Running a small business as a single-member LLC comes with flexibility, but also raises questions when it comes to funding. If you're wondering whether you can get an SBA loan for an LLC with no employees, the answer is yes. In fact, 81% of U.S. small businesses operate without any W-2 staff, according to the SBA. And many of these solo owners qualify for SBA-backed loans to help grow their business.

This guide breaks down how SBA loans work for LLCs, even without employees on payroll. We'll cover eligibility requirements, loan types available, the application process, and what to expect after applying. Whether you need working capital, want to invest in equipment, or are preparing to launch a new project, SBA loans for LLCs offer flexible options with competitive interest rates. For example, SBA 7(a) loan rates currently range from the base rate plus 3% to 6.5%.

Let's walk through how to qualify and make the most of SBA financing — even if you're the only one running the business.

Can LLCs With No Employees Get SBA Loans?

Yes, your LLC can still qualify for an SBA loan even if you don't have employees. Many small business owners operate solo, and the SBA doesn't require you to have W-2 staff on payroll to be eligible. Instead, they look at other factors, like your business structure, ownership, credit history, and how the funds will be used.

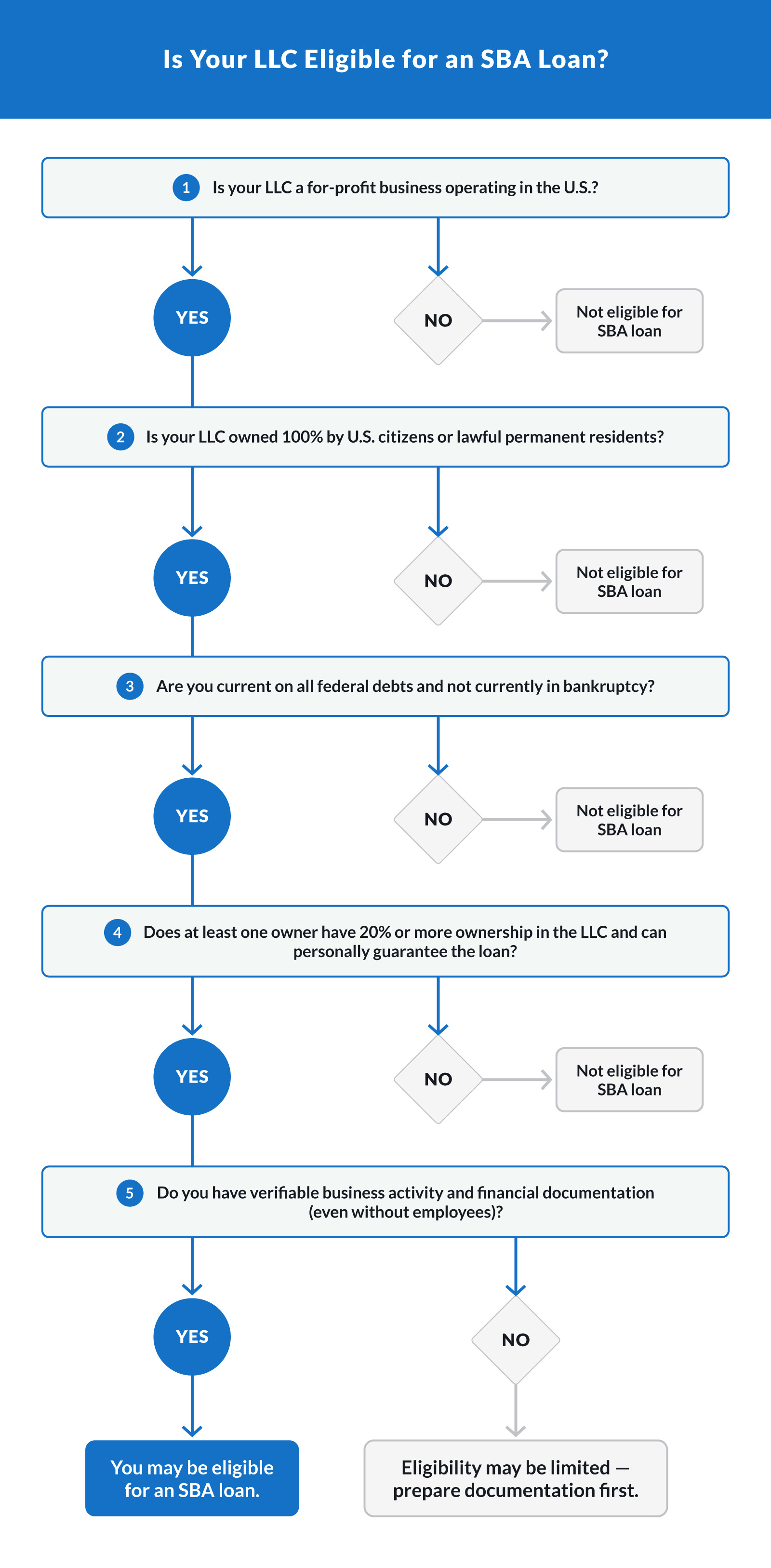

The SBA defines a small business based on size standards for each industry, but more importantly, the business must be for-profit, based in the U.S., and independently owned and operated. LLCs, including single-member ones, meet these requirements if they're properly registered and operational.

Here's what matters most if you're applying as a no-employee LLC:

You must provide a personal guarantee. The SBA requires any owner with 20% or more equity to personally guarantee the loan. This helps protect the lender if the business can't repay.

You must be a U.S. citizen or lawful permanent resident. Your LLC must be 100% owned by individuals who meet this residency requirement.

Single-member LLCs are treated differently from sole proprietors. While both may operate without employees, LLCs offer legal separation between personal and business finances. That said, SBA lenders still evaluate your personal credit score and income since you're the sole operator.

As long as your business is active, generates revenue, and meets basic eligibility requirements, you can likely apply for an SBA loan without employees on payroll. Follow this flowchart to see if you are eligible:

Which SBA Loans Can LLCs Without Employees Qualify For?

Solo LLCs have access to several types of SBA loans, each designed for different business needs. Even without employees, you can qualify for funding if you meet the basic eligibility criteria. These loans can help with working capital, equipment purchases, startup costs, and more.

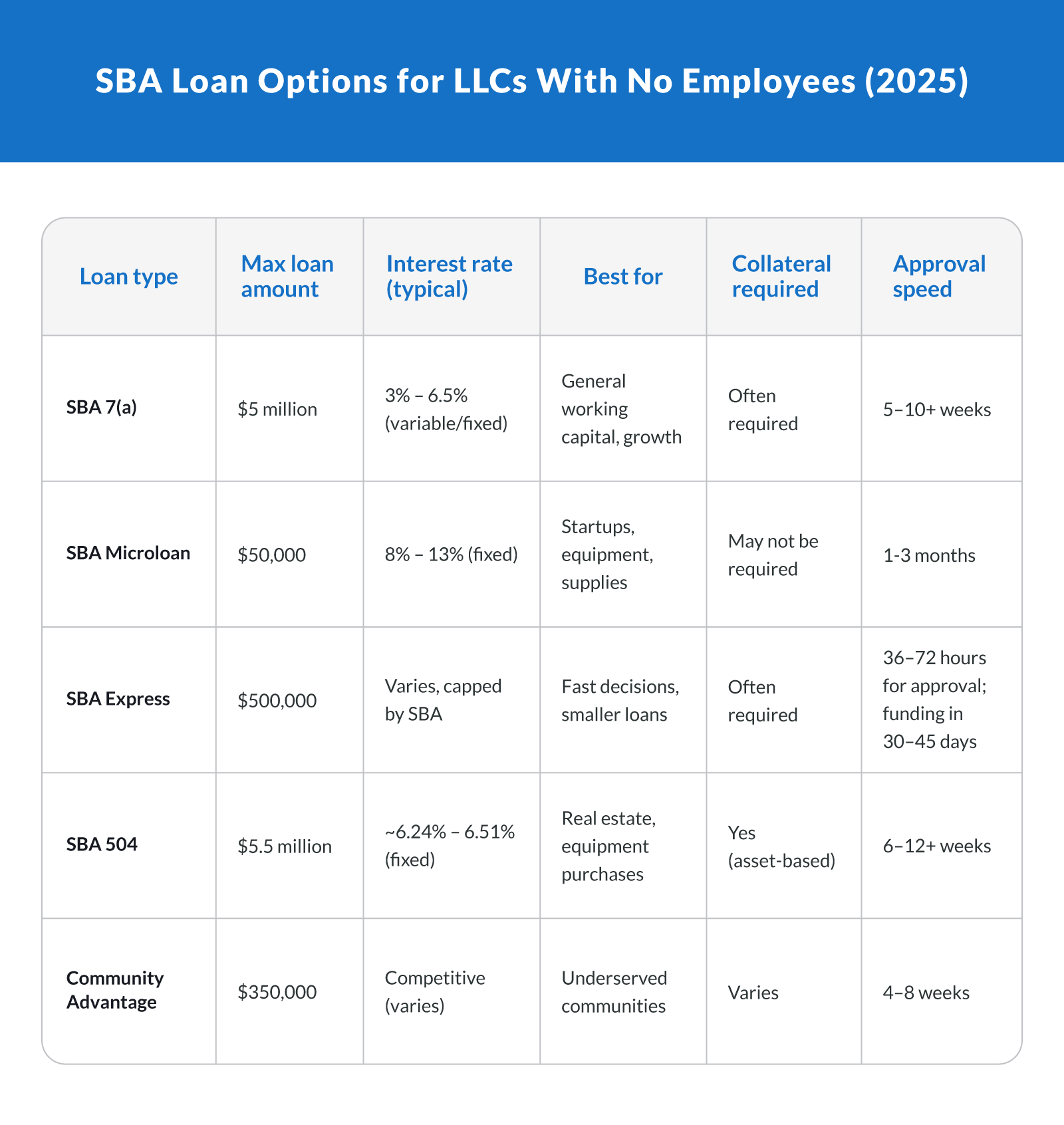

Here's a breakdown of the most common SBA loan programs that work well for LLCs with no employees:

Each loan type serves a different purpose:

SBA 7(a) loans. These are the most flexible and widely used. You can use the funds for almost any business need.

Microloans. Ideal for smaller funding needs — great for startups or solo LLCs making modest investments.

SBA Express loans. If you need fast funding, this option offers quicker turnaround and less paperwork.

504 loans. Best for long-term investments in commercial property or high-value equipment.

Community Advantage. Aimed at borrowers in underserved markets, this program is ideal if you're building credit or lack strong financials.

SBA loan programs cater to a range of business models, including LLCs with no employees. Choosing the right one depends on your funding goal, timeline, and how much capital you need.

How To Apply for an SBA Loan Without Employees

Applying for an SBA loan as a solo LLC is straightforward, but preparation is key. Since you don't have employees, lenders will look closely at your personal finances and business operations. Here's how to navigate the application process.

Gather your documents. You'll need basic paperwork like your business license, articles of organization, and personal identification. Lenders also ask for recent tax returns, business bank statements, and financial statements.

Know your credit score. Since you're the only owner, your personal credit score will heavily influence approval. A score of 650+ improves your chances, but SBA lenders can work with lower scores, especially for microloans or Community Advantage loans.

Build a strong business plan. This should include your company's mission, product or service overview, target market, financial projections, and how you'll use the loan. Make sure it's detailed but easy to follow.

Choose the right loan type. Based on your goals — like needing working capital or buying equipment—select the loan program that fits best. Refer to the table in the previous section to compare options.

Submit your loan application. You'll apply directly through your chosen lender. Make sure all forms are complete and accurate to avoid delays.

Wait for a lender decision. Approval times vary. Express loans may take just days, while 7(a) or 504 loans could take weeks. Stay in contact with your lender and be ready to provide more information if needed.

Download the SBA Loan Application Checklist for LLCs With No Employees to make sure you have all of your bases covered.

Clarify Capital simplifies the SBA loan process by helping small business owners every step of the way. After a quick two-minute application, your dedicated loan advisor will guide you through lender selection, document prep, and submission — making the process smoother and faster. Apply now to see what you qualify for.

What To Expect After Applying: Approval, Use, and Repayment

Once you submit your SBA loan application, the process moves into underwriting and approval. Timelines vary based on the loan type, lender, and your financials, but there are a few things every LLC owner should expect.

Approval timelines. SBA Express loans may get a response in just 36 hours. Traditional SBA 7(a) or 504 loans can take several weeks. During this time, lenders evaluate your business plan, revenue, credit score, and supporting documents.

Common reasons for rejections. Applications may be declined due to low personal credit, weak cash flow, or missing documents. Make sure your business is registered properly, your paperwork is clean, and your income is consistent.

Collateral and personal guarantees. Most SBA loans — especially those over $25,000 — require some form of collateral or a personal guarantee. Even if you don't have employees, the SBA expects you to share financial risk, particularly for higher loan amounts.

How funds can be used. SBA loans must support eligible business expenses like buying equipment, hiring contractors, paying rent, or purchasing inventory. Keep detailed records to avoid compliance issues later.

Repayment terms. Most SBA loan terms range from five to 25, years depending on how you use the funds. Working capital loans may have shorter repayment periods, while loans for real estate or equipment can extend longer. Rates are typically fixed or capped if variable, and payments are monthly.

Support for solo owners. Programs like SBA's Community Advantage can offer extra support and flexible terms for underserved business owners, including those without W-2 employees.

In FY 2024 alone, the SBA backed over 103,000 financings to small businesses across the U.S. Whether you're self-employed or scaling up, you're not alone — thousands of solo LLCs use SBA-guaranteed loans to grow every year.

Next Steps for LLC Owners

If you run a single-member LLC with no employees, you still have strong financing options through the SBA. Whether you need working capital, want to invest in equipment, or plan to grow in the near future, SBA loans can provide the support to help you move forward.

As long as your small business meets basic eligibility — like being based in the U.S., for-profit, and personally guaranteed — you can apply for an SBA loan for an LLC with no employees. Programs like the SBA 7(a), microloan, and Express loans are built to work for solo operators, especially those just getting started or building credit.

Now is a good time to explore your funding options. SBA interest rates remain competitive, and approval can happen in as little as a few days, depending on the loan type. If you're unsure where to begin, Clarify Capital can guide you through the entire application process and connect you with the right SBA lenders.

FAQ: SBA Loans for LLCs With No Employees

Even if you're the only person running your business, you likely still qualify for SBA financing. Below are answers to common questions about SBA loans for LLCs without employees.

Can an LLC With No Employees Get an SBA 7(a) Loan?

Yes. As long as your LLC meets the SBA's eligibility requirements — like being U.S.-based, for-profit, and personally guaranteed by the owner — you can apply for a 7(a) loan. The fact that you don't have W-2 employees doesn't disqualify you.

Do I Need a Business Credit Score for SBA Approval?

Not necessarily. SBA lenders often rely on your personal credit score, especially if your business is new or you operate solo. However, having business credit can strengthen your application, especially for higher loan amounts or larger lenders.

What Documents Are Required for a Loan as a Single-Member LLC?

You'll typically need your business formation documents, tax returns (personal and business), bank statements, a business plan, and identification. Some lenders may also ask for a profit and loss statement or cash flow forecast.

Is There a Minimum Revenue Requirement?

Yes. While it varies by lender, most SBA-approved lenders require at least $10,000 in monthly revenue to qualify for a small business loan. You'll need to submit recent bank statements to verify income.

What Are the Collateral Requirements for Under $50K?

SBA loans under $50,000 may not require traditional collateral, but many still ask for a personal guarantee. Microloans and Community Advantage loans often offer more flexibility, especially for solo LLCs that may not own large assets.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts