Equipment financing helps business owners to purchase the essential machinery, technology, and tools needed to operate and grow, without depleting their working capital. With the right equipment loan, you can finance up to 100 percent of the equipment cost, using the assets themselves as collateral. Whether you are a startup business, a small business owner, or a seasoned entrepreneur, these loans unlock access to the equipment you need, from medical machinery to heavy construction gear, while preserving your cash flow.

In this 2026 guide, we compare the best equipment financing companies, show how their financing options differ, and explain how to choose the right lender based on your business's needs.

| Best Equipment Financing Companies at a Glance | |||

|---|---|---|---|

| Lenders | Ideal for | Min. credit score | Max. loan amount |

| Clarify Capital | Small business owners | 550 | $7 Million |

| SBA | SBA loans | 650 | $5 Million |

| Bank of America | Traditional loans | 700 | $ 5 Million |

| OnDeck | Poor credit | 625 | $250,000 |

| Ameris Bank | Fast approval | 620 | $500,000 |

| Fundbox | Startups | 600 | $150,000 |

| Funding Circle | Established businesses | 660 | $500,000 |

Best for Small Businesses: Clarify Capital

Why it's a good choice: Clarify Capital supports thousands of small businesses nationwide and across a wide range of industries. With flexible eligibility and a network of over 75 lenders, we help streamline the application process to provide your business with fast, same-day funding.

Loan Amount Range: $10,000-$7 Million

Minimum Credit Score: 550

Pros:

Easy online application process

APR rates as low as 6%

Seasoned loan advisors for support

No collateral loans available

Cons:

Possibly short repayment terms with higher interest rates

Certain products and services not available in every state

Loan Details:

Requires a minimum $10,000 monthly revenue

6+ months in business for loan eligibility

Loan terms range from six months to two years

Won't impact your credit

Best for SBA Loans: Small Business Administration

Why it's a good choice: The U.S. Small Business Administration (SBA) offers a wide selection of loans that are flexible to use for any business need, including purchasing equipment. Since the SBA guarantees a percentage of every SBA loan, most small business owners can secure them with low down payments and interest rates.

Loan Amount Range: Up to $5 Million

Minimum Credit Score: 650

Pros:

Capped interest rates

Flexible loan repayment terms

Variety of loan options available

Cons:

Most loans require collateral

Lengthy application process

Loan Details:

Must demonstrate a need for funds

Requires an unlimited personal guarantee

Best for Traditional Equipment Loan: Bank of America

Why it's a good choice: To purchase general-purpose equipment, Bank of America offers equipment financing as well as a line of credit with fixed rates as low as 6.75%. Through its business rewards program, you can take advantage of up to a 0.75% discount on interest rates.

Loan Amount Range: $25,000-$5 Million

Minimum Credit Score: 700

Pros:

0% interest on medical practice loans the first six months

Fixed-rate loans with terms up to five years

Discounts for veterans and through rewards program

Cons:

Lengthy application process

May not reveal interest rate until loan contract

Application submissions must be in person

Loan Details:

Offers up to 100% financing for certain loan options

Minimum two years in business eligibility

Requires $250,000 in annual revenue

Best for Poor Credit: OnDeck

Why it's a good choice: OnDeck offers lines of credit and term loans, including same-day loans, for small businesses to purchase necessary equipment in a quick turnaround time. It also reports on-time payments to credit bureaus, helping you build business credit over time.

Loan Amount Range: $5,000-$250,000

Minimum Credit Score: 625

Pros:

Available to businesses with poor credit

Offers same-day funding up to $100K

Quick application process

Cons:

Generally high APR rates (starting at 35.4%)

Requires a lien on your business and a personal guarantee

Services not available in every state

Loan Details:

Must qualify for the prepayment benefit to cover 100% interest

0%-4% origination fee based on the total loan amount

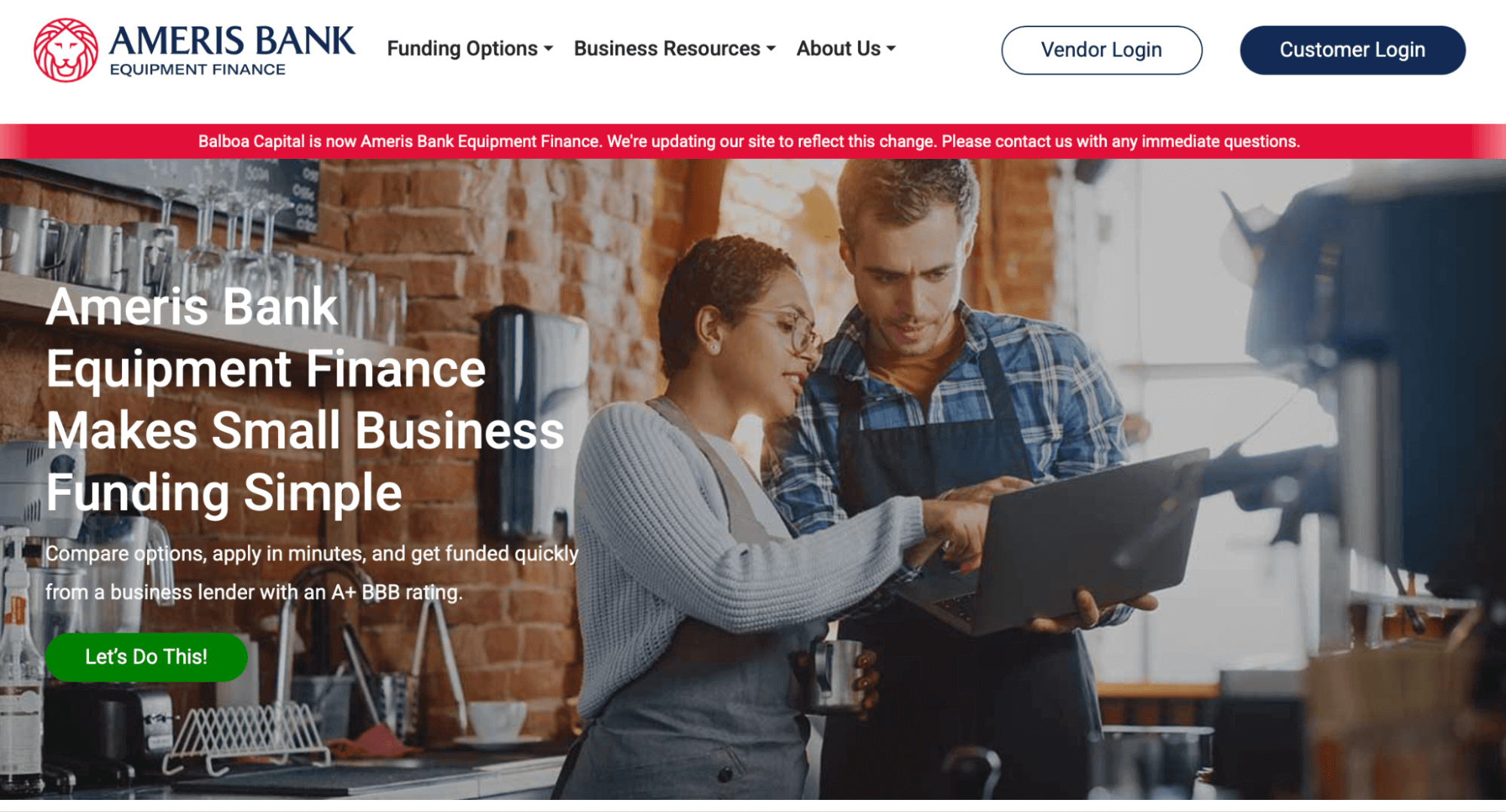

Best for Fast Approval: Ameris Bank

Why it's a good choice: Ameris Bank offers up to $500K for equipment financing, which is helpful for companies purchasing heavy machinery. Quick loan approval within the hour is also available, but hard collateral is required.

Loan Amount Range: $5,000-$500,000

Minimum Credit Score: 620

Pros:

Quick approval process, possibly within the hour

Same-day funding for approved borrowers

Flexible loan terms

Cons:

Potential fees (e.g., equipment inspection fee and documentation fee)

Requires minimum $100K in revenue

Loan Details:

Monthly repayment plan for equipment financing; daily/weekly for short-term loans

Requires a business operation of at least a year

Term lengths range from two to five years

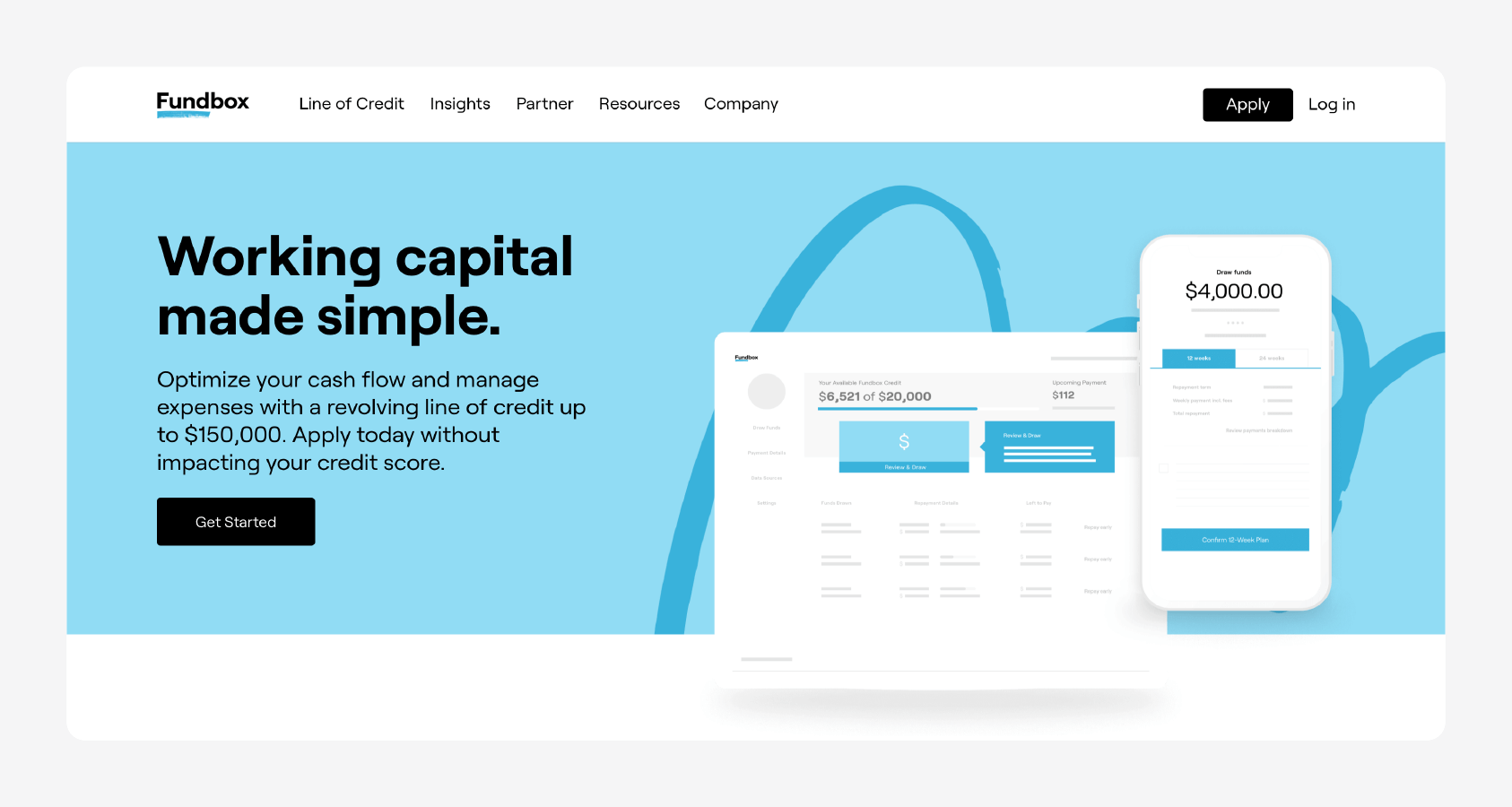

Best for Startups: Fundbox

Why it's a good choice: Fundbox is willing to work with businesses with less than six months in operation, which is advantageous for startups. It also has a low credit score requirement, offering same-day approval and next-day loans.

Loan Amount Range: $1,000-$150,000

Minimum Credit Score: 600

Pros:

Open to borrowers with bad credit

Allows early repayment with no fees

Supports startups in business less than a year in operations

Can receive funds within one business day

Cons:

Short repayment terms (maximum 24 weeks)

Potentially high APR rates

Details:

$100,000 minimum annual revenue for eligibility

Same-day approval with next-day funds

Weekly repayment schedule

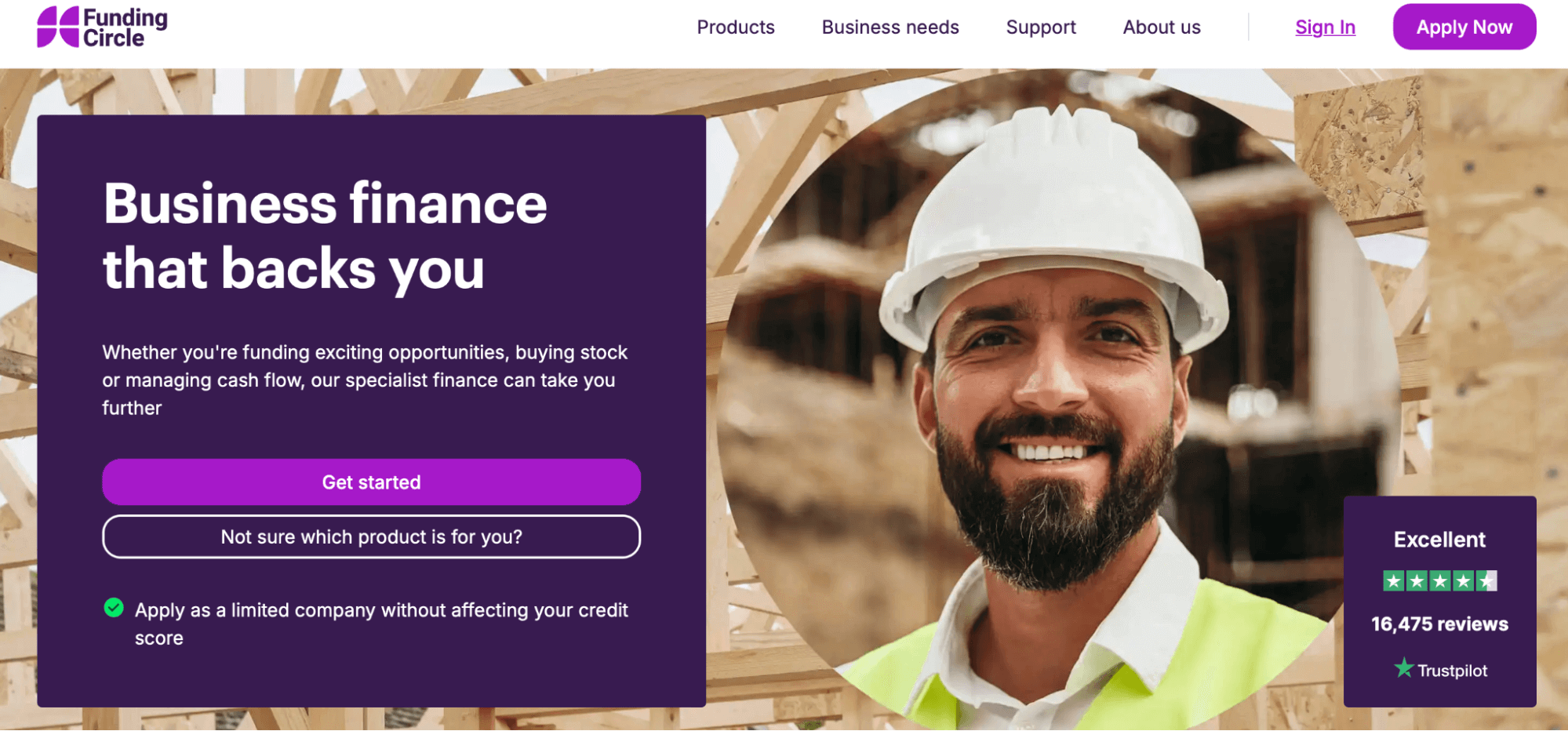

Best for Established Businesses: Funding Circle

Why it's a good choice: Funding Circles offers a wide selection of loans for small businesses as well as long-term loans up to seven years. It also doesn't require applicants to meet a minimum revenue.

Loan Amount Range: $25,000-$500,000

Minimum Credit Score: 660

Pros:

Loan terms range from six months to seven years

No minimum revenue requirement

No prepayment penalty on loans

Cons:

Borrowers must provide a personal guarantee

Origination and late fees for missed payments

Loan Details:

Monthly repayments

At least two years in business

No bankruptcies within the past seven years

What Is Equipment Financing?

Equipment financing is a business financing solution that allows you to purchase business equipment through a loan. Instead of paying for large machinery or technology up front, you can spread the cost over time, making it more manageable for your cash flow.

This type of small business loan is used for:

Medical and dental equipment

Construction equipment and vehicles

Office tech, computers, and software

Restaurant and commercial kitchen equipment

Once the loan is paid off, the borrower owns the equipment outright. Most equipment financing loans are secured by the equipment itself, eliminating the need for additional collateral.

How Equipment Financing Works

The process behind equipment financing loans is straightforward. You choose the type of equipment you need, apply for financing, and upon approval, receive funds to make your purchase. Repayment terms and monthly payments are determined based on the equipment's value, your credit score, and the expected lifespan of the asset.

Many lenders offer same-day approval with minimal documentation. Some may also include equipment leasing as an alternative, where you return the asset at the end of the lease term rather than owning it.

Pros and Cons

Understanding the pros and cons of equipment financing helps you decide whether this funding option aligns with your business needs.

Pros:

Financing up to 100% of equipment value

Often no need for extra collateral

Accessible to poor credit (as low as 550 credit score)

May offer tax savings through deductions

Cons:

Limited only to leasing or purchasing equipment

Possibility of high interest rates

Origination fees and documentation costs may apply

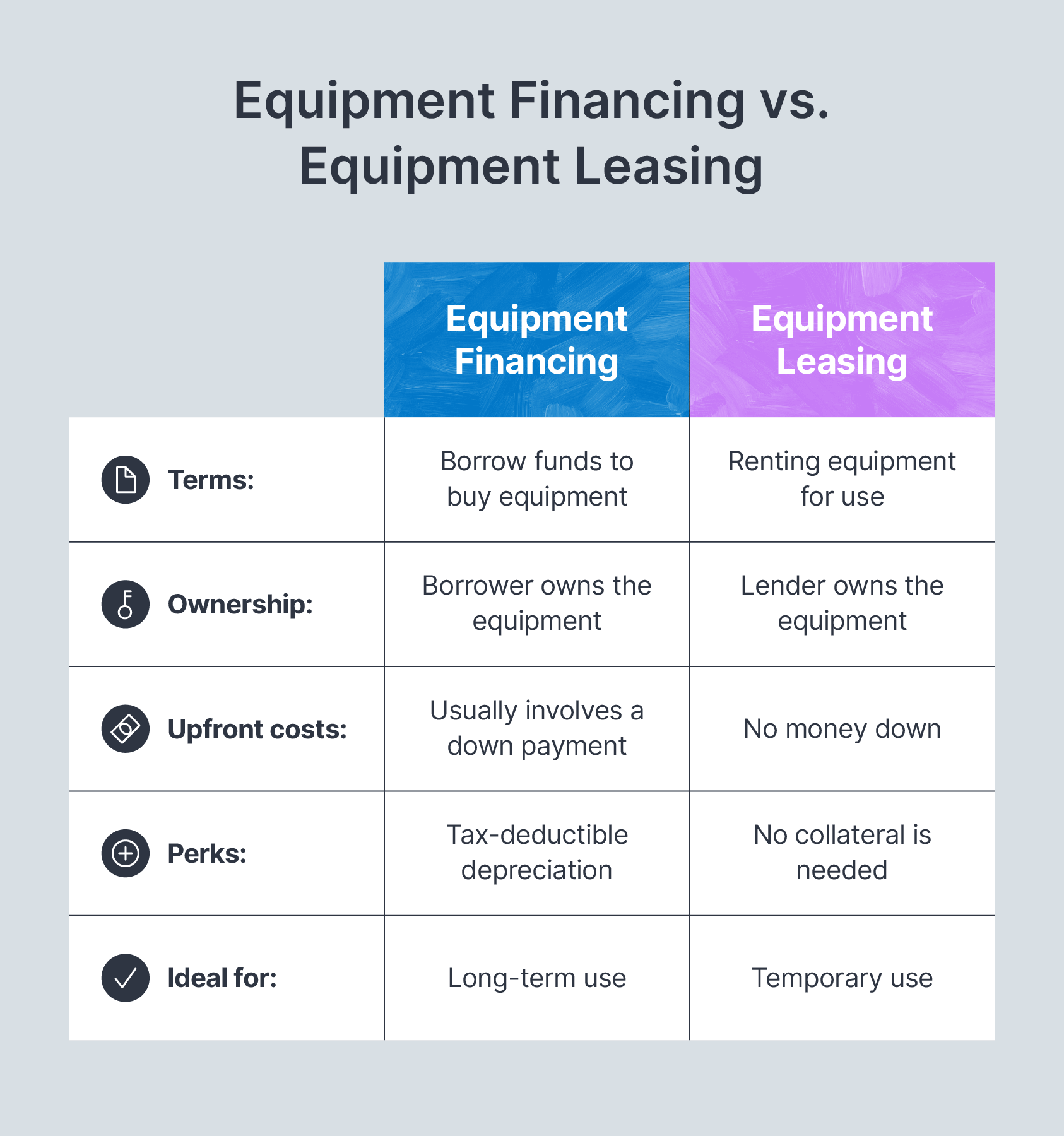

Equipment Financing vs. Equipment Leasing

Though you can use them for the same purpose, there is a difference between equipment financing and equipment leasing. With an equipment loan, you purchase and own the equipment even though it serves as collateral.

With leasing equipment, on the other hand, you pay the vendor for the use of the equipment for an agreed term and return it afterward. You don't own the equipment.

An easier way to understand equipment financing compared to leasing is to think of renting versus owning a home.

When renting a home, you live in it for the duration of your lease but have to renew it to continue living there, and the landlord remains the owner. However, with homeownership, you pay a mortgage to purchase and live in the home as your own, and it serves as collateral if you default on the loan.

How To Get an Equipment Loan

Fortunately, receiving equipment financing is easier since the equipment will serve as collateral. However, requirements for small business owners may still vary by lender. Here are ways to prepare for an equipment loan and narrow your lender options.

1. Check Your Eligibility

When applying for general business loans, lenders typically look at personal credit score, time in business, and annual revenue. They’ll also consider the value of your equipment, including the condition and resale value, to determine how much you can qualify for and your ability to repay the loan.

2. Gather Required Documents

Most lenders also request proof of your business's performance credit history. They'll likely ask for documents, including bank statements, your business plan, personal and business tax returns, personal credit score, and any licenses or certifications (if applicable).

3. Complete and Submit Your Application

The last step is to apply online and wait for approval. Traditional banks and credit unions can take several weeks to confirm the approval. Fortunately, online lenders like Clarify Capital can get same-day approval.

Discover Equipment Loans With Clarify Capital

When it comes down to it, having efficient machinery and advanced technology can make or break your business. If and when a big equipment purchase is necessary, equipment financing can supply the funds you need without breaking the bank.

Our Clarify Capital team works with a network of over 75 lenders, helping you find equipment financing options with the best rates. Get started today by contacting our dedicated advisors or applying online.

FAQs About Equipment Financing

This section covers the top FAQs about equipment financing, interest rates, credit score requirements, and how to choose the best lender.

What Is a Good Rate for an Equipment Loan?

You can qualify for rates as low as 6% APR with an equipment loan. Rates do, however, depend on several factors, such as your credit score, time in business, and annual revenue.

Can I Get an Equipment Loan With Bad Credit?

Yes. You can qualify for an equipment loan with many lenders with a credit score as low as 550. Since equipment serves as the collateral, this financing is one of the easier types of loans for those with bad credit.

What Is an Example of Equipment Financing?

If you own a restaurant, such as a bakery, you'll likely need a commercial oven to bake your products. Since you'll use this type of expensive machinery for as long as you'll be in business, you can take out an equipment loan to buy and use the oven, which will serve as collateral. Once you finish with the term repayments, the oven is yours to keep.

How Much Can I Borrow With Equipment Financing?

Loan amounts typically range from $5,000 to $5 million, depending on the lender, the type of equipment, and your business's creditworthiness and annual revenue.

Do I Need a Down Payment for an Equipment Loan?

Some lenders offer 100% financing as part of their flexible payment options, while others may require a down payment of 10% to 20%. The exact amount depends on the loan amount, equipment type, and your business's financial profile.

What Types of Equipment Can Be Financed?

You can finance nearly any type of business equipment, including medical devices, restaurant appliances, construction vehicles, computers, and manufacturing tools.

How Long Are Equipment Loan Terms?

Repayment terms usually range from 1 to 7 years, based on the equipment's expected lifespan and the lender's policies.

Is Equipment Financing Tax-Deductible?

In many cases, yes. Equipment financing may offer tax benefits through deductions under IRS Section 179, but it's best to consult a tax professional for specifics.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts