Net working capital (NWC) is a fundamental financial metric that shows whether your business has enough short-term resources to cover immediate obligations. Calculated simply as your company’s current assets minus current liabilities, NWC gives you a clear picture of your company's liquidity position and ability to fund day-to-day operations.

When your business maintains healthy net working capital, you're better positioned to handle operational expenses while managing cash flow effectively. This matters not just for internal financial health but also when seeking outside funding. Lenders regularly evaluate NWC when assessing loan applications, as it demonstrates your company's ability to meet short-term obligations without disruption.

Financial analysts and investors also examine net working capital trends to gauge overall company financial health. A consistently positive NWC signals operational stability, which is particularly valuable in uncertain economic times when managing liquidity becomes even more essential for business survival and growth.

This comprehensive guide to net working capital explains what it means for your business's financial stability and how this key liquidity indicator can help secure your company's future.

Understanding Net Working Capital

Net working capital is the money your business has available for day-to-day operations. It shows whether your company’s short-term resources are enough to cover your immediate financial obligations while keeping things running smoothly. Having a clear picture of your company's working capital helps you make smarter financial decisions and navigate through tough economic times.

Here's how businesses typically use net working capital:

Funding daily operations. Positive NWC gives you the cash needed for expenses like payroll and rent without disrupting business activities.

Managing cash inflows and outflows. It helps balance the timing gaps between paying suppliers and getting paid by customers.

Planning capital expenditures. Good working capital levels let you invest in necessary equipment without financial strain.

Building financial reserves. Proper management creates buffers against economic downturns or seasonal fluctuations.

In financial forecasting, businesses use NWC to project future cash needs and plan investments within specific timeframes. This information helps you anticipate when you might need additional funding or when you have excess cash to put to work. Incorporating working capital into your financial modeling can help you develop more accurate projections and maintain the liquidity needed to meet upcoming obligations.

Smart business owners track NWC trends over time to spot potential issues early. For example, a steadily decreasing working capital position might signal growing cash management problems that need attention. Monitoring these patterns helps maintain the liquidity needed to support growth while meeting short-term financial obligations.

Positive vs. Negative Net Working Capital

Positive net working capital means your business has more current assets than current liabilities — a sign of healthy liquidity and financial stability. With positive NWC, your company can easily cover its short-term obligations while maintaining normal operations. Businesses with consistently positive working capital generally have more flexibility to pursue growth opportunities, weather economic downturns, and negotiate better terms with suppliers.

Negative working capital happens when your current liabilities exceed your current assets, which might signal cash flow problems. While sometimes concerning, negative NWC isn't always bad — particularly in certain industries where business models allow for quick inventory turnover and extended payment terms.

Components of Net Working Capital

Net working capital comprises two main categories that appear on your company's financial statements: current assets and current liabilities. Understanding these components helps business owners more effectively manage their overall financial position:

Current assets. These are resources you expect to convert to cash within one year, including cash equivalents, short-term investments, accounts receivable, inventory, and prepaid expenses. Current assets represent the most liquid resources available to fund your day-to-day operations.

Current liabilities. These are financial obligations due within one year, including accounts payable, accrued expenses, short-term debt, and other immediate financial obligations. Current liabilities represent the claims against your business's short-term resources.

Effective management of these components is essential for maintaining adequate liquidity. For example, improving accounts receivable collection processes can accelerate cash inflows while carefully managing inventory levels of raw materials, which helps prevent cash from being unnecessarily tied up in unsold products. Similarly, negotiating favorable payment terms with vendors can optimize your accounts payable timeline without damaging supplier relationships.

Many businesses implement strategies to balance these components by accelerating the conversion of current assets to cash while responsibly extending the timeline for paying current liabilities. This balanced approach helps maintain the liquidity needed for smooth operations while maximizing the efficiency of working capital deployment.

Working Capital Formula and Calculation

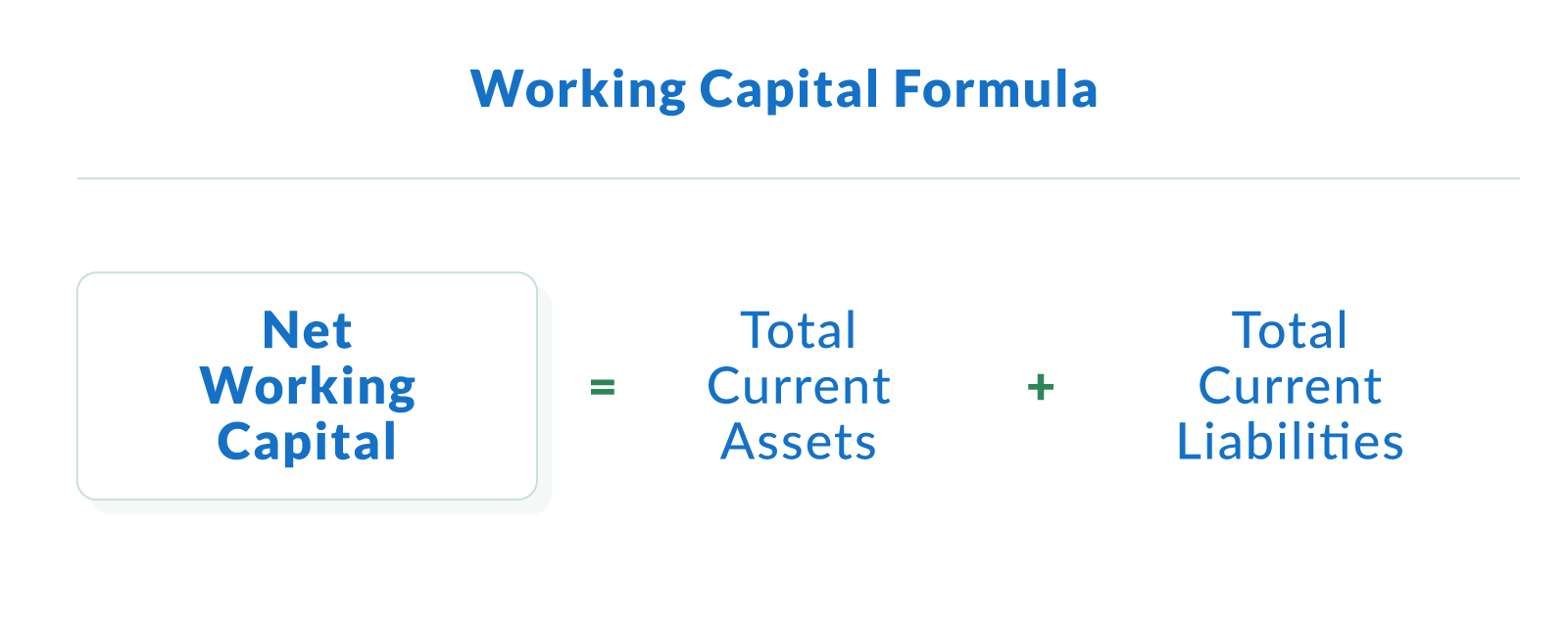

Calculating your net working capital is straightforward using a simple formula found on your balance sheet. This working capital calculation provides a snapshot of your business's short-term financial position and helps you make informed decisions about your company's liquidity.

The net working capital formula is:

Net Working Capital = Total Current Assets – Total Current Liabilities

Let's break down each component of this working capital formula to help you understand what it measures:

Total current assets. These are resources your business owns that will convert to cash within one year. On your balance sheet, current assets typically include cash, accounts receivable, inventory, short-term investments, and prepaid expenses. These short-term assets represent resources immediately available to cover your operating expenses.

Current liabilities. These are financial obligations your business must pay within one year. Your balance sheet lists current liabilities such as accounts payable, short-term debt, accrued expenses, and taxes due. These short-term liabilities represent the immediate claims against your business's resources.

The result of this calculation gives you a dollar amount that indicates your liquidity position. A positive number means you have more short-term assets than short-term liabilities, while a negative number indicates potential cash flow challenges.

For example, if your business has $250,000 in total current assets and $150,000 in current liabilities, your net working capital would be $100,000. This positive working capital indicates your business has enough short-term resources to cover its immediate obligations with $100,000 to spare for operational needs or growth opportunities.

It's a good idea to calculate your working capital regularly — at least quarterly — to track trends and identify potential issues before they become serious problems. By monitoring changes in your net working capital over time, you can make smarter decisions about inventory management, accounts receivable collections, and payment schedules for your financial obligations.

The Right Amount of Working Capital for Your Business

Every industry has different requirements for healthy net working capital based on their business model and cash flow patterns. Understanding what constitutes appropriate NWC levels for your specific industry provides crucial context for evaluating your company's financial health and operational efficiency.

Businesses with strong operational efficiency often maintain optimal rather than maximum NWC levels. Excess working capital might indicate underutilized funds that could generate better returns through strategic investments or even dividend payments to shareholders. The goal is finding the right balance: enough liquidity to meet your short-term obligations while putting capital to productive use through sound financial modeling and forecasting.

Here's how working capital needs vary across different business types:

Retail Businesses

Retail businesses typically operate with lower NWC levels than manufacturing companies due to differences in inventory management and payment cycles. Since retailers collect cash from customers immediately while paying suppliers on terms, they can function with tighter working capital margins. This cash flow advantage allows them to maintain adequate liquidity even with less of a buffer between current assets and current liabilities.

Manufacturing Companies

Manufacturing businesses generally require higher net working capital to support their operational needs. With longer production cycles, significant raw materials inventory, and extended timeframes to convert products into cash, manufacturers need stronger liquidity positions. Their working capital requirements must account for the substantial gap between paying for production inputs and receiving payment for finished goods.

Service-Based Businesses

Service-based businesses may require less working capital than product-based companies since they don't maintain physical inventory. With minimal inventory investments and often upfront customer payments, service providers can operate efficiently with lower NWC levels. Their primary current assets typically consist of accounts receivable and cash equivalents rather than inventory-heavy balance sheets.

Net Working Capital vs. Working Capital Ratio

While net working capital gives you a dollar amount of your available short-term funds, the working capital ratio shows you how your short-term resources compare to your short-term debts. This ratio gives you a different perspective on your company's financial health.

The working capital ratio is calculated using a simple formula:

Working Capital Ratio = Total Current Assets ÷ Current Liabilities

Think of it this way: if net working capital tells you that you have $100,000 more in current assets than current liabilities, the working capital ratio tells you how many times over you could pay all your short-term debts using your short-term resources.

For example, if your business has $300,000 in current assets and $150,000 in current liabilities, your working capital ratio would be 2.0. This means you have twice as many short-term resources as short-term debts — generally indicating good financial health.

Banks and investors often prefer looking at the working capital ratio when comparing businesses of different sizes. A ratio between 1.5 and 2.0 is typically considered healthy for most businesses, though this varies by industry. You can find all the information needed to calculate both metrics on your standard financial statements.

How To Improve Your Net Working Capital

Running your business with negative net working capital is risky. When your short-term debts exceed your short-term resources, you might struggle to pay bills on time, potentially disrupting your daily operations. Lenders and investors often view negative working capital as a red flag, making it harder to secure additional funding when needed.

Here are practical ways to improve your working capital position:

Speed up customer payments. Implement better billing systems, offer small discounts for early payment, or request deposits on large orders to improve cash flow and get paid faster.

Manage inventory. Keep just enough inventory to meet customer demand without tying up too much cash in products sitting on shelves, helping maintain healthy liquidity.

Stretch out vendor payments. Negotiate longer payment terms with suppliers when possible to keep cash in your business longer without damaging relationships.

Cut unnecessary expenses. Regularly review your accrued expenses to find areas where costs can be reduced without hurting your business operations.

Arrange backup financing. Consider setting up short-term loans or a line of credit before you need them to provide a safety net during seasonal fluctuations or growth periods.

Get Help Maintaining Healthy Working Capital

Your company's net working capital shows how financially healthy and liquid it is. Keeping an eye on this number helps make sure you have enough resources to cover short-term expenses and keep daily operations running smoothly. Whether you're streamlining inventory, speeding up collections, or finding the right financing, even small changes can make a big difference in efficiency and cash flow.

Every industry and business has different working capital needs. Reviewing your financial statements on a regular basis helps keep your strategy aligned with your business goals.

Are you looking for funding to boost your working capital? Apply now to explore financing options that can help strengthen your financial position.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts