For many pharmacists, owning a pharmacy is the next big step after years of clinical experience. But whether you're launching a new store or expanding an existing operation, the financial barrier can be steep. Pharmacy financing helps bridge that gap, offering flexible funding to cover everything from prescription automation systems to bulk inventory purchases.

Today's pharmacy loans give independent pharmacy owners a competitive edge. With costs ranging from $400,000 to $600,000 for location build-out, licensing, and initial inventory, even seasoned business owners need solid capital behind them. That's where business financing programs like SBA 7(a) loans, equipment loans, and working capital advances come in.

In a $94.9 billion independent pharmacy market, pharmacists can't afford to wait months for traditional funding pipelines. This guide breaks down the best loans for pharmacists, highlighting fast-track options and tailored financing for inventory, expansions, tech upgrades, and acquisitions. Whether you're buying out a competitor or planning a remodel, this resource will help you compare options and take the next step with confidence.

Loan Comparison Table

Here's an overview of the different business loan types, eligibility requirements, and terms.

| Loan type | Eligibility | Terms | Max loan amount |

|---|---|---|---|

| SBA 7(a) loan | Good credit, business plan | Up to 25 years | Up to $5 million |

| Conventional | Strong credit, collateral | 5-20 years | Varies by lender |

| Short-term loan | Flexible, all credit types | 3-24 months | Up to $1.5 million |

| Inventory financing | Inventory as collateral | 6-24 months | Up to $400,000 |

Why Independent Pharmacies Need Financing

Owning a pharmacy means juggling high operating costs with fluctuating revenue streams. From stocking prescription medications to upgrading systems for compliance and efficiency, the pharmacy business demands consistent access to capital. That's where pharmacy financing becomes essential.

Independent pharmacies make up 35% of the U.S. retail pharmacy market, yet they often face tighter margins than large chains. Many rely on third-party reimbursements that take weeks or even months to process. During these delays, business owners must still cover payroll, rent, and replenish stock. Access to working capital helps bridge the gap between service delivery and payment receipt.

Some pharmacies need funding to purchase inventory in bulk ahead of seasonal surges or supply chain constraints. Others seek capital to buy out a retiring pharmacist or open a second location. Financing is also critical when investing in automation technology or specialty drug storage to stay competitive.

Whether you're expanding your footprint or modernizing your operation, financing gives independent pharmacies the agility to act fast, without draining cash reserves.

Types of Pharmacy Loans and Financing Options

Pharmacy owners have several loan types available depending on their financing needs, business history, and growth goals. Understanding these pharmacy lending options can help you choose the most cost-effective and strategic path forward.

SBA 7(a) Loans

This loan program, backed by the Small Business Administration, is a popular choice for pharmacists acquiring an existing business or expanding operations. SBA 7(a) loans offer longer repayment terms, lower interest rates, and higher loan limits, but typically require more documentation and longer approval timelines.

Best for: Business acquisitions, expansions, and large capital investments

Conventional Term Loans

Offered by banks or online lenders, term loans provide a lump sum of capital repaid over a fixed term. While not government-backed, they may fund faster than SBA options and offer flexible use of funds.

Best for: Pharmacy remodels, marketing, or smaller expansions

Inventory Financing

This is a specialized form of pharmacy financing that helps you purchase inventory without tying up cash. Lenders use your stock as collateral, making this option ideal for high-turnover businesses.

Best for: Seasonal restocks or bulk medication purchases

Equipment Financing

Pharmacies can use equipment financing to upgrade technology, such as automation systems or refrigerated units for specialty drugs. These loans are often structured so that the equipment itself serves as collateral.

Best for: Technology upgrades, compounding tools, and medical refrigeration

Business Lines of Credit

A business line of credit is a flexible solution for managing short-term expenses. This financing option works like a credit card; you borrow only what you need and repay as you go, making it great for handling cash flow swings.

Best for: Ongoing working capital needs or unexpected expenses

Short-Term Working Capital Loans

These loans are designed for speed. Ideal for pharmacies facing time-sensitive opportunities like buying a competitor's location or responding to reimbursement delays, short-term loans typically fund in 24-48 hours.

Best for: Immediate funding gaps or emergency needs

Comparing Lenders and Loan Terms

Choosing the right lender is a crucial step in securing pharmacy financing that supports your business goals. Whether you're seeking a business loan for a new pharmacy, expansion, or working capital, understanding the differences between banks, SBA preferred lenders, and fintech companies can help you compare loan amounts, repayment terms, and approval times. Below, we break down each lender type so you can find the best fit for your needs, while highlighting how Clarify Capital stands out with fast, flexible funding.

Banks

Traditional banks are a longstanding source of business loans, offering stability and competitive rates for established borrowers.

Loan terms: Typically five to 20 years for term loans; repayment terms may be longer for commercial real estate.

Approval times: Usually one to three weeks for approval, with funding taking up to 30 days or more.

Capital limits: Varies widely by institution, but can range from $50,000 to several million dollars, depending on collateral and business profile.

SBA Preferred Lenders

SBA preferred lenders are authorized by the Small Business Administration to process and approve SBA loans in-house, streamlining the process for borrowers.

Loan terms: Up to 25 years for real estate, seven to 10 years for working capital or equipment; longer repayment terms help reduce monthly payments.

Approval times: As little as five to 10 business days for SBA 7(a) loans, with funding typically within 30-90 days. SBA Express loans can be approved in as little as 36 hours.

Capital limits: SBA 7(a) loans up to $5 million; SBA Express loans up to $500,000.

Fintech Lenders

Fintech lenders leverage technology to offer fast, accessible business loans with streamlined applications, ideal for pharmacy owners needing quick access to capital.

Loan terms: Typically six months to two years for short-term business loans; repayment terms can be flexible and tailored to cash flow.

Approval times: Funding can be provided within 24-48 hours after approval, making fintech lenders one of the fastest options available.

Capital limits: Loan amounts generally range from $10,000 up to $5 million, depending on business revenue and creditworthiness.

Clarify Capital: Fast Funding Advantage

Clarify Capital stands out as a fintech lender specializing in pharmacy business loans, connecting borrowers with a network of over 75 lenders. With a simple online application, approval decisions are typically made within 24 hours, and funds can be deposited the same day, helping you seize opportunities or cover urgent expenses without delay. Flexible loan amounts up to $5 million and repayment terms tailored to your business make Clarify Capital a top choice for fast pharmacy financing.

By comparing each lender's loan terms, approval times, and capital limits, you can make an informed decision and secure the right pharmacy loan to support your business growth.

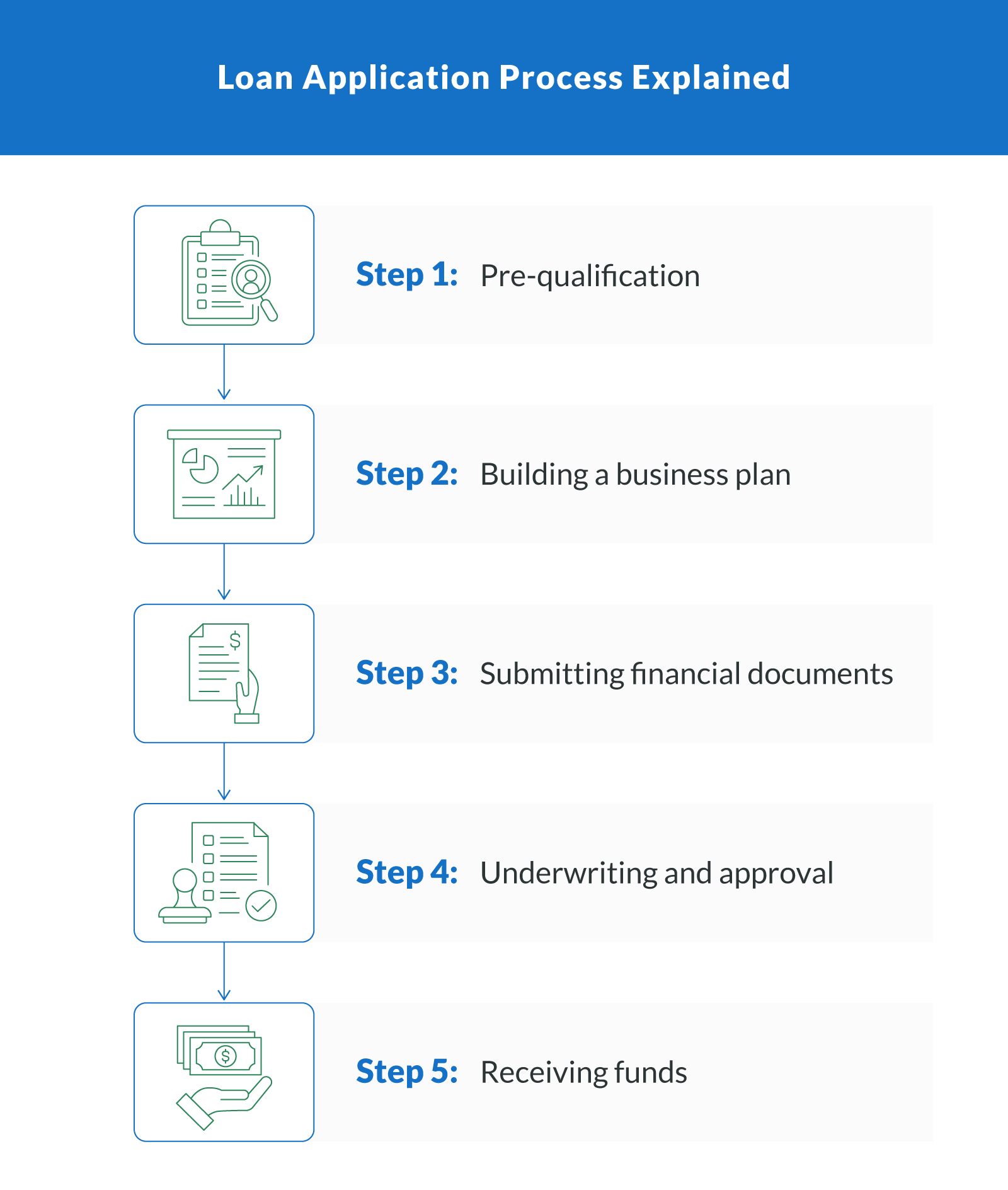

Loan Application Process Explained

Whether you're modernizing your pharmacy or expanding your business, understanding the loan process can help you secure funding faster. While every lender varies slightly, most borrowers will follow a similar path when applying for pharmacy loans.

Step 1: Pre-Qualification

Start by determining if you meet basic eligibility benchmarks. Most lenders expect your credit score to be at least 650, though Clarify Capital can often help applicants with lower scores find suitable options. In many cases, you'll need between $50,000 and $100,000 in capital to qualify, especially when pursuing ownership or large-scale expansions.

Step 2: Build a Business Plan

Your business plan should include a financial forecast, management background, local market overview, and growth goals. For startups, lenders want to see a strong plan that shows how the business will become profitable within 12-24 months.

Step 3: Submit Financial Documents

Gather your business tax returns, bank statements, profit and loss reports, and licensing documentation. The more organized your submission, the smoother your application process will be.

Step 4: Underwriting and Approval

Lenders will review your documents, analyze your business model, assess collateral (if applicable), and determine risk. Clarify Capital works with 75+ lenders to streamline this phase and increase your approval odds.

Step 5: Receive Funds

Once approved, funds can be disbursed in as little as 24-48 hours, especially through Clarify's network of fast-moving non-bank lenders. SBA or traditional bank loans may take several weeks, so choose based on urgency and need.

Buying or Expanding a Pharmacy

For many pharmacy business owners, acquiring an existing pharmacy or expanding to a second location is a strategic way to increase revenue and market share. But doing so often requires significant capital, especially in today's shifting retail healthcare landscape.

Pharmacy acquisition loans typically exceed $1 million, making outside funding essential for most independent operators. Whether you're looking to buy out a retiring owner, remodel a current store, or open in a high-growth neighborhood, targeted financing options can help make it possible.

Adding a second location or investing in real estate can also improve margins and provide more control over operations. Clarify Capital works with lenders that specialize in high-ticket business acquisition financing, helping you close quickly, before competing buyers step in.

What's more, expansion may be a timely opportunity: The independent pharmacy market is under pressure, with the U.S. losing about one pharmacy per day in 2023. That's created room for well-prepared buyers to step in and grow.

How Clarify Capital Helps Pharmacy Owners

Pharmacy owners often face tight timelines and complex funding needs, especially when dealing with inventory spikes, expansion plans, or rising tech costs. Clarify Capital understands these challenges and simplifies the path to funding with speed, flexibility, and one-on-one guidance.

Unlike traditional lenders, Clarify offers a wide range of funding options tailored to the pharmacy business. Whether you're applying for short-term working capital, planning a remodel, or acquiring a new location, our network of 75+ lenders makes it easy to find the right fit.

You'll benefit from:

Fast approval. Get decisions in hours, not weeks.

Flexible terms. Choose from loan products that match your business model.

Dedicated support. Your Clarify advisor walks you through every step of the process.

Many independent pharmacists have turned to Clarify when banks were too slow or rigid. We've helped first-time buyers, long-time owners, and franchise operators access capital quickly, so they can focus on running a successful store.

Take the Next Step

Independent pharmacists face a unique mix of opportunity and pressure — rising inventory costs, tight margins, and urgent chances to grow or modernize. The right pharmacy financing can make all the difference, giving your business the speed and flexibility to stay competitive.

Whether you're expanding to a second location or responding to a time-sensitive acquisition, Clarify Capital offers a streamlined path to capital. From small business loans and equipment financing to fast-turnaround working capital solutions, Clarify's nationwide lender network helps you secure funding that fits your needs, not the other way around.

Our dedicated advisors will guide you through the entire process — no confusing paperwork, no long waits. Just fast, clear answers and funding options that align with your pharmacy's future.

Start your pharmacy's funding journey today. Clarify makes it fast, easy, and tailored to your business.

FAQs About Pharmacy Loans

Here are answers to the most common questions pharmacy owners ask when exploring pharmacy loans and funding options.

What Types of Pharmacy Loans Are Available?

Pharmacy owners can choose from several loan types depending on their needs:

SBA 7(a) loans: Backed by the Small Business Administration, these offer low interest rates and long repayment terms.

Conventional term loans: Issued by banks or online lenders, ideal for stable businesses seeking large capital.

Short-term working capital loans: Useful for covering payroll, inventory, or seasonal fluctuations.

Equipment financing: Helps pharmacies upgrade POS systems, dispensing tech, or automation systems.

Inventory financing: Short-term funding specifically for large inventory purchases.

Each loan program offers different advantages based on use case, credit history, and funding speed.

How Do I Qualify for a Pharmacy Loan?

To qualify, borrowers typically need:

A solid business plan that outlines your pharmacy's strategy and projected revenue

A minimum of six months in business (or strong financials for a startup)

Bank statements and financial documentation

A reasonable credit score; most lenders prefer 625 or higher

Some loan programs may also require a down payment or collateral, especially for large acquisitions

Working with a lender or broker like Clarify can help simplify the application process and improve your chances of approval.

What Credit Score Is Needed for Pharmacy Financing?

Most lenders look for a credit score of 625 or higher, though some flexible loan options may accept lower scores. SBA loans often require stronger credit and financial history, while short-term loans and alternative financing are available for borrowers with less-than-perfect credit. Strong revenue and consistent cash flow can sometimes offset a moderate credit score.

Can I Get a Loan To Buy an Existing Pharmacy?

Yes, pharmacy loans can be used to acquire an existing pharmacy. Acquisition financing is available through SBA 7(a) loans, term loans, and private lenders. These loans typically fund purchase costs, transition expenses, and working capital. If you're buying a business with strong financials, you'll likely qualify for better rates and repayment terms.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts