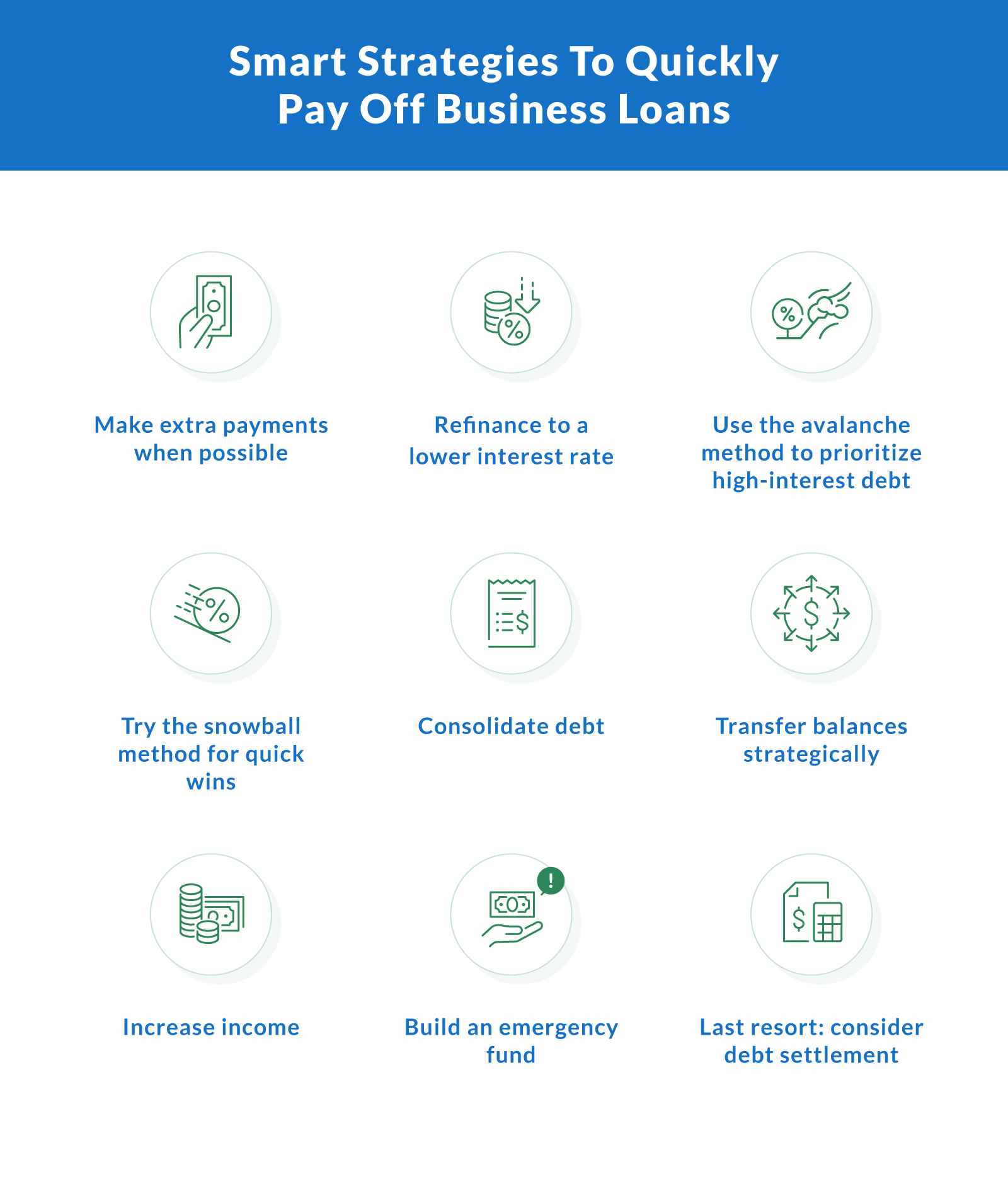

Paying off your business loan ahead of schedule comes with major benefits — like reducing total interest charges, freeing up cash for other priorities, and putting you on a faster path to being debt-free. It also strengthens your overall financial position, giving you more flexibility and peace of mind during uncertain times.

The best approach depends on your financial situation, the type of loan you have, and your current interest rate. From extra loan payments to refinancing options and income-boosting strategies, this article outlines nine ways to speed up your repayment and improve your personal finance game — all without compromising day-to-day operations.

1. Make Extra Payments When Possible

One of the most effective ways to shorten the life of the loan and reduce total interest is by making extra payments toward the principal. Even small additional payments can go a long way over time. If you receive a tax refund, take on a side hustle, or find yourself with extra cash, consider putting that extra money toward your loan payments. These lump-sum contributions lower your balance faster, saving you money on interest and helping you pay off the loan ahead of schedule.

2. Refinance to a Lower Interest Rate

If your interest rate is higher than what's currently available, refinancing into a new loan can reduce your monthly payments, shorten your loan term, or both. This strategy works best when your credit score has improved or market rates have dropped. Refinancing can be a smart move for business owners looking to free up cash or simplify their repayment plan.

3. Use the Avalanche Method To Prioritize High-Interest Debt

The avalanche method targets interest-heavy debt first. You focus on making the minimum payment on all your loans while directing extra funds toward the loan with the highest interest rate. Once that's paid off, you move to the next highest. This strategy helps minimize total interest paid over time and accelerates your debt payoff. It's ideal for those who want to be efficient with their repayment plan and reduce interest debts faster.

4. Try the Snowball Method for Quick Wins

The snowball method focuses on paying off the loan with the smallest balance first, regardless of interest rate. This gives you early wins and builds momentum, which can be motivating if you're tackling multiple debts. You still make the minimum monthly payment on other loans, but you put anything extra toward that smallest balance. While it may not save as much in interest as the avalanche method, it supports consistent progress toward your financial goals.

5. Consolidate Debt

A debt consolidation loan can combine multiple debts into one manageable monthly payment, often at a lower interest rate. This simplifies your repayment and can reduce financial stress. Consolidation works well if you have several personal loans or credit card debt with high rates. Look for reputable providers and compare terms carefully to make sure the new loan truly improves your repayment situation.

6. Transfer Balances Strategically

A balance transfer can help reduce interest charges temporarily, especially if you're carrying high-interest credit card balances. Many credit card companies offer low or 0% introductory APRs for balance transfers, which can give you breathing room to make real progress on your repayment plan. Just make sure to read the fine print.

Here are a few tips to choose the right offer and avoid unexpected costs:

Check the transfer fee. Some cards charge 3–5% upfront, which can offset your savings.

Watch the intro period. Know exactly how long the promotional rate lasts and when the regular rate kicks in.

Pay on time. Missing a minimum payment may cancel the promo rate and trigger retroactive interest.

Limit new spending. Using the card for new purchases can complicate your repayment plan.

Used wisely, a balance transfer can be a smart short-term move to save on interest and get ahead.

7. Increase Income

Sometimes, the best way to pay off debt faster is to boost your income. Extra money from a side hustle or freelance gigs can go directly toward loan payments. This approach not only helps you reach financial goals but keeps you motivated along the way. Every bit of extra cash you apply reduces your balance and interest over time — and gets you closer to being debt-free.

8. Build an Emergency Fund

Creating an emergency fund may not seem like a debt repayment strategy, but it plays a crucial role in staying on track. Having emergency savings gives you a cushion to handle unexpected expenses without pausing debt payments or taking on new debt. For business owners managing a tight financial situation, it's a safety net that protects your repayment plan and supports your long-term personal finance goals.

9. Last Resort: Consider Debt Settlement

If you're truly overwhelmed and other strategies haven't worked, debt settlement could be an option — but it comes with trade-offs. This approach involves negotiating with creditors to settle for less than what you owe, which may lower your total interest debts but can significantly impact your credit report. It should only be considered when you're unable to maintain minimum payments or qualify for more manageable alternatives. Debt management programs may offer a structured path with fewer consequences, depending on your financial situation.

Choose the Strategy That Fits Your Business Goals

Every business has different financial goals, and the best repayment plan is one that supports your long-term success. Whether you're focused on lowering your interest rate, shortening your loan term, or becoming debt-free faster, understanding your options helps you take control of your personal finance strategy.

Being proactive about managing debt and the life of the loan puts you in a stronger position for future growth. Need funding that works with your plan? Explore your options with Clarify Capital and find flexible financing that aligns with your goals.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts