For many veterinary professionals, access to advanced diagnostic tools and treatment technology can make the difference between offering good care and delivering exceptional outcomes. But with vet clinic equipment costs averaging $85,000 for essentials like X-ray systems, surgical tables, and monitoring devices, most clinics need financial support to make those investments.

That's where veterinary equipment financing comes in. Whether you're starting a new practice, expanding services, or replacing outdated machinery, equipment loans help you avoid large upfront costs while keeping cash flow steady. This guide breaks down how veterinary equipment loans work, compares leasing versus buying, and offers real-world financing examples, like securing funding for a $50,000 ultrasound machine or investing in new treatment tables.

We'll also explore how vet clinic equipment financing options vary by lender, what most veterinarians qualify for, and how to choose the right solution for your practice's growth goals. With the global veterinary equipment market expected to reach $5.01 billion by 2030, staying competitive means staying equipped, and financing is often the smartest way to do it.

Why Veterinary Equipment Financing Matters

Veterinary equipment is one of the largest and most necessary investments a clinic makes. From imaging machines to anesthesia systems, the upfront price tags can be overwhelming. That's why many clinic owners turn to veterinary equipment loans to fund purchases without draining reserves. Financing enables your veterinary practice to secure new equipment while keeping cash flow intact for day-to-day operations, payroll, or marketing efforts.

High-cost items like digital X-ray systems, MRI machines, or surgical lasers often range from tens to hundreds of thousands of dollars. Instead of paying that amount upfront, financing breaks it into predictable monthly payments, a practical move for most small business owners.

It's also a growth strategy. With nearly 51% of veterinary practices making capital improvements last year alone, investing in updated tools is becoming a competitive necessity. And with equipment expenses consuming over 62% of veterinary clinic revenue in North America, finding ways to spread out the cost is critical.

Ultimately, financing is about making ROI-driven decisions that allow your clinic to deliver better care and scale with confidence.

Veterinary Equipment Costs by Practice Type

Equipment needs vary widely between a general veterinary clinic and a specialty vet practice, but both require substantial investment. Understanding the differences helps veterinarians choose the right equipment loans and structure their vet clinic equipment financing for long-term sustainability.

General practices typically invest in foundational tools like:

Basic X-ray machines

Dental units

Ultrasound systems (averaging around $30,000)

In-house blood analyzers

Surgical and anesthesia machines

These practices often start with an equipment budget between $85,000–$125,000 for initial setup and early expansion.

On the other hand, a specialty vet practice, such as cardiology, oncology, or emergency care, needs more advanced, high-ticket items like MRI units, fluoroscopy systems, and advanced lab diagnostics. These setups can require over $250,000 in equipment.

That difference in capital requirements significantly impacts veterinary care providers' financing needs. Specialty clinics typically require longer loan terms or more flexible financing programs, while general clinics may benefit from shorter-term equipment financing with faster payoff.

Whether you're adding basic imaging or planning a full surgical suite, choosing the right loan structure depends on the scale and specialization of your practice.

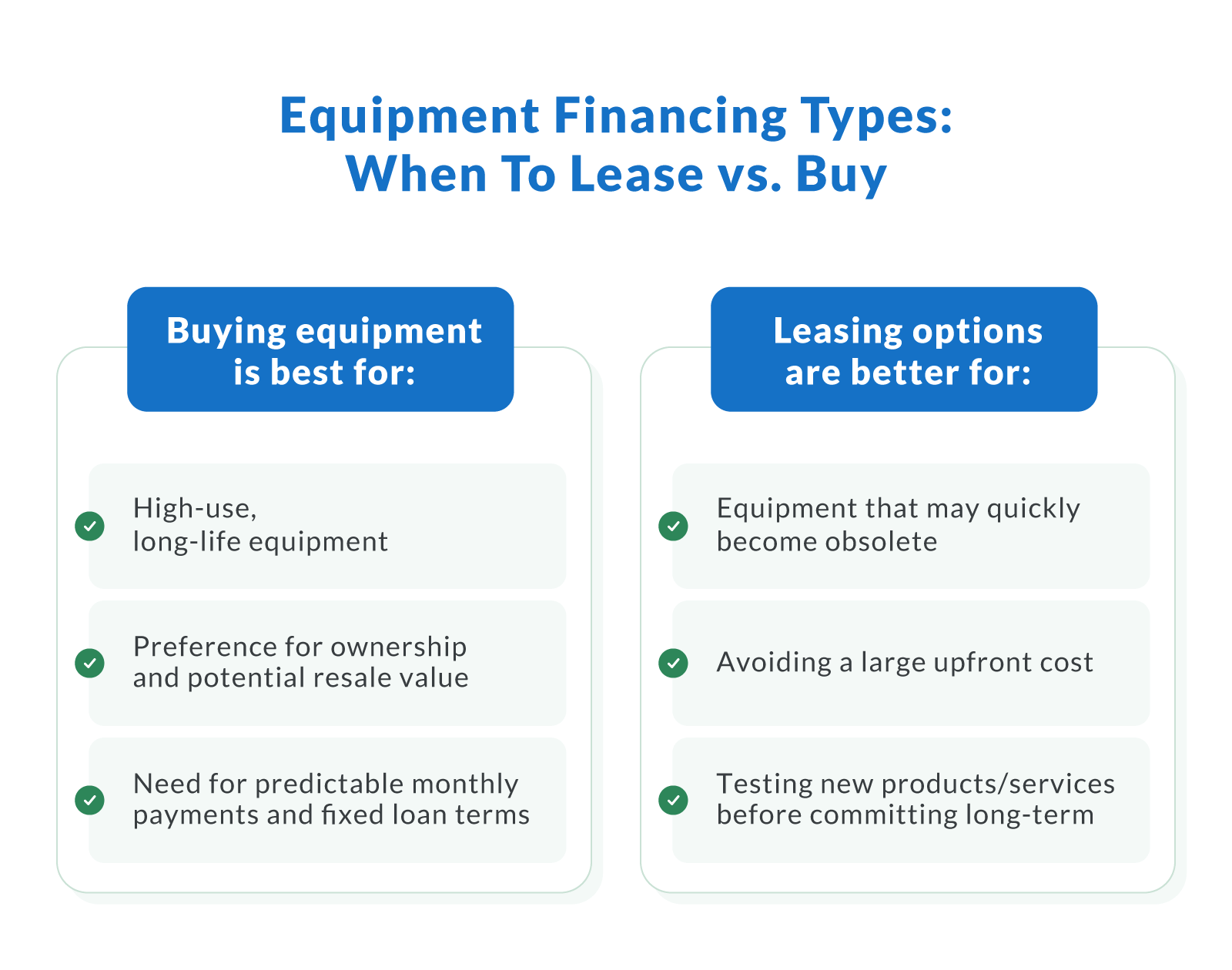

Equipment Financing Options: Loans vs. Leases

Choosing between veterinary equipment financing structures can significantly impact your clinic's cash flow, flexibility, and long-term costs. Both loans and leases serve specific use cases, and the right choice often depends on your equipment needs and how long you plan to keep the asset.

Buying veterinary equipment is best for:

High-use, long-life equipment (e.g., ultrasound, anesthesia, in-house lab machines)

Practices that prefer ownership and potential resale value

Clinics looking for predictable monthly payments and fixed loan terms

SBA-backed equipment loans, for example, offer repayment terms of up to 10 years, helping clinics spread out costs while benefiting from lower interest rates.

Leasing options are better for:

Equipment that may quickly become obsolete (e.g., digital X-rays, endoscopy towers)

When you want to avoid a large upfront outlay

If you're testing new services before committing long-term

In fact, 46% of endoscopy tower placements were completed using an operating lease, illustrating how equipment leasing can offer short-term flexibility for specialty gear.

Your lender or broker can walk you through both financing options to align with your goals, whether that's ROI, flexibility, or cash conservation.

How Equipment Financing Works in a Vet Clinic

Veterinary clinics often face the challenge of balancing necessary equipment upgrades with day-to-day operating costs. Financing offers a way to invest in essential tools without derailing your cash flow. Whether you're purchasing an ultrasound system or upgrading lab equipment, the ability to spread costs over time makes equipment financing a strategic move for many veterinary practices.

Let's walk through a practical scenario to understand how veterinary equipment financing works, from monthly payments to projected ROI, using a real-world example.

Example: Financing a $50,000 Ultrasound Machine

Ultrasound machines are vital for diagnostics and treatment, especially in small animal and equine practices. But the $50,000 upfront cost can be prohibitive without external funding. With equipment financing, that investment becomes manageable and potentially profitable.

Here's how it could break down:

Loan amount: $50,000

Repayment terms: 60 months (five years)

Interest rate: 9% APR (typical range 8%-11%)

Estimated monthly payment: ~$1,038

Revenue impact: Ultrasound services could generate an extra $1,500-$3,000/month, depending on patient volume

ROI potential: Clinic could break even in under 24 months, then operate at a profit for the remaining loan term

Key Practice Metrics To Consider

Understanding your practice benchmarks helps determine if financing makes sense:

Average revenue per patient: $622

Average vet practice square footage: 4,200 square feet, affecting equipment and layout needs

By evaluating repayment terms against expected revenue, practice owners can make smart, scalable decisions about financing their equipment needs.

Can I Lease Veterinary MRI Machines?

Yes, veterinary MRI machines can be leased, and leasing is often the preferred option due to their high cost. These machines can easily exceed six figures in price, making an outright purchase impractical for most vet clinics. Leasing offers a cost-effective way to access advanced imaging technology without draining your cash reserves.

Leasing is especially common for specialty or referral hospitals, where MRI usage is high enough to justify the investment. Vendor-backed lease programs are widely available, making it easier for veterinary practices to get started without extensive upfront costs. Many of these programs are tailored to the healthcare sector and offer flexible repayment schedules.

To lease a veterinary MRI machine, lenders typically look for:

Established business credit

Consistent revenue

A strong repayment history

Proof of clinical need or patient demand

For smaller or newer practices, veterinary equipment loans may still be the better fit depending on your cash flow and long-term ownership goals. Leasing often includes maintenance packages and upgrade options, which reduce operational risk and help manage costs over time.

Tax Benefits and Deductions for Financed Equipment

Financing veterinary equipment doesn't mean missing out on tax breaks. In fact, veterinary practices that finance equipment can still take full advantage of Section 179 deductions. This IRS rule allows business owners to deduct the full purchase price of qualifying equipment, whether it's bought outright or financed, during the year it's placed into service.

That means your clinic can finance a $100,000 piece of equipment and still write off the full amount on your taxes, as long as it's installed and operational before year-end. This creates significant tax savings while preserving cash flow for other financing needs like staffing, marketing, or inventory.

Section 179 is especially useful for high-ticket items like X-ray systems or dental suites. Keep in mind that you must meet eligibility thresholds, and the equipment must be used for business purposes more than 50% of the time.

Up to $1.25 million in qualified equipment purchases is deductible in 2025

Repayment does not affect deduction eligibility

Interest rates on loans are not deductible under Section 179, but may be written off separately as a business expense

Is Veterinary Equipment Financing Right for You?

For many veterinarians, upgrading or replacing clinical tools is a necessary part of practice management, but the high cost of specialized technology can drain resources fast. That's where veterinary equipment financing comes in. Whether you're outfitting a new clinic, expanding services, or replacing outdated systems, financing provides a way to get what you need without putting your cash flow at risk or maxing out credit cards.

From equipment loans for ultrasound or dental machines to flexible leases for high-ticket items like MRI units, today's practice financing solutions make it easier than ever to invest in your clinic's future. These options not only reduce upfront costs but also offer tax advantages and predictable monthly payments, helping you manage overhead while delivering excellent patient care.

If you're exploring equipment upgrades or starting a new practice, now is the time to act. Clarify Capital connects veterinarians with fast, affordable financing tailored to your goals, whether that means growth, efficiency, or simply keeping up with the latest standards in animal health.

Ready to upgrade your practice? Get pre-qualified today or speak to a Clarify advisor about flexible vet equipment financing options that fit your clinic's needs.

FAQs About Veterinary Equipment Financing

Veterinarians exploring their next big equipment purchase often have questions about how financing works and which loan options make the most sense for their veterinary practice. Here are answers to some of the most common questions we hear from business owners in the animal health space.

What's the Difference Between Equipment Loans and Working Capital Loans for Vets?

Equipment loans are used to buy tangible assets like surgical tables, imaging machines, or lab analyzers. These loans are typically secured by the equipment itself, which can result in lower interest rates and longer terms.

Working capital loans, on the other hand, are used for day-to-day expenses, like payroll, rent, or inventory. They're more flexible in how you use the funds, but usually have shorter repayment periods and higher rates. Many business owners use both types to balance investment and cash flow.

Do SBA Loans Cover Veterinary Equipment Financing?

Yes. The Small Business Administration (SBA) 7(a) loan program allows borrowers to finance medical and veterinary equipment with favorable terms, up to 10 years for equipment, with low fixed rates. SBA loans can also bundle equipment financing with working capital, real estate, or renovations.

If you meet the SBA's eligibility criteria, this can be one of the most cost-effective ways to equip a growing veterinary practice.

How Long Are Repayment Terms for Vet Clinic Loans?

Repayment terms vary based on loan type and lender, but most equipment loans for veterinarians range from three to 10 years. SBA loans offer some of the longest terms, while working capital loans and lines of credit are usually shorter, between six and 24 months.

Longer terms can help reduce monthly payments and improve cash flow, especially when financing higher-cost equipment. Clarify Capital works with multiple lenders to match you with the loan structure that fits your clinic's growth stage and financial goals.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts