Before applying for a loan, it's important for any small business to understand what their monthly payment will look like and how it fits into their cash flow. An SBA loan calculator gives business owners a quick way to estimate payments based on the loan amount, interest rate, and loan term they're considering. It's a practical tool for comparing options, planning ahead, and making sure the financing is truly affordable.

This article breaks down how SBA loans work, what factors affect your payment, and how to use a loan calculator to simplify the process from start to finish.

What Is an SBA Loan, and Who Is It For?

An SBA loan is a type of financing backed by the Small Business Administration. It's designed to help small businesses secure affordable funding through approved lenders. The SBA doesn't issue the loan directly — instead, it guarantees a portion of the loan to reduce the lender's risk. This type of funding makes it easier for eligible borrowers to qualify and get better terms.

SBA loans can be used for a wide range of business needs, including:

Working capital. Manage everyday operating expenses or cover seasonal cash flow gaps.

Real estate. Purchase or renovate commercial property to support business growth.

Equipment. Invest in machinery, vehicles, or technology needed to run your business.

Startup. Cover initial costs when launching a new business or expanding into a new market.

Try Clarify Capital's SBA Loan Calculator

Clarify Capital's SBA loan calculator is a quick and easy tool that helps small business owners estimate their SBA loan payments. It calculates your estimated monthly payment, total interest, and total cost over the life of the loan — giving you a clearer picture of what to expect.

To get your results, just enter the following:

Loan amount. This is the total funding you're applying for.

Interest rate. The annual interest rate is tied to your SBA loan.

Loan term. The repayment period typically ranges from 10 to 25 years.

Down payment. This is the upfront amount you'll put toward the loan.

The calculator works whether you're considering an SBA 7(a) loan, an SBA 504 loan through a CDC, or another type of loan that fits your business needs.

How SBA Loan Payments Are Calculated

SBA loans typically follow an amortization schedule, which means your loan is paid down gradually through fixed monthly payments. Each payment includes both principal and interest, with more interest paid upfront and more principal paid over time.

Your monthly payment is calculated based on:

Loan amount. This is the total you borrow.

Interest rate. The cost of borrowing is set by the lender and influenced by market rates.

Loan term. This is the number of months or years to repay the loan.

Amortization schedule. The repayment structure determines how much of each payment goes toward interest versus principal.

Understanding how these factors affect your payment amount helps you evaluate affordability and make informed financing decisions. SBA loans typically offer a fixed rate, so your monthly payment stays consistent over the life of the loan.

Factors That Impact Your SBA Loan Payment

Several key variables determine your monthly SBA loan payment and the total cost of financing over time. Understanding these factors helps small business owners assess affordability and choose the right loan structure for their cash flow needs.

Credit score. A higher score can help you qualify for better interest rates and loan terms.

Down payment. A larger upfront payment reduces the total amount you need to finance.

Type of loan. Whether you're applying for an SBA 7(a), SBA 504, or another loan program can impact repayment structure and eligibility.

Repayment terms. Longer terms lower the monthly payment but increase the total interest paid.

Prime rate. If you choose a variable-rate loan, changes in the prime rate will affect your payment amount over time.

These factors also influence how lenders evaluate your loan application and determine the best financing options for your business.

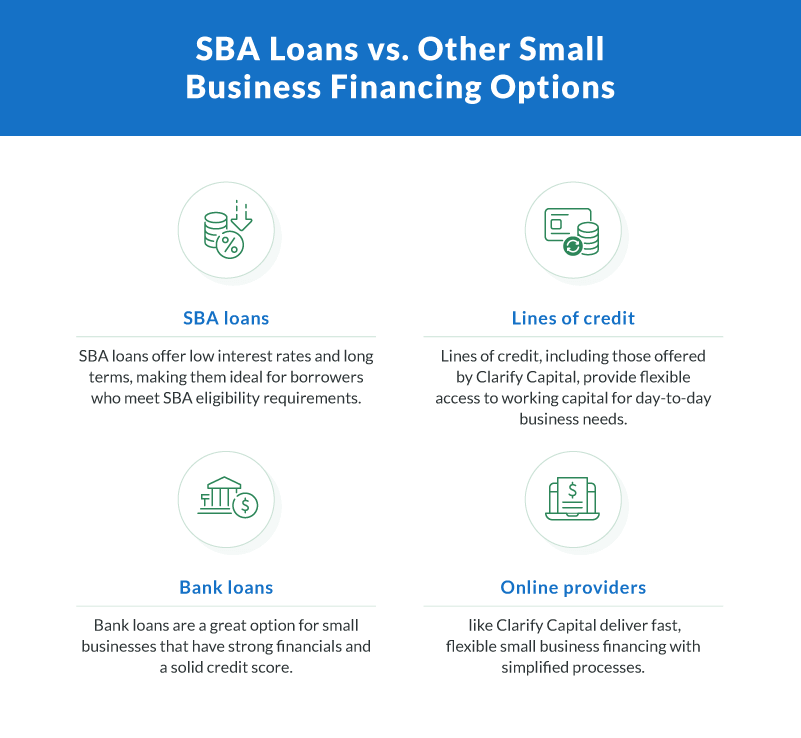

Compare SBA Loans to Other Financing Options

When evaluating how to fund your business, it's important to understand how SBA loans compare to other small business financing options. Below is a quick comparison to help business owners assess the best path forward based on their goals, cash flow, and timeline:

SBA loans. Backed by the Small Business Administration, these small business loans typically offer lower interest rates and longer repayment terms, but they may involve a more detailed loan application process and longer approval time.

Line of credit. A revolving loan option that gives business owners flexible access to capital. It's ideal for managing working capital, covering unexpected expenses, or smoothing out seasonal fluctuations.

Bank loan. Traditional bank loans generally offer competitive fixed rates but often require strong credit, a detailed business plan, and collateral.

Online providers. Online financing platforms like Clarify Capital offer quick access to loan funds through a streamlined application and approval process. These providers are ideal for entrepreneurs seeking speed, flexibility, and customized loan options — such as equipment loans and invoice financing — to suit specific business needs.

What To Know Before Applying for an SBA Loan

SBA loans are known for their favorable terms, but the application process requires preparation. Lenders want to understand your business's financial picture, how much you're requesting, and how you plan to use the funds.

Here's what to expect:

Loan application. You'll complete forms provided by your lender and the SBA.

Financials. Be prepared to submit tax returns, profit and loss statements, and projections.

Business plan. A detailed business plan helps show how the loan will support your growth.

Borrower history. Lenders will evaluate your credit history, experience, and ability to repay the loan.

Upfront requirements. Some SBA loan types may require a down payment or collateral depending on the loan amount.

Planning ahead helps streamline the process and improves your chances of approval.

Use the SBA Loan Calculator To Plan With Confidence

Estimating your monthly SBA loan payments in advance gives you clarity before you apply. The SBA loan calculator helps small business owners understand their payment amount, total cost, and how different loan terms affect their cash flow.

Using a business loan calculator not only supports smarter planning but also prepares you for conversations with lenders and helps you compare financing options with confidence.

Ready to take the next step? Use Clarify Capital's SBA loan calculator to see what your estimated monthly payment could look like, and visit Clarify Capital to explore funding options that fit your goals.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts