An equipment loan is a type of business financing used to purchase or lease essential tools, vehicles, or machinery. From commercial trucks and kitchen appliances to printing presses, farm equipment, and medical devices, these loans help small business owners acquire what they need to run and grow their operations.

With equipment financing, the asset typically acts as collateral, making it a practical and accessible option even if you're conserving working capital. Equipment loans are also often easier to qualify for compared to other loans for the same reason. Using the equipment as collateral reduces the lender's risk and makes approval more accessible.

This guide includes an easy-to-use equipment loan calculator that helps you estimate your monthly payment, total interest, and overall loan cost based on your inputs. We'll also break down key loan terms and financing options so you can make confident, informed decisions for your business.

Equipment Loan Calculator

Use this loan calculator to estimate your monthly payment, total equipment loan cost, and interest based on the loan amount, down payment, interest rate, and repayment term. It works for nearly any equipment purchase, whether you're buying farm machinery, upgrading construction tools, or financing commercial vehicles.

Here's a quick overview of the inputs used in the equipment finance calculator and how each one affects your total payment:

Purchase price. This is the total cost of the equipment before financing. Your down payment reduces the final loan amount.

Loan term. The repayment period affects how much interest you'll pay over time. Shorter terms mean higher monthly payments but lower total interest.

Interest rate. Rates are based on the borrower's credit score, the lender you choose, and the type of equipment being financed.

Down payment. A larger down payment lowers your monthly payment and reduces how much you need to borrow.

Payment frequency. Most loans follow a monthly repayment schedule, but some lenders may offer quarterly or customized options.

Once you've run your numbers, explore actual financing offers to see what you qualify for. Apply now at Clarify Capital — it only takes two minutes to get matched with personalized options.

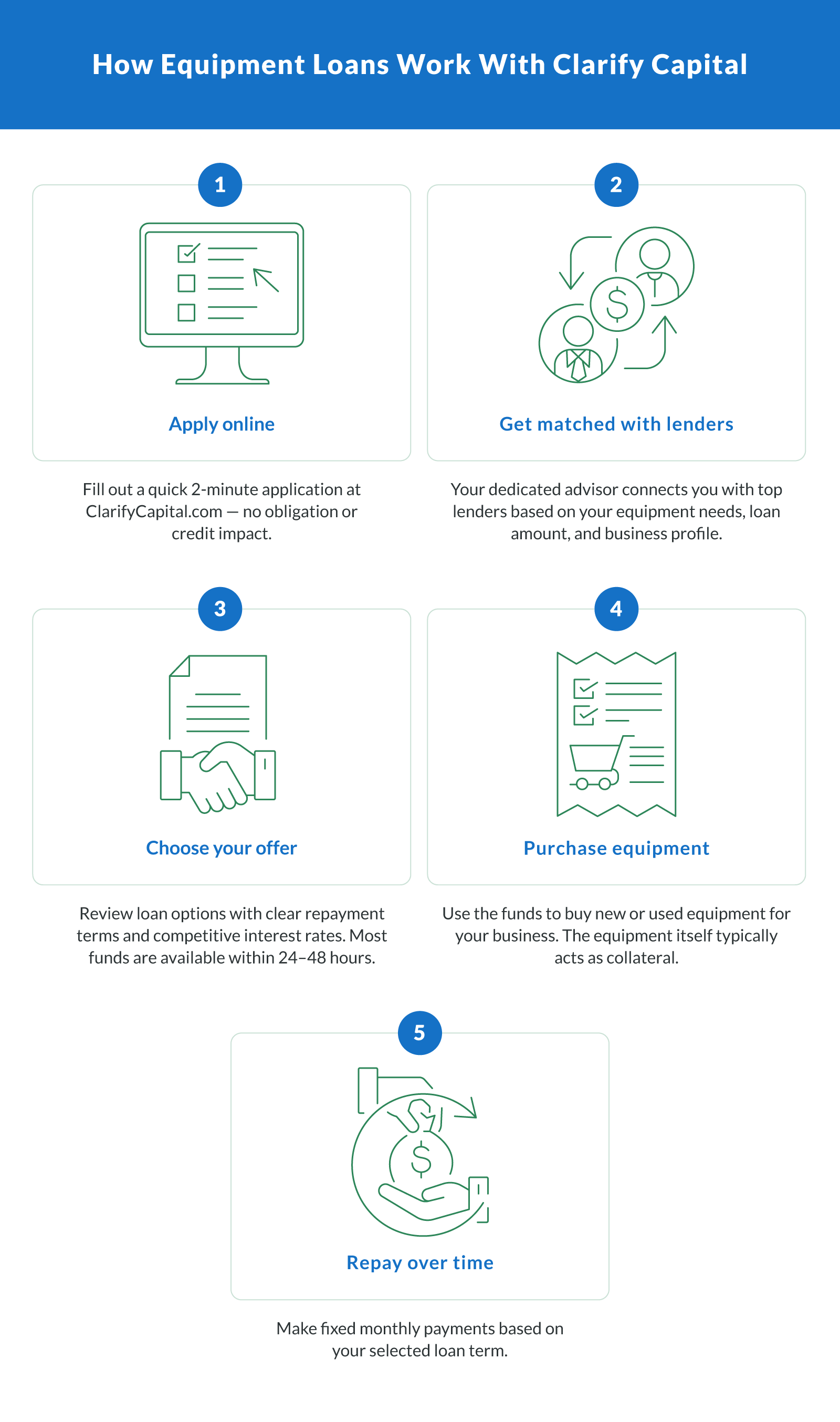

How Equipment Loans Work

An equipment loan helps business owners finance the purchase of new or used equipment — whether it's a delivery vehicle, commercial refrigerator, or heavy machinery. With equipment financing through Clarify Capital, the asset you're purchasing acts as collateral, which reduces the lender's risk and helps you secure more competitive terms and monthly payment amounts.

Lenders calculate the loan amount based on the value of the equipment and the amount you can put down up front. You'll make fixed payments over a set loan term — typically between 12 and 60 months — until the full amount is repaid. Some lenders may offer options with seasonal or deferred payments, depending on your cash flow.

Here's what lenders look for:

Type of equipment. The asset's resale value and useful life affect loan terms.

Business cash flow. Consistent income is key to qualifying for favorable repayment terms.

Credit profile. A stronger credit score usually results in better interest rates.

Loan term. Shorter terms reduce total cost, while longer terms lower monthly payments.

Equipment financing loans give you ownership of the asset from day one and help preserve working capital for other expenses. This makes them a popular choice among small businesses that rely on tools, vehicles, or machinery to operate efficiently.

Comparing Loan vs. Lease Options

If you're acquiring equipment for your business, you have two main options: take out a loan to purchase it or lease it. Equipment loans offer ownership and long-term value, while equipment leases provide flexibility with lower upfront costs.

Here's how the two options compare:

| Feature | Equipment loan | Equipment lease |

|---|---|---|

| Ownership | Borrower owns the equipment once it's paid off | You return or buy the equipment at end of lease |

| Upfront cost | Typically includes a down payment | Usually lower or no upfront cost |

| Monthly payment | Fixed based on loan amount and term | Often lower than loan payments |

| Tax treatment | May qualify for Section 179 deduction | Lease payments may be deductible as expenses |

| Warranties & repairs | Typically covered by manufacturer, then your responsibility | Often included in lease terms |

| Total cost | Lower total cost over time | May cost more long-term with buyout option |

| Best for | Long-term equipment use | Short-term needs or rapidly depreciating equipment |

Loans make sense when you plan to use the equipment for many years. Leasing can work well if your equipment needs change often or you want to avoid maintenance responsibilities.

How To Qualify for Equipment Financing

Qualifying for equipment financing through Clarify Capital is straightforward, especially if you prepare ahead of time. Lenders want to see that your business has stable revenue and a clear need for the equipment you're financing.

Here's what you'll typically need to qualify:

Time in business. Your business should be operational for at least six months.

Credit score. A credit score of 500 or higher is required. The better your credit, the more competitive your loan offer.

Monthly revenue. You should generate at least $10,000 in monthly revenue (or about $120,000 annually).

Type of equipment. When determining loan terms, lenders consider whether you're purchasing used or new equipment, along with the asset's value, useful life, and resale potential.

Below are a few tips to improve your chances of getting a strong financing offer:

Organized bank statements, P&L statements, and tax returns help speed up approvals.

Putting money down can lower your monthly payments and increase your approval odds.

If you qualify, SBA-backed equipment loans offer better rates and longer repayment terms.

Plan Ahead With a Clear Equipment Loan Estimate

Understanding your payment options before you finance equipment helps you budget with confidence and avoid unexpected costs down the road. Use our loan calculator and review multiple offers; you'll be better equipped to choose the financing solution that supports your business goals.

When you're ready to take the next step, Clarify Capital makes it simple. Apply online in just two minutes and get matched with business loan offers tailored to your business.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts