Timing matters when it comes to refinancing a business loan. If done right, it can lead to lower interest rates, improved repayment schedules, and better access to working capital — giving small business owners more room to breathe and grow. Whether you're looking to cut monthly payments, streamline multiple loans, or secure funding for expansion, refinancing can be a smart financial move.

This article breaks down nine key signs that it might be time to refinance your current loan. You'll learn how to evaluate your financial situation, compare your options, and determine whether refinancing can boost cash flow and support long-term goals.

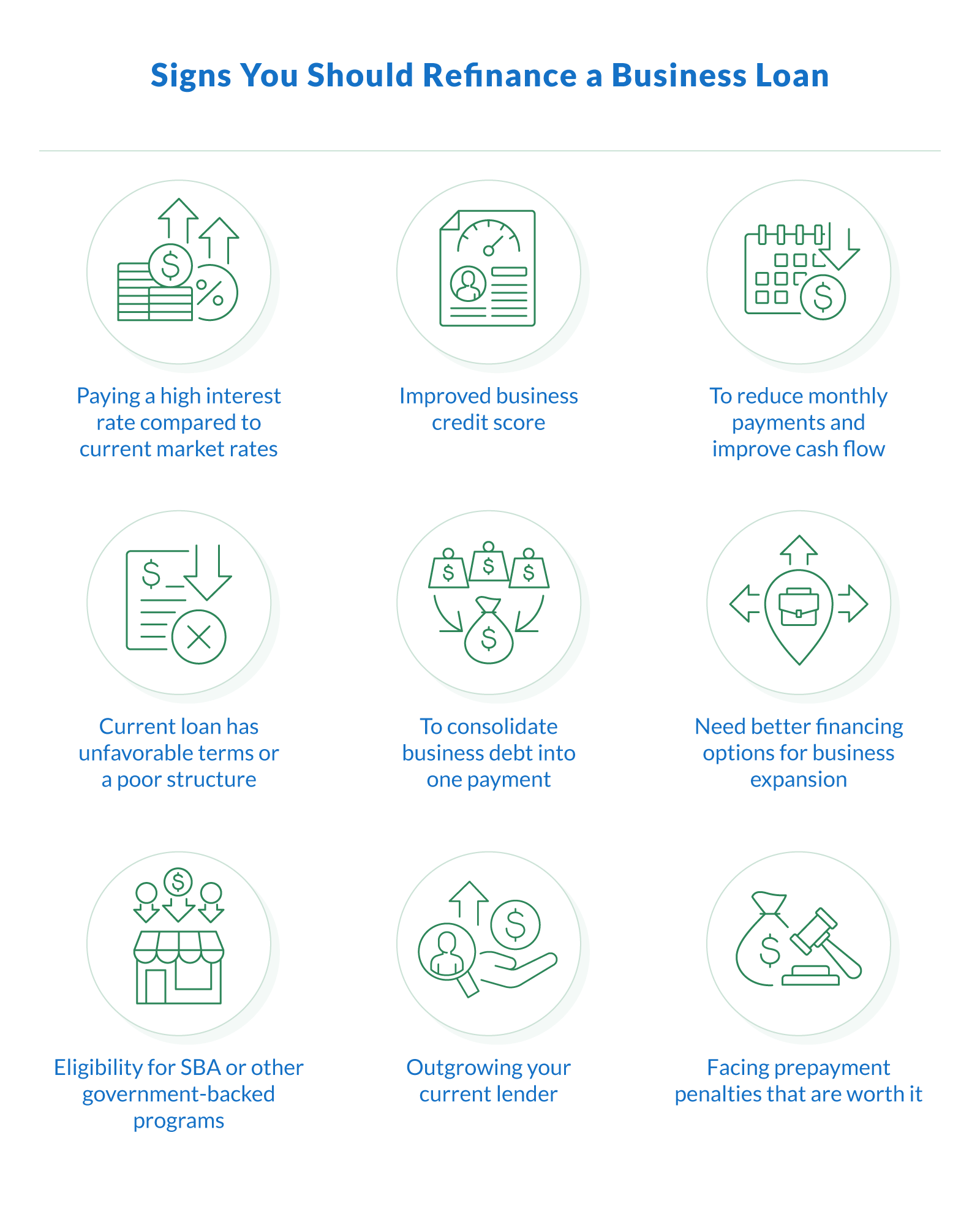

1. You're Paying a High Interest Rate Compared to Current Market Rates

If your current loan carries a high interest rate, and today's market offers more competitive rates, it may be time to refinance. Interest rates fluctuate based on economic conditions, and lenders regularly adjust their offers to stay competitive.

If you're locked into a fixed rate that's no longer in line with the current interest rate environment, or you're on a variable rate that's spiked, refinancing could lower your loan payments. Clarify Capital typically offers rates starting as low as 7%, depending on credit and financials — which could significantly reduce your cost of borrowing.

2. Your Business Credit Score Has Improved

A stronger credit score opens the door to better financing options. Whether it's your business credit score or personal credit score, lenders see improved credit as a sign of lower risk. That can make you eligible for refinancing at more favorable rates and terms. Most lenders — including Clarify Capital — consider a minimum credit score of 500 for a business loan, but higher scores often unlock better offers.

Don't let a bad credit score keep you from getting funded. Check your eligibility with a quick Clarify Capital loan application.

3. You Want To Reduce Monthly Payments and Improve Cash Flow

If your current loan is putting a strain on day-to-day operations, refinancing could be a way to ease pressure. Switching to a lower interest rate or extending your loan term can result in lower monthly payments — giving you more flexibility to manage working capital. Improving your repayment terms can help meet short-term business needs, reinvest in growth, or build a stronger financial cushion without sacrificing cash flow.

4. Your Current Loan Has Unfavorable Terms or a Poor Structure

Some loans come with features that aren't well-suited for your business — such as balloon payments, very short repayment schedules, or payment timing that doesn't match your revenue cycle. These unfavorable terms can hurt your financial situation over time. Refinancing gives you the opportunity to restructure the loan for a better fit.

With Clarify Capital, repayment schedules are typically flexible and designed to align with your cash flow, helping you stay on track without added stress.

5. You Want To Consolidate Business Debt Into One Payment

If your business is juggling multiple debts — like a credit card balance, line of credit, or working capital loan — refinancing can simplify things. Debt consolidation allows you to replace several high-interest debts with one refinanced loan at a lower rate. This makes managing payments easier and can reduce the total loan amount paid over time. By consolidating existing debt into a single monthly payment, you gain better control of your cash flow and create a clearer path to becoming debt-free.

6. You're Expanding and Need Better Financing Options

Growth takes capital — and refinancing can help unlock better business financing. Whether you're investing in commercial real estate, purchasing equipment, or preparing for a hiring push, refinancing your current loan can improve your access to funding. Small Business Association (SBA) programs like SBA 504 and SBA 7(a) are designed to support expansion through long-term, affordable financing. You can also explore flexible funding through a business expansion loan with Clarify Capital to meet your evolving business needs.

7. You're Eligible for SBA or Other Government-Backed Programs

An SBA loan often offers more favorable terms than conventional financing — including lower interest rates and longer repayment schedules. If your business now qualifies for SBA-backed programs like the SBA 504 or SBA 7(a), refinancing into one of these options could improve your financial position significantly. The loan application process is more structured and typically requires additional documentation, but the payoff is access to a reliable loan program supported by the Small Business Administration.

8. You've Outgrown Your Current Lender

As your business grows, your financial needs may evolve beyond what your current lender can provide. Switching to Clarify Capital can offer more flexibility, better customer service, and a wider range of refinancing options. We compare your loan options across multiple lenders to get you competitive rates and find a financing partner that truly supports your long-term goals.

9. You're Facing Prepayment Penalties, but They're Worth It

Some original loans include prepayment penalties, but that shouldn't automatically stop you from refinancing. If the long-term savings from a new loan with lower interest rates outweigh the short-term cost of the penalty, refinancing can still be the right move.

For example, if refinancing saves you $10,000 in interest, but your prepayment penalty is $2,000, the net benefit is clear. Always calculate the total amount saved and weigh it against your remaining repayment timeline.

Know When To Make the Move

Recognizing the right time to refinance a business loan can save you money, improve cash flow, and give your company the breathing room it needs to grow. Small business owners who take a proactive approach to loan management can often reduce their financial burden while unlocking better loan terms.

If refinancing sounds like the right move for your business, start your application with Clarify Capital to compare options and build a repayment plan that supports your financial situation.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts