Key Takeaways:

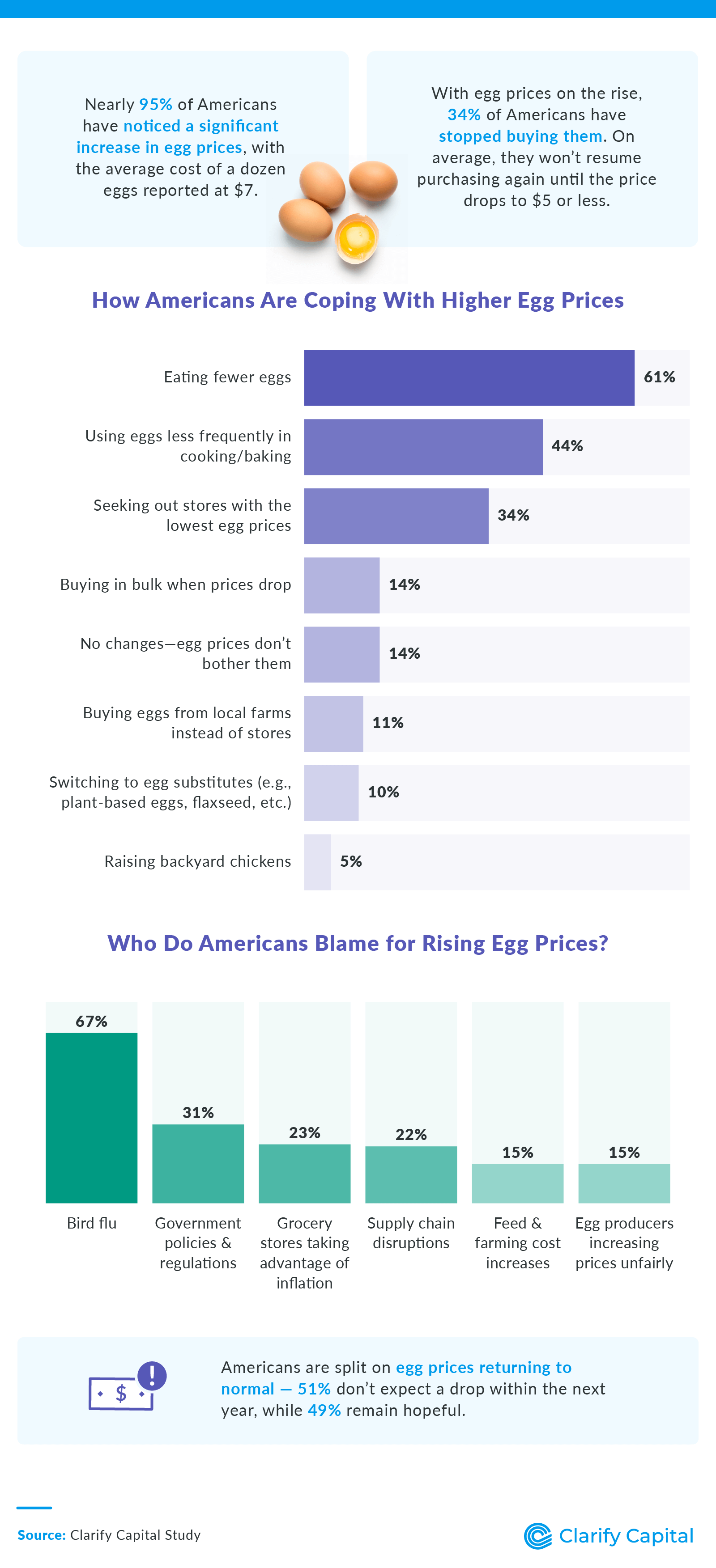

Nearly 95% of Americans have noticed a significant increase in egg prices, with the average cost now at $7 per dozen.

1 in 3 Americans have stopped buying eggs due to rising costs, with many waiting for prices to drop to $5 or less per dozen.

More than 2 in 5 Americans (42%) have seen others panic buy eggs, but only 1 in 14 (7%) admit to panic buying themselves.

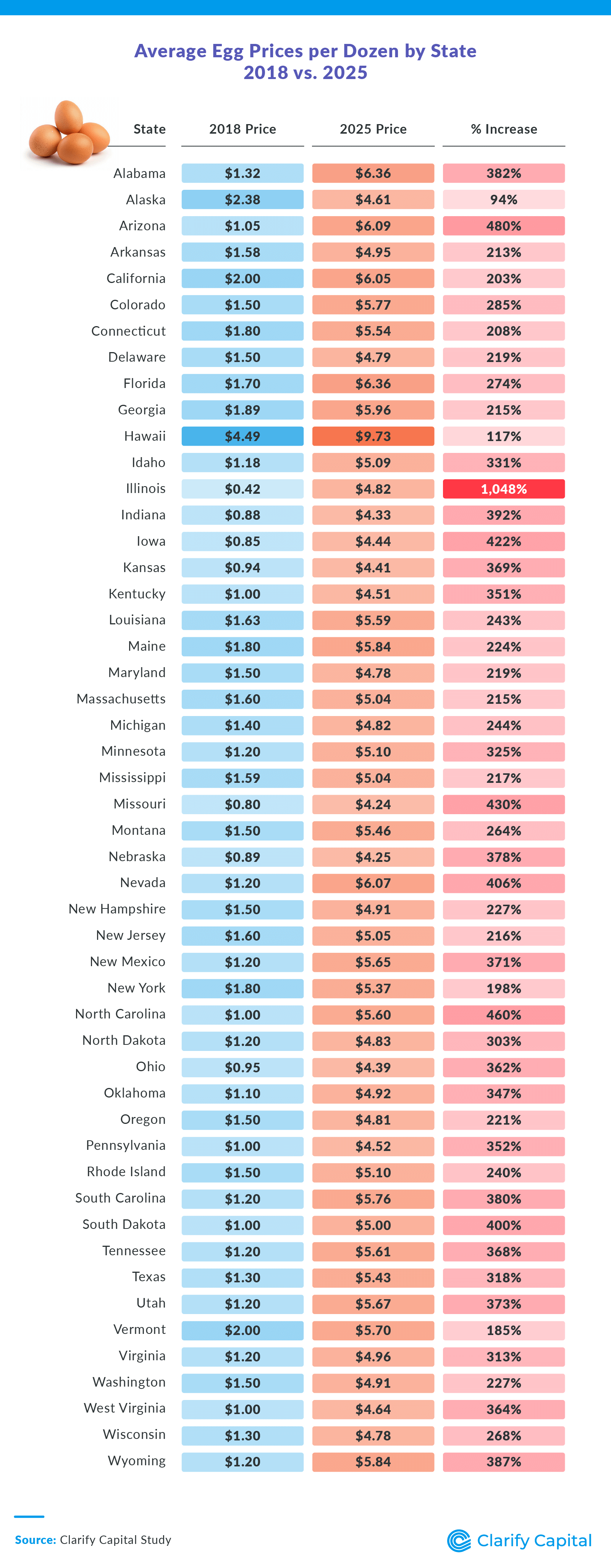

In 2025, the average price of eggs is expected to hit $5.18 per dozen nationwide — more than tripling from $1.49 in 2018.

Illinois is set to experience the biggest egg price surge, with costs projected to increase 1,048% from 2018 to 2025.

How Americans Are Responding to Rising Egg Prices

Over 9 in 10 Americans have seen egg prices rise significantly, reporting that they cost an average of $7 per dozen. On average, Americans say they would stop buying eggs when prices hit $8 per dozen.

More than a third of Americans (34%) have already stopped buying eggs, including baby boomers (31%), millennials (32%), Gen Zers (34%), and Gen Xers (38%). They would resume buying eggs once they dropped to $5 or less a dozen.

Over 2 in 5 Americans (42%) have seen others panic buy eggs, while only 1 in 14 (7%) admit to panic buying themselves.

The States Hit Hardest by Soaring Egg Prices

The average price of a dozen eggs across all states:

2018: $1.49

2025: $5.18

Many states will see egg prices exceed $5 per dozen in 2025.

Illinois will see the most dramatic jump in egg prices, increasing 1,048% — more than 10 times its 2018 price. Arizona (480%), North Carolina (460%), and Missouri (430%) will face the next most extreme price hikes.

Nevada (406%) and South Carolina (380%) are among the hardest-hit states, with egg prices more than quadrupling from 2018 to 2025.

Even states with the lowest percentage increases, like Alaska (94%), are still facing significant price jumps.

Methodology

We surveyed 1,000 Americans to understand how rising egg prices are affecting grocery shopping habits. The average respondent age was 42, with an equal gender split (50% female, 50% male). Generationally, 9% were baby boomers, 24% were Gen X, 49% were millennials, and 17% were Gen Z.

For historical pricing, 2018 state-wide egg prices were sourced from Ballotpedia (Egg prices by state, 2018). Projected 2025 egg prices were obtained from World Population Review (Egg Prices by State 2025)

About Clarify Capital

Clarify Capital helps business owners secure the financing they need to thrive in today's competitive marketplace, including no-doc business loans and fast business loans. Our tailored financial solutions support entrepreneurial dreams, turning visions into reality.

Fair Use Statement

Feel free to share these findings for noncommercial purposes, but please provide a link back to this page.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts