The trucking industry is the backbone of U.S. logistics, yet it comes with significant costs. Growing your trucking or transportation business requires more than just hard work — it demands the right financial support. From purchasing new semi-trucks to managing cash flow during slow periods, having access to business loans is essential.

This guide breaks down the best trucking business loans, covering their benefits, application processes, and how to choose the right option for your business needs. Whether you’re an owner-operator or a small business owner in the trucking industry, this article will help you navigate your financing options.

Why Trucking Businesses Need Expansion Loans

The trucking industry is booming, but growth comes with challenges. Expansion requires capital to purchase equipment, hire drivers, and manage operating expenses. Trucking business loans are a lifeline for business owners looking to grow their operations.

Growing Demand in the Trucking Industry

Demand for transportation services continues to grow due to the rise of e-commerce and global supply chain needs. Trucking companies must scale operations to meet this demand, which requires substantial investments in equipment and facilities.

Common Uses for Loans

Purchasing equipment. Adding new commercial trucks or upgrading your fleet.

Operating expenses. Covering costs like payroll, fuel, and maintenance.

Accounts receivable. Addressing delayed payments with invoice factoring.

Real estate. Securing or expanding facilities for logistics or storage.

Challenges in Securing Financing

Many trucking businesses face hurdles when applying for loans, including strict eligibility requirements like strong credit scores, steady cash flow, and detailed financial documentation. Understanding these challenges can help you prepare for the loan application process.

Types of Trucking Business Expansion Loans

There are several funding options available, each tailored to different business needs. Understanding these loan types will help you find the best fit for your trucking company.

Equipment Financing

Equipment financing is a specialized loan for purchasing or leasing commercial trucks and other essential equipment.

How it works. The equipment itself serves as collateral for the loan.

Best for. Purchasing new semi-trucks or upgrading your fleet.

Pros.

Fixed repayment terms

No need for additional collateral

Lower interest rates due to surety

Cons.

Limited to equipment purchases

Requires a down payment

Term Loans

Term loans provide a lump sum of capital that’s repaid in fixed monthly installments over a set period.

How it works. Borrowers receive a set loan amount and repay it with interest over a predetermined term.

Best for. Long-term projects like real estate or fleet expansion.

Pros.

Predictable repayment terms

Competitive rates with traditional lenders

Flexible loan amounts

Cons.

Requires a strong credit history

Can involve high upfront fees

SBA Loans

Loans through the Small Business Administration (SBA) (SBA) offer government-backed funding for small business owners and entrepreneurs in the trucking industry.

How it works. The SBA partners with approved lenders to provide partially guaranteed loans.

Best for. Startups or businesses with long-term growth plans.

Pros.

Low interest rates

Favorable repayment terms

Designed for small businesses

Cons.

Lengthy application process

Stringent eligibility requirements

Business Lines of Credit

A business line of credit is a flexible loan option that provides access to funds as needed, up to a set limit.

How it works. Borrowers draw on a revolving credit line and repay only the amount used.

Best for. Managing cash flow or covering seasonal expenses.

Pros.

Only pay interest on the funds used

Flexible borrowing and repayment

Quick access to working capital

Cons.

Higher variable interest rates

Requires regular credit reviews

Invoice Factoring

Invoice factoring allows trucking companies to sell their accounts receivable to a factoring company in exchange for immediate cash.

How it works. Invoices are sold at a discount, providing upfront capital.

Best for. Businesses with delayed payments from clients.

Pros.

Immediate cash flow

No need for a strong credit history

Cons.

Reduced invoice value

Higher costs compared to traditional loans

Cash Advances

Cash advances provide upfront funding based on projected future revenue.

How it works. A lender provides funds in exchange for a percentage of future sales.

Best for. Emergency funding or short-term cash flow issues.

Pros.

Fast approval and funding

No collateral required

Cons.

High interest rates

Repayment tied to sales, impacting cash flow

Potential Costs of Trucking Business Loans and How to Prepare

Securing trucking business loans is a major financial decision, and understanding the true costs involved can prevent unexpected financial strain. From interest rates to origination fees, knowing the full expense breakdown helps trucking companies prepare for loan repayment while maintaining profitability.

Common Costs of Trucking Loans:

Interest rates. Depending on your credit score, loan type, and lender, rates can vary from low interest rates on SBA loans to higher rates on short-term loans or factoring.

Origination fees. Many lenders charge upfront fees for processing loan applications, which typically range from 1% to 5% of the total loan amount.

Monthly payments. Repayment terms differ based on the type of financing, and it's important to ensure your cash flow can handle monthly revenue fluctuations.

Prepayment penalties. Some traditional loans penalize early repayment, making it essential to read the loan’s fine print.

Down payment. A commercial truck loan or equipment financing may require a down payment, typically between 10% and 30% of the total loan amount.

Other lender fees. Watch for administrative, underwriting, or servicing fees that might impact the profitability of your business.

How to Prepare for Trucking Loan Costs:

Improve your credit score. A higher business credit score can help you secure low interest rates and better loan options.

Compare financing solutions. Whether you need invoice factoring, a business line of credit, or a lump sum loan, choose the best fit for your business needs.

Plan for cash flow. Ensure you can cover monthly payments without disrupting working capital or business expenses.

Check lender requirements. Understand what business financing providers require, such as bank statements, personal credit history, and proof of profitability.

Top Lenders for Trucking Business Expansion

The right lender can make all the difference when it comes to securing funding. Below are some options for traditional banks, online lenders, and specialized loan providers.

Comparing Lenders

Traditional banks. Offer comprehensive loan programs with competitive rates but may have stricter requirements.

Online lenders. Provide fast approvals and flexible repayment terms but often have higher interest rates.

Factoring companies. Specialize in invoice factoring for businesses with accounts receivable needs.

Loan Details to Look For

Loan amount. Ensure the loan covers your business needs.

Repayment terms. Choose terms that fit your cash flow.

Interest rates. Compare rates to find the most competitive option.

Application process. Look for lenders with streamlined online applications.

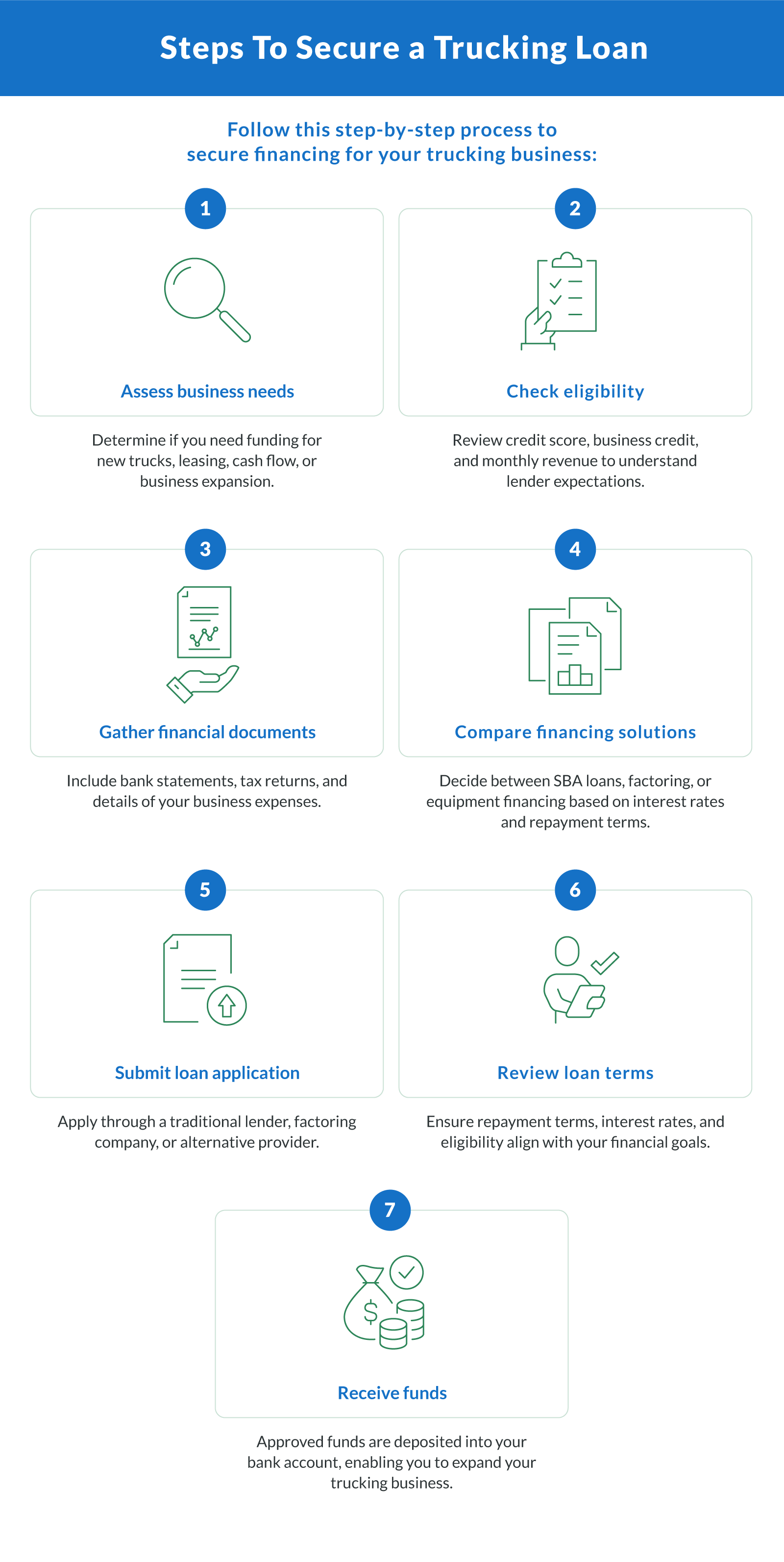

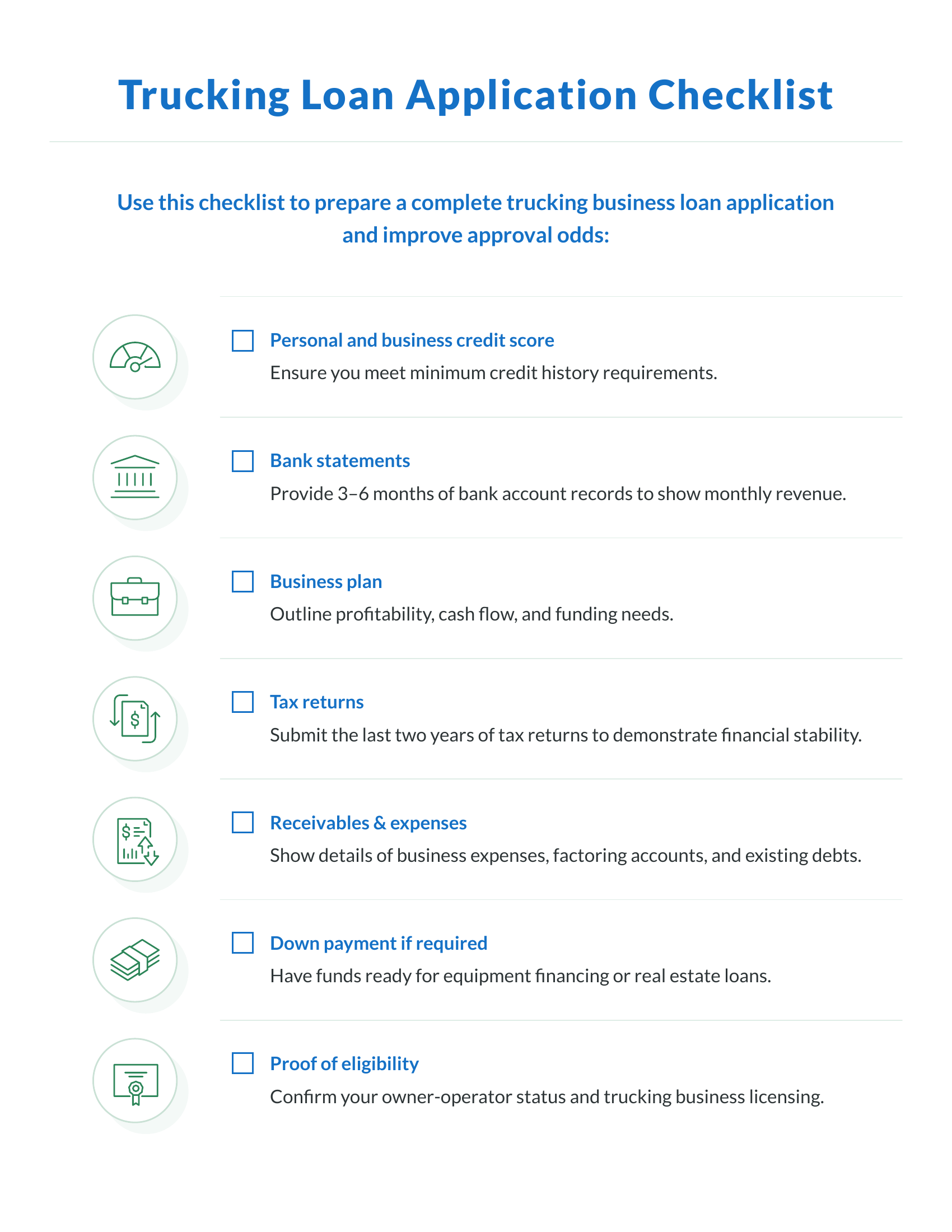

How To Structure Your Loan Application for Approval

A well-structured loan application increases your chances of approval, whether you're applying for equipment loans, SBA loans, or invoice factoring. Lenders assess credit history, monthly revenue, and business plan details to determine if you qualify for a small business loan.

Key Components of a Strong Loan Application:

Detailed business plan. Clearly outline how the loan amount will be used, covering new equipment purchases, business expansion, or cash flow management.

Strong financials. Include bank statements, tax returns, and receivable reports to prove financial stability.

Good credit history. While bad credit doesn’t disqualify you, a strong business credit score helps secure lower interest rates.

Collateral (if required). Some truck financing requires assets like semi-trucks or real estate as collateral for loan approval.

Upfront documentation. Provide all required paperwork to avoid delays in the online application or underwriting process.

How To Qualify for Trucking Business Loans

Qualifying for trucking business loans requires preparation and an understanding of lender requirements.

Eligibility Requirements

Lenders typically evaluate:

Credit history and score. Strong scores demonstrate reliability.

Annual revenue and cash flow. Proof of consistent income.

Business plan. A detailed plan showcasing growth potential.

Improving Your Chances

Strengthen credit score. Pay off debts and monitor your credit report.

Prepare documentation. Include tax returns, bank account statements, and business expenses.

Show financial stability. Demonstrate steady cash flow and revenue.

Common Pitfalls

Avoid issues like providing incomplete documentation, underestimating costs, or failing to understand eligibility requirements.

Choosing the Right Type of Loan for Your Trucking Company

Selecting the right loan depends on your specific business needs and goals.

Assessing Your Needs

Determine if funding is needed for equipment loans, operating expenses, or working capital.

Evaluating Loan Terms

Pay attention to repayment terms, monthly payments, and overall loan costs.

Understanding Loan Types

Match the loan type to your goals. For example:

Equipment loans for purchasing trucks.

Business lines of credit for managing cash flow.

SBA loans for long-term growth.

Weighing the Benefits and Risks

Before committing to a loan, consider the advantages and potential drawbacks.

Benefits

Access to working capital for growth

Improved cash flow during slow cycles

Ability to scale operations with new trucks or facilities

Risks

High interest rates for bad credit borrowers

Challenges meeting repayment terms during low revenue periods

Upfront costs like down payments or fees

Navigating Market Trends in Trucking and How Financing Fits In

The trucking industry is evolving, with economic shifts, leasing trends, and new regulations affecting financing availability. Understanding market conditions can help small business owners and owner-operators make smarter funding decisions.

Key Trends in Trucking Business Financing:

Rising fuel costs. Higher fuel prices impact monthly revenue, making working capital loans or business lines of credit crucial for managing fluctuations.

Electric and alternative fuel trucks. More trucking companies are seeking equipment leasing for energy-efficient vehicles, which may qualify for specialized business financing programs.

Driver shortages. The need for more truck drivers increases payroll costs, making factoring or cash advance options useful for short-term business funding.

Supply chain disruptions. Companies using invoice factoring can offset payment delays, ensuring steady cash flow while waiting for customer payments.

Practical Tips for Securing the Best Loan

To maximize your chances of success, follow these steps:

Prepare thoroughly. Submit a complete application with accurate documentation.

Compare lenders. Review interest rates, repayment terms, and loan amounts.

Time your loan. Align funding with your immediate and future business needs.

Grow Your Trucking Business With the Right Loan

Expanding your trucking business requires smart financial planning and access to the right funding. Whether you’re looking to purchase equipment, manage cash flow, or expand operations, the best trucking business loans can make it possible.

Take the first step today. Visit Clarify Capital to explore your options and find the perfect loan for your trucking company. With Clarify Capital, securing the financing you need is fast, simple, and tailored to your business goals.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts