Key Takeaways:

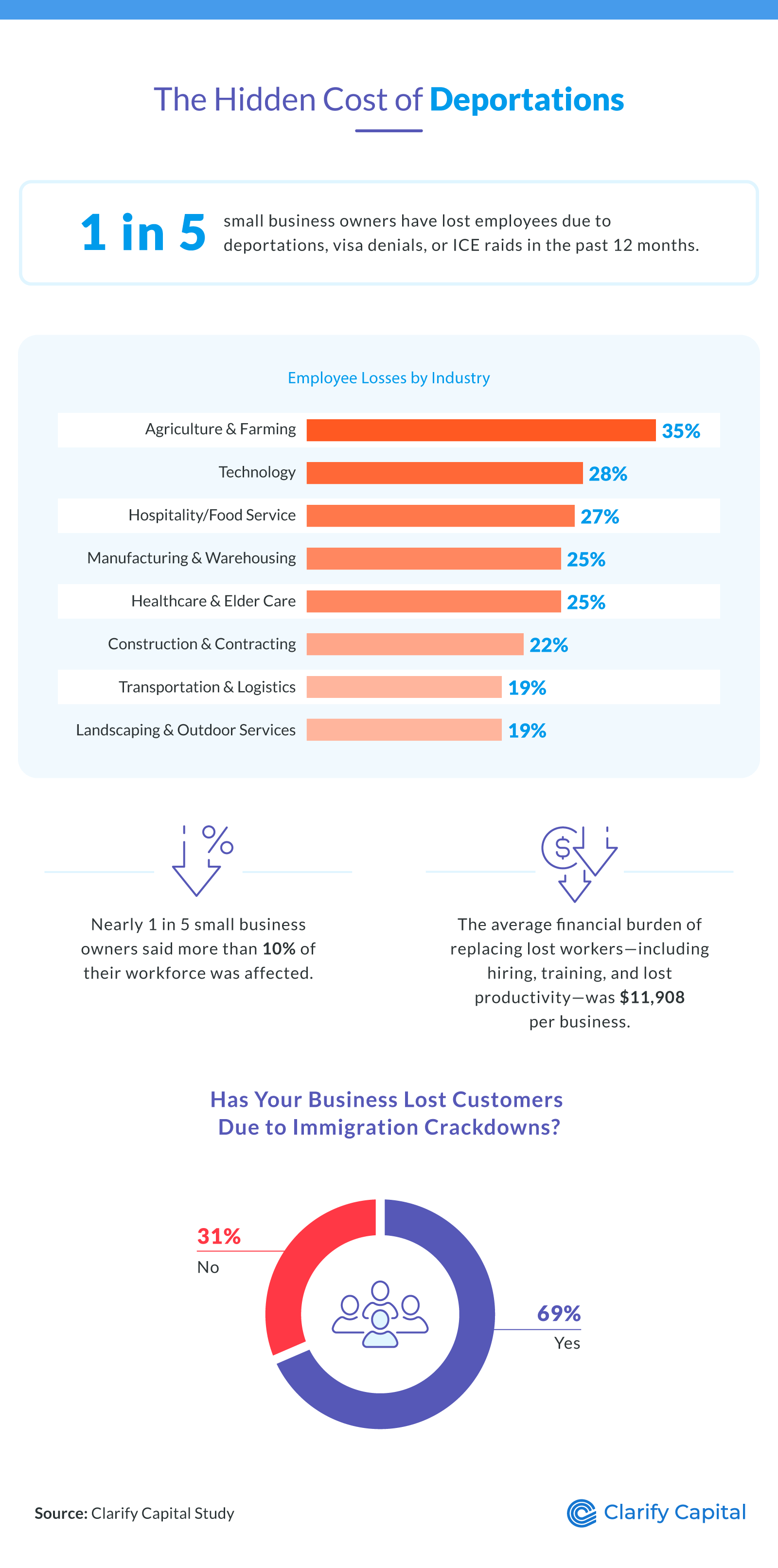

1 in 5 business owners have lost employees due to deportations, visa denials, or ICE raids in the past 12 months.

The average financial burden of replacing lost workers — including hiring, training, and lost productivity — was $11,908.

69% of businesses have had to raise wages significantly to attract new workers, with 1 in 8 increasing wages by more than 20%.

72% of small business owners have shut down locations, reduced hours, or delayed expansion due to hiring challenges.

Nearly half of small business owners have either relocated (15%) or are considering moving to another state (32%) due to workforce challenges.

51% of small business owners say immigration enforcement is hurting their industry.

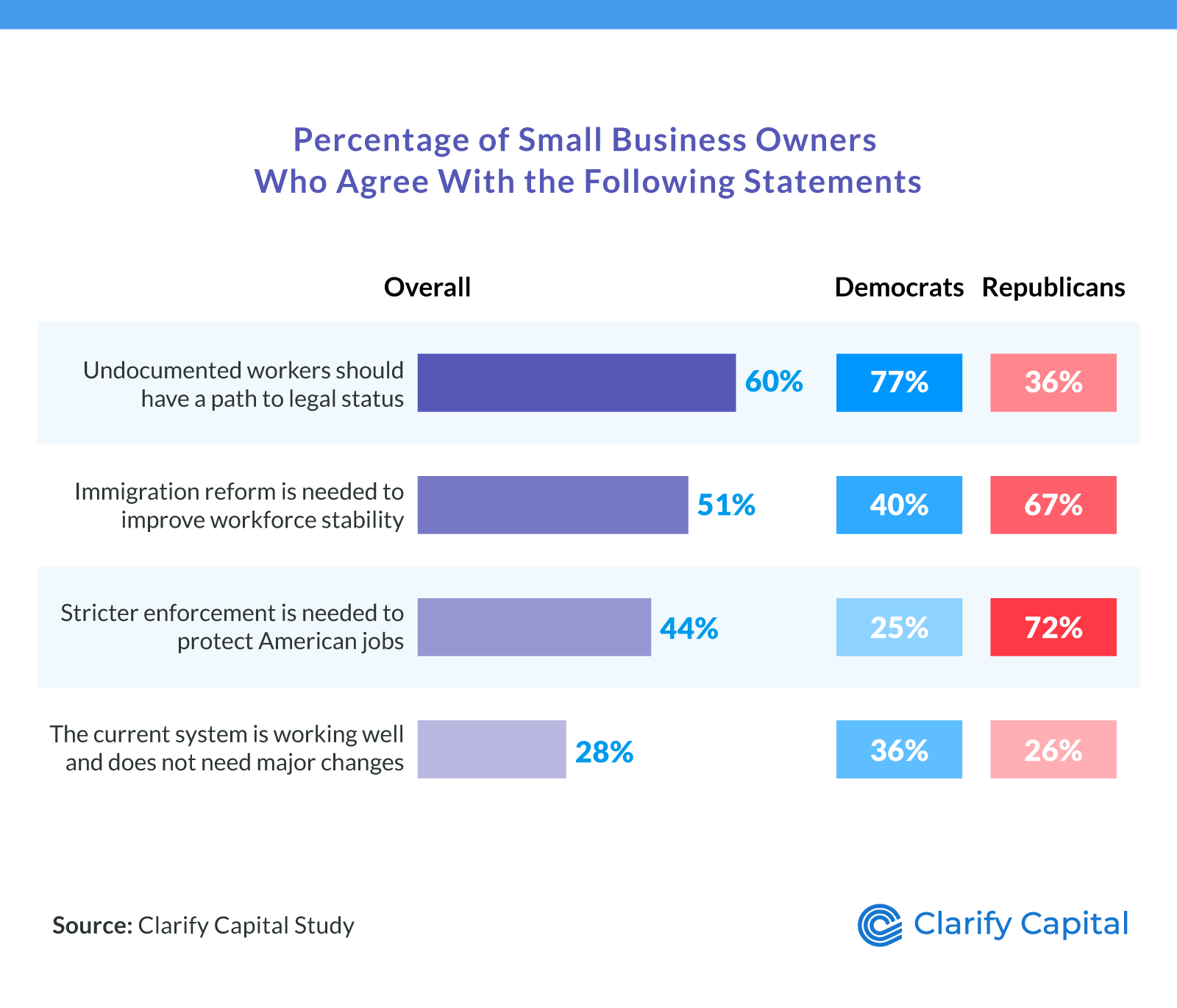

44% believe stricter immigration enforcement is needed to protect American jobs. Only 25% of Democrats agree, compared to 72% of Republicans.

The Cost of Workforce Loss

1 in 5 business owners reported losing employees in the past 12 months due to deportations, visa denials, or ICE raids.

Agriculture/farming (35%) is the most impacted industry, followed by technology (28%), and hospitality/food service (27%).

The average financial burden of replacing lost workers — including hiring, training, and lost productivity — was $11,908.

Percentage of small business owners' workforce affected by deportations:

- Less than 5%: 44%

- 5%-10%: 39%

- 11%-20%: 12%

- More than 20%: 5%

69% of small businesses have lost customers due to immigration crackdowns.

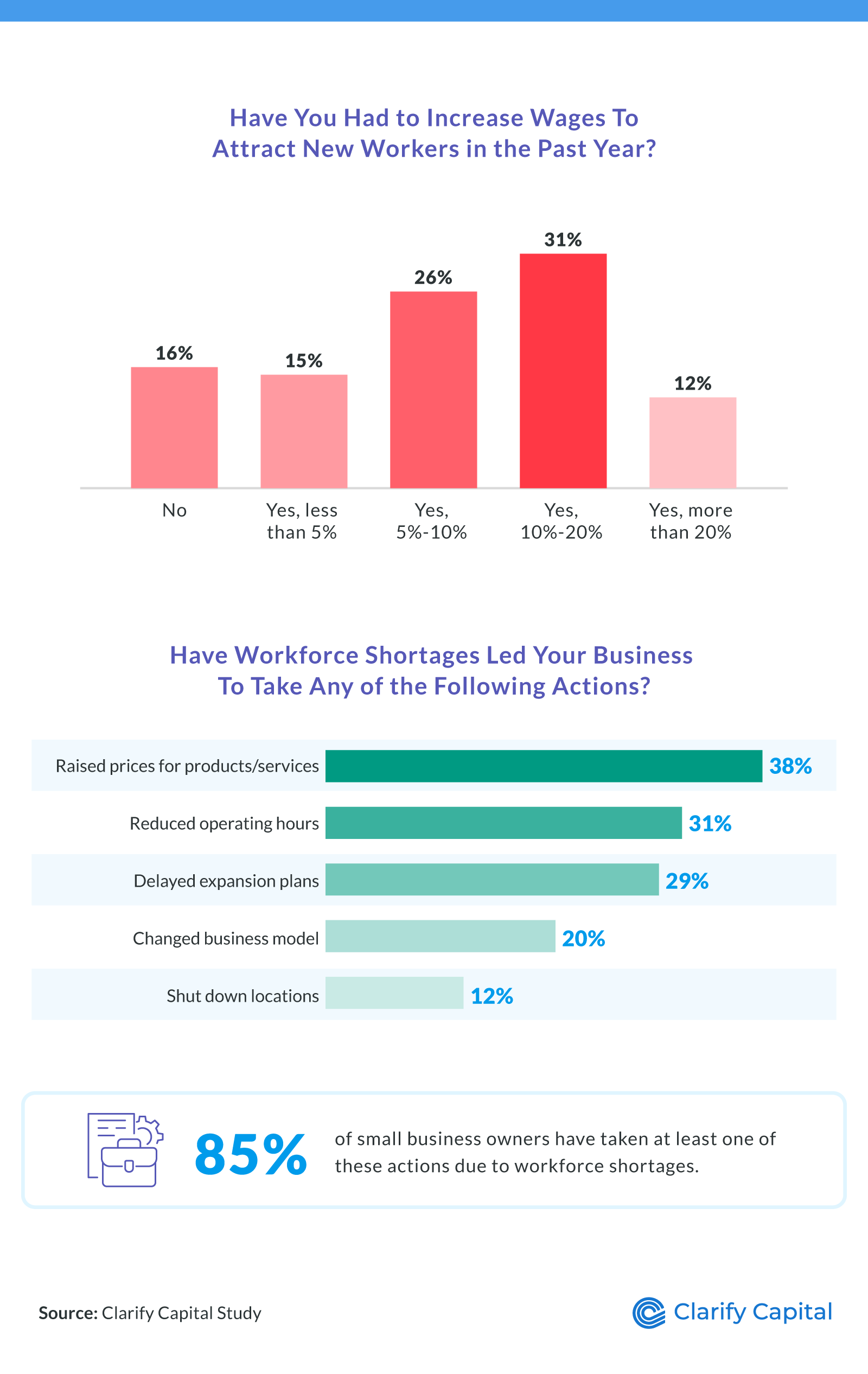

69% of businesses have had to raise wages significantly to attract new workers, with 1 in 8 increasing wages by more than 20%.

72% of small business owners have shut down locations, reduced hours, or delayed expansion due to hiring challenges.

71% of small business owners are still struggling to find qualified replacements for workers lost due to immigration enforcement. For those who managed to hire new employees, the process took an average of 3 months.

Coping With Workforce Shortages

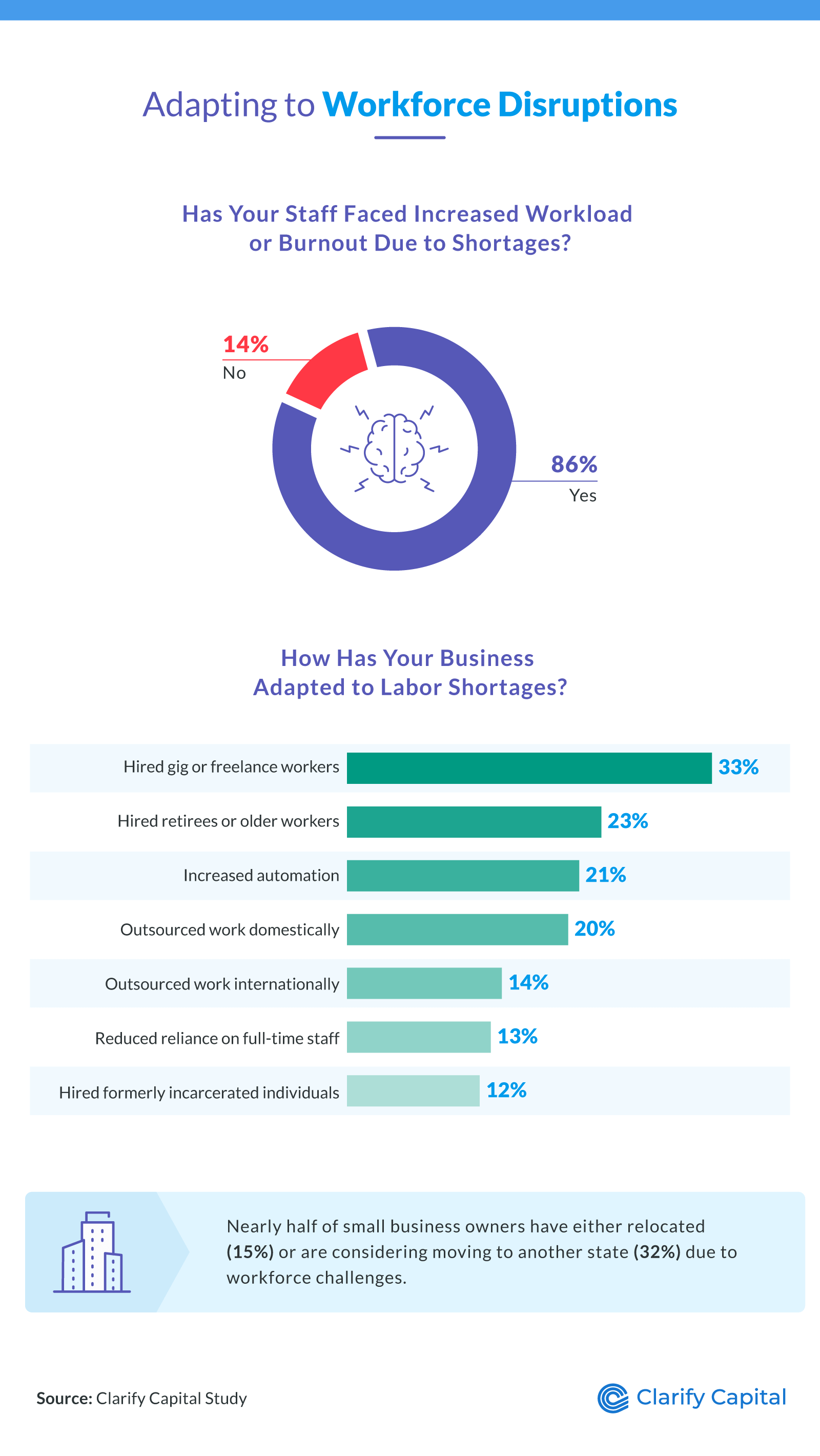

86% of small business owners report that their staff has faced increased workloads or burnout due to labor shortages.

To adapt to labor shortages, businesses are turning to gig or freelance workers (33%), hiring retirees (23%), and increasing automation (21%).

Nearly half of small business owners have either relocated (15%) or are considering moving to another state (32%) due to workforce challenges.

Business Owners on Immigration

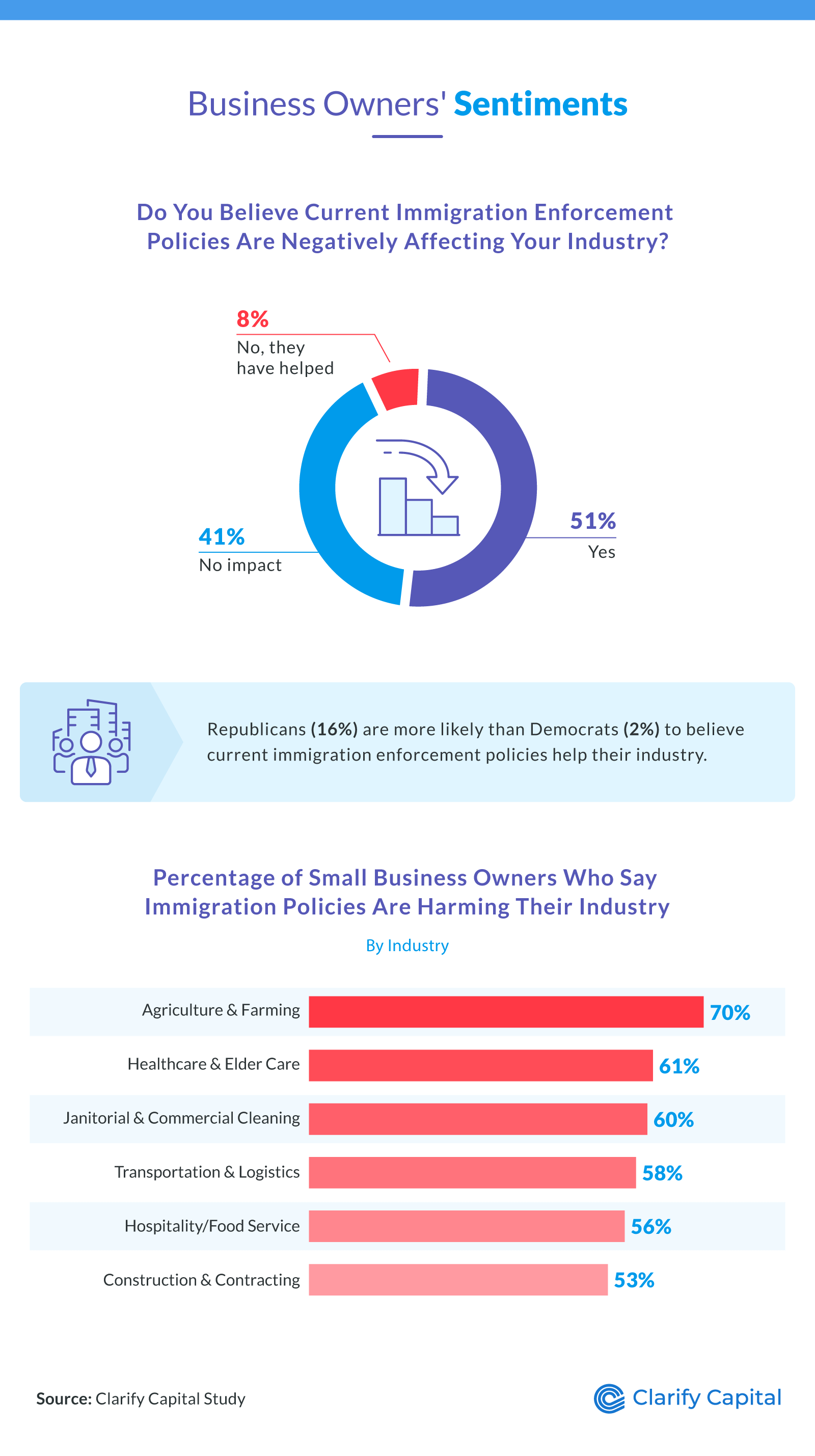

51% of small business owners say immigration enforcement is hurting their industry.

Republicans (16%) were more likely than Democrats (2%) to believe current immigration enforcement policies have helped their industry.

Agriculture/farming is the most impacted industry, with 70% of business owners saying immigration policies are harming their operations.

A majority of small business owners (60%) believe undocumented workers should have a path to legal status, with strong support from Democrats (77%) but far less agreement from Republicans (36%).

44% believe stricter immigration enforcement is needed to protect American jobs. Only 25% of Democrats agree, compared to 72% of Republicans.

A majority of small business owners (83%) have not taken direct action on immigration policy, with 53% taking no action at all and 30% expressing concern but remaining inactive. Only 16% have engaged in advocacy, whether by contacting lawmakers (7%) or signing petitions (9%).

Methodology

We surveyed 1,047 small business owners to explore how immigration enforcement and labor shortages are affecting their businesses and industries. The data was collected in February 2025.

About Clarify Capital

Clarify Capital helps business owners secure financing to overcome economic challenges and fuel growth. With fast approvals and flexible loan options, such as no-doc business loans and fast business loans, we support entrepreneurs in navigating unexpected workforce disruptions.

Fair Use Statement

Feel free to share these findings for noncommercial purposes, but be sure to include a link back to this page.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts

![Business Action Plan Template for 2025 Growth [Free]](/assets/blog/business-action-plan-template-2025/business-action-plan-template-2025-small-cda22747f8266c0ffbaec17daaaae20a84835bff0f9e94315070bb25a2d95f6b.jpg)