Running payroll in 2025 isn't just about writing checks — it's about navigating tax deadlines, employee classifications, benefit deductions, and compliance rules. It's no wonder 41% of small business owners still manage payroll themselves, often spending up to five hours per pay run. That's valuable time better spent growing your business.

This guide breaks down payroll management for small businesses into simple, actionable steps. Whether you're setting up payroll for the first time or trying to streamline your existing payroll process, you'll get a clear roadmap to stay compliant, save time, and cut costs. We'll walk through setup basics, cost comparisons, compliance essentials, and the latest tools and templates designed to help your small business run payroll with confidence.

Why Smart Payroll Management Matters in 2025

For many small businesses, payroll isn't just another admin task — it's a major source of avoidable costs. From misclassifying workers to missing tax deadlines, poor payroll systems quietly drain resources and put business owners at risk of fines and employee dissatisfaction. In fact, one in three small business owners make payroll errors, and about 40% are hit with an average of $845 in IRS penalties each year due to payroll irregularities.

The good news? A few strategic changes can go a long way. If you know how to manage payroll costs, you can reduce risk, boost compliance, and free up time. These small business payroll tips—like switching to digital tax filing or automating calculations — help you streamline operations and protect your bottom line. Smart payroll management doesn't just help you avoid the IRS. It also builds employee trust and gives your team confidence that their paychecks will be accurate and timely.

Step-by-Step Payroll Setup for Small Businesses

Getting your payroll system up and running doesn't have to be complicated. With a solid structure, small businesses can make payroll easier, stay compliant, and avoid expensive mistakes. A well-run system also smooths out onboarding and takes care of the details when you bring on new hires.

The steps below cover everything — from getting an EIN to calculating payroll taxes and keeping your records clean. Whether you're hiring your first employee or fine-tuning an existing setup, this guide keeps you on track and in compliance.

Register Your Business and Get an EIN

The employer identification number (EIN) is like a Social Security number for your business, and it's legally required if you plan to hire employees. You'll need it to file tax forms, report wages, and handle employment taxes and federal tax filings. Without one, you risk delays and potential penalties.

Generally, an EIN is required to hire employees. You can apply for free through the IRS EIN portal.

Classify Your Workers Correctly

Properly categorizing your team as either employees or independent contractors protects you from tax issues and lawsuits. Under the FLSA and IRS guidelines, misclassification can lead to audits, back taxes, and fines.

Misclassification can lead to IRS penalties. Review job duties, hours, and control level to determine the right classification before processing payroll.

Choose a Pay Schedule and Method

Your pay period or payroll schedule (weekly, biweekly, or monthly) affects cash flow and employee satisfaction, especially for hourly employees who depend on consistent pay periods. Most businesses find biweekly or semi-monthly pay easier to manage. Also, choose how you'll deliver pay: direct deposit is now the norm.

In fact, 93% of employees receive pay via direct deposit. Be consistent with pay dates to avoid late payments and protect employee pay.

Calculate Gross Pay, Deductions, and Net Pay

Once you set the pay rates, calculate employee wages (gross pay), subtract tax withholdings (federal tax, state tax, FICA, Social Security, Medicare), and benefit deductions — like health insurance or retirement plans — to arrive at net pay. Don't forget to include deductions for employee benefits such as health insurance, vision, dental, or workers' compensation insurance.

Total payroll cost = 1.25 to 1.4 times salary when you factor in benefits and taxes. Use trusted tools like Gusto or Patriot Software to automate this step.

File and Remit Payroll Taxes

Employers must submit payroll taxes to federal, state, and local agencies on time and accurately, including unemployment insurance contributions required in most states. This includes both employee withholdings and employer-matched taxes.

Seeing as 25% of small businesses are fined for tax mistakes annually, consider using the IRS Tax Calendar for Businesses and automating filings to avoid penalties.

Maintain Payroll Records and Reports

Keep accurate employee information, tax return records, pay stubs, and time sheets for at least four years. These records are vital for audits and compliance. Data shows that 33% of employers make costly payroll mistakes, often due to missing or incorrect records. Download our free Recordkeeping + Tax Deadlines Checklist to stay on top of your requirements.

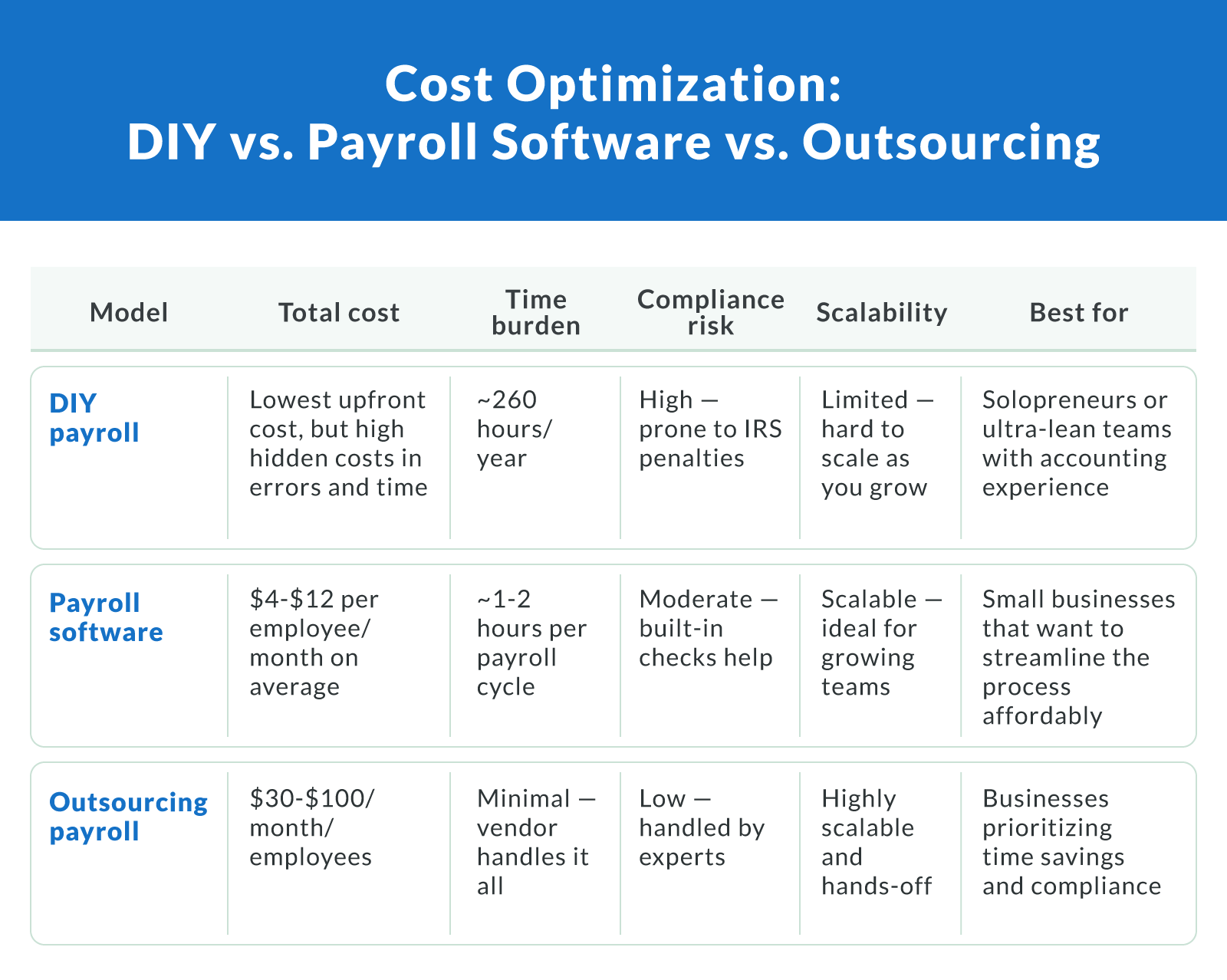

Cost Optimization: DIY vs Payroll Software vs Outsourcing

When deciding how to manage payroll costs, small business owners need to weigh more than just price. The time spent processing payroll manually, the risk of compliance errors, and the potential for scalability all play a role in long-term efficiency and ROI. Below is a side-by-side comparison to help you choose the right method for your business.

While manual payroll or DIY methods might look cheaper upfront, they often come with steep learning curves and higher risks. In contrast, payroll software strikes a balance between cost and control, automating much of the process while allowing business owners to stay hands-on. If you're ready to delegate, outsourcing payroll offers peace of mind, especially for companies scaling quickly or juggling complex compliance needs.

By choosing the right model, you can streamline operations, reduce errors, and reinvest saved time into business growth.

Recommended Payroll Software for Small Business Owners

Choosing the right payroll provider can significantly reduce administrative time and minimize compliance errors. In 2025, online payroll services are more robust than ever, offering features like automated payroll, tax filing, and seamless integration with accounting tools. Most charge between $4 and $8 per employee per month, making them an affordable option for small businesses looking to scale efficiently.

Here are four top-rated platforms to consider:

1. Gusto

Pricing: Starts at $59/month + $8/employee

Functionality: Full-service payroll, tax filing, benefits admin, and time tracking

Pros: Clean UI, strong compliance tools, good for growing teams

Cons: Pricier tiers for advanced features

Best for: Small businesses needing an all-in-one solution with HR tools

2. Patriot Payroll

Pricing: Starts at $17/month + $4/employee

Functionality: Payroll processing, W-2s, and tax filing (add-on)

Pros: Budget-friendly, easy setup, U.S.-based support

Cons: Limited integrations compared to larger providers

Best for: Very small businesses or first-time employers

3. QuickBooks Payroll

Pricing: Starts at $85/month + $6/employee

Functionality: Payroll, automatic tax payments, and same-day direct deposit

Pros: Seamless integration with QuickBooks accounting

Cons: Some features locked behind higher tiers

Best for: Businesses already using QuickBooks for bookkeeping

4. ADP RUN

Pricing: Custom quotes based on company size

Functionality: Comprehensive payroll service with benefits management and HR tools

Pros: Scalable and highly customizable

Cons: Higher pricing, contracts often required

Best for: Businesses planning to scale or with complex payroll needs

All these platforms streamline core payroll processes, automate tax compliance, and allow you to easily set and adjust pay rates. Depending on your size and budget, there's a payroll provider that fits your workflow and business goals.

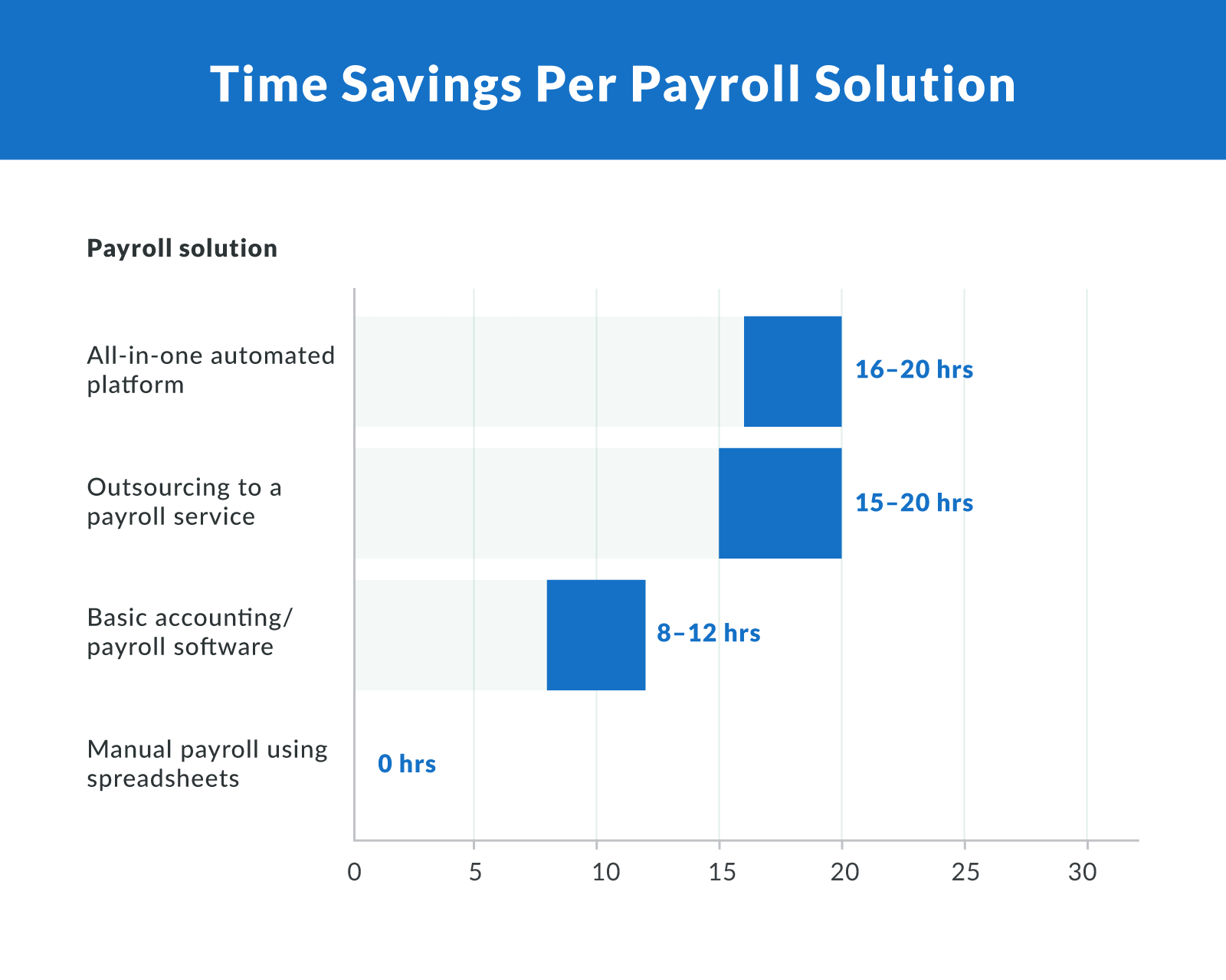

Save Time and Cut Costs With Smarter Payroll

Efficient payroll management for small businesses isn't just about getting paychecks out on time — it's about reducing risk, saving hours each week, and protecting your bottom line. Whether you decide to handle payroll in-house or work with a provider, the key is to streamline your process with the right tools, schedules, and systems.

As we move through 2025, small business owners can no longer afford manual errors, late tax filings, or compliance gaps. Using modern payroll software or outsourcing smartly can help you handle payroll accurately while freeing up time for growth-focused tasks.

Ready to make payroll one less thing to worry about? Explore Clarify Capital 's financial tools and funding options to support your next step.

Frequently Asked Questions About Payroll Management

Still have questions? These common concerns from small business owners can help clarify the details of how to efficiently run payroll and stay compliant in 2025.

What Is the Easiest Way To Run Payroll for a Small Business?

The easiest method is using automated payroll software that calculates pay, files taxes, and issues direct deposits. This reduces manual effort and helps you stay compliant with IRS regulations and the Fair Labor Standards Act (FLSA). Most platforms also generate required forms automatically, making payroll less time-consuming.

What Payroll Taxes Do I Need To Withhold as an Employer?

Employers must withhold federal income tax, Social Security, and Medicare from each employee's paycheck. In many states, you'll also need to withhold state and local taxes. Employers are also responsible for paying their share of Social Security, Medicare, and federal and state unemployment taxes. Always consult updated IRS and state guides for the latest tax payment rules.

How Do I Avoid Payroll Tax Penalties?

To avoid IRS penalties, make sure to file returns and remit payroll deductions on time. Automating your payroll system helps reduce late or incorrect filings. It's also critical to double-check employee classifications and keep accurate payroll records in case of an audit.

Can I Handle Payroll Myself Without Software?

Yes, but it's risky. You can run payroll manually if you're comfortable calculating gross pay, withholdings, and submitting tax filings. However, errors are common without a system in place. Most small business owners find that software or outsourcing pays off in saved time and reduced risk.

What Are the Benefits of Outsourcing Payroll?

Outsourcing payroll saves time, cuts down compliance headaches, and helps avoid tax slip-ups. Providers take care of everything — calculating pay, filing taxes, sending checks — so you can focus on running and growing your business. If you don't have a full HR or finance team, it's usually the smartest and most affordable way to go.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts