Business term loans are one of the most reliable ways to fund your business, offering a lump sum up front, fixed interest rates, and predictable monthly payments. Whether you're refinancing debt, buying equipment, or expanding operations, a term loan can help you move forward with confidence.

Apply for a business term loan through Clarify Capital and get matched with top lenders. Funding is available as fast as the next business day.

Term Loan Highlights

Here's what makes business term loans through Clarify Capital a smart funding choice for small business owners:

Lump sum funding. Receive your entire loan amount up front to cover immediate business needs.

Fast approvals. Get a decision within hours and funding as fast as the next business day.

Low documentation. Clarify typically only requires three months of business bank statements.

No prepayment penalties. Pay off your loan early and save on interest; no hidden fees.

Five-star rated support. Work with a dedicated Clarify advisor and join thousands of satisfied borrowers.

What Are Business Term Loans?

A business term loan provides a lump sum of capital up front, repaid over a fixed period with scheduled payments, often at a fixed interest rate. These loans are one of the most widely used types of financing for small business owners because they offer predictable loan repayment terms and flexible use cases. Whether you're looking to refinance existing debt, purchase commercial real estate, or boost working capital, a business term loan can meet a variety of business needs.

Here's how it works:

You receive a one-time disbursement, then repay the loan through regular payments, typically monthly, covering both the principal and interest. These repayment terms are defined at the outset and remain consistent, especially with fixed-rate loans.

Business term loans are offered by a variety of lenders, including traditional banks, online lenders, and credit unions. Each lender may have different requirements based on your credit score, business and credit history, and financial performance.

Key Features of Business Term Loans

While individual lenders may offer different terms, most business term loans share the same basic structure:

Up-front funding. The borrower receives a lump sum payment at the start of the loan term.

Fixed or variable interest rates. Many term loans come with fixed APRs, though some lenders offer variable-rate options tied to market benchmarks.

Set repayment schedule. Payments are typically made monthly and cover both principal and interest. Some short-term loans may require weekly or daily payments.

Defined term length. Repayment periods range from a few months to several years, depending on the loan type and lender.

Flexible use of funds. Loan proceeds can be used for working capital, equipment, commercial real estate, refinancing, or other business needs.

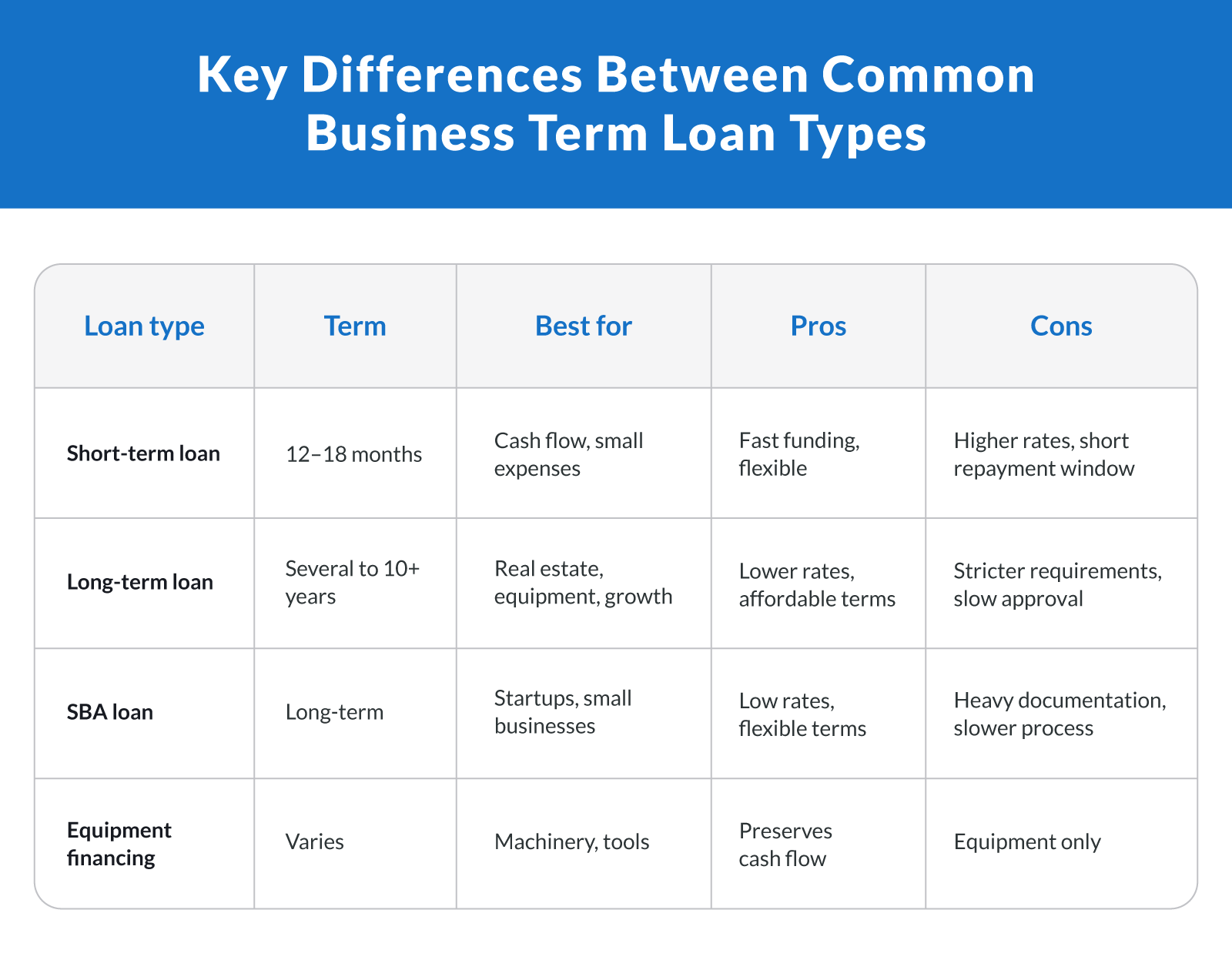

Types of Business Term Loans

Business term loans come in several variations, allowing business owners to tailor their financing to specific needs.

Here's a detailed breakdown of these common loan types.

Short-Term Loans

Short-term loans provide quick access to capital but require faster repayment.

How it works: Borrowers receive a lump sum up front and repay it within 12-18 months. Payments may be daily, weekly, or monthly.

Best for: Covering urgent cash flow needs or small expenses like inventory purchases or minor repairs.

The pros of short-term loans include:

Quick funding, often within 24-48 hours from online lenders

Flexible eligibility requirements

The cons of short-term loans include:

Higher interest rates

Short repayment periods can strain cash flow

Long-Term Loans

Long-term loans are ideal for significant investments and business expansion projects.

How it works: These loans offer repayment terms ranging from several years to a decade or more, with lower monthly payments spread over the loan's life.

Best for: Funding large projects like commercial real estate, equipment purchases, or refinancing debt.

There are two primary upsides to long-term loans:

Lower interest rates

Affordable monthly payments due to extended repayment periods

The cons include:

Stricter eligibility requirements, including high credit scores and strong annual revenue and financial statements

Lengthy approval process for loans from traditional banks

SBA Loans

Small Business Administration (SBA) loans are government-backed, offering favorable terms for small business owners.

How it works: The SBA guarantees a portion of the loan, reducing risk for lenders and enabling better interest rates for borrowers.

Best for: Startups and small businesses that may not qualify for traditional loans.

SBA loans have several benefits:

Lower interest rates and flexible repayment schedules

Long-term repayment options

The downsides of SBA loans are:

Extensive documentation requirements, including a business plan, tax returns, and financial statements

Lengthy application process

Equipment Financing

Equipment financing is tailored to help business owners purchase or lease equipment.

How it works: The equipment serves as collateral, allowing lenders to offer favorable terms.

Best for: Businesses that need to upgrade or replace essential machinery or tools.

The upsides of equipment financing include:

Preserves cash flow by spreading out costs

Easier approval compared to unsecured loans

The drawbacks include:

Limited to equipment purchases

Higher interest rates for businesses with lower credit scores

How Interest Rate Trends Are Shaping Term Loan Decisions

In 2026, many lenders continue to offer competitive fixed-rate term loans, but overall borrowing costs remain higher than pre-2022 levels. This makes choosing the right interest rate structure more important than ever.

Fixed vs. Variable Rates

Fixed interest rates offer stability and predictable monthly payments. This is ideal for long-term financing, planning, and budgeting. On the other hand, variable rates may start lower but can increase over time depending on market conditions, adding risk for longer repayment terms.

When Fixed Rates Make Sense

For small businesses making multi-year investments, such as real estate purchases, equipment upgrades, or refinancing, a fixed-rate term loan offers certainty and protects your cash flow from future rate hikes.

When Variable Rates Might Work

If your loan term is short or you're planning to pay off the balance early, a variable rate may save you money, especially if market rates are projected to fall.

How Clarify Can Help

Clarify Capital matches you with lenders offering both fixed- and variable-rate term loans, so you can choose what fits your business strategy. Your dedicated funding advisor will walk you through repayment options, interest rate structures, and cost comparisons to help you make an informed decision.

Understanding the Pros and Cons of Business Term Loans

Business term loans have several advantages but also come with potential drawbacks.

The pros include the following:

Predictable monthly payments. Fixed repayment schedules help with budgeting and long-term planning.

Access to large loan amounts. Term loans can cover substantial investments, including equipment, real estate, or working capital.

Flexible use of funds. Use your lump sum for nearly any business purpose, unlike restricted-use financing options.

Fixed-rate options. Many lenders offer fixed APRs, so your cost of capital stays consistent over time.

Builds business credit. Making on-time payments can improve your business credit profile.

Downsides of business term loans include:

Stricter eligibility requirements. Higher credit scores, strong financials, and established revenue may be required.

Interest costs vary. Businesses with lower credit scores may receive higher rates or less favorable terms.

Fees may apply. Some lenders charge origination fees, and others may include prepayment penalties (Clarify Capital does not).

Not ideal for short-term needs. If you only need funds for a few months, a line of credit or short-term loan may be more efficient.

When Not To Use a Term Loan

While business term loans offer structure and stability, they're not ideal for every financial situation. In some cases, more flexible lending options may be a better fit. Consider other financing solutions if:

You have short-term working capital needs. A business line of credit provides revolving access to funds, so you can borrow what you need, when you need it, without locking into long-term repayment.

You're covering everyday operating expenses. Business credit cards may offer more convenience for small, recurring purchases, along with rewards or cashback incentives.

Your cash flow is unpredictable. If your revenue fluctuates seasonally or week to week, a term loan's fixed repayment schedule may be too rigid. Flexible products like lines of credit allow you to adjust your borrowing.

When flexibility matters more than structure, alternatives like revolving credit or short-term financing may better support your business goals.

Who Business Term Loans Are Best For

Term loans are a great fit for businesses with predictable revenue and clear plans for how to use the funds. Here's who benefits most:

First-time business owners with strong credit and a solid business plan

Established companies with annual revenue and financial statements to support larger loan amounts

Business owners investing in long-term growth, such as equipment, real estate, or expansion

Those using online banking and checking accounts for better loan visibility and easier repayment tracking

Understanding your eligibility and preparing your documents in advance can make the loan process faster and more successful.

How To Qualify for a Business Term Loan

Most lenders evaluate your business's financial health, creditworthiness, and operational history when reviewing a term loan application. Clarify Capital makes the process faster and more flexible by working with a wide range of lending partners.

Basic Eligibility Requirements

Lenders look at several factors to decide if your business qualifies for financing. Those factors include:

Credit score. A minimum personal credit score of 500+ is typically required. Higher scores may unlock lower rates and better terms.

Monthly revenue. Most lenders want to see at least $10,000 in monthly revenue to qualify.

Time in business. You should be operating for at least six months.

Bank statements. Clarify usually only needs three months of business bank statements to get started.

Tips To Strengthen Your Application

Before you apply for financing, consider doing these things to strengthen your application:

Organize financial documents. Keep tax returns, profit and loss statements, and bank records up to date.

Improve your credit. Pay down debts and correct any issues on your credit reports (both personal and business).

Prepare a business plan. Lenders may want to see how you'll use the funds to support long-term business goals.

Compare lenders. Clarify helps you access multiple offers from 75+ lenders, so you can choose the best-fit loan option without shopping around.

Real Business Use Cases: Matching Loan Type to Business Goals

Choosing the right business loan depends on your industry, objectives, and timeline. Here are a few examples of how small business owners use different term loan options:

Construction company upgrading equipment. A business term loan offers the lump sum needed to buy heavy equipment, with manageable monthly payments over several years.

Restaurant refinancing build-out debt. Refinancing through an SBA loan lowers their interest rate and spreads payments over a longer term, freeing up cash flow.

Retail startup needing inventory for the holiday season. A short-term loan bridges the gap between up-front costs and expected revenue, helping cover working capital without long-term debt.

E-commerce brand investing in automation tools. A term loan funds new software and fulfillment systems to streamline operations and reduce labor costs. Fixed payments allow the owner to forecast ROI more confidently.

Each of these examples shows how aligning your financing strategy with your business goals can lead to stronger, more sustainable growth.

Comparing Loan Options and Lenders

Finding the right loan means understanding the differences between traditional banks, online lenders, and other financial institutions.

Traditional Banks

These are often the first place small business owners turn for financing.

Pros: Offer lower interest rates and larger loan amounts

Cons: Stricter eligibility requirements and longer application timelines

Online Lenders

These are a popular option for businesses that need quick access to capital.

Pros: Faster approvals, flexible terms, and tailored small business loans

Cons: Higher interest rates compared to traditional banks

Credit Unions

Credit unions are a good choice for those who value personalized support and local decision-making.

Pros: Member-focused with competitive rates and personalized service

Cons: May have limited loan options compared to banks and online lenders

Tips for Choosing a Lender

A bit of research up front can save money and stress down the road. When researching, be sure to:

Look for competitive interest rates and transparent terms

Assess whether fees like origination fees and prepayment penalties will impact your loan's affordability

Match the loan type to your specific business purposes

Ready To Secure Your Business Term Loan?

Business term loans offer stable, fixed-rate financing that supports growth, equipment purchases, or debt refinancing, all with predictable monthly payments. Whether you're investing in your operations or stabilizing cash flow, a term loan can provide the capital you need to move forward.

Clarify Capital connects you with 75+ lenders to find the best fit based on your business goals, credit profile, and funding timeline. You'll work with a dedicated advisor who handles the paperwork and helps you compare options.

Apply today to get matched with top loan offers and receive funding in as little as 24 hours.

FAQs About Business Term Loans

Business owners often have questions about how term loans work, what to expect during the application process, and how to choose the right structure. Here are answers to common questions that can help you make a more informed borrowing decision.

What Is a Business Term Loan?

A business term loan is a lump sum of capital repaid over a fixed period, usually through monthly payments that include principal and interest. These loans often come with fixed interest rates, which help with budgeting and long-term planning.

How Fast Can I Get Funded?

Clarify Capital offers funding as fast as 24 hours after approval. You'll complete a quick application, submit recent bank statements, and get matched with the best-fit lenders.

What's the Difference Between a Short-Term and Long-Term Loan?

Short-term loans are repaid in three to 18 months and are best for fast-moving expenses or temporary needs. Long-term loans may span two to 10+ years and work best for larger investments or refinancing.

How Do I Know What Loan Term Length Is Right for My Business?

The ideal loan term depends on your cash flow, the size of your loan, and how long it will take to see a return on the funds.

If you're funding a long-term investment (like equipment or real estate), a longer repayment term helps keep monthly payments manageable. If you're covering short-term needs (like inventory or payroll), a shorter term reduces interest costs and gets you debt-free sooner.

A good rule of thumb: Match the loan term to the lifespan or payoff period of the investment.

Can I Refinance an Existing Loan With a Term Loan?

Yes, many business owners use term loans to refinance high-interest or short-term debt into one fixed monthly payment with a longer repayment schedule. This can improve cash flow, reduce your total interest costs, and simplify financial management.

Clarify Capital helps you compare refinancing options and choose a structure that aligns with your business's current financial goals.

Are Interest Rates Fixed or Variable?

Clarify offers both, but many business term loans come with fixed interest rates, giving you predictable monthly payments. Variable-rate options may be available depending on the lender.

What Do I Need To Apply?

To start, Clarify typically only requires:

Three months of business bank statements

Basic business information

Estimated monthly revenue and funding needs

A personal credit score of 500+ is generally required.

Can I Pay Off My Loan Early?

Yes. Clarify Capital loans have no prepayment penalties, so you can pay off your balance early and save on interest.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts