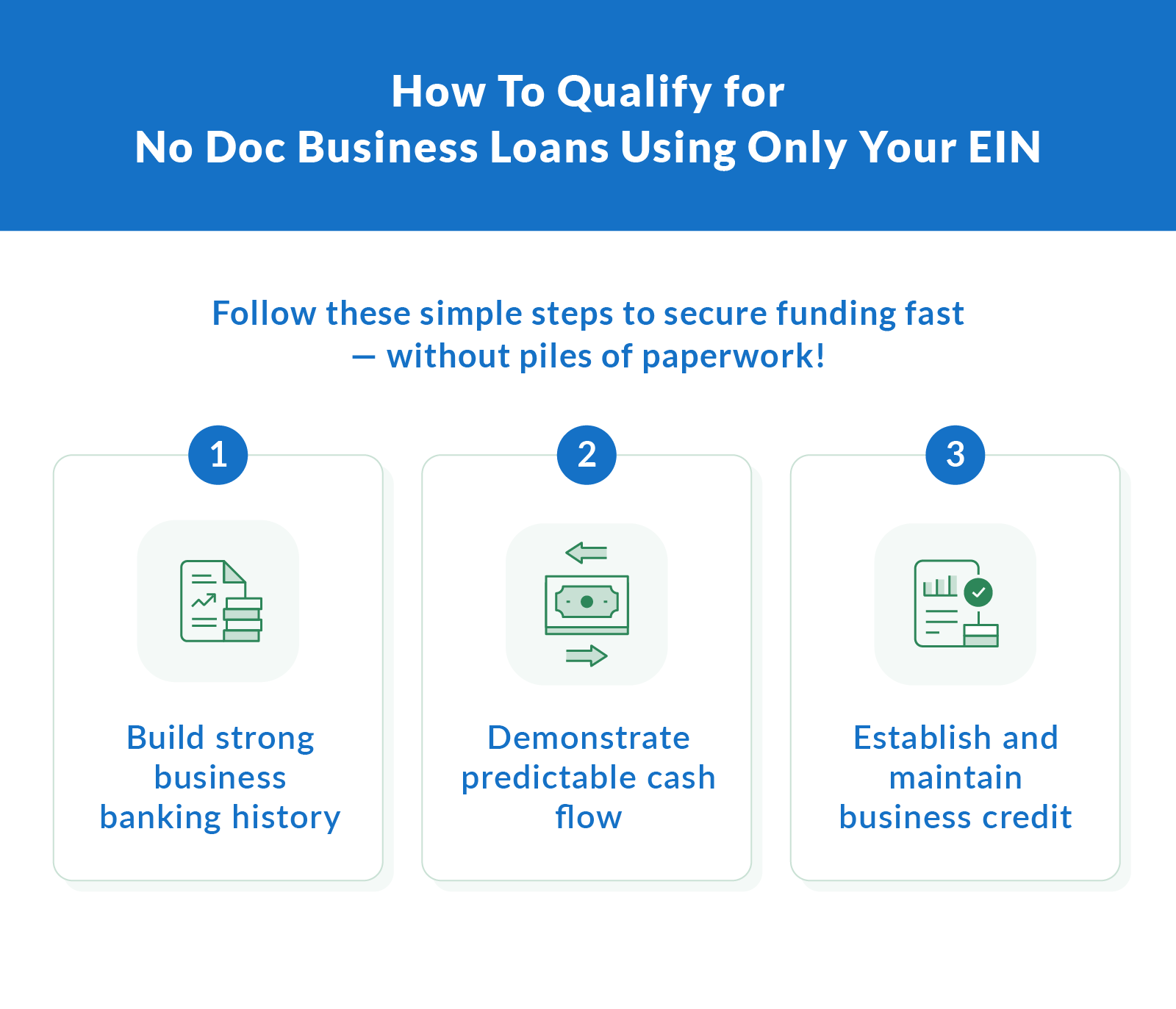

How To Qualify for an EIN-Only, No-Doc Loan

Meeting lender expectations is easier when you know what matters. These steps can help you qualify for an EIN-only loan with minimal friction.

Build a strong business banking history. Lenders offering minimal-doc options often rely on business bank accounts and bank statements to assess cash flow, annual revenue, and deposit activity. A consistent banking history builds trust.

Demonstrate predictable cash flow. Even if you are not submitting tax returns, lenders want to see regular business income. Steady cash flow supports repayment confidence.

Establish and maintain business credit. Business credit bureaus such as Dun & Bradstreet, Experian, and Equifax help lenders verify creditworthiness. Paying suppliers on time and maintaining accounts helps you build business credit.

Pros and Cons of No-Doc EIN-Only Loans

Balancing the advantages and limitations of no-doc loans helps determine whether they are the right financing fit for your business.

| Pros | Cons |

|---|---|

| Fast approvals | Higher interest rates |

| Minimal paperwork | Smaller loan amounts |

| No personal credit pull | Shorter repayment terms |

| Less risk to personal finances | Up front capital in exchange for unpaid customer invoices |

Each benefit and drawback should be weighed carefully depending on your business needs and financial situation.

EIN-Only Loans vs. Traditional Financing

Compared with traditional loans such as SBA loans or bank-provided term loans, no-doc EIN-only options are more accessible for those without years of tax returns and extensive financial statements. However, they typically come with higher interest rates, shorter repayment terms, and smaller loan amounts.

Traditional financing is often preferable when you have:

A long operating history. Lenders tend to favor businesses that have been operating for several years, as this shows stability and staying power.

Strong financial health supported by financial statements. A solid financial track record backed by documents like balance sheets and profit-and-loss statements can help secure better terms.

A willingness to provide detailed documentation. Traditional loans require thorough paperwork, and being prepared to deliver these materials makes you a stronger candidate.

What Lenders Review for Traditional Loans

Unlike no-doc loans that only require your EIN to apply, traditional lenders often require extensive documentation and personal financial details. Here's what they typically review before approving a business loan.

| EIN-Only Loan vs. Traditional Business Loan Requirements | ||

|---|---|---|

| Criteria | Traditional loans | EIN-only loans |

| Personal credit score | ✅ Required — most lenders check FICO score (usually 600–650 minimum) | ❌ Not required — some may do a soft pull if needed |

| Business credit score | ✅ Often reviewed, especially for LLCs | ✅ May be considered if available, but not essential |

| Tax returns | ✅ Typically required | ❌ Not required |

| Profit-and-loss statements | ✅ Required to show business financial performance | ❌ Not required |

| Balance sheets | ✅ Required to verify assets, liabilities, and equity | ❌ Not required |

| Bank statements | ✅ Reviewed to verify cash flow and account activity | ✅ Required — primary method for evaluating cash flow |

| Cash flow | ✅ Must be strong and well-documented across multiple documents | ✅ Must be consistent, verified through bank data |

| Personal guarantee | ✅ Often required, especially for small or new businesses | ✅ Sometimes required depending on lender and risk |

| Collateral/personal assets | ✅ May be required as security | ❌ Rarely required, depends on loan type |

| Business plan | ✅ Required — includes strategy, revenue projections, and market research | ❌ Not typically required |

| Revenue projections | ✅ Often needed to demonstrate repayment ability | ❌ Not required — real-time revenue preferred |

Personal and Business Credit Scores

Your credit scores are one of the first things lenders will review. For LLCs, both your personal credit score and your business credit score matter.

Lenders use your personal credit score to gauge how responsible you are with debt. Even though you're applying for a loan for your LLC, most lenders will require a minimum FICO score of at least 600–650. If your score is lower than that, it doesn't necessarily mean you're out of options, but it may limit the types of loans you qualify for or result in higher interest rates.

Your LLC's business credit score reflects how your company manages its finances. Scores from agencies like Dun & Bradstreet and Experian range from 0 to 100, with anything above 75 considered a good score. If you have little to no business credit history, lenders may lean more heavily on your personal credit score.

Tip: If your personal or business credit score is less than ideal, it could be beneficial to focus on improving it before applying. Pay off existing debts, correct any inaccuracies in your credit report, and establish a track record of timely payments.

Financial Statements and Cash Flow

Lenders want to make sure your LLC has the financial stability to repay a loan. This is where your financial statements and cash flow come into play. You'll likely need to submit several documents:

Bank statements. Lenders will look at your business and personal bank statements to verify your financial activity and ensure you have enough cash flow to make loan payments.

Balance sheets. This document shows your business's assets, liabilities, and equity, giving lenders a snapshot of your company's financial health.

Income statements. Also known as profit-and-loss statements, income statements show your business's revenues and expenses over time.

Cash flow statements. This tracks the money moving in and out of your business, showing lenders if you have enough liquidity to meet your debt obligations.

Strong cash flow is a critical factor in getting approved for a loan. If your cash flow is inconsistent or negative, it will be harder to qualify for traditional loans.

Personal Guarantee and Personal Assets

Even though LLCs offer limited liability protection, meaning your personal assets are usually shielded from business debts, many lenders will still ask for a personal guarantee. So, if your LLC can't repay the loan, you'll be personally responsible for making up the difference.

In some cases, lenders may require you to put up personal assets, such as your home, car, or personal savings, as collateral for the loan. This is particularly common with small business loans or if your business doesn't have a long financial history.

Tip: Be cautious when offering personal guarantees or collateral. If your business runs into trouble and can't make payments, you could risk losing personal assets, and your personal finances could be at stake.

Business Plan and Revenue

A well-thought-out business plan is another important piece of the puzzle, especially for startups or newer LLCs. Lenders want to see a clear, detailed plan that explains how you'll use the loan, what your business goals are, and how you expect to generate revenue to repay the loan.

Your plan should include:

Revenue projections. These are detailed estimates of future income, showing how you'll generate the cash flow to cover loan payments.

Business strategy. This is your roadmap for growth or sustainability, including how the loan will help achieve these goals.

Market analysis. This helps show lenders that you've done your homework by including information about your target market, competition, and industry trends.

Real-world example: If you're applying for a loan to expand your retail business, include projections showing how new product lines, locations, or marketing strategies will increase revenue.

Which Option To Choose?

Choosing between an EIN‑only loan and traditional financing depends on your business's revenue, documentation, and long-term goals. Understanding where each option fits can help you avoid unnecessary costs or delays.

EIN‑only loans are best for:

Businesses with steady deposits and cash flow. Consistent revenue and strong bank activity make EIN‑based approvals more feasible.

Owners protecting personal credit. EIN‑only loans can reduce reliance on personal credit checks or personal guarantees when possible.

Short-term working capital needs. These loans work well for covering operational gaps, managing cash flow, or handling near-term expenses.

Entrepreneurs and small business owners without extensive documentation. Businesses that lack years of tax returns or formal financial statements may find EIN‑only loans more accessible.

Traditional loans are a better fit for:

Businesses with a long operating history. Established companies with several years of financial records often qualify for better rates.

Borrowers seeking low interest rates and long repayment terms. SBA loans and bank loans typically offer more favorable pricing.

Applicants prepared to provide detailed documentation. Traditional lenders expect tax returns, financial statements, and formal business plans.

Businesses planning major, long-term investments. Large expansions, real estate purchases, or refinancing often require traditional financing.

In short, EIN‑only loans prioritize speed, flexibility, and reduced paperwork, while traditional loans favor stability, documentation, and lower long-term costs. The right choice depends on how quickly you need funding and how much documentation you're willing (or able) to provide.

Other Loan Options if an EIN-Only Loan Isn't the Right Fit

There's no one-size-fits-all loan. Depending on your business's needs, financial situation, and credit profile, some types of loans will be a better fit than others. Here are some common loan options available.

SBA Loans (U.S. Small Business Administration)

SBA loans are a go-to option because they offer low interest rates and long repayment terms. The U.S. Small Business Administration partially guarantees these loans, reducing lenders' risk and making them more willing to work with small businesses.

Pros: Low interest rates, longer terms, ideal for growing businesses

Cons: The application process can be lengthy and requires a strong financial profile

SBA 7(a) Loan

The SBA 7(a) loan is the most popular option. It's ideal for businesses that need working capital, want to purchase equipment, or are looking to refinance debt. Loan amounts can go as high as $5 million, and the repayment terms can be stretched out over several years, depending on your needs.

SBA Microloans

If your business needs a smaller loan, the SBA Microloan program offers up to $50,000 in funding. These loans are great for startups and newer businesses that may not qualify for larger loans yet.

Term Loans

A term loan gives you a lump sum up front that you repay over a fixed period, typically with monthly payments. These loans are ideal for major one-time expenses like purchasing commercial real estate or significant equipment.

Loan amounts can range from $10,000 to several million, depending on your business's needs.

Repayment terms typically range from 1 to 10 years, with fixed interest rates and consistent payments.

Pros: Predictable payments and longer repayment periods.

Cons: You need strong credit and financials to qualify for the best rates.

Business Lines of Credit

A business line of credit is a flexible loan option that works similarly to a credit card. You're given access to a set amount of money and can draw from it as needed. You only pay interest on what you use, making this an ideal option for businesses with fluctuating cash flow or those that need access to working capital on an ongoing basis.

Typical limits range from $10,000 to $500,000.

Use it for short-term expenses like payroll, inventory, or unexpected repairs.

Pros: Flexibility — you only pay for what you borrow.

Cons: Interest rates can be higher, especially if you have poor credit.

Invoice Factoring and Merchant Cash Advances

If your business has bad credit or struggles with inconsistent cash flow, options like invoice factoring or merchant cash advances may be worth considering.

Invoice factoring allows you to sell your unpaid invoices to a lender for immediate cash. This can help with cash flow issues, but it often comes with higher fees.

Merchant cash advances (MCA) provide a lump sum up front that you repay through a percentage of your daily credit card sales. MCAs can be helpful for businesses with high sales volumes, but they often come with high costs and short repayment periods.

Caution: Both of these options can be expensive in the long run due to higher interest rates and fees. Use them only if other options are unavailable.

Apply Now With Only Your EIN

If you are ready to secure funding without submitting tax returns or digging up financial documents, an EIN-only, no-doc business loan could be your ideal solution. These financing options are built for speed and simplicity, focusing on real-time business performance rather than paperwork. Apply now with only your EIN (no tax returns needed) and take the next step toward growing your business with Clarify Capital.

FAQs About No-Doc Loans

Many business owners have similar questions about no-doc EIN-only loans. This section provides clear, quick answers to help you make informed decisions.

What's the Minimum Credit Score To Qualify for an LLC Loan?

While the exact number varies by lender, most require a personal credit score of at least 600–650. For SBA loans, a FICO score of 680 or higher is often preferred. Some alternative lenders may approve lower scores, but you'll likely face higher interest rates.

Can I Get an LLC Loan With Bad Credit?

Yes, but your options may be more limited. If your credit score is below 600, you may need to look into online lenders, merchant cash advances, or invoice factoring. Just be aware that these options usually come with higher costs and shorter repayment terms.

Do I Need a Down Payment for an LLC Loan?

It depends on the type of loan. SBA loans and commercial real estate loans often require a down payment, usually around 10% to 30% of the loan amount. For other types of loans, like term loans or lines of credit, a down payment is not typically required.

How Do Interest Rates Vary for Different Loan Types?

Interest rates can vary widely depending on the type of loan and your financial profile. Traditional bank loans and SBA loans generally offer the lowest rates, typically between 4% and 10%. Online lenders or merchant cash advances can have interest rates ranging from 10% to 50% or higher.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts