No credit check business loans offer small business owners the opportunity to access essential business funding without relying on credit scores or credit history. In this guide, you'll learn how to qualify, explore various financing options, and discover actionable steps to strengthen your business credit for future funding opportunities.

For many entrepreneurs and small business owners, accessing capital is critical for growth. Whether you're a startup or an established business, small business loans and other business financing options help cover essential needs like working capital, equipment, or expansion costs. However, traditional lenders often base loan approvals on a borrower's creditworthiness, which can leave those with poor credit or no credit history at a disadvantage.

No credit check business loans provide a solution by focusing on alternative factors like cash flow, monthly revenue, bank statements, annual revenue, and collateral rather than a personal credit score alone. Many business funding providers review your recent bank statements and business performance instead of relying on traditional credit scoring, and some can offer fast funding or even same-day funding for qualified applicants.

This guide provides a detailed breakdown of the types of no-credit check loans available, steps to improve eligibility, and answers to common questions about this financing option.

What Are No Credit Check Business Loans?

No credit check business loans are a form of business financing where lenders don't rely primarily on your personal credit score or business credit score as part of the application process. Some key factors lenders review instead of your credit score include the following:

Cash flow. Consistent revenue and strong cash flow show your ability to repay.

Bank statements. Proof of deposits, a healthy business bank account, and stable account activity help business lenders evaluate risk.

Outstanding invoices. Unpaid invoices and other accounts receivable can be used as collateral for invoice factoring.

Collateral. Assets like equipment, real estate, or receivables help secure loans and may support larger approved loan amounts.

In many cases, no-credit-check business loans avoid a hard credit check that appears on your credit report with the major credit bureaus. Some providers may still run a soft credit pull to verify your identity and review basic credit history, but approval depends more on cash flow, monthly revenue, annual revenue, and recent bank statements than on a strict credit score requirement or minimum credit score.

These loans are particularly helpful for business owners with bad credit or low credit scores who may not qualify for traditional loans that rely heavily on personal credit and business credit scores. However, they often come with higher interest rates to compensate for the increased risk lenders take.

Why Choose No Credit Check Loans?

Many small business owners, especially startups, face challenges accessing traditional loans due to strict credit requirements and credit score cutoffs. No credit check loans offer an alternative pathway to funding, particularly for entrepreneurs with unique business needs, different types of business models, or low credit scores and limited credit history.

Owners with bad credit often turn to these loans when they need short-term help with cash flow or working capital and don't meet a traditional lender's eligibility rules.

Benefits of No Credit Check Loans

Accessibility. Designed for borrowers with poor credit, low credit, or no credit history and low credit scores.

Quick approval process. Online lenders often provide decisions within 24–48 hours, which can lead to fast funding or even same-day funding for qualified applicants.

Flexible funding options. Includes merchant cash advances, invoice factoring, equipment financing, working capital loans, and other short-term loan options.

Diverse use cases. Suitable for covering working capital, purchasing real estate, expanding operations, or managing short-term cash flow gaps.

Drawbacks of No Credit Check Loans

Higher interest rates. These loans come with higher interest rates compared to many traditional loans and SBA loans.

Short repayment terms. Some options require frequent payments (daily, weekly, or monthly), which can affect your cash flow and limit the loan amounts you can comfortably manage, whether you choose a lump sum or a revolving line of credit.

No credit check loans may not be the cheapest financing option, but they can provide a lifeline for small business owners with urgent funding needs and can fill gaps when other types of business loans aren't available.

"There's hope with a low credit score! Clarify Capital was there for me when no one else was. I'd like to thank Bryan and Adam for staying in constant communication and making this process a breeze. I look forward to continuing to work with them."

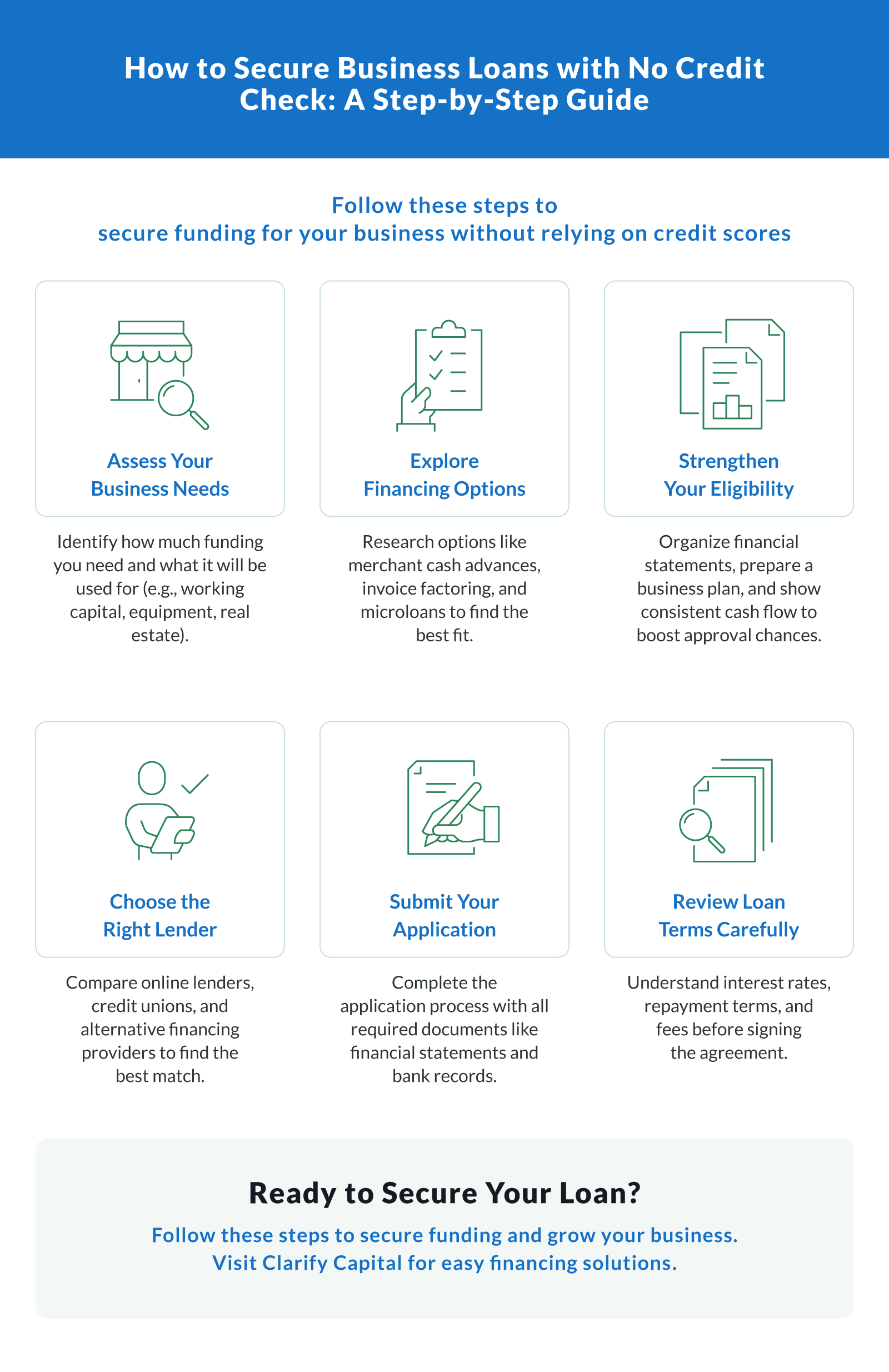

Step-by-Step Guide to Securing a No Credit Check Loan

Securing a no-credit-check loan involves careful planning, research, and preparation. It helps you move from defining your business needs to choosing a lender and signing your agreement with confidence.

1. Identify Your Business Needs

The first step is determining why you need the loan and how much funding you require. Common reasons include:

Working capital. Helps cover daily expenses like payroll, rent, or inventory.

Equipment financing. Used for purchasing or upgrading tools, machinery, or vehicles.

Real estate. Used to purchase or lease new business space.

Startup costs. Important for launching a new business or expanding operations.

Your type of business and reason for borrowing influence the loan amounts you can qualify for, the repayment terms you accept, and whether you choose a lump sum term loan, a revolving business line of credit, or a working capital loan.

2. Explore Financing Options

Researching the right loan type is critical. These loan options and funding options can work well for owners who want to avoid a hard credit check and focus on business funding based on revenue and cash flow. Here are popular no-credit check financing options (more on this later):

Merchant cash advances (MCAs). Provide upfront funding based on future sales.

Invoice factoring. Converts unpaid invoices into immediate cash by using outstanding invoices as collateral.

Microloans. Small loans tailored for startups and new businesses.

Crowdfunding. Raises funds from a large pool of backers.

Business lines of credit. Offers revolving credit for ongoing expenses.

3. Strengthen Your Eligibility

Even though credit checks are not required, lenders still evaluate your financial health. They look at your bank account activity, business bank account history, and overall cash flow instead of a strict credit score requirement. Here's how to improve your eligibility:

Organize financial documents. Include financial statements, recent bank statements from your business bank account, and tax returns so lenders can complete underwriting.

Show consistent cash flow. Business lenders value steady revenue streams, strong monthly revenue, and reliable annual revenue.

Provide collateral. Real estate, equipment, receivables, and other accounts receivable can strengthen your application.

Prepare a business plan. Outline how the loan will be used, how it supports your business needs, and how you'll repay it.

4. Choose the Right Lender

Selecting the right lender is essential to securing favorable terms. Many business lenders and providers specialize in working with borrowers who have bad credit or low credit scores, so it pays to compare options. Options include:

Online lenders. Fast approvals and flexible terms for businesses with poor credit and low credit scores, sometimes with no hard credit pull at the initial application stage.

Credit unions. Community-focused institutions offering microloans and alternative financing.

Nonprofits. Ideal for startups or underserved small businesses.

5. Submit Your Loan Application

Submit a complete application with all required documents. A thorough application improves your chances of approval and ensures a smooth process. Most lenders share timelines in business days, and a complete loan application can help you get fast funding or even same-day funding if you meet their approval process requirements.

6. Review Loan Terms Carefully

Before signing, review the loan agreement for:

Interest rates. Ensure they align with your budget and cash flow, and remember that high interest rates increase the total cost of borrowing over time.

Repayment terms. Understand whether payments are daily, weekly, or monthly. Shorter repayment terms can feel tighter on cash flow, even if the loan amount is smaller.

Fees. Look for origination fees, late fees, or prepayment penalties. If you have a good credit score, compare these terms with traditional loans or SBA loans to be sure a no-credit-check option still fits your goals.

Types of No Credit Check Business Loans

Understanding the different types of business loans that don't require a credit check will help you select the best funding option for your business.

Merchant Cash Advance

Receive funds up front and repay through a percentage of daily or weekly sales. These advances often arrive as a lump sum that you repay from credit card and debit card transactions, and merchant cash advances (MCAs) can provide fast funding or even same-day funding for eligible businesses.

Best for: Businesses with steady credit card transactions

Pros: Fast funding, no collateral required

Cons: Higher interest rates can make MCAs one of the more expensive types of business loans, daily repayments can strain cash flow

Invoice Factoring

Sell outstanding invoices to a lender for immediate cash. A factoring company buys your unpaid invoices and other accounts receivable at a discount, which can work like a short-term working capital loan based on customer payments.

Best for: Businesses with unpaid invoices and reliable clients

Pros: Quick funding, doesn't rely on credit scores

Cons: Reduced profit margins, relies on timely customer payments

Equipment Financing

Use equipment as collateral to secure funding for purchases or upgrades. Lenders focus on the equipment value, expected useful life, loan amounts, and business cash flow rather than strict credit scores alone.

Best for: Businesses needing to acquire or upgrade tools or machinery

Pros: Fixed payments, ownership after repayment

Cons: Limited to equipment-related expenses, equipment value may depreciate

Microloans

Small, short-term loans are provided by nonprofits or community lenders. These microloans often support startups and small business owners who don't meet a traditional minimum credit score with larger institutions.

Best for: Startups or businesses with minimal funding needs

Pros: Low interest rates, support for new businesses

Cons: Smaller loan amounts, lengthy approval process

Business Line of Credit

Offers revolving credit for recurring expenses. Some lenders may approve a business line of credit without a hard credit check if your revenue and financials are strong.

Best for: Businesses with fluctuating cash flow needs

Pros: Flexibility to borrow as needed, pay interest only on what you use

Cons: Risk of overuse, may require a personal guarantee

Frequently Asked Questions

Understanding no-credit-check business loans can be overwhelming, especially with so many types of financing options and lenders available. Below, we answer some of the most common FAQs business owners and entrepreneurs have about this type of business funding and financing options. These insights will help you make an informed decision that suits your business needs.

Can Startups Get No Credit Check Loans?

Yes, startups can qualify for no-credit check loans by leveraging alternative criteria like strong cash flow, providing collateral such as equipment or receivables, or presenting a detailed business plan.

Additionally, startup business loans, microloans, and crowdfunding are excellent options tailored specifically for new businesses.

Many founders also ask if they can get a business loan with no credit, which is often possible if the business shows healthy cash flow and a realistic plan.

Do No Credit Check Loans Always Have Higher Interest Rates?

Higher interest rates are common for business loans with no credit check since lenders take on greater risk by not evaluating credit scores. However, borrowers can reduce costs by offering collateral, demonstrating consistent cash flow, or comparing multiple lenders to secure competitive rates.

What Documents Are Needed for the Loan Application?

Even without a credit check, lenders require financial documentation to assess eligibility. You'll typically need:

Financial statements and cash flow reports

Bank statements showing regular deposits and stable balances

A business plan outlining how you'll use the loan and your repayment strategy

Proof of collateral, such as equipment, real estate, or receivables

Are There Alternatives to No Credit Check Loans?

Yes, several alternatives exist, including:

SBA loans. Government-backed loans with favorable terms for eligible businesses

Invoice financing. Converts unpaid invoices into working capital

Business grants. Non-repayable funds for specific industries or business initiatives

Traditional loans. Suitable for borrowers with strong credit and financials

Crowdfunding. Allows businesses to raise funds from their community or customers

Are There Truly No Credit Check Business Loans?

Many lenders advertise no-credit-check business loans, but most still review your business performance and may run a soft check instead of a hard credit check. Approvals usually depend more on cash flow, revenue, collateral, and recent bank statements than on a strict score cutoff, which helps protect your credit report while you explore options.

How Long Does the Approval Process Take?

The approval process for no-credit-check loans is typically faster than traditional loans. Online lenders often approve applications within 24–48 hours, while more complex loans like invoice factoring or equipment financing may take a few days.

Build Your Business With Flexible Financing

No credit check business loans give entrepreneurs and small business owners a practical way to access business funding when traditional credit requirements are a barrier. When you understand your options, prepare your documents, and choose a lender that fits your business, you can move forward with confidence. Clarify Capital offers fast funding based on your revenue, not just your credit score.

Ready to move ahead? Apply online today and check your eligibility without a hard credit pull.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts