Key Takeaways:

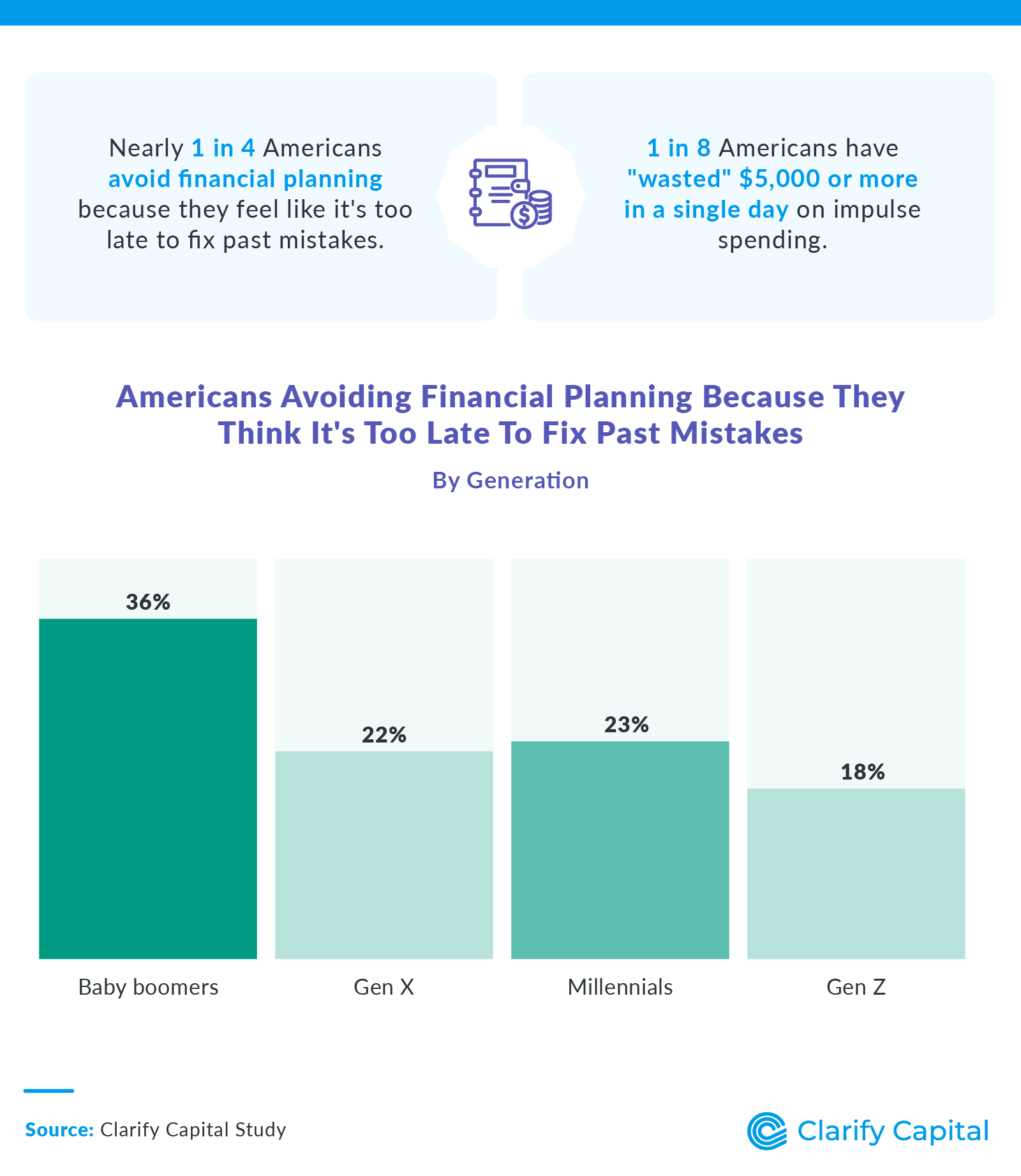

1 in 8 Americans have "wasted" $5,000 or more in a single day on impulse purchases.

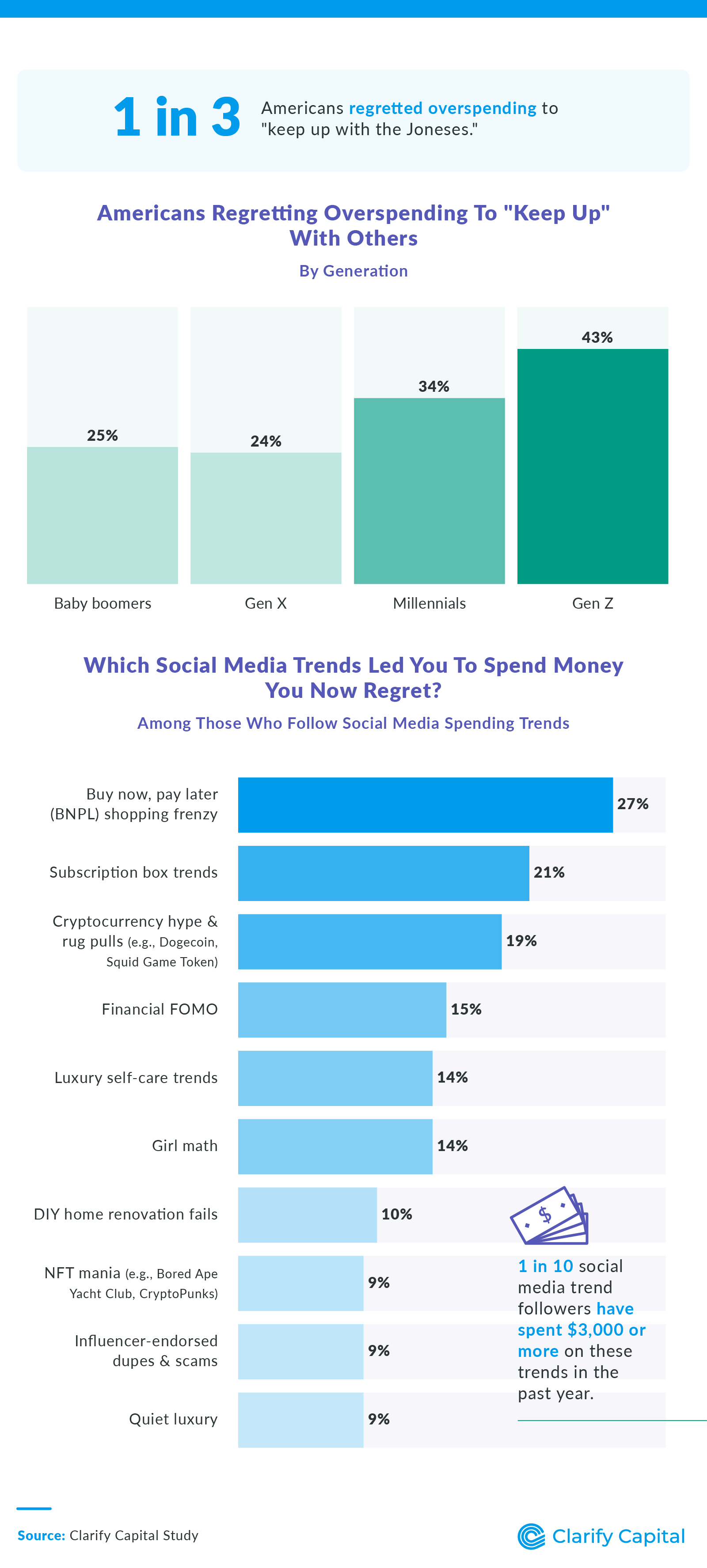

1 in 3 Americans regret overspending to "keep up with the Joneses."

1 in 10 Americans regret quitting a job without a backup plan.

Over 1 in 2 Americans (55%) say financial regret has increased their stress and anxiety.

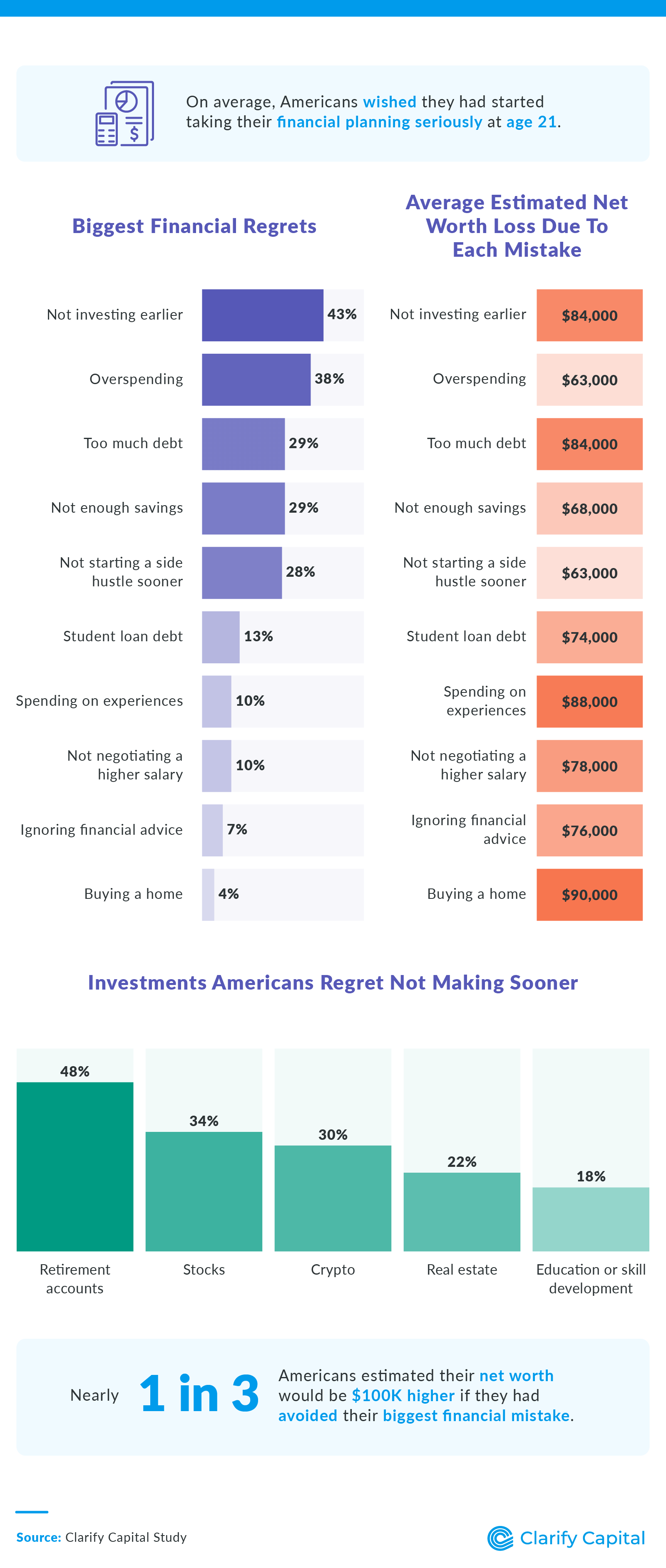

1 in 3 Americans believe their net worth would be $100K higher if they had avoided their biggest financial mistake.

The Cost of Financial Regrets

Many Americans look back on their financial choices and wish they had done things differently. From impulse buys to not saving enough, these regrets often affect how people manage their money moving forward.

One of the biggest financial lessons Americans struggle to learn is saving and investing early for retirement — 18% admitted they keep making this mistake. Poor budgeting was another recurring issue (13%), as was impulse spending (15%).

On average, Americans have wasted $1,000 on impulse purchases in a single day. A quarter of them have spent $2,000 or more impulsively in one day, while 1 in 8 have wasted $5,000 or more. One in 10 Gen Zers admitted to repeatedly making this financial mistake, spending an average of more than $800 in a single day on impulse purchases.

Beyond spending regrets, 1 in 10 Americans said quitting a job without a backup plan was the one big financial decision they wish they could take back. Walking away from a steady paycheck without a safety net can lead to unexpected financial struggles, especially if finding new work takes longer than expected.

Americans' biggest financial regrets were not investing earlier in life, overspending, and taking on too much debt. On average, they estimated their net worth would be $40,000 higher today if they had avoided their biggest financial mistake, while 1 in 3 believed they'd have $100,000 more in their accounts.

Retirement accounts topped the list of investments Americans regretted not making sooner. Nearly half (48%) said they should have started saving earlier, including 56% of Gen X, 51% of baby boomers, and 35% of Gen Z. Many Gen Zers also wished they had bought stocks sooner (42%), while 28% regretted not investing in education or skill development — over three times more than Gen X (9%).

Crypto was another source of investment regret. Those who wished they had invested earlier estimated they could have $125,000 more in net worth today. Millennials (36%) and Gen Z (31%) were more likely to regret missing out compared to Gen X (26%) and baby boomers (10%). Real estate investment was another missed opportunity for 22% overall, with millennials (26%) and Gen X (20%) being more regretful than baby boomers (14%).

Americans took different approaches to recover from financial mistakes. More than a third (37%) cut all non-essential spending, while 23% started saving and investing aggressively. Another 23% took on multiple jobs or side gigs to rebuild their finances. However, not everyone felt empowered to take action — 21% became afraid to invest altogether, and 19% avoided managing their finances entirely.

The Emotional Toll of Financial Regret

Money mistakes don't just impact bank accounts — they also take a toll on mental health, relationships, and overall well-being. Many Americans struggle with the weight of financial regrets, often feeling stuck, stressed, or ashamed about their past decisions.

Overspending was a common source of regret, with 1 in 3 Americans admitting they've spent money to "keep up with the Joneses." This was especially true for younger generations: 43% of Gen Z and 34% of millennials regretted overspending to fit in, compared to 25% of baby boomers and 24% of Gen X.

Social media has only intensified these spending pressures. Among trend followers, 27% regretted "buy now, pay later" shopping sprees, while 21% wished they hadn't signed up for subscription boxes, and 19% fell for cryptocurrency hype and rug pulls. Other missteps included financial FOMO (15%), luxury self-care trends (14%), and "girl math" (14%). One in 10 spent $3,000 or more on these trends in the past year.

For many, financial regrets take a serious emotional toll. More than half of Americans (55%) said it has increased their stress and anxiety, while 34% admitted to feeling stuck or hopeless about improving their situation. Another 31% said financial regret has made them feel embarrassed or ashamed. Some (22%) even reported long-term struggles, saying they've lost confidence in their ability to make smart money decisions.

Money missteps have also affected relationships. About 1 in 5 said it has led to fights with a spouse or partner, and 15% admitted to keeping purchases or debt a secret from loved ones. However, not all regret has been negative. For 26%, it has been a wake-up call, motivating them to take control of their finances and make better money decisions moving forward.

Tips for Avoiding Financial Regrets

Start now, even if it's just $10 (or securing a business loan to scale)

The biggest regret? Not saving or investing sooner — whether for retirement, a home, or business growth. Many business owners wish they had secured funding earlier to seize opportunities. Automating savings, setting up a high-yield savings account, or contributing a small amount to an investment account can help build momentum.

Balance saving with reinvesting

Many regret overspending personally, but others regret being too frugal. A 50/30/20 rule (allocating 50% to needs, 30% to wants, and 20% to savings and investments) can help individuals and business owners create a sustainable financial balance.

Spending "for the moment" lasts longer than the moment

Short-term splurges can have long-term financial consequences. Credit card purchases don't disappear when the Instagram likes do, and neither do business debts from unplanned spending. Setting a 24-hour or 30-day "cool-off period" before making big purchases can help curb impulse spending.

Watch for financial red flags.

If you don't know your exact personal or business-related expenses or debt, that's a problem. For business owners, poor cash flow management is a top reason companies struggle to secure funding. A simple monthly financial check-in (tracking spending, reviewing bank statements, and monitoring credit scores) can help avoid costly mistakes.

Mistakes aren't the end — they're a lesson.

The best way to recover from financial missteps is to stay consistent with a plan like rebuilding credit, increasing savings, or structuring business debt wisely. Start by identifying the mistake, making a repayment or investment plan, and setting small, achievable financial goals. Progress, not perfection, is key.

Turning Regret Into Financial Growth

Financial mistakes are a common experience, but they don't have to define a person's future. Many Americans have used regret as a learning opportunity, adjusting their spending, investing, and saving habits to build a more secure financial future. The key is recognizing past missteps, making a plan, and staying to better money habits. While mistakes are bound to happen, they also offer valuable lessons that can lead to smarter financial decisions in the future.

Methodology

We surveyed 1,000 Americans to uncover their biggest financial regrets. The average age of respondents was 41; 50% were female, and 50% were male. Generationally, 10% were baby boomers, 21% were Gen X, 52% were millennials, and 17% were Gen Z.

About Clarify Capital

Clarify Capital helps business owners secure the financing they need to thrive in today's competitive marketplace, including no-doc business loans and fast business loans. Our tailored financial solutions support entrepreneurial dreams, turning visions into reality.

Fair Use Statement

These insights are available for noncommercial use as long as you provide a link back to our article.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts