An SBA Express loan is an SBA 7(a) loan that uses a streamlined delivery method. It's designed for faster decision-making and less paperwork while still offering U.S. Small Business Administration (SBA) backing. Under the SBA Express option, borrowers can request up to $500,000, with the SBA promising a credit decision within 36 hours (though full funding may take longer).

Because participating lenders process express loans under delegation authority (without direct SBA review), they often reach approval and closing faster than standard SBA 7(a) loans — though interest rates may be slightly higher to compensate for the reduced guarantee and quicker underwriting.

In this article, we'll cover eligibility requirements, the application process and required documentation, interest rates and repayment terms, major benefits, and common FAQs. By the end, you'll know whether an SBA Express loan fits your business's financing needs, especially if you need funding faster but still want favorable SBA‑backed terms.

What Is an SBA Express Loan?

An SBA Express loan is a variant of the SBA 7(a) loan program, featuring a streamlined structure for faster turnaround and reduced paperwork. It allows borrowers to request up to $500,000 under the SBA Express delivery method.

Under the SBA Express model, the SBA provides a maximum 50% guarantee to participating lenders — meaning the SBA backs up to half of the loan if a borrower defaults.

Common business uses for an SBA Express loan include:

Working capital

Refinancing existing business debt

Purchasing equipment

Commercial real estate acquisitions or improvements

Leasehold improvements

Because SBA Express is a delivery method for 7(a) loans, its permitted uses largely mirror those of standard 7(a) loans.

How it differs from a standard SBA 7(a) loan:

Speed. Express loans enable lenders to approve under delegated authority without full SBA review, speeding up the decision-making process.

Guarantee level. The SBA guarantee is capped at 50% for SBA Express, whereas standard 7(a) loans may have higher guarantee percentages (e.g., 75% or more), depending on the loan size and program.

Cost/interest rates. Because the SBA's risk is lower for SBA Express loans (via lower guarantee), lenders may charge slightly higher interest or fees to compensate.

Maximum loan size. SBA Express is capped at $500,000, whereas standard 7(a) loans can go higher (up to $5 million), depending on the program.

SBA Express Loan Requirements

SBA Express loans have clear, publicly documented eligibility rules. In addition, certain prerequisites must be met by businesses that apply for this type of loan at Clarify Capital.

Clarify Capital's Requirements

$10,000 monthly revenue (or similar minimum revenue threshold)

At least six months in business

U.S. incorporation or a legal entity registered in the United States

Active business bank account in the company name

These internal guidelines help streamline the loan process and ensure alignment with preferred lender standards.

Public/Typical SBA Express Eligibility and Credit Criteria

To qualify for an SBA Express loan, businesses typically need to meet the following eligibility and credit criteria:

Operates as a for‑profit business in the U.S. or its territories

Owned principally by U.S. citizens, permanent residents, or appropriately lawful nationals

Demonstrates the ability to repay the loan from business cash flow

Has typical credit score minimums — 650+ for most lenders, though others may consider lower scores (e.g., 550+), depending on compensating strengths (revenue, cash flow, collateral)

In addition, because SBA Express is not suited for startups, existing businesses with some operating history usually qualify more readily than brand new ventures.

Required Documentation (Common Across SBA Express/7(a) Applications)

Here is a typical list of documents lenders may request for an SBA Express application:

Completed SBA application forms. Examples include SBA Form 1919, SBA Express Authorization forms, and credit authorization forms.

Federal tax returns. Including personal and business returns for the last two to three years.

Business bank statements. Last three months or more.

Year‑to-date (YTD) financial statements. Showing profit, loss, and a balance sheet.

Business debt schedule. Must list existing liabilities, creditors, and payments.

Proof of business entity. Incorporation documents, business license, and ownership records.

Business plan. Some lenders may require a plan for the use of funds.

Collateral documentation. Not required by every lender.

Ownership/personal financial statements. Often required for owners with significant equity shares.

Because lenders may use delegated authority for SBA Express loans, their standards can vary. Always confirm the specific documentation checklist with the lender or through your marketplace (such as Clarify Capital).

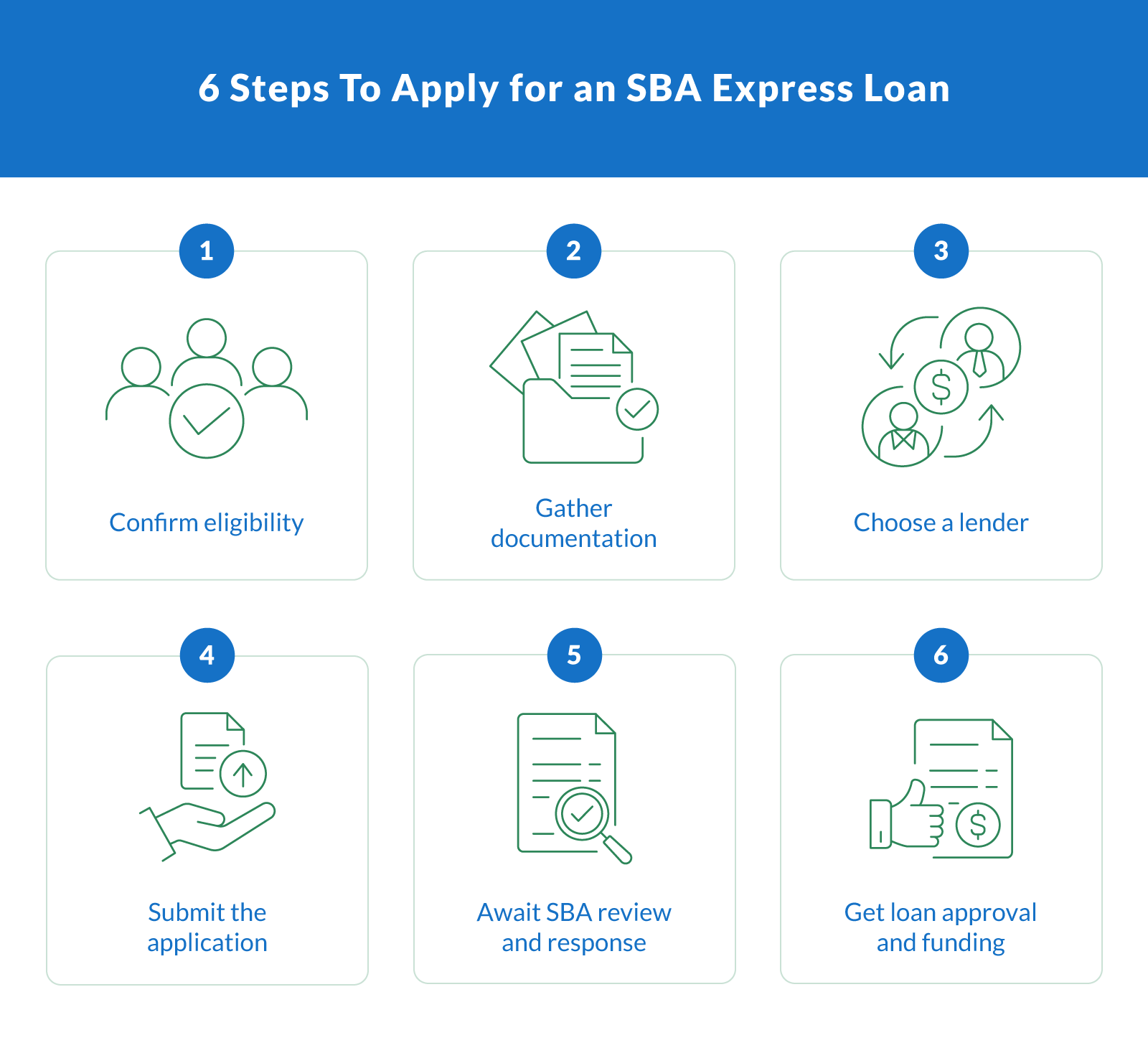

How To Apply for an SBA Express Loan in Six Steps

Applying for an SBA Express loan can help small business owners access fast funding with less paperwork. This streamlined loan program typically delivers a turnaround time under 36 hours after applicants submit their materials — much faster than traditional SBA loans. That speed, however, depends on how well-prepared you are and whether you work with an SBA preferred lender.

These lenders can speed up the loan process and approve loans without full SBA review. Whether you're seeking working capital, expanding operations, or meeting another business purpose, getting familiar with each step improves your chances of fast approval and smooth funding.

Follow the six-step process below to ensure you get the fastest decision you can — and receive your funds quickly.

1. Confirm Eligibility

Before applying, ensure your business meets basic eligibility requirements. To qualify for an SBA Express loan, your business must:

Be officially incorporated in the U.S.

Meet SBA size standards and generate sufficient business revenue

Operate for a minimum length of time (typically two years)

Fall within an eligible business type

Have a valid business purpose for the funds (e.g., equipment, working capital, expansion)

2. Gather Documentation

You can significantly reduce approval delays by organizing your documentation ahead of time.

Lenders generally request:

SBA application forms, such as Form 1919

Federal tax returns (usually the last two to three years)

Recent bank statements

Current and projected financial statements

A complete debt schedule with outstanding loans and repayment terms

3. Choose a Lender

Working with an SBA preferred lender speeds up approval by reducing SBA involvement. These lenders have the authority to make credit decisions, which can reduce your turnaround time.

Many FDIC-insured banks and credit unions offer SBA Express loans. Find the one that's right for you by comparing financing options based on experience with your industry, interest rates, terms, and service options.

4. Submit the Application

When you're ready to complete your lender's application package, include all SBA forms and internal paperwork. Accuracy is key — missing or inconsistent information can slow the loan process or lead to denial.

Double-check details like your requested loan amount, credit limit, and business purpose before submitting.

5. SBA Review and Response

Once your lender submits the package, the SBA usually returns a decision within 36 hours. Using an SBA preferred lender may skip this step entirely, providing even faster feedback. That's why choosing the right loan program partner matters.

6. Loan Approval and Funding

If approved, your lender will outline the loan terms, including repayment schedule, interest rate, and disbursement timeline. Review these carefully before signing. Many borrowers receive funds within days, especially if working with a preferred lender.

SBA Express Loan Benefits

Compared to standard SBA 7(a) commercial loans, the SBA Express loan offers a significantly faster turnaround time, typically within 36 hours. This speed makes it one of the most appealing business financing options for companies needing quick access to funds.

Flexible Business Purposes

Borrowers can use SBA Express funds for a wide range of business purposes.

The most common uses include:

Working capital to support day-to-day operations

Refinancing existing debt on more favorable terms

Purchasing equipment or machinery

Buying or improving owner-occupied real estate

Acquiring inventory and supplies

Payroll for full-time employees, contractors, and part-time or temporary workers

Marketing and advertising expenses

The flexibility of an SBA Express loan helps business owners align the loan amount they apply for with their most pressing needs.

Revolving Lines of Credit

Unlike many traditional business loan programs, SBA Express supports revolving lines of credit that offer ongoing access to funds up to a set credit limit. This feature allows businesses to draw and repay funds as needed, which is especially helpful for managing uneven cash flow or seasonal demand.

Lower SBA Loan Guarantee

While SBA Express loans come with a lower loan guarantee (up to 50%) than standard SBA 7(a) loans, they still reduce risk for lenders. Partial backing makes it easier for borrowers to qualify, even with less-than-perfect credit or limited collateral.

SBA Express Loan vs. Standard SBA 7(a) Loan

Choosing between an SBA Express loan and a standard SBA 7(a) loan depends on your priorities, speed, or scale. If your business needs fast access to funds for short-term needs or smaller expenses, the Express program is ideal. With a 36-hour decision time and support for revolving lines of credit, it's one of the quickest financing options available.

On the other hand, if you're financing a major purchase like commercial real estate, expanding operations, or seeking lower interest rates with more flexible loan terms, the standard SBA 7(a) loan is a better fit. Though approval may take weeks, it supports higher loan amounts with a stronger loan guarantee for lenders.

The table below shows a side-by-side comparison of SBA Express and SBA 7(a) loans.

| Comparison of SBA Express and Standard SBA 7(a) Loans | ||

|---|---|---|

| Feature | SBA Express Loan | Standard SBA 7(a) Loan |

| Approval Time | Within 36 hours | Several weeks |

| Loan Amount | Up to $50,000 | Up to $5 million |

| SBA Loan Guarantee | 50% | 75% to 85% (depending on loan size) |

| Interest Rate Cap | Higher than standard 7(a) | Lower interest rate cap |

| Repayment Terms | Typically up to seven years (10 for real estate | Up to 10-25 years (depending on purpose) |

| Revolving Lines of Credit | Available (up to seven years) | Not standard |

| Best For | Fast funding, smaller loan amounts | Larger commercial loans, longer terms |

SBA Express Loan Terms and Conditions

The SBA created the SBA Express loan program to provide quick, flexible funding for small businesses who have immediate or short-term needs. While it shares many features with the standard SBA 7(a) program, it includes specific caps and terms that borrowers should understand before applying.

Loan Amount and SBA Guarantee

The maximum loan amount for SBA Express is $500,000. The SBA provides a loan guarantee of up to 50% of the loan, lower than the 75% to 85% typically offered for standard 7(a) loans. Even with the smaller guarantee, this still reduces risk for lenders and improves access to funding for borrowers who may not qualify through traditional channels.

Repayment Terms

Loan terms vary by lender and loan use.

Working capital or purchasing equipment. Repayment typically spans five to 10 years.

Commercial real estate. Property purchases may qualify for longer terms, depending on the lender's policy and the asset's value.

Other uses. Lenders may have other terms depending on the intended use of the loan.

Prepayment Policies

Some SBA Express loans may include prepayment penalties, especially for real estate or longer-term financing. However, many lenders offer a fee waiver if borrowers pay off the loan after a certain period, often three years. It's important to review your lender's full loan terms before signing to avoid surprises later on.

Is an SBA Express Loan Right for Your Business?

The SBA Express loan offers a fast-track loan process with fewer documentation requirements and a 36-hour approval window. It's a solid option for businesses that need quick access to funding.

However, SBA Express funding has trade-offs. With speed and flexibility comes slightly higher interest rates, shorter repayment terms, and a smaller loan amount cap compared to other business financing programs.

Apply for an SBA Express Loan Today

If speed and simplicity are what your business needs most, an SBA Express loan might be the right fit. You can apply today with Clarify Capital to get started on your funding application.

FAQs About SBA Express Loans

Have questions about the SBA Express loan program? Below are answers to the most common concerns borrowers have when considering this fast, flexible funding option.

How Long Does It Take To Get Approved for an SBA Express Loan?

One of the biggest advantages of SBA Express loans is speed. The SBA typically completes its review within 36 hours of receiving a complete application from your lender. However, the full loan process depends on how quickly the lender underwrites and disburses the funds. With some financing options, funding can happen within a few days, especially if you're working with an SBA preferred lender.

Delays often happen when documentation is missing, inconsistent, or requires additional verification. To minimize turnaround time, make sure all required paperwork is accurate and complete before submitting your application.

What Are the Interest Rates for SBA Express Loans?

The lender sets the interest rate for an SBA Express business loan, but it must fall within SBA-established limits. Lenders typically base these rates on the prime rate plus an allowable margin, often ranging from 4.5% to 6.5%, depending on the term length and loan amount.

Because SBA Express loans offer faster processing and less paperwork, their rates are usually higher than those of a standard SBA 7(a) loan. Still, many borrowers find the trade-off worth it for the speed and flexibility of the SBA Express program. Be sure to review the full loan terms — including rate structure and repayment schedule — before accepting an offer.

How Does SBA Export Express Compare to EWCP?

Here's how the SBA Export Express program compares to the Export Working Capital Program (EWCP) across key criteria:

Export Express (SBA Export Express)

Export Express offers a streamlined SBA-backed option designed specifically to help small businesses access export-related financing quickly and flexibly.

Fast approval. Export‑related financing with delegated authority for approval without prior SBA review.

Maximum loan amount. Up to $500,000.

SBA guarantee structure. 90% guarantee for loans less than $350,000 and 75% guarantee for amounts above $350,000 to $500,000.

Turnaround and decision time. Typically within 36 hours.

Permitted uses. More flexibility for export development (e.g., trade shows, translation, marketing), capital expenditures (equipment, real estate) tied to export business, revolving export lines, transaction financing, etc.

Repayment and maturity. Lines of credit up to seven years, or term financing for equipment or real estate up to their useful life or longer, depending on lender policy.

Interest rate caps. Similar to standard SBA Express caps — prime + 6.5% for amounts less than $50,000 and prime + 4.5% for amounts over $50,000.

Collateral and underwriting. Standard lender collateral policies for loans above $25,000 (may not be required below that).

Advantages. Speed, flexibility in purpose, delegated underwriting, and the ability to serve export development beyond strictly working capital.

Export Working Capital Program (EWCP)

The EWCP provides short-term, transaction-specific funding to help small businesses fulfill export orders and manage working capital tied directly to international sales.

Traditional SBA program. SBA 7(a) export‑finance vehicle focused on working capital needs tied to fulfilling export orders (inventory, production costs, foreign receivables, standby letters of credit, etc.)

Maximum loan amount. Up to $5 million.

SBA guarantee: Up to 90% of the eligible portion.

Repayment and maturity. Typically very short-term (12 months or less), though some loans or renewals can be extended.

Processing time. Slower than Export Express due to stricter underwriting and SBA oversight.

Collateral and receivables. Can include export‑related inventory and foreign accounts.

Uses. Transaction‑specific funding tied to export contracts and working capital needs rather than broad business purposes.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts