Running a business has many challenges, especially when you need the right financing to fuel growth, manage cash flow, or cover day-to-day expenses. Whether you're looking for a line of credit to manage seasonal cash flow gaps or a term loan to expand operations, securing the right loan can be time-consuming and overwhelming.

That's where a loan broker steps in.

What Is a Loan Broker?

A loan broker is a financial professional who acts as an intermediary between borrowers and lenders — similar to how a real estate brokerage matches clients to agents. Essentially, they do the legwork of finding a loan that meets your business needs.

Unlike loan officers, who work for a specific financial institution and can only offer their bank's loan products, a loan broker works independently. They have access to a wide range of lenders — banks, credit unions, online lenders, and alternative financial institutions — and help match you with the best loan for your specific situation.

Loan brokers can assist with various business loans, including SBA loans, term loans, lines of credit, equipment financing, and more. Whether you're a small business owner or running a well-established company, loan brokers help simplify the process of securing financing, especially if you're not familiar with loan programs or don't have time to shop around.

Why Use a Loan Broker?

Business financing can be a complex process. From gathering documents to comparing loan terms for the first time, there's a lot involved in finding the right loan for your business. Loan brokers not only save you time but also improve your chances of getting the best loan terms available. Here's how they add value:

Saving time. Loan brokers handle the heavy lifting — researching, comparing, and negotiating with lenders. This allows you to focus on running your business.

Offering access to multiple lenders. Brokers work with a network of lenders, which increases your chances of finding the most competitive rates and terms.

Expert guidance. With their knowledge of the lending market, brokers help you navigate the often complicated loan application process, ensuring you understand the fine print and avoid any pitfalls.

How Loan Brokers Work

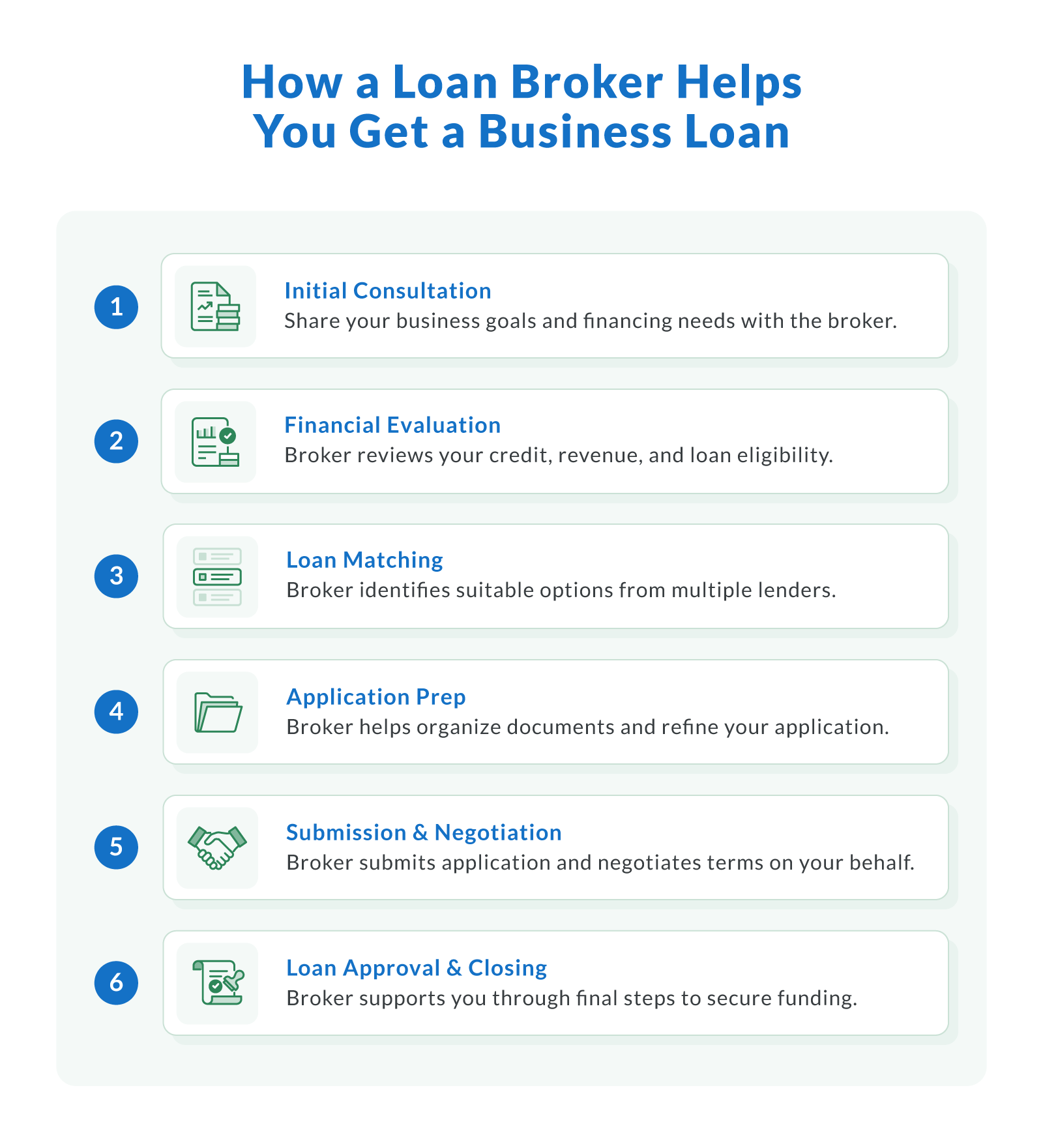

Loan brokers do more than just match you with lenders. They guide you through the entire process, from assessing your financial situation to securing the best possible loan for your business.

How the Process Works

Here's how working with a loan broker typically goes:

Initial consultation. You share your business goals and financial needs with the broker.

Financial evaluation. The broker reviews your credit, financials, and loan eligibility.

Loan matching. They present loan options from a range of providers.

Application prep. The broker helps complete and polish your application.

Submission and negotiation. They submit your application to lenders and negotiate terms.

Loan approval and closing. Once approved, the broker supports you through closing.

The Loan Application Process

The first step in securing a loan is completing the loan application. For many business owners, this process can be overwhelming — especially if you're not familiar with the paperwork required. Loan brokers simplify this by helping you prepare everything you need.

Here's how a loan broker supports you during the loan application process:

Document preparation. Brokers help you gather the necessary documents, such as financial statements, tax returns, business plans, and cash flow projections. They know what lenders look for and make sure your application is complete and accurate.

Single application. Instead of submitting multiple loan applications to different lenders, your broker submits your information to multiple lenders simultaneously, saving you from having to repeat the process over and over.

Managing communications. Brokers act as the go-between for you and potential lenders, managing all communications to ensure a smooth application process.

This not only saves time but also ensures that you're presenting the most compelling case to lenders, increasing your chances of loan approval.

What You Need To Qualify

Use this checklist to prepare for a faster, smoother approval process:

Credit score and history. Good business and personal credit help you access better terms.

Business financials. Lenders want to see balance sheets, income statements, and cash flow.

Business plan. A clear business strategy can help demonstrate loan readiness.

Time in business. Most lenders prefer businesses that have been operating for at least one year.

Revenue. A consistent revenue stream proves your ability to repay the loan.

Common Documents To Gather

To apply for a loan through a broker, you'll typically need:

Business tax returns

Personal tax returns

Profit and loss statement

Balance sheet

Bank statements

Business licenses

Legal business documents (LLC, S Corp, etc.)

Evaluating Your Financial Situation

One of the key roles a loan broker plays is evaluating your business's financial situation. Before they approach lenders, brokers assess several aspects of your finances to determine what kind of loans you qualify for and which lenders are most likely to approve your application.

This evaluation typically includes:

Credit score and credit history. Your business and personal credit scores are important factors that influence the type of loans you qualify for and the interest rates you'll be offered. Brokers review your credit report to identify any potential issues that might affect your loan options.

Financial health. Brokers analyze your business's financial statements, cash flow, and revenue trends to ensure that you're applying for a loan that fits your current financial situation. This helps them identify which lenders are most likely to approve your application based on your financial health.

Loan amount and purpose. Brokers will also help you determine the appropriate loan amount based on your financing needs, whether it's for working capital, equipment purchases, expansion, or real estate investment.

Finding the Best Loan

Once the broker has a clear understanding of your financial situation and your business needs, they will search for the best loan. Here's how brokers identify the right options:

Access to multiple lenders. Brokers have relationships with a variety of lenders, including traditional banks, credit unions, direct lenders, and alternative lenders like online platforms or private lenders. This allows them to cast a wide net and find loan offers that you might not have access to on your own.

Comparing loan terms. Brokers don't just look at interest rates — they compare the full package, including repayment terms, loan amounts, and fees. Their goal is to secure the best loan terms based on your unique financial profile.

Negotiating with lenders. Because brokers work with lenders regularly, they often have more negotiating power than individual borrowers. They can help secure better terms, such as lower interest rates, reduced fees, or flexible repayment schedules.

Once the broker has identified a few options, they'll present you with a shortlist of loan offers, making it easier for you to choose the best fit for your business.

Broker vs Direct Lender: What's the Difference?

Wondering if you should work with a broker or go straight to a lender? Here's a quick comparison:

| Loan Broker vs. Direct Lender | ||

|---|---|---|

| Feature | Loan broker | Direct lender |

| Access to multiple lenders | Yes | No (only offers in-house loans) |

| Personalized loan matching | Yes | Limited to own products |

| Negotiation power | Often higher | Limited |

| Application process | Streamlined with single submission | Individual for each lender |

| Licensing | Broker license required | May vary |

Types of Loan Brokers

Not all loan brokers are the same. Some specialize in securing loans for specific business needs, while others work broadly across industries. Understanding the different types of loan brokers can help you choose the right one for your business.

Business Loan Brokers

A business loan broker specializes in securing financing for businesses of all sizes. They can assist with a wide range of loan options, including:

SBA loans. These government-backed loans offer favorable terms for small businesses. However, these loans often require more documentation and have a longer approval process. A loan broker can help you navigate this.

Term loans. With these traditional loans, you receive a lump sum up front and repay it over a set period with fixed monthly payments. This is ideal for large, one-time expenses like purchasing equipment or expanding your business.

Business lines of credit. This flexible financing option allows you to borrow up to a certain limit, only paying interest on the funds you actually use. It's ideal for managing cash flow or handling unexpected expenses.

Equipment financing. These loans are specifically for purchasing equipment, and the equipment itself often serves as collateral (anything from machinery to vehicles or office technology).

Commercial real estate loans. Here's an option that lets you purchase or refinance property for your business. Brokers can help you secure the right financing for everything from office buildings to warehouses. In some cases, brokers can even coordinate with a real estate agent to streamline the process.

Specialized Brokers

Some loan brokers focus on specific types of loans or industries, offering deeper expertise in certain areas. For example:

Invoice factoring brokers specialize in financing that allows businesses to sell their unpaid invoices to a lender in exchange for immediate cash. This can be a great option for businesses with outstanding invoices that need quick access to cash.

Merchant cash advance brokers specialize in cash advances that are repaid based on your business's future credit card sales. While these advances can be more expensive than traditional loans, they provide quick access to funds.

Choosing the right loan broker depends on your specific business needs. If you're looking for general business financing, a business loan broker is likely your best bet. But if you need a specific type of loan, such as equipment financing or invoice factoring, a specialized finance broker might be the better option.

Benefits of Using a Loan Broker

Wondering why you should use a loan broker instead of applying directly with a lender? Here are the key benefits:

Access to Multiple Lenders

One of the main advantages of working with a loan broker is their access to a wide network of lenders. Instead of relying on a single bank or credit union, brokers can connect you with a range of potential lenders, including:

Traditional banks

Credit unions

Online lenders

Alternative lenders

This increases your chances of finding a loan with terms that meet your needs. Different lenders have different requirements, and a loan broker can match you with the right one for your financial profile.

Saving Time and Reducing Stress

Applying for a business loan can be a long, complex process. A loan broker does the heavy lifting for you by:

Researching and comparing loan options

Preparing your loan application and documentation

Submitting your application to multiple lenders

Managing communications with lenders and ensuring you meet deadlines

Brokers let you focus on running your business while they take care of the time-consuming details.

Negotiating Better Rates and Terms

Loan brokers often have established relationships with lenders, which gives them more leverage when negotiating loan terms. Brokers can help you:

Secure lower interest rates

Extend repayment terms

Reduce fees such as loan origination fees or closing costs

This can make a big difference in the total cost of your loan, saving your business money in the long run.

Expert Guidance Through the Process

Navigating the loan application and approval process can be tricky. Loan brokers help you avoid common pitfalls by:

Ensuring that your application is complete and accurate

Walking you through the underwriting process

Helping you understand loan terms and avoid hidden fees

Managing the closing process to ensure everything goes smoothly

Their expertise helps minimize delays and increases your chances of getting approved quickly.

Loan Broker Fees and How They Get Paid

While loan brokers provide a valuable service, it's important to understand how they get paid and what fees you'll be responsible for.

How Do Loan Brokers Get Paid?

Loan brokers typically get paid in one of two ways:

Lender-paid commissions. Many loan brokers earn a commission from the lender when your loan is approved. This means you don't have to pay them directly, but it's important to know that the lender's fee may still be built into your loan pricing.

Borrower-paid fees. Some brokers charge an up front fee or a percentage of the loan amount. This fee is usually included in your closing costs and is paid when your loan is finalized.

Are Fees Disclosed Up Front?

Yes. Reputable brokers will disclose all fees and commissions before you proceed. Disclosure practices are often governed by federal law or industry regulations to protect borrowers and support transparency.

Always ask for a written breakdown of costs and make sure it aligns with your loan agreement. This builds trust and helps you avoid surprises during the loan process.

Choosing the Right Loan Broker

Not all loan brokers are the same, so how do you choose the right one for your business? Here are some tips:

Look for Experience

Choose a broker with years of experience in securing the type of loan you need. If you're looking for an SBA loan or commercial real estate financing, work with a broker who specializes in these areas. Experienced brokers will have a deeper understanding of the nuances involved in different types of business loans.

Check Credentials

Ensure that your broker is licensed and has the proper credentials. For instance, mortgage brokers or a mortgage company should be licensed through the Nationwide Multistate Licensing System (NMLS ID). For business loans, check for professional affiliations or certifications that demonstrate expertise in the lending market. Licensing requirements may vary for commercial versus mortgage lending, so be sure to verify your broker's qualifications.

Get Referrals and Read Reviews

Check reviews and ask for referrals from other business owners. A loan broker's reputation speaks volumes about their ability to deliver results and provide a smooth, stress-free experience.

Ask About Their Network

A good loan broker should have access to a wide network of lenders. The more options they can offer, the better your chances of securing a loan with favorable terms.

Why a Loan Broker Is Your Best Bet for Business Financing

Securing the right loan for your business can make or break your ability to grow, manage cash flow, or tackle unexpected expenses. A loan broker simplifies this process by helping you find the best financing options, saving you time and potentially securing better rates and terms than you could get on your own.

Ready to secure funding for your business? Contact a trusted loan broker or apply for a business loan today with Clarify Capital. With Clarify Capital's expert guidance, you'll get access to a wide range of loan options and financial services tailored to meet your business needs. Start your application now and find the best loan for your business!

FAQ About Loan Brokers

How Much Does a Loan Broker Cost?

Costs vary. Some brokers are paid by the lender (commission), while others charge you directly. Always ask for full fee disclosure before proceeding.

What's the Difference Between a Broker and a Loan Marketplace?

A broker works one-on-one with you and negotiates with lenders on your behalf. A loan marketplace is a platform that shows multiple lender offers, but you handle the applications and negotiations yourself.

How Do I Choose the Right Broker?

Look for licensing, experience with your loan type, and positive reviews. A broker's broker license, lender network, and past client success are all good indicators.

How Are Loan Brokers Different From Loan Officers?

Loan brokers are independent and work with multiple lenders, while loan officers are employed by a single bank or credit union. Loan officers can only offer the products from their institution, while brokers can provide a wider range of options.

Do Brokers Help With All Types of Loans?

Yes, business loan brokers can help with a variety of financing options, including SBA loans, lines of credit, equipment financing, and more. Specialized brokers may focus on particular types of financing, like invoice factoring, mortgage loans, or real estate loans.

Are Brokers Better Than Applying Directly to a Lender?

For many business owners, working with a loan broker is a better option because brokers can compare multiple lenders, saving you time and increasing your chances of securing better rates and terms.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts