From covering day-to-day expenses to funding expansions, a business loan can provide the finances you need to succeed. Searching for the right loan, however, requires significant time and research before applying.

Follow this step-by-step guide on how to apply for a business loan, compare lenders, and prepare everything you need.

1. Choose the Right Type of Business Loan

Do you need working capital to cover day-to-day operations? Are you looking to buy new equipment and expand? Assessing your business’s financial needs will help you determine how much funding you need and which types of loans to consider.

Below are the most common types of business loans to compare interest rates, terms, repayment structures, and additional offerings:

Short-term business loans: Those with short repayment periods, typically six months to two years. Once approved, you receive a short-term loan in a lump sum to repay as fixed payments.

SBA loan: One from an SBA-approved lender, where the U.S. Small Business Administration (SBA) pays the lender the guaranteed amount. SBA loans tend to have low interest and longer repayment periods.

Small business loans: Available financing specifically to companies that qualify as small businesses. This funding can be short term or long term, accessible through SBA loans, lines of credit, and equipment financing.

Working capital loans: Provide the funding you need to cover day-to-day operations for your business. You can take them out in multiple forms, such as a business line of credit or merchant cash advance, and use them for any business expense.

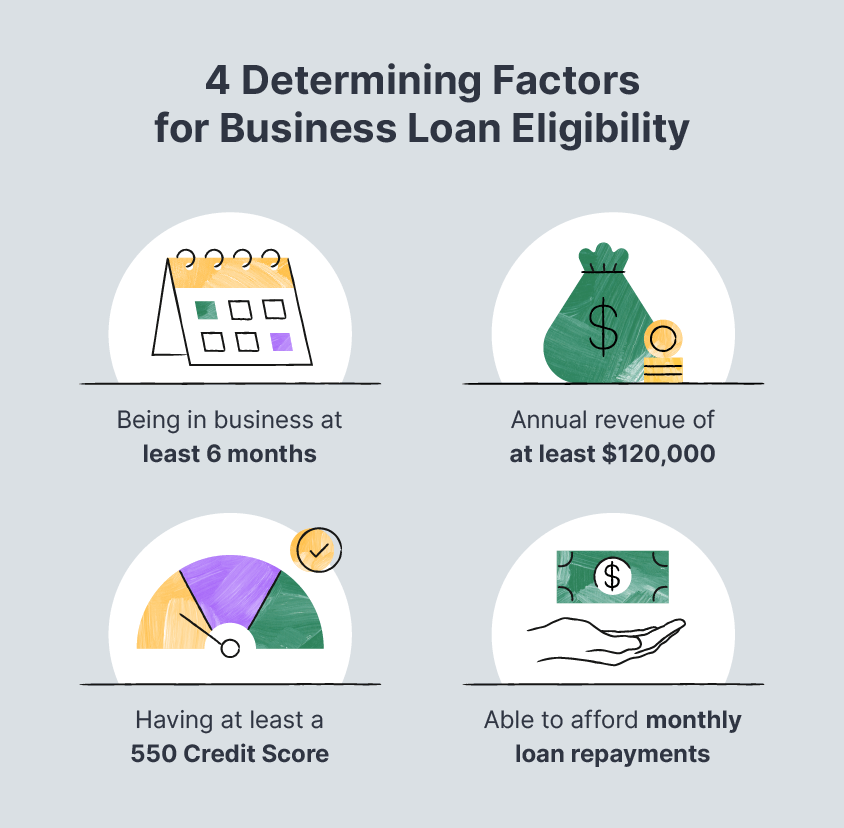

2. Determine Your Eligibility

Though eligibility requirements may differ, here are what most lenders look for when reviewing applications:

Length of Time in Business

Lenders may require you to be in business for at least six months prior. Your time in business is what they use to determine the level of risk lending to you and your creditworthiness. The longer you’ve been in business, the lower your risk is considered.

Annual Revenue

Most lenders want proof of consistent, substantial business income beforehand. We recommend that your business has an average annual income of $120,000 ($10,000 monthly) for the best odds of approval.

Credit Score

Most lenders require a credit score of at least 550 for approval, which helps them determine your creditworthiness. You can pull and monitor your business credit score from credit reporting agencies, like Experian, Equifax, and Dun & Bradstreet.

Ability To Repay

Lenders want to make sure you can afford to repay the loan. They will factor in your income, assets, and liabilities to determine how much you can repay each month. A good rule of thumb is to have an income of at least 1.25 times the total expenses and the repayment amount combined.

3. Compare Potential Lenders

Vet different lenders, as one may provide better offers based on your unique business needs. Also, ask for recommendations from other business owners, especially if you’re unsure if different lenders/applications will perform a soft or hard credit check.

| Lender | Min. Credit Score | Max. Loan Range | Perks |

|---|---|---|---|

| Bank | 660 | $250,000 – $5 million | Low Interest Rates |

| SBA | 550 | $500,000 – $5 million | Long Term Lengths |

| Online | 550 | $10,000 – $5 million | Quick Funding |

Banks

Most traditional banks, like Bank of America, offer a wide range of financing options, including term loans, SBA loans, and business credit cards. You can expect banks to have stricter criteria and a longer application process.

- Recommended for: Businesses with excellent credit scores and in operation for at least two years.

Government Lenders

The SBA provides several programs and loans to support small business owners, accessible through banks and SBA-approved lenders. These loans generally require a down payment. The most common loan is the SBA 7(a), which offers up to $5 million.

- Recommended for: Businesses with good credit scores that can provide at least a 10% down payment of the total loan amount.

Online Lenders

Also known as alternative lenders, online lenders usually provide fast funding to small business owners who were previously denied a bank loan. While interest rates tend to be higher, online lenders typically have fewer restrictions and criteria than banks.

- Recommended for: Businesses with average credit and looking for the fastest possible funding.

4. Prepare Your Loan Application Documents

Before applying for a loan, gather and prepare all of the information lenders will likely require. The most common documents you’ll need include:

- Business Information: Such as your Employer Identification Number (EIN), tax ID, and credit score.

- Business License(s): Requirements for these differ state by state, so you’ll want to make sure these are up-to-date before applying for funding.

- Financial Documentation: Tax returns and any income or cash flow statements, like balance sheets and profit and loss statements.

- Articles of Incorporation: Any bylaws or operating agreement, such as your building lease, required within your business entity.

Since a business plan typically covers and includes all of the above, preparing one can work in your favor.

5. Complete and Submit Your Application

You’re ready to apply once you’ve compared lenders and have your documentation prepared. Most lenders provide applications at your convenience. Applications generally require your business name, the desired loan amount, annual revenue, and the last 4 months of your bank statements as proof of income.

After submitting your application, your Clarify advisor will call you to learn more about your business. You can often get approved and funded within 24-48 hours.

6. Review the Loan Agreement and Accept Funding

Once approved, your lender will send you the loan agreement to review and sign. Be sure to thoroughly review the terms and conditions, repayment schedule, and interest rate, noting anything unclear that you’d like to discuss. After you sign the agreement, your lender will disburse the funds.

Alternative Funding Options

If you are denied the loan, consider exploring other funding options. One option is crowdfunding, which involves raising money from a large number of people. A second alternative is a small business grant, such as those available through the U.S. Small Business Administration.

Frequently Asked Questions

Who can apply for small business loans?

Any small business can apply for a business loan, but it must qualify as one by SBA standards and meet the criteria of the lender.

Can I get a business loan with bad credit?

While most lenders require businesses to have at least a 660 credit score, there are flexible alternatives, like business lines of credit for bad credit.

Can I apply for a business loan with no money?

Yes, you can get a business loan with no money down. Many small business loans don’t require down payments.

Do you need collateral to get approved for a business loan?

Many lenders require collateral, such as equipment and personal assets, for you to get a business loan. Fortunately, there are unsecured business loans that allow you to borrow capital without collateral.

How long does the funding process take?

With some traditional lenders, it can take up to six months for you to receive funds. Online lenders, on the other hand, tend to streamline the application process, where you can receive funding within a few days.

What fees are associated with getting a loan?

In addition to interest, you can expect many lenders to charge origination fees, underwriting fees, and annual fees with their business loans. These fees are usually rolled into the loan’s annual percentage rate (APR.)

Shop Around for the Best Loan Rates

Searching and applying for the right business loan can be stressful and time-consuming, especially when unsure of your eligibility. With Clarify Capital, our in-house account managers connect borrowers with lenders nationwide.

Try our easy application process to help you qualify and match with the best business loans for your needs.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts