So, what's the easiest SBA loan to get? In 2025, it depends on how quickly you need the money, your credit profile, and your business goals. The good news: options like the SBA Express loan and SBA microloan are helping more small business owners qualify faster — even if you're a startup.

This guide breaks down your top choices, including how to meet SBA loan eligibility in 2025, what to expect from the application process, and which loans work best for different business needs. Whether you're building cash flow, buying equipment, or just getting started, we'll show you a path to funding.

Let's take a closer look at your options and help you find the small business loan that's the best fit.

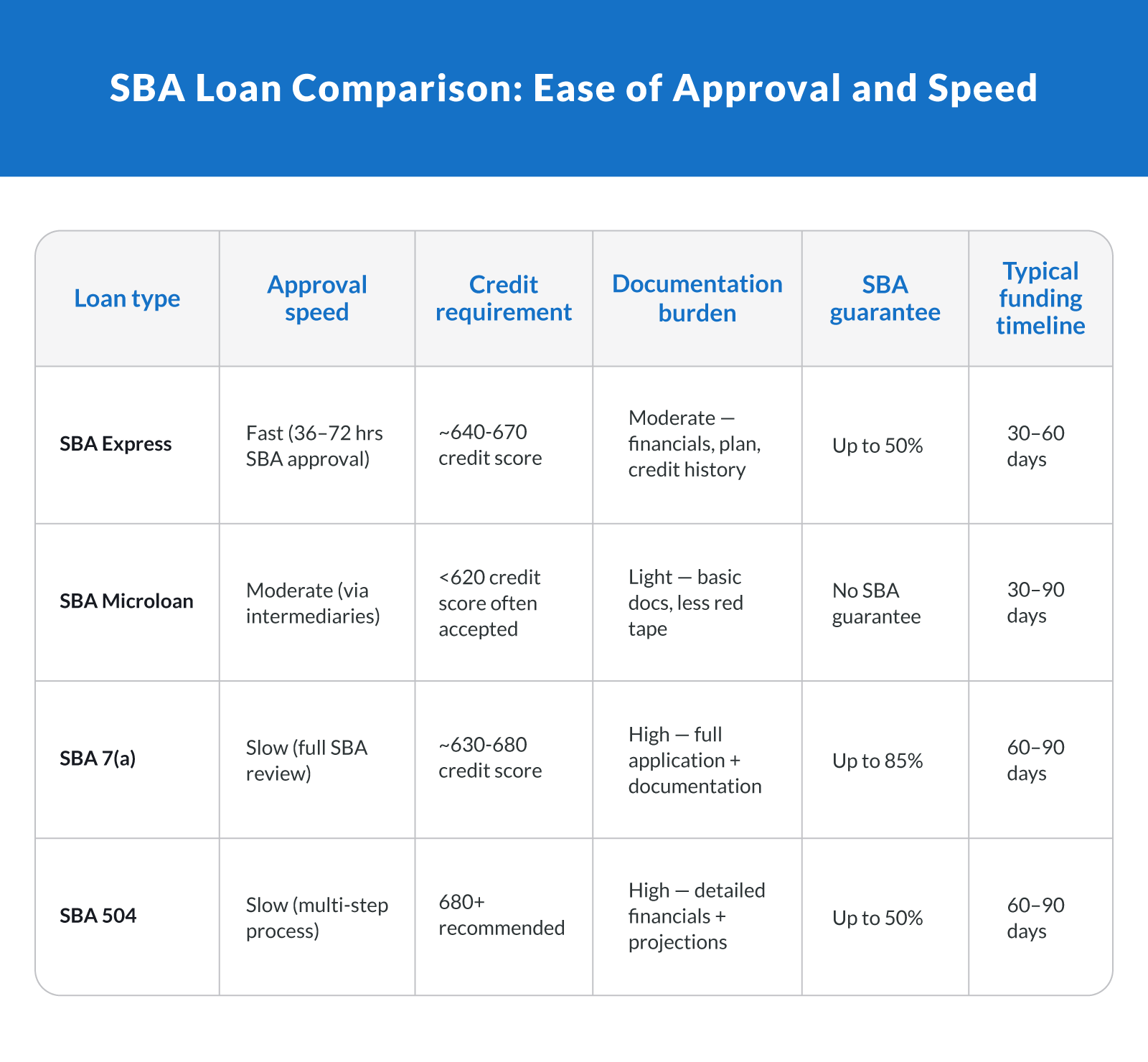

SBA Loan Programs Compared — Which Is Easiest?

SBA loan programs all serve different purposes, but some are easier to qualify for than others. Here's a look at how the main SBA loans stack up in 2025, based on speed, credit requirements, paperwork, and lender flexibility.

SBA Express loan. This is the go-to for speed. The SBA guarantees up to 50% of the loan, which allows lenders to approve and process applications faster. You can get up to $500,000, and decisions from the SBA come in as little as 36 hours. You'll need a credit score of 640 or higher to get approved.

SBA microloan. Best for startups and very small businesses. These loans go up to $50,000, with average amounts closer to $13,000. Requirements are more flexible, including lower credit scores (620 or under) and simpler documentation. Approved through nonprofit intermediaries.

SBA Community Advantage. Great for underserved businesses. Similar to 7(a) loans but focused on low-income or minority-owned businesses. Loan amounts up to $350,000. Requires more paperwork but offers support for those who qualify.

SBA 7(a) loan. The most popular SBA loan, used for working capital, real estate, and refinancing. Higher approval standards apply. Loan amounts can go up to $5 million, but it's not ideal if you're in a hurry or have a low credit score.

SBA 504 loan. Best for buying fixed assets like commercial real estate or heavy equipment. These require a larger down payment, strong financials, and longer approval timelines. Not beginner-friendly.

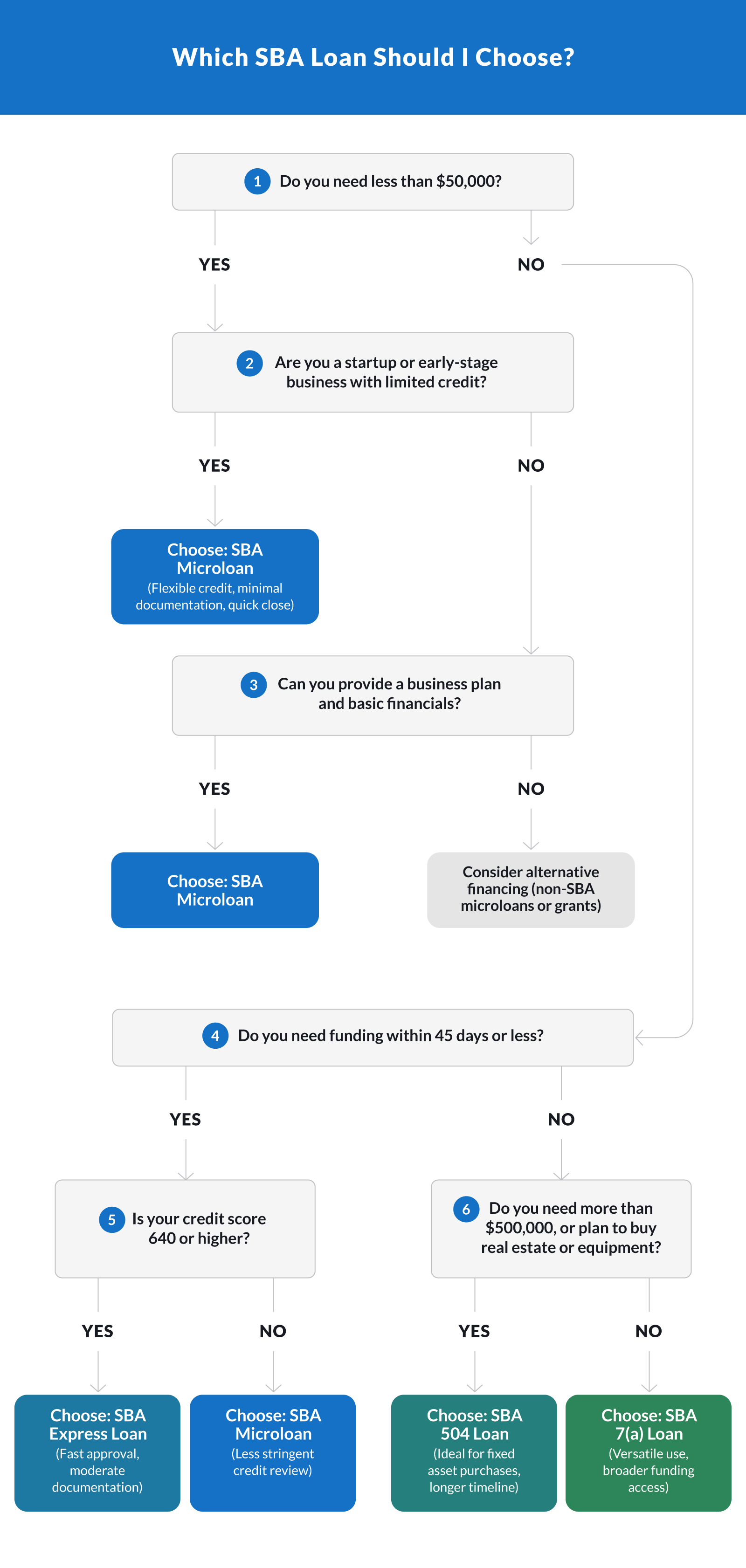

How To Choose the Right SBA Loan in 2025

With several loan options available, the best SBA loan depends on your business size, timeline, and credit profile. Here's how to make a smart choice based on your current situation.

If you need fast funding and have fair credit, the SBA Express loan is your best bet. It's designed for speed, making it ideal for businesses that can't wait 60 to 90 days. You'll typically need a credit score of 640 or higher and moderate documentation.

If you're just starting out or need a small loan amount, consider an SBA microloan. These loans often accept credit scores around 620 or lower and have lighter paperwork. Many small businesses can get approved in under 30 days. Microloans also work well for short-term needs and flexible working capital.

For larger financing needs — like real estate purchases or multi-use working capital — look at the SBA 7(a) loan. It takes more time and requires a stronger credit profile, but you can borrow up to $5 million with longer repayment terms.

Preferred Lenders help speed up the process, no matter which loan you choose. They can skip SBA processing delays and offer more streamlined approvals.

Qualifying Criteria for SBA Loans in 2025

Most SBA loans follow the same core requirements. Your business must be U.S.-based, operate for profit, meet SBA size standards, and show you've tried other financing first. But the details vary depending on the loan.

General Eligibility Requirements

To qualify for any SBA loan, you need:

U.S.-based, for-profit business. Nonprofits don't qualify.

Meet SBA size standards. These depend on your industry and revenue.

Owner investment. You should have some equity in the business.

Reasonable creditworthiness. Lenders evaluate both personal and business credit.

Minimum Requirements by SBA Loan Type

Here's what it typically takes to qualify in 2025:

SBA Express loan. Credit score of at least 640. Moderate paperwork. Time in business preferred but not required.

SBA Microloan. Credit scores of 620 or lower are often accepted. Startup-friendly with light documentation.

SBA 7(a) loan. Minimum credit score around 615. Requires financial statements, business plan, and proof of cash flow.

In addition, the SBA looks at your FICO SBSS score, which blends personal and business credit. You'll usually need a score of at least 155 to move forward.

Meeting these standards is the first step to getting approved. The stronger your financials and documentation, the better your terms.

Why SBA Express Is Often the Fastest Option

Speed matters — especially when your business needs cash to cover expenses, seize opportunities, or smooth out cash flow. That's where the SBA Express loan stands out.

The SBA promises a response to lenders within 36 hours, which is much faster than traditional SBA programs. While the full loan process still takes 45 to 60 days in most cases, that's quicker than the two to four months required for larger SBA loans.

You can borrow up to $500,000, and the loan is partly backed by the SBA. This lowers risk for lenders and helps more borrowers get approved, especially when working with a preferred lender. These lenders have authority to make final credit decisions without SBA interference, saving even more time.

The tradeoff? You'll typically need a higher credit score (640+) and stronger financials than you would for a Microloan. But if you qualify, it's one of the fastest ways to secure SBA-backed funding.

Microloans — Ideal for Startups and Small Amounts

If you're a new business or only need a small infusion of working capital, SBA Microloans are a strong option. These loans go up to $50,000, but most are much smaller — around $13,000 on average.

Microloans are funded by the SBA but distributed through nonprofit intermediary lenders. This creates more flexibility in the approval process. Startups, sole proprietors, and business owners with less-than-perfect credit often qualify.

They also have faster closing times — often less than 30 days — and minimal paperwork. That makes them ideal if you're buying inventory, paying rent, or covering short-term expenses while building credit.

You may not get the highest loan amount or the longest term, but you'll avoid the complexity of larger loans. If you're just getting off the ground or testing a new idea, a microloan could be the simplest way to fund it.

Final Decision: Which SBA Loan Is Easiest?

If you're asking, “What's the easiest SBA loan to get?” — the answer depends on your needs.

For speed and higher loan amounts, the SBA Express loan offers the best mix of fast approval, moderate paperwork, and lender flexibility. It's especially helpful if your business has fair credit and needs up to $500,000 quickly.

For smaller loan sizes or new ventures, the SBA microloan is a standout. It has more flexible credit requirements, easier documentation, and quicker turnaround through local nonprofits.

In 2025, both options give small business owners real paths to affordable funding, and Clarify Capital can help you get started. Apply now to see what you qualify for.

FAQs About SBA Loans in 2025

Here are answers to common questions about SBA loan options, eligibility, and the loan process in 2025.

What Is the Easiest SBA Loan To Qualify for in 2025?

The SBA Microloan is typically the easiest to qualify for. It accepts lower credit scores, requires less documentation, and is offered through nonprofit lenders who can be more flexible with startups and new businesses.

How Fast Can I Get an SBA Express Loan?

While the SBA responds to lenders within 36 hours, full funding for an SBA Express loan usually takes 45 to 60 days. This makes it one of the fastest SBA loan options available.

What's the Minimum Credit Score for a Microloan?

Many SBA microloan lenders accept credit scores of 620 or lower, especially if your business shows potential and the loan amount is small.

Do SBA Lenders Check Personal Credit?

Yes. Most SBA lenders check both your personal and business credit. Your FICO SBSS score — which combines both — is a key factor in the approval process.

How Do I Apply for an SBA Loan With Bad Credit?

Start by looking into Microloans or working with a preferred SBA lender who understands your situation. Be prepared with a strong business plan, bank statements, and a detailed explanation of your credit history. Demonstrating consistent revenue can help offset a lower credit score.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts