A strong business plan does more than describe your business — it can help you secure the funding to grow it. If you're applying for a business loan, banks, credit unions, and SBA lenders want to see a clear, organized, and realistic plan before they will consider approval.

In this guide, we'll walk through how to write a business plan for a loan that gives lenders confidence. You'll get step-by-step tips, an editable template to plug your details into, and visuals to help you understand what lenders expect.

And the timing couldn't be better. In 2024 alone, SBA lenders approved over 70,000 loans totaling $31.1 billion. Even better? Entrepreneurs who write a business plan are 260% more likely to launch their business. So if you're serious about getting funding, this is the place to start.

Download our Lender-Ready Business Plan Template:

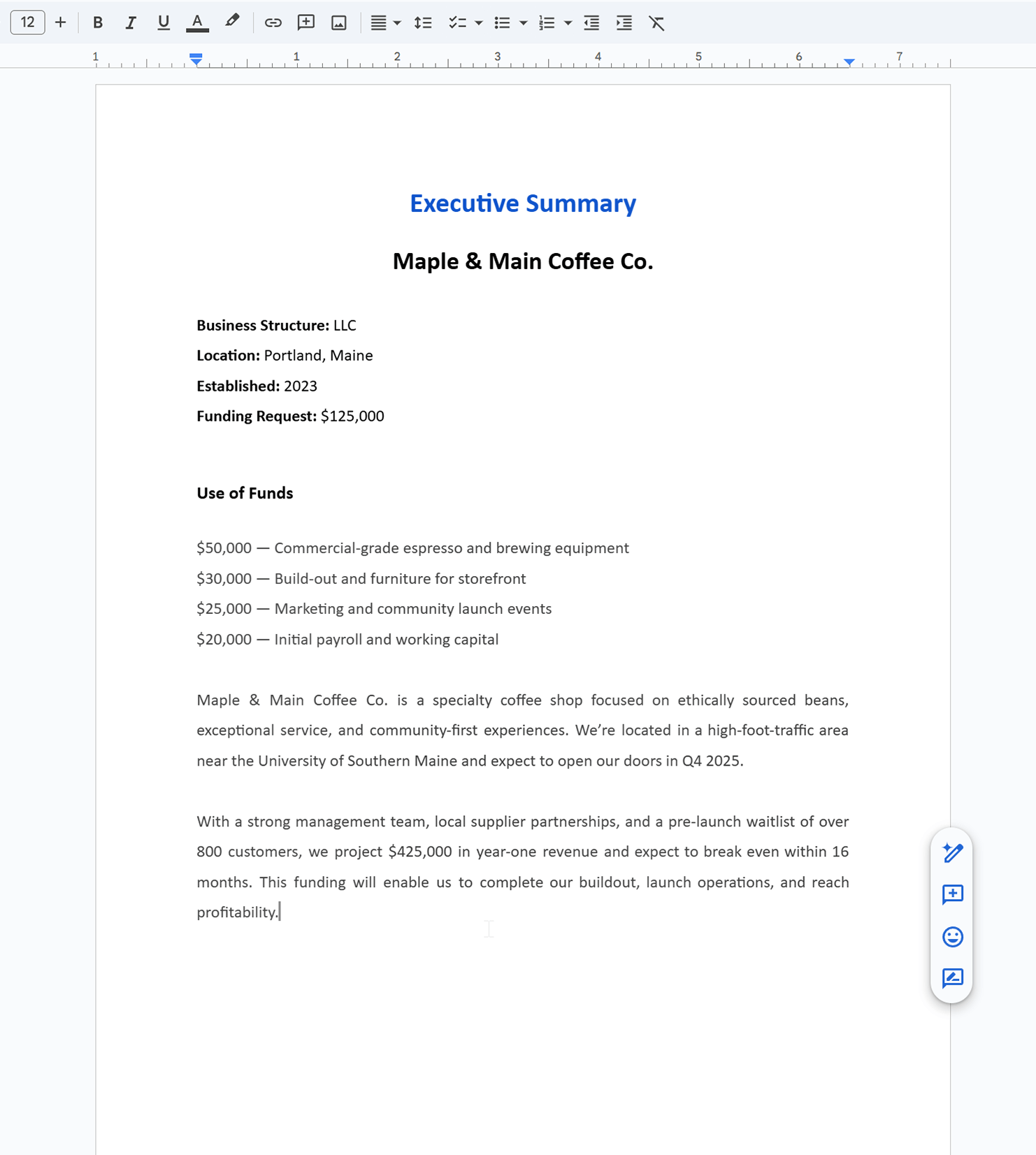

Executive Summary: Your Business in a Nutshell

The executive summary is the first thing lenders read — and often the only thing they remember. This section should quickly highlight what your business does, why it exists, how much funding you're requesting, and how you plan to use it.

Keep it short but specific. Focus on what matters to lenders: your business model, your goals, and how their money will help you reach them.

Lenders want to see a confident, clear plan right up front. They expect the executive summary to explain what sets your business apart and why you're a good investment.

Key things to include:

Business type and structure. Describe your company in one or two sentences. Are you a service-based LLC, a product-based C-corp, or something else?

Funding request and use of funds. Be direct. Example: “We are requesting $150,000 to purchase inventory, hire two employees, and expand our marketing reach.”

Business goals. Share what this loan will help you achieve over the next 12–24 months.

Fast-growing companies often start with clear business plans — in fact, 71% of high-growth businesses have one. On the flip side, poor planning leads to poor outcomes. A staggering 82% of business failures are tied to cash flow issues.

Company Overview: Who You Are and Why You'll Succeed

The company overview sets the stage for your loan application. It gives lenders the context they need to trust that your business is viable and ready to grow.

Start with your legal structure. Are you a sole proprietorship, LLC, S-Corp, or partnership? Make this clear, and include your business location and the year you started. If your business is still in the startup phase, explain your launch timeline.

Next, share your mission statement—a brief sentence or two explaining why your business exists. This information helps lenders connect with your purpose and understand your long-term focus.

Then, describe your business idea in plain language. What are you offering, and who are your customers? Be direct about the problem you solve and how your product or service delivers real value.

Finally, show why you're different. Highlight your value proposition—what sets you apart from competitors. Ideas for what to highlight could include your pricing model, faster delivery, better customer service, or a niche product with high demand.

Together, these elements show lenders that you're not just passionate — you're prepared.

Market Research & Competitive Analysis

Lenders want proof that you know your market and understand your customers. This section gives them confidence that there's real demand for your business and that you've done your homework.

Start by identifying your target market. Who are your ideal customers? Define their age, location, income level, or business type — whatever details help paint a clear picture. The more specific, the better.

Next, summarize your market research. Share trends that show your industry is growing or stable. Reference reliable sources, and back up your assumptions with real data when possible.

Then, break down your competitive analysis. List your main competitors and how you compare. What are they doing well? Where do you have an edge?

Finally, give an overview of your marketing plan. How will you reach your customers? Mention channels like social media, paid ads, email marketing, or in-person events. Show that you have a strategy to get in front of your audience — and a plan to convert them.

A lack of demand is the top reason small businesses fail — 42% close their doors because customers simply don't need what they're offering. That's why it's so important to prove that your product or service fills a real need.

Marketing & Sales Strategy

Lenders don't just want to know what you sell — they want to know how you plan to sell it. This section outlines how you'll attract and retain customers, convert leads into sales, and keep revenue flowing.

Start by summarizing your marketing strategy. Explain which channels you'll use to reach your audience — think social media, paid ads, content marketing, or email campaigns. Be specific. If your audience spends time on Instagram or LinkedIn, say so.

Next, break down your sales plan. Describe how you'll move prospects through your funnel — from awareness to purchase. Mention any tools or systems you'll use, like a CRM, email automation, or follow-up process.

Talk about pricing, too. Show that your pricing aligns with your market, and explain how it supports your overall revenue goals.

Finally, outline any sales strategies you use to retain customers and encourage repeat business. Think loyalty programs, referral incentives, or upsells.

Offering up this information is how you can help lenders see the path between your marketing efforts and your projected revenue. It also shows them you've thought through more than just how to launch — you've planned how to grow.

Management Team & Operations

Even the best business idea needs strong people to bring it to life. This section shows lenders that you've got the right team and systems in place to execute your plan.

Start with your management team. Introduce the key players running the business. Include their names, roles, and a summary of their experience. If anyone has worked in the same industry, grown a business before, or led successful teams, call that out.

Then, provide a simple organizational chart. It doesn't need to be fancy — just a visual that outlines who's responsible for what.

Next, describe your operational plan. Walk through how your business runs on a daily basis. What happens behind the scenes to fulfill orders, deliver services, or support customers? If you rely on suppliers, software, or contractors, mention them here.

Tie everything back to your business needs. For example, if part of your funding request includes hiring staff or upgrading systems, explain how those changes will improve operations and support growth.

Lenders want to see that your business isn't just an idea — it's an organized, well-run operation with a capable team behind it.

Products or Services Offered

This section lays out exactly what your business sells. Lenders want to see that your offerings are clearly defined, competitive, and tied to customer needs.

Start by describing your core business model. Are you selling physical products, digital goods, or services? If necessary, break it down into categories.

Then, list your main offerings. Highlight key features and benefits for each one. Keep it simple but specific. Show that your products or services solve real problems and provide value.

If your offerings have a future roadmap — like new features, seasonal products, or additional services — include it. This information helps demonstrate long-term planning and growth potential.

Also, point out any competitive advantage you have. Maybe it's a proprietary product, lower price point, faster delivery, or niche market. Lenders want to know why customers will choose you over the competition.

Finally, explain how your products or services fit into your day-to-day operations. This overview ties your offerings back to your overall business strategy and funding needs.

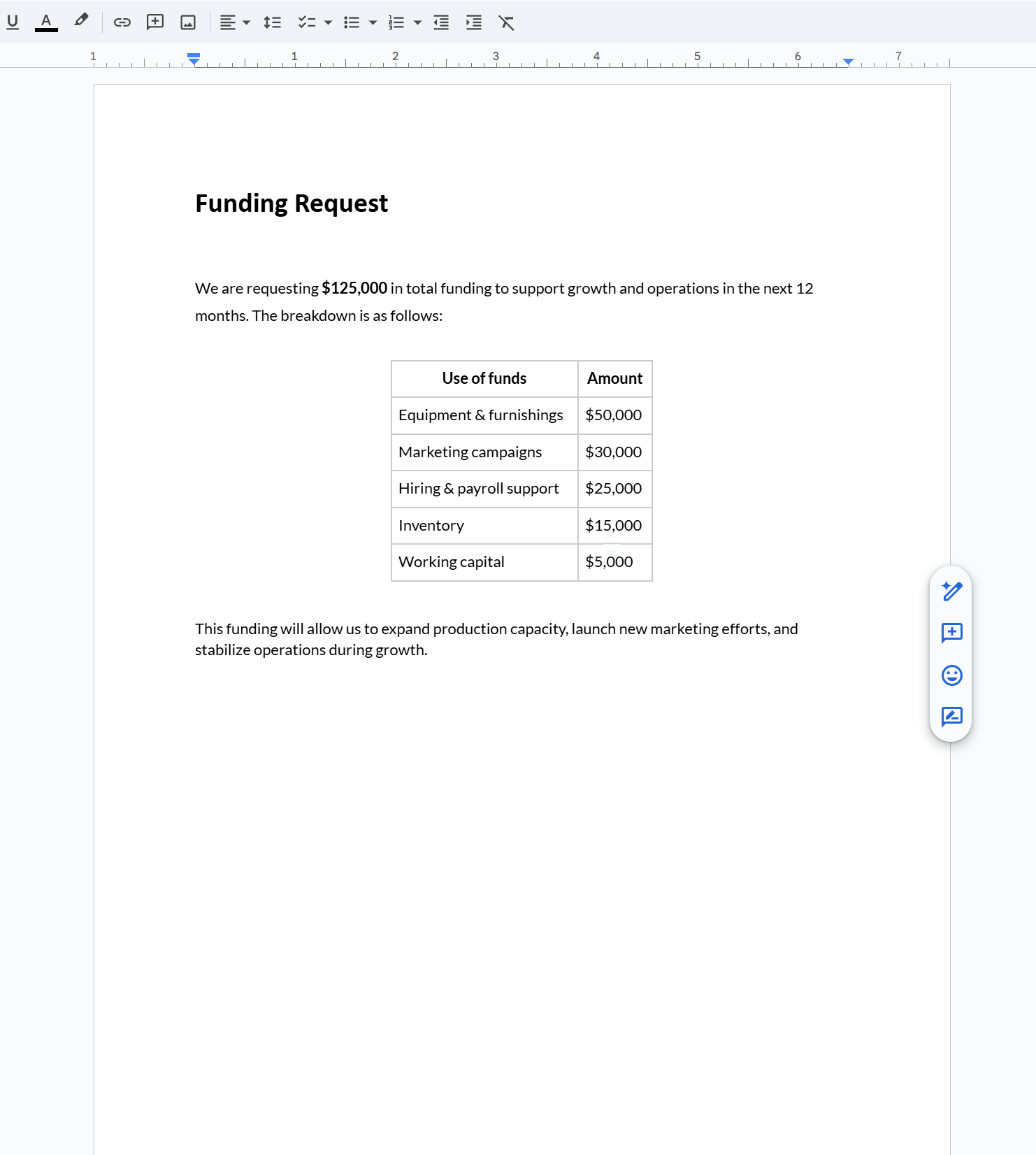

Funding Request: How Much and Why?

During this part of the process, you really need to get specific. Lenders need to know exactly how much funding you're asking for, what you'll do with it, and how it supports your business goals.

Start by stating the amount you're requesting through your loan application. Be direct and realistic. If you're asking for $100,000, say so.

Then break it down. Create a simple table or bulleted list that shows how the funds will be used — things like inventory, equipment, hiring, marketing, or buying real estate. If you plan to invest in growth or shore up cash flow, mention that too.

Be sure to explain how this funding will impact your business. Connect each expense to a clear outcome — more customers, higher revenue, better efficiency. By providing a greater understanding of your funding needs, you'll help lenders see that you're not just spending — you're building.

Also, touch on your credit score and financial position. If your score is strong or improving, say so. Lenders want to know you're financially responsible and likely to repay.

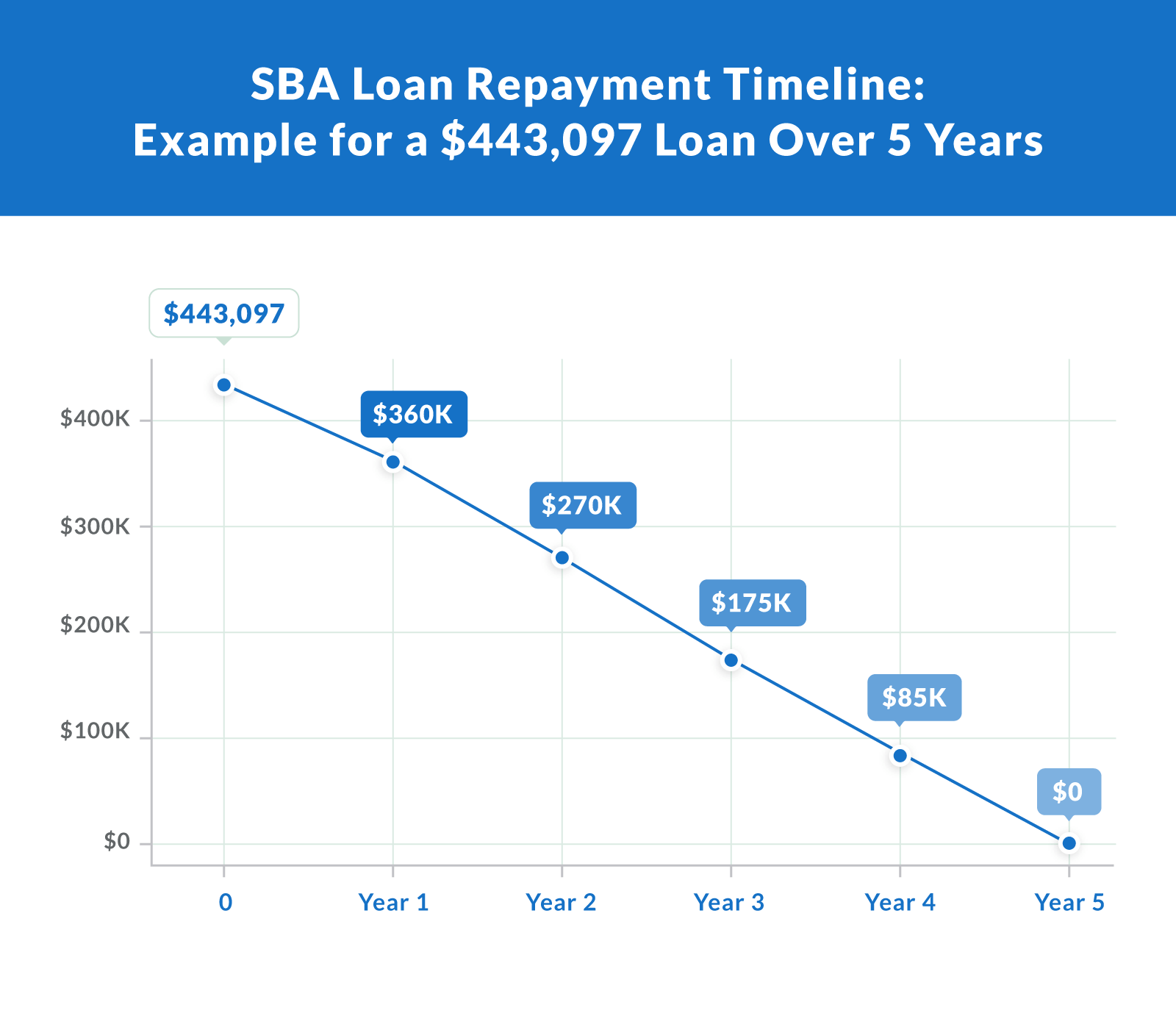

Financial Plan: Projections and Repayment Confidence

Your financials are one of the most important parts of your business plan. Lenders want to see that you've thought through your numbers, planned for growth, and built in room to repay the loan.

Start with your financial projections. Show 3 to 5 years of revenue forecasts, cost of goods sold, operating expenses, and net profit. Include both conservative and optimistic scenarios to demonstrate planning flexibility.

Include the core financial statements lenders expect:

Income statements. Show projected revenue and expenses.

Balance sheets. Outline your business's assets and liabilities over time.

Cash flow statements. Prove that you'll have enough liquidity to cover day-to-day operations and loan payments.

If your business is already operating, include historical financial data too. For startups, focus on forecasted numbers and explain your assumptions.

Only about half of SBA loan applications get approved — just 52% are successful, often because of weak financials. Solid projections give lenders the confidence they need to move forward.

Appendix & Supporting Documents

Lenders want more than a written plan—they need documentation to back it up. This section includes the supporting documents that show your business is real, legal, and ready to operate.

Here's what to include:

Legal documents. Business licenses, articles of incorporation, permits, and any contracts relevant to your operations.

Tax returns. At least two years of personal and business tax filings, if available.

Credit history. Personal and business credit reports give lenders insight into your financial reliability.

Resumes. Backgrounds of the owners and leadership team, especially if you're in a regulated or technical industry.

Financial documents. Bank statements, profit and loss reports, or other statements not already included in your financial plan.

Providing these up front makes your loan application more complete and shows you're prepared. It also reduces back-and-forth delays — a big plus for busy lenders reviewing dozens of applications at once.

Bonus: Drafting Your Plan with AI + CPA Oversight

Writing a solid business plan doesn't have to be overwhelming. AI tools can help you move faster by generating first drafts of key sections like your executive summary, financial information, or market analysis. You can use a business plan template and customize it with your own data, goals, and voice.

AI can also help organize your thoughts and catch gaps — for example, if your step-by-step funding breakdown doesn't align with your cash flow projections, the tool may flag that for review.

But don't rely on automation alone. Before submitting your plan to a lender, have it reviewed by a CPA or financial advisor. They can validate your numbers, flag risky assumptions, and offer insights to improve your good business plan even further.

It's also a smart way to make sure your plan meets any legal or tax requirements. Tools can get you 80% of the way there — professional input gets you across the finish line.

Build Your Plan, Secure Your Loan

Writing a business plan might seem like extra work, but it's one of the most important steps in securing funding. A clear, lender-focused plan helps you stand out and shows that you're serious about growing your business.

Whether you're starting a new business or scaling a startup business, this is your chance to prove you're ready. Lenders want more than good ideas — they want borrowers who can follow through. With the right approach, you can impress lenders with your business plan and get the capital you need.

Download your business plan template and start building your loan-ready strategy today. Clarify Capital is here to help you get funded.

Frequently Asked Questions

Here are answers to common questions business owners ask when preparing a loan-ready business plan.

Do I need a business plan to get a loan?

Yes, most traditional lenders — including banks and those offering SBA loans — require a formal business plan. It helps them assess your company's potential and determine the viability of your funding request. Even if you're applying through alternative lenders, having a plan strengthens your application.

How detailed should financial projections be?

Your projections should cover at least three years and include income statements, balance sheets, and cash flow forecasts. Be realistic. Lenders look for logical assumptions backed by market data. They also want to see that you've accounted for loan repayments in your forecasts.

What documents do lenders require for SBA loans?

Along with your business plan, most lenders ask for supporting documents such as financial statements, tax returns, legal documents, and ownership details. Credit history is also important — both business and personal credit reports help lenders evaluate risk.

Can startups get approved with no revenue?

Yes, but it's harder. Lenders focus more on your business idea, management team, and personal credit when there's no operating history. Startups often need to offer collateral or apply through programs like microloans or SBA loans that are startup-friendly.

How long should a business plan be for lenders?

There's no strict page count, but most entrepreneurs submit plans that are 15–25 pages long, plus appendices. Focus on quality over quantity. Lenders care more about clear financials, a solid strategy, and strong leadership than extra fluff.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts