Most small business loans are installment loans, meaning you borrow a lump sum of money and repay it in fixed monthly payments over a set period. Revolving loans, like business lines of credit and business credit cards, let you borrow repeatedly up to a credit limit, repaying only what you use.

Recognizing the difference between these two loan types is essential for managing your cash flow and choosing the right financing solution. Whether you're funding equipment, covering operational expenses, or preparing for seasonal fluctuations, the structure of your loan can impact your budget, repayment schedule, and overall financial flexibility.

In this guide, we'll break down how installment and revolving loans work, compare their pros and cons, and help you decide which option best supports your business needs in 2025.

What Are Installment Loans?

Installment loans provide a fixed amount of money that you repay over a set period with regular payments. These loans usually have structured repayment terms, often between 6 and 60 months, and feature fixed interest rates, meaning your monthly payments stay the same. That predictability makes installment loans a smart choice for small business owners who want clear budgeting and stable cash flow.

Installment loans are ideal for large, one-time business expenses. By borrowing a lump sum upfront, you can invest in your business immediately and repay it over time through consistent, manageable payments.

In 2025, Clarify Capital offers business term loans ranging from $10,000 to $500,000, with fixed APRs starting at 8.5%. Many small business owners use installment loans to fund big investments like real estate, renovations, or expansion projects.

For example, a café owner might use an installment loan to renovate their kitchen and upgrade commercial appliances, repaying the loan over 36 months. A contractor could finance the purchase of a new work vehicle and spread payments over five years.

Because the repayment amount doesn't change, installment loans simplify financial planning. You'll know exactly how much to pay each month, making it easier to manage your cash flow and avoid surprises. That structure supports long-term growth while keeping your operating budget in check.

What Are Revolving Loans?

Revolving loans provide ongoing access to capital through a set credit limit. Unlike installment loans, which offer a lump sum upfront, revolving credit lets you borrow only what you need, when you need it, and repay it at your own pace. As you repay, your available credit replenishes, so you can draw funds again without reapplying.

Common examples include business lines of credit and business credit cards. These are ideal for managing fluctuating expenses, like inventory restocking, payroll gaps, or unexpected expenses and repairs.

For instance, a retail business might use a revolving line of credit to stock up on seasonal inventory ahead of the holidays, then repay the balance as sales come in. A marketing agency might draw on its credit line to front campaign costs for clients, repaying it as invoices are collected.

Revolving credit offers flexibility but also requires discipline. You're only charged interest on the amount you borrow, not the full credit limit. However, high utilization can impact your credit score, and variable interest rates may make monthly payments harder to predict. Still, for short-term needs and working capital management, it's one of the most useful small business financing tools available.

Installment vs. Revolving Loan Comparison

Choosing the right type of small business loan starts with understanding how each option works. Installment loans offer structure and predictability, while revolving credit provides flexibility and reusable access to funds. The table below highlights the key differences to help you compare repayment styles, interest rates, and ideal use cases side by side.

| Loan Type | Repayment Style | Interest | Flexibility | Best For |

|---|---|---|---|---|

| Installment loan | Fixed monthly payments | Typically lower; often fixed | Low; set amount and term | Equipment purchases, real estate, long-term projects |

| Revolving line of credit | Borrow as needed, repay as you go | Variable; interest-only on borrowed amount | High; reusable credit limit | Working capital, seasonal needs, fluctuating expenses |

| Business credit card | Minimum payments or pay in full | Highest; variable APR | Very high; instant access to funds | Small recurring expenses, emergencies, travel, vendor payments |

Pros and Cons: Installment vs. Revolving Loans

Both installment and revolving loans have advantages depending on your business's cash flow, financial goals, and how you plan to use the funds. Here's a quick comparison to help you weigh the trade-offs:

| Installment Loans | Revolving Loans |

|---|---|

| Pros | Pros |

| - Predictable monthly payments | - Flexible borrowing; draw only what you need |

| - Typically lower, fixed interest rates | - Credit replenishes as you repay |

| - Great for large, one-time expenses | - Quick access to working capital |

| - Helps with long-term financial planning | - No need to reapply for every withdrawal |

| - Builds repayment discipline | - Useful for unexpected or recurring expenses |

| Cons | Cons |

| - Less flexible once terms are set | - Higher interest rates, often variable |

| - Harder to adjust repayment if cash flow changes | - Can be harder to budget due to rate fluctuations |

| - May have stricter credit or income requirements | - Overuse may impact credit score or lead to debt cycling |

When To Use Installment vs. Revolving Financing

Not all business financing needs are the same. The right type of loan depends on whether you're making a one-time investment or managing ongoing expenses. Here's how real businesses use each type of financing.

When an Installment Loan Makes Sense

Installment loans are ideal when your business needs a lump sum upfront to fund a specific project or purchase. This structure works best when you have a clear repayment timeline and your business can comfortably manage predictable payments. If you're financing something with a fixed cost, like a renovation, equipment purchase, or expansion, an installment loan gives you the capital you need with a structured plan to pay it back over time.

Installment loan use cases:

A café owner takes out a three-year business installment loan to renovate the kitchen and purchase new equipment, knowing exactly what the monthly payment will be.

A construction business uses a term loan to buy a new work truck, spreading the cost over 60 months while keeping operating cash flow stable.

A boutique hotel owner secures a fixed-rate SBA loan to remodel guest rooms, planning repayment alongside projected seasonal bookings.

When a Revolving Loan Is the Better Fit

Revolving credit is better suited for businesses with ongoing or fluctuating expenses. If your costs are unpredictable or change month to month, the flexibility of a revolving line allows you to borrow only what you need, when you need it. It's also a smart choice if your cash flow isn't always consistent. The ability to draw funds, repay them, and borrow again gives you a safety net to handle seasonal slowdowns, emergency repairs, or short-term working capital needs.

Revolving loan use cases:

A retailer uses a revolving line of credit to stock inventory ahead of the holidays and pays it down gradually as sales roll in.

An e-commerce business taps into a credit line to cover marketing spend during a new product launch, adjusting the draw based on weekly performance.

A service-based company uses a business credit card for travel and vendor expenses, paying the balance in full each month to avoid interest.

Each financing option serves a different purpose. What matters most is aligning the structure with your cash flow and business strategy.

Interest Rates, Repayment Terms & Loan Structure

Understanding how business loans are structured can help you choose the right financing option for your needs. In 2025, most lenders continue to offer flexible approvals, soft credit checks, and faster timelines, and many funding decisions happen within 24–72 hours.

Installment loans typically come with fixed interest rates ranging from 6%–18% APR, depending on your credit score, time in business, and lender type (e.g., traditional financial institutions vs. online lenders). Repayment terms range from 6–60 months, with regular monthly payments that help with budgeting. These loans are best for fixed-cost investments, like purchasing equipment or funding a renovation.

Revolving loans, like lines of credit or business credit cards, generally offer variable APRs from 8%–29%, depending on creditworthiness and usage. Interest accrues only on the borrowed amount, and available credit replenishes as you repay. Revolving products typically have no set end date, but many require a full renewal or review every 12–24 months. They're useful for managing cash flow, handling short-term needs, or covering seasonal expenses.

Many lenders now offer soft credit checks during the prequalification stage, so you can review your loan options without impacting your score. Once you move forward, a hard credit pull is usually required to finalize approval and funding.

2025 Lender Examples: What To Expect

To give you a better sense of real-world offers, here's what Clarify Capital and other lenders typically provide in 2025:

Installment Loans (Term Loans):

Loan amounts: $10,000–$750,000

APR range: 7.99%–24.99%

Repayment terms: 6–60 months

Approval time: 1–3 business days

Best for: Equipment purchases, expansion projects, debt consolidation

Revolving Loans (Lines of Credit):

Credit limits: $5,000–$250,000

APR range: 9%–29% (interest-only payments common)

Access: Ongoing withdrawals up to your credit limit

Approval time: Same day to 72 hours

Best for: Managing fluctuating cash flow, inventory restocking, short-term gaps

Larger maximums (up to $5 million) are available for highly qualified borrowers. Actual rates and terms depend on the borrower's profile, credit score, revenue, loan purpose, and overall business health.

Clarify Capital matches business owners with offers from 75+ lenders, and your advisor will help you find the right loan structure, rate, and terms based on your goals.

Eligibility and Creditworthiness

To qualify for a small business loan, installment or revolving, lenders typically evaluate your credit score, financial history, revenue, and time in business. In 2025, most lenders offer prequalification with a soft credit check, so you can explore offers without impacting your score.

Here's what most lenders look for:

Credit score:

700+: Best rates and access to all loan types

620–699: Eligible for most products, though rates may be higher

500–619: Limited options; may need to show strong revenue or provide collateral

Documents required:

Business bank statements (typically last three months)

Most recent tax return

Proof of revenue or P&L statement

Time-in-business verification (usually 6+ months)

Traditional banks and credit unions often have stricter documentation and longer approval times, while online lenders tend to offer faster, more flexible options, sometimes funding in as little as 1–3 business days.

SBA Loans & Alternative Financing Options

The Small Business Administration (SBA) offers both installment and revolving loan products through approved lenders, often with lower interest rates and longer repayment terms.

SBA 7(a) Loans

These are installment loans ideal for funding major purchases, commercial real estate, or business expansions. Repayment terms can stretch up to 10–25 years, with interest rates generally ranging from 10.5%–15.5% APR, depending on loan amount and terms.

SBA CAPLines

Designed for short-term working capital needs, CAPLines are revolving lines of credit. They offer flexibility for seasonal businesses, inventory purchases, or managing receivables. Credit limits vary by use case and borrower strength.

Alternative Financing

For business owners who need faster, less document-heavy options, alternative financing may help. Merchant cash advances offer quick access to funds based on daily card sales, which is best for high-volume retail businesses. Meanwhile, invoice financing converts outstanding invoices into working capital, which is ideal for B2B companies with slow-paying clients.

These alternatives can be more expensive, but they're useful for businesses that can't qualify for traditional loans or need immediate cash flow support.

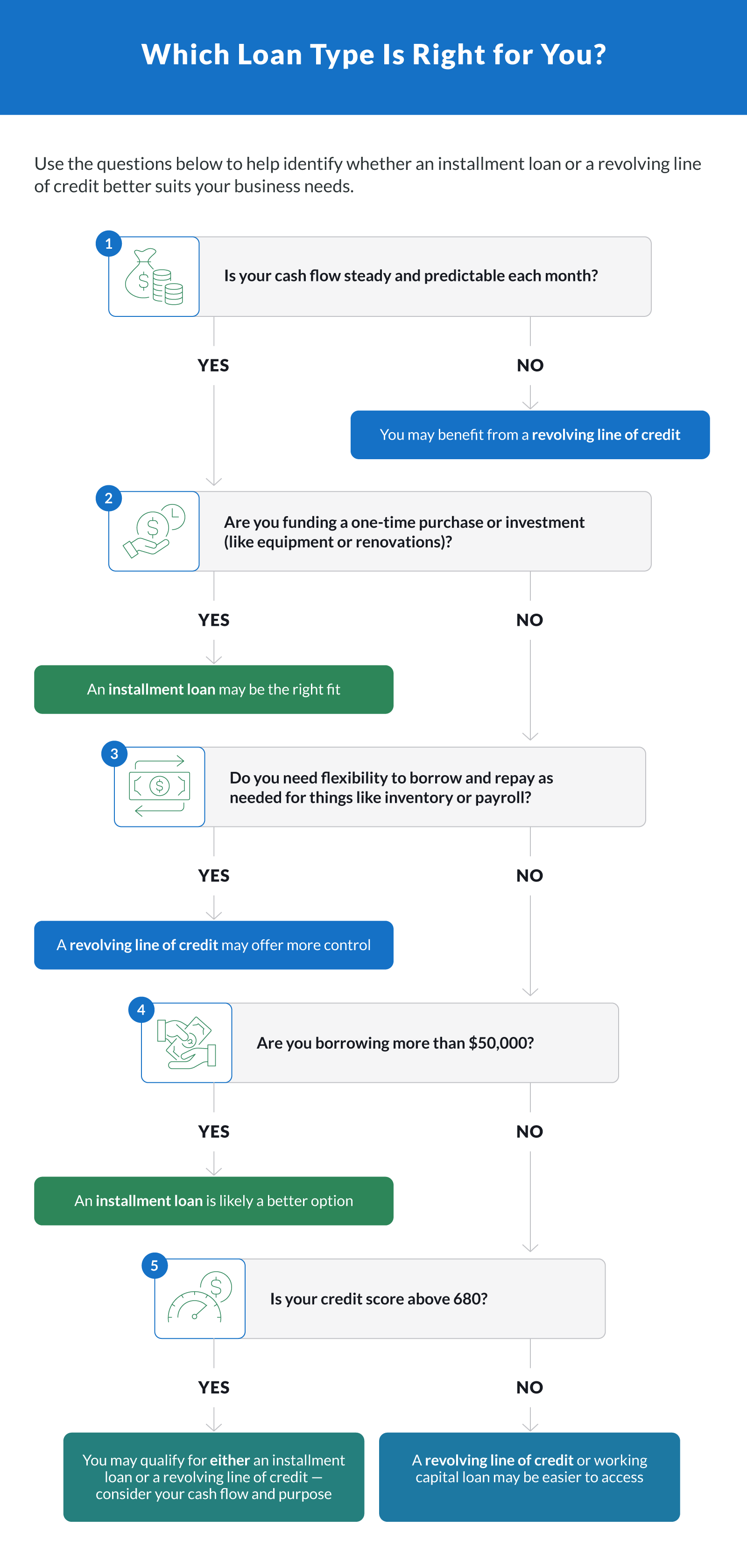

How To Choose the Right Loan Type

Not sure which loan structure fits your business best? Start by evaluating how your business operates and what you need the funding to do. These factors will help point you toward either an installment or revolving loan.

Predictable vs. Variable Cash Flow

If your income is steady month to month, an installment loan with fixed payments might be a better fit. If your revenue swings seasonally or unpredictably, a revolving line of credit gives you flexibility to borrow and repay as needed.

One-Time vs. Recurring Expenses

Installment loans are ideal for one-time purchases, like equipment, renovations, or big investments. Revolving loans work better for ongoing financial needs like inventory, marketing, or payroll during slow periods.

Desired Repayment Flexibility

Need predictable monthly payments and a clear repayment timeline? Go with an installment loan. Prefer to draw funds only when needed and repay on your own schedule? Choose revolving credit.

Amount of Money Needed

For larger amounts ($50K+), installment loans often make more sense. Revolving credit lines usually cap at lower limits unless you have strong revenue and credit.

Credit Profile

Good credit (680+) opens the door to most types of business loans with competitive terms. If your credit is lower, you may have better luck with a revolving business line of credit or a working capital loan from an online lender.

Need more information? Learn more about small business term loans or explore how business lines of credit work and who they're best for.

Frequently Asked Questions

Looking for fast answers about business loan structures? Here are common questions about installment and revolving loans.

Can I Convert a Revolving Line Into an Installment Loan?

In most cases, no, you can't directly convert a revolving line of credit into an installment loan. However, some lenders allow you to refinance the outstanding balance from a revolving loan into a new installment product. This can simplify the repayment period and lock in fixed terms if you no longer need ongoing access to funds.

Which Loan Type Is Best for Equipment Purchases?

Installment loans are typically the best choice for equipment loans. You receive the full loan amount upfront and repay it over a fixed term that often matches the expected life of the equipment. You can also consider equipment financing, a specialized type of installment loan that uses the equipment as collateral.

Are SBA Lines Revolving or Installment?

The Small Business Administration (SBA) offers both types. SBA 7(a) loans are installment loans with fixed repayment terms. However, SBA CAPLines are revolving lines of credit designed for short-term and working capital needs.

Each serves different business goals, so the right option depends on how you plan to use the funds.

Is a Business Credit Card a Revolving Loan?

Yes. Business credit cards are a form of revolving credit. You're assigned a credit limit, and you can borrow, repay, and reuse funds as needed, just like a line of credit. They're useful for short-term expenses, but higher interest rates are typical than with other financing options.

Will Prequalifying Affect My Credit Score?

No. Most online lenders and platforms like Clarify Capital offer soft credit checks during prequalification, which won't impact your score. A hard credit check only happens once you accept a loan offer and move forward with funding.

What If I Need a Mix of Both Loan Types?

Some businesses benefit from having both an installment loan for large purchases and a revolving line of credit for ongoing cash flow. You can apply for each separately or talk to your advisor about blended financing solutions that combine both structures.

Choosing the Right Loan Type for Your Business

Ready to choose the right type of financing? Whether you need predictable monthly payments or to access funds flexibly, Clarify Capital connects you with the best loan for your business goals.

Apply online in just two minutes with no fees and no obligation. Get matched with top lenders and work with a dedicated advisor to find your ideal financing solution.

Apply today and get funded as fast as 24 hours.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts