Running a wellness clinic or alternative medicine practice presents unique financial hurdles, especially for medical professionals and providers operating outside traditional insurance networks. That's where health care professional loans come in.

These flexible funding solutions are designed for medical doctors, naturopaths, behavioral health specialists, chiropractors, and wellness clinic owners. Whether you're launching a new practice or expanding an existing one, financing can help you grow without compromising your care philosophy.

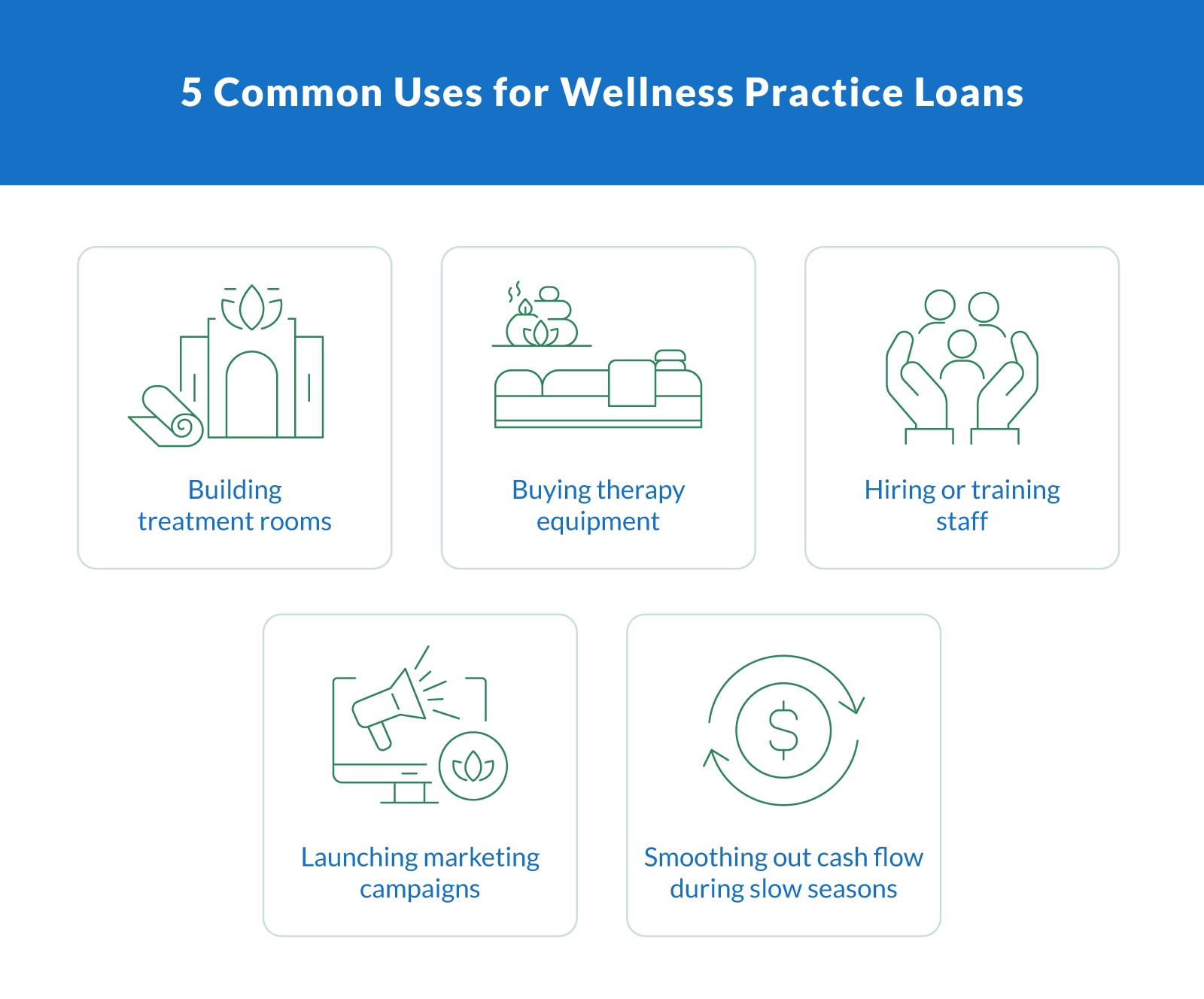

Funds can be used for treatment room buildouts, electrotherapy equipment, staffing, marketing, rent, or managing seasonal cash flow. Even with less-than-perfect credit, lenders like Clarify Capital offer fast, tailored funding with a simple prequalification process.

Why Lenders Treat Holistic Providers Differently

Holistic health professionals often have unique financial models and funding needs compared to conventional medical practices. Here's why lenders approach them differently:

Unconventional payment structures. Many holistic providers rely on out-of-pocket payments or boutique packages rather than insurance reimbursements, making income less predictable.

Smaller client bases. Acupuncturists, massage therapists, nutritionists, and behavioral health specialists often serve fewer patients, which can affect cash flow stability.

Specialized services and limited insurance billing. Niche offerings and minimal insurance involvement contribute to a different risk profile for lenders.

Diverse financing needs. Common expenses include treatment space rentals, wellness technology (like PEMF mats or red light therapy), digital marketing, and telehealth tools.

Because of these unique needs, lenders often prefer to work with partners like Clarify Capital that understand how to structure loans that align with holistic business models and long-term growth.

Key Loan Types for Holistic Wellness Practices

Holistic health providers, such as massage therapists and integrative MDs or mental health professionals, often need flexible funding to grow their practices. Whether you're opening a new location or upgrading treatment tools, these financing options can support your specific goals:

SBA Loans

Backed by the Small Business Administration, SBA loans offer competitive interest rates and long repayment terms. These are ideal for larger expenses like buildouts or multi-service wellness centers.

Pros: Low fixed-rate options, long repayment terms

Cons: Longer approval timelines, strict eligibility requirements

Typical loan amount: Up to $5 million

Business Line of Credit

This flexible option lets you draw funds as needed, which is great for covering fluctuating costs like marketing campaigns or seasonal dips.

Pros: Revolving access to capital, interest only on what you use

Cons: May require stronger business credit

Loan amount: $10,000–$500,000

Equipment Financing

Perfect for purchasing high-ticket items like infrared saunas, cryotherapy machines, or therapy beds. The equipment itself typically secures the loan.

Pros: Fast approvals, asset-backed

Cons: Funds limited to specific purchases

Loan amount: Varies by asset cost

Personal Loans

If your wellness practice is just starting out, personal loans based on your credit history can be a useful fallback.

Pros: Fast access, minimal paperwork

Cons: Typically smaller amounts, higher rates

Loan amount: $5,000–$100,000

Each loan type offers different advantages depending on your business stage, service model, and growth plans. Whether you're a nurse practitioner, physician assistant, or licensed acupuncturist, Clarify Capital helps match health care professionals with financing solutions that suit their practice models.

Eligibility & Documentation Checklist

Before starting your loan application, it's important to understand what lenders typically look for when evaluating health care professionals, especially those in holistic and wellness-based practices. For first-time borrowers launching a wellness clinic, a strong business plan and credit history are key to getting approved. While requirements vary by lender and loan type, most follow a common set of eligibility criteria and documentation needs.

To qualify for most wellness clinic loans, you'll need:

Credit score of 600+. Some lenders accept lower scores, but a higher credit score improves your rates and approval odds.

6+ months in business. Startup loans are available, but lenders often prefer an established operation.

Minimum $10,000 in monthly revenue. Shows sustainable cash flow to handle monthly payments.

Business plan. Demonstrates how you'll use the funds, especially if applying for an SBA or startup loan.

Valid business license and proof of practice. This also goes for massage therapists, naturopaths, and other similar professionals.

Tax returns and financial statements. You'll likely need to include information from the past 1–2 years.

Voided check. Make sure it's attached to your business bank account.

Identification. This can include a driver's license or Social Security number for verification.

Lenders may also require additional information during underwriting, such as proof of equipment quotes or marketing budget. This is especially likely for alternative medicine practice financing.

Clarify Capital helps simplify the application process by pre-screening for lender fit, so you can focus on what matters most: delivering quality care.

How To Choose the Right Loan

With so many lenders offering different financing products, holistic health care professionals need to weigh their options carefully. When opening a new practice or looking to refinance business debt, comparing rates, terms, and approval criteria is key to finding the right fit.

Start by narrowing down your priorities. Do you need fast funding, the lowest possible APR, or long-term stability? Some providers, like SBA-backed lenders, offer low rates but take weeks to process. Others, like online lenders, may approve you within a day, but typically charge more.

The best loan isn't always the one with the lowest rate; it's the one that aligns with your credit approval odds, repayment capacity, and practice goals.

Many providers are balancing educational loans or student loan debt alongside practice startup costs, which can impact their loan eligibility and repayment terms. Review the different types of loans below to see which is best for your financial needs:

| Loan Comparison for Health Care Practices | |||||

|---|---|---|---|---|---|

| Loan type | Typical APR | Loan size | Term length | Best for | Funding speed |

| SBA loan | 6%–10% | Up to $5 million | 5–25 years | Expanding or purchasing practices | 2–6 weeks |

| Business line of credit | 8%–24% | $10K–$250K | Revolving | Managing seasonal cash flow | 1–3 days |

| Personal Loan | 7%–30% | Up to $100K | 2–7 years | Startups with limited business credit | 1–5 days |

| Equipment financing | 5%–20% | Based on equipment value | 2–6 years | Buying massage tables, EMR tools, etc. | 1–5 days |

| Online term Loan | 9%–30% | $10K–$500K | 1–5 years | Quick capital with moderate terms | Same day – 3 days |

When comparing options, look beyond the interest rate, consider total borrowing cost, monthly payment structure, and how well the loan matches your business model. And if you already have existing debt, refinancing into a longer-term or lower-rate product may free up cash flow for marketing or equipment upgrades.

Clarify Capital matches borrowers with vetted lenders based on specific business needs, helping you secure the right loan without the guesswork.

Loan Application Walkthrough

Applying for a health care professional loan doesn't have to be overwhelming. Big goals, like launching a new wellness center or expanding a behavioral health practice, require a clear roadmap that can increase your chances of credit approval and speed up funding.

Below is a step-by-step guide to walk you through the loan application process, from initial online application to final approval:

Prequalify with a lender. Start by filling out a short online application to get prequalified. You'll need to provide basic business information, including your industry, years in operation, and monthly revenue. This step helps you see estimated loan terms without impacting your credit score.

Gather required documents. Most lenders will request financial statements, your Social Security number, tax returns, a business plan, and proof of licensing. Have these ready to streamline your review process.

Submit your full loan application. Once prequalified, submit a full loan application with supporting documentation. Clarify Capital makes this step easy with one universal application sent to multiple lenders.

Undergo an underwriting review. The lender verifies your information, assesses risk, and determines your credit approval. Expect follow-up questions about revenue trends, expenses, or business goals.

Receive and review the offer. You'll receive your loan terms, including APR, repayment timeline, and total loan amount. Ask questions and compare offers before accepting.

Accept and fund. Once you accept the offer, the lender can transfer the funds as soon as the same day, especially if you're working with an online lender focused on health care professionals.

Clarify Capital's streamlined application process helps you move from “apply” to “approved” faster, while matching you with financing that fits your goals and growth stage.

Financing Wellness Practices With Confidence

Whether you're opening a new acupuncture clinic, expanding your behavioral health services, or upgrading your massage therapy equipment, the right funding can move your practice forward. With so many financing options available, from personal loans to SBA programs, health care professionals in alternative and holistic spaces have more flexibility than ever.

That said, it's important to choose a financing structure that aligns with your revenue cycle, credit profile, and growth timeline. Many lenders now offer health care professional loans tailored for smaller practices and wellness businesses, even if you're just starting out.

Clarify Capital simplifies the loan process by connecting you to top-rated lenders based on your business needs. You can compare rates, terms, and eligibility with no obligation and get pre-qualified in just minutes.

Compare lenders and calculate your monthly loan cost. Start here with Clarify Capital.

FAQs About Wellness and Health Care Professional Loans

If you're exploring wellness clinic loans or alternative medicine practice financing, these FAQs will help clarify your next steps.

What Types of Loans Are Available to Alternative Medicine Practices?

Alternative and holistic health care providers can access a variety of health care professional loans depending on their practice goals and financial profile. Common loan options include SBA 7(a) loans for high-capital investments, equipment financing for therapy devices or diagnostic tools, lines of credit for recurring costs, and personal loans for startup expenses. Some wellness clinic loans are available through online lenders with flexible repayment structures and lower documentation requirements.

Some borrowers may also qualify for a federal loan repayment program if their practice serves underserved communities or meets public health criteria.

How Can I Qualify for a Wellness Clinic Loan?

Lenders typically assess your loan application based on several factors: business plan, credit score, time in business, and annual revenue. If your clinic is new, some lenders may approve a smaller loan amount using personal credit and projected income. Having clear documentation can improve your approval chances. Examples include licenses, tax returns, and a detailed use-of-funds statement.

What Credit Score Do I Need for a Health Care Loan?

Most lenders look for a minimum credit score of 620–650 for health care professional loans, though higher scores (700+) unlock better interest rates and longer terms. If your credit score is lower, offering collateral or securing a co-signer may help you qualify.

Are SBA Loans Available for Acupuncturists and Chiropractors?

Yes. SBA loans are available to a wide range of wellness practitioners, including acupuncturists, chiropractors, massage therapists, and naturopathic doctors. These loans are backed by the Small Business Administration and can fund equipment purchases, office buildouts, or marketing campaigns. SBA loans and equipment financing may require a down payment, typically 10%–20% of the loan amount, depending on credit and collateral. Keep in mind that SBA loans require solid documentation and typically take longer to process.

What Is the Typical Interest Rate for a Holistic Practice Loan?

Interest rates vary based on loan type, term length, and borrower profile. For qualified applicants, SBA loans may offer rates as low as 6–9%. Equipment loans and personal loans generally range from 8% to 18%, depending on the lender and creditworthiness. Shorter terms and higher risk typically come with higher interest. Always compare multiple offers to find the most affordable fit.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts