Financial projections are forward-looking estimates of your business's income, expenses, and cash flow — and they're essential for both startups and established small businesses. A strong financial forecast helps business owners and entrepreneurs set realistic goals, stay on top of their financial planning, and build a business plan that attracts lenders or investors.

Whether you're launching a startup or scaling an existing operation, projections provide a roadmap for smart decision-making. This article walks you through how to build a reliable forecast, what to include, and how to use our free, downloadable financial projection template to make the process easier and more organized.

What Are Financial Projections and Why Do They Matter?

Financial projections are estimates of your business's future income, expenses, and cash flow over a set period — usually one to five years. For a startup business, projections help assess viability and secure funding.

For a small business already in operation, they guide decision-making and track progress toward goals. Whether you're building a business plan, applying for financing, or planning for growth, financial projections provide the structure to make confident choices.

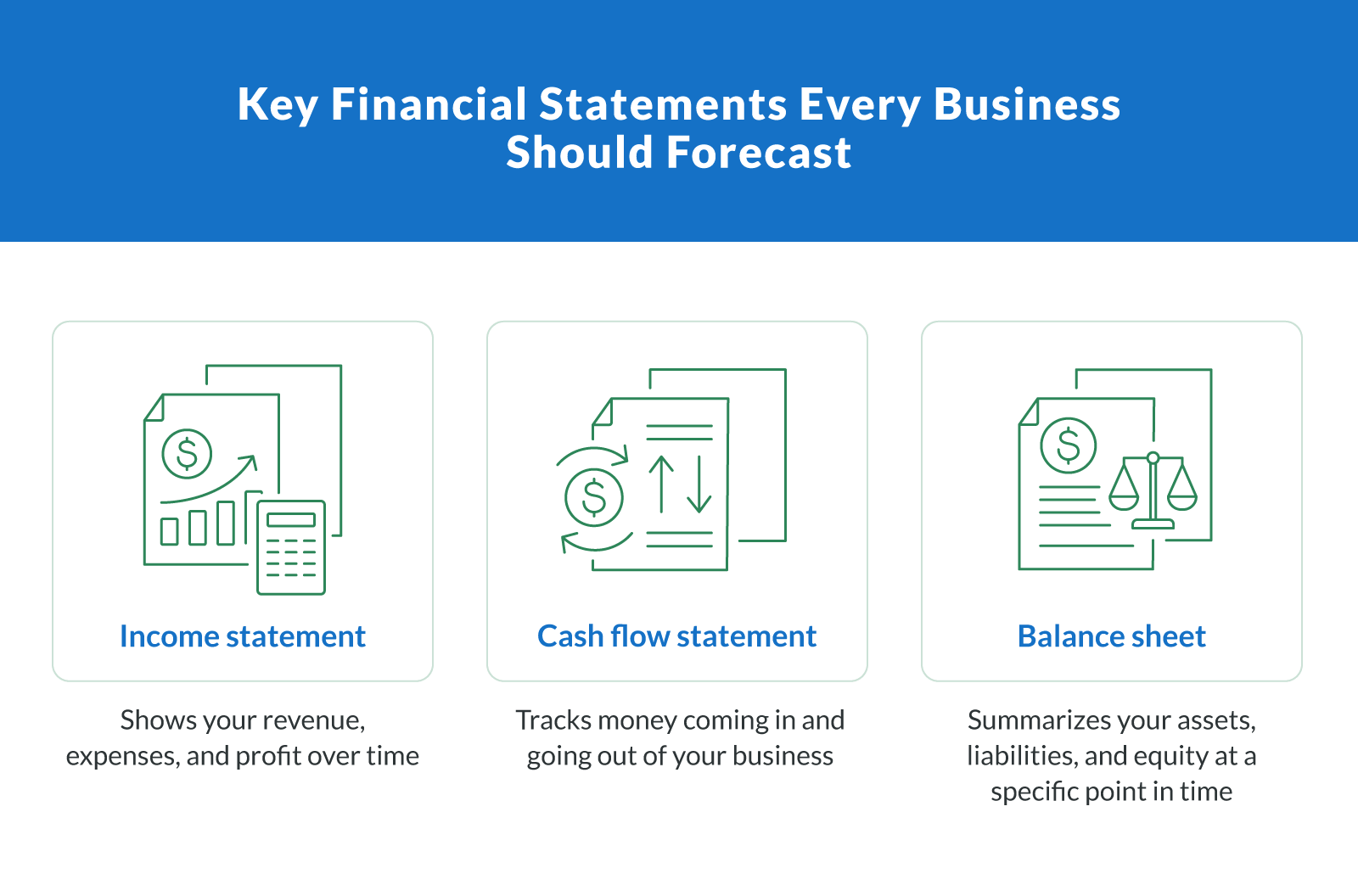

The 3 Core Financial Statements You Need To Project

Projecting your financials starts with building out three essential reports. Each one plays a specific role in painting a clear picture of your business's operations and outlook.

Income Statement

The income statement shows your projected profitability over time. Here's what to include:

Revenue projection. Estimate expected income from sales or services.

Cost of goods sold (COGS). Include direct costs tied to delivering your product or service.

Operating expenses. Factor in rent, payroll, utilities, marketing, and other recurring expenses.

Gross profit and profit margins. Subtract COGS from revenue to determine gross profit and margins.

Net income. Show final earnings after subtracting all expenses from revenue.

Cash Flow Statement

This projection tracks how money flows in and out of your business. It's key for monitoring short-term liquidity and making sure you can meet obligations as they arise.

Cash inflows. Include revenue, loans, or outside investments.

Cash outflows. List all business expenses and debt repayments.

Accounts receivable and payable. Project expected timing for incoming payments and outgoing bills.

Working capital. Measure short-term assets minus liabilities to evaluate cash on hand.

Cash flow projections. Summarize monthly or quarterly cash position to maintain financial stability.

Balance Sheet

The balance sheet is a snapshot of your business's financial position at a given moment. It ties directly into long-term strategy and risk management.

Total assets. Include cash, inventory, equipment, and other owned resources.

Liabilities. List all debts, loans, or other financial obligations.

Current assets. Separate short-term assets from long-term holdings.

Equity. Calculate owner's equity as assets minus liabilities.

Financial ratios. Use your financial data to track solvency and growth potential.

How To Build Your Financial Projections: Step-by-Step

If you're wondering how to write a financial projection, the process is simpler than you might think — especially with the right structure. Whether you're a startup planning your first year or a small business updating your forecast, using a consistent framework helps make your financial model clear and credible.

The steps below tie together your sales forecast, expense planning, and break-even analysis into one cohesive view of your business:

Estimate your revenue. Start with a detailed sales forecast based on historical data, market research, or projected customer demand. Break it down monthly or quarterly, depending on your business type.

Calculate the cost of goods sold (COGS). Identify all direct costs tied to producing your product or service — materials, labor, packaging, etc. This strategy helps you calculate gross profit and set realistic margins.

Outline operating expenses. Include all fixed and variable costs, such as payroll, rent, utilities, software, and marketing. This method will help you estimate your total expenses accurately.

Add startup expenses if needed. For a startup business, include one-time costs like legal fees, initial inventory, and equipment. These expenditures are essential for your launch plan.

Build your income statement. Subtract total expenses and COGS from your revenue to project net income.

Create a cash flow forecast. Factor in timing for payments and collections. Use projected inflows and outflows to build cash flow projections and track your working capital needs.

Develop your balance sheet. Project your assets, liabilities, and equity to complete the picture.

Run a break-even analysis. Use your financial data to calculate when your business will cover its expenses and begin generating profit.

Adjust and review regularly. Update your forecast based on actual results or changes in your business model. Many planners revisit projections quarterly.

For a real-world example, check out this five-year financial projections spreadsheet shared by a Reddit user. It provides a helpful look at how to structure a full financial forecast using Excel or Google Sheets.

Download Clarify Capital's Free Financial Projection Template

To make this process even easier, we created a structured financial projection template designed to guide you through revenue planning, expense tracking, and cash flow forecasting. It's built with Google Sheets, so you can start filling in your numbers immediately — no software or advanced formulas required.

This template is perfect for startups and small businesses that want to build a strong financial foundation without overcomplicating the process. Whether you're applying for funding or just getting your numbers organized, this forecasting template helps turn raw financial data into a clear plan.

Download Clarify Capital's free Financial Projection Template here

Visualize the Data: Using Graphs and Metrics for Insight

Once your numbers are in place, turning them into visuals can make your financial data easier to understand and act on. Charts, graphs, and key metrics help business owners spot trends, compare forecasts to actual results and communicate insights clearly. They're especially useful when presenting your financial planning to investors, lenders, or internal teams.

Common Mistakes To Avoid in Financial Forecasting

Even experienced entrepreneurs can run into trouble with financial projections. Avoiding these common pitfalls will help make your forecast more accurate and useful:

Unrealistic sales forecasts. Overestimating revenue without data to back it up can throw off your entire financial model. Use conservative estimates tied to actual market research.

Ignoring expenses. Underreporting total expenses — especially operational or startup expenses — will inflate your projected net income. Be thorough and honest about costs.

Poor cash flow estimates. Forgetting to factor in the timing of inflows and outflows can lead to liquidity issues. Build detailed cash flow projections to stay on track.

Failing to update projections. A financial forecast is not a one-time task. Regular updates help business owners adjust to real-world changes and keep projections aligned with growth.

Skipping key financial statements. A complete forecast should include an income statement, cash flow statement, and balance sheet. Omitting one creates blind spots in planning.

Forecast Your Financials with Confidence

Creating accurate financial projections isn't just a planning exercise — it's a strategic tool for every startup and small business. With the right approach, business owners and entrepreneurs can build a financial roadmap that supports smarter decisions, stronger cash flow, and long-term success.

Use the free financial projection template to get started, stay organized, and plan with confidence. Whether you're building a business plan or preparing to apply for funding, reliable projections are a key part of financial planning.

Ready to take action? Apply for business funding with Clarify Capital and connect your financial plan to real growth opportunities.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts