Understanding the factors that harm your credit score is essential to keeping your finances in order. Whether you’re a borrower trying to qualify for a personal loan, a homeowner avoiding foreclosure, or a student managing debt, knowing how credit reports work can help you make smarter financial decisions. Let’s dive into the details.

How Credit Scores and Reports Work

Your credit score and credit report are tools that lenders, credit card companies, and even insurance companies use to assess your creditworthiness. A good understanding of these tools is the first step in managing your personal finances.

What is a Credit Score?

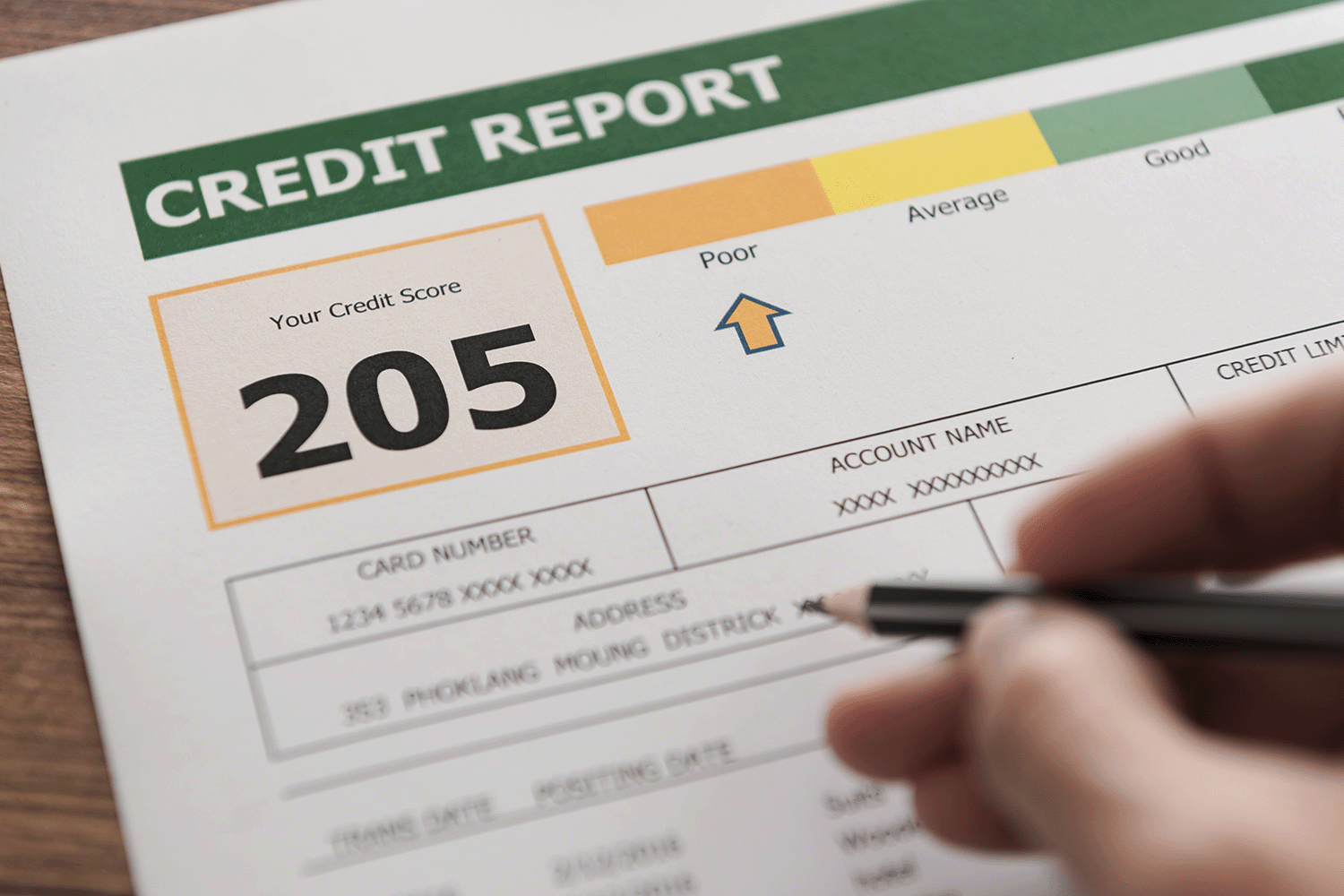

A credit score is a three-digit number that reflects your creditworthiness. Credit scoring models, like the FICO Score and VantageScore, calculate your score based on your credit history. Scores range from 300 (poor) to 850 (excellent) and determine how risky it is for lenders to approve you for credit.

What is a Credit Report?

A credit report is a detailed record of your financial history, compiled by major credit bureaus — Experian, Equifax, and TransUnion. It includes:

Payment history. Details about whether you’ve made on-time monthly payments for credit cards, student loans, or other debts.

Credit inquiries. A list of hard inquiries when you apply for new credit or loans.

Public records. Information about foreclosures, liens, or bankruptcies.

Credit mix. A variety of accounts, such as credit card accounts, auto loans, or lines of credit.

Why Credit Scores Matter

Your credit score affects many aspects of your financial life:

Lending decisions. Lenders use it to evaluate your credit risk.

Interest rates. Higher scores mean lower interest rates on loans and credit cards.

Opportunities. A good credit score helps you qualify for better terms on lines of credit, cell phone plans, and even insurance premiums.

Common Credit Report Red Flags

Credit report red flags signal financial risk and can severely impact your credit score. These issues show lenders that you may have difficulty repaying debt.

Late and Missed Payments

Payment history is the most important factor in your credit score. A single late payment or missed payment can significantly lower your score and stay on your credit report for seven years.

How it Affects You:

Lenders see late or missed payments as a sign that you’re unreliable. It increases your credit risk and makes borrowing more expensive.

How to Fix It:

- Pay down your credit card debt.

- Request a credit limit increase, but avoid overspending.

High Credit Utilization Ratio

Your credit utilization ratio measures how much of your available credit you’re using. For example, if you have a $10,000 credit limit and $4,000 in credit card debt, your ratio is 40%.

How it Affects You:

A high credit utilization ratio signals that you rely heavily on credit cards, which can lower your score. Aim to keep this ratio below 30%.

How to Fix It:

- Pay down your credit card debt.

- Request a credit limit increase, but avoid overspending.

Too Many Hard Inquiries

When you apply for a new credit card or loan, the lender performs a hard inquiry. While a few hard inquiries over time are normal, too many in a short period can harm your score.

How it Affects You:

Hard inquiries temporarily lower your credit score and remain on your report for two years.

How to Fix It:

- Only apply for new credit when necessary.

- Avoid opening multiple accounts in a short period.

Negative Public Records

Public records like bankruptcies, foreclosures, or liens are major red flags for lenders.

How it Affects You:

These records stay on your credit report for up to 10 years, making it harder to qualify for loans or get favorable interest rates.

How to Fix It:

- Avoid foreclosure by negotiating repayment plans with lenders.

- Seek credit counseling to manage debts.

Identity Theft and Inaccuracies

Errors or fraudulent accounts on your credit report can damage your score without your knowledge. Examples include unauthorized credit card accounts or inaccuracies in your payment history.

How it Affects You:

Inaccuracies can lower your score and misrepresent your credit risk to lenders.

How to Fix It:

- Monitor your credit regularly through credit bureaus or free services like annualcreditreport.com.

- Dispute errors directly with Experian, Equifax, or TransUnion.

How Lenders Use Credit Reports

Lenders rely on your credit report to make lending decisions, evaluate credit risk, and determine the terms of your loan or credit card.

What Lenders Look For

Lenders review:

Credit mix. Having different types of credit (e.g., personal loans, student loans, auto loans) shows financial stability.

Length of your credit history. A longer average age of accounts demonstrates experience in managing credit.

Credit risk. Red flags like charge-offs or excessive hard inquiries indicate higher risk.

Why it Matters

A poor credit report can lead to:

Higher interest rates

Loan denials

Limited access to lines of credit

Preventing and Fixing Credit Report Red Flags

Proactively managing your credit is the best way to avoid issues.

Proactive Credit Management

Pay bills on time. Late payments are a major red flag. Use autopay or reminders to ensure timely payments.

Monitor your credit. Check your free credit report annually at annualcreditreport.com.

Keep balances low. Aim for a credit utilization ratio under 30%.

Addressing Inaccuracies

If you spot inaccuracies or fraudulent accounts:

Report the issue to the credit bureaus.

Provide documentation, such as proof of payment, to support your dispute.

Follow up to ensure corrections are made.

Responsible Use of Credit

Limit credit inquiries by applying for credit only when needed.

Avoid closing old accounts to maintain the length of your credit history.

Use credit cards wisely by paying more than the minimum balance each month.

Your Credit Score is Key to Your Financial Future

Your credit report and score are powerful tools that influence your financial opportunities. By avoiding red flags and building good habits, you can achieve a good credit score, lower your interest rates, and gain access to better financial options.

Looking for a financial boost? Apply for funding today with Clarify Capital to explore flexible options for your business needs.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts