When revenue slows or an unexpected opportunity arises, small business owners face a critical funding decision. The choice between a merchant cash advance vs. a loan shapes your company's financial future for months or years. Both options provide working capital, but they work in fundamentally different ways, and those differences matter.

A merchant cash advance isn't a traditional loan. Instead, it's a purchase of your future credit card sales in exchange for immediate cash. Business loans follow the familiar path of borrowing a fixed amount and repaying it with interest over a set period of time. These financing options differ significantly in their cost structures, repayment schedules, approval requirements, and long-term cash flow implications.

Today, we'll compare merchant cash advances and traditional business loans across five key areas. You'll also learn which type of financing fits different business needs and how to choose the option that supports sustainable growth rather than creating financial strain.

What Is a Merchant Cash Advance (MCA)?

A merchant cash advance provides a lump sum of cash in exchange for a portion of your future credit card sales or receivables. The MCA provider purchases your future sales, then collects repayment through automatic daily or weekly withdrawals from your business bank account.

Unlike traditional business loans with fixed monthly payments, MCA repayment fluctuates with your sales volume. Higher revenue means larger payments; slower periods result in smaller withdrawals. This flexible repayment structure appeals to businesses with inconsistent cash flow.

How MCA Costs Work

MCAs don't use interest rates — they use factor rates, typically between 1.1 and 1.5. Here's a quick example: Borrow $50,000 with a 1.3 factor rate, and you'll repay $65,000 total. That translates to effective APRs often ranging from 40% to 150% or higher. In fact, merchant cash advances can carry APRs well above 100%.

Pros & Cons of Merchant Cash Advances

MCAs come with distinct advantages and serious drawbacks. Here's what business owners need to weigh before moving forward with this type of financing.

Pros:

Fast approval and funding. Money often arrives within 1-2 business days, sometimes faster.

Less strict credit requirements. Poor credit history won't automatically disqualify you.

Payments adjust with sales. When business slows, so do your payments.

Minimal documentation needed. Usually just bank statements showing credit card sales volume.

Cons:

Extremely high costs. Factor rates translate to triple-digit APRs in most cases.

Daily or weekly withdrawals. Constant deductions can disrupt your working capital.

No credit building. MCAs don't report to business credit bureaus.

Risk of debt cycles. High costs make it tempting to take another advance to cover the first.

What Is a Traditional Business Loan?

A traditional business loan provides a fixed amount of capital that you repay with regular monthly payments over a set period. Term loans typically range from one to ten years, with borrowing amounts from $10,000 to several million dollars, depending on your qualifications.

Unlike MCAs, business loans use interest rates rather than factor rates. Traditional business loans typically carry APRs between 6.5% and 16%, which is significantly lower than MCA costs. Interest rates vary based on your credit score, revenue, and time in business.

Key Characteristics of Traditional Business Loans

Here are major characteristics of a business loan:

Predictable repayment schedule. Fixed monthly installments make budgeting straightforward.

Credit building. On-time payments strengthen your business credit profile.

Collateral options. Some loans require collateral; unsecured business loans are available with stronger credit.

Longer approval times. Traditional lenders conduct thorough underwriting, which can take several days to weeks.

Stricter eligibility. Lenders typically require solid credit history, consistent revenue, and at least one year in business.

The structured repayment terms and lower costs make business loans ideal for long-term growth investments, though they require more documentation and stronger qualifications than MCAs.

Benefits of Traditional Business Loans

Traditional loans offer advantages that make them the smarter choice for many business owners. Here's what sets them apart from alternative financing options.

Lower overall costs. Interest rates beat factor rates by a significant margin.

Predictable monthly payments. Fixed repayment schedules make financial planning easier.

Builds business credit. Regular payments improve your credit profile for future borrowing.

Larger funding amounts available. Banks and alternative lenders can provide substantial capital for growth.

Longer repayment periods. More time to pay back reduces the monthly burden on cash flow.

Cost Comparison: Factor Rates vs. Interest Rates

Understanding the true cost difference between an MCA and a traditional loan requires looking past the surface numbers. Factor rates seem simple until you break them down.

Let's say you need $50,000 for inventory or equipment. With a merchant cash advance at a 1.3 factor rate, you'll repay a total of $65,000. That's $15,000 in fees. If you pay this back over six months through daily deductions, the effective APR shoots up to roughly 80-90% or higher, depending on how quickly your sales volume triggers full repayment.

Compare that to a traditional business loan with a 15% annual interest rate over three years. Your total repayment comes to approximately $62,000, including interest. Over a longer term, like five years at the same rate, monthly payments drop even more, though you'll pay more interest overall.

Here's a side-by-side breakdown:

| $50,000 Financing Comparison | ||||

|---|---|---|---|---|

| Financing type | Total repayment | Payment frequency | Repayment period | Effective APR |

| Merchant Cash Advance | $65,000 | Daily | 6-12 months | 80-150%+ |

| Traditional Business Loan | $62,000 | Monthly | 3 years | 15% |

The repayment structure creates another crucial difference. Daily or weekly payments with an MCA pull money from your account constantly, which can feel like you're always behind. Monthly installments with a loan let you plan around due dates and maintain better control over working capital between payments.

Traditional business loans also offer transparency. You'll receive a clear amortization schedule showing exactly how much of each payment goes toward principal versus interest. MCAs rarely provide this level of detail, and the daily percentage of receivables calculation can be confusing to track.

One argument in favor of MCAs is the flexible repayment tied to sales. During a rough month, your payment shrinks proportionally. But even that comes with a catch. Lower sales mean you stay in debt longer, and you're still paying that massive factor rate on the full dollar amount.

Approval, Eligibility, and Funding Speed

Funding speed separates MCAs from traditional business loans. When you're facing urgent cash needs — payroll, equipment repairs, or time-sensitive opportunities — the difference between 48 hours and three weeks matters.

MCA Funding Timeline

Merchant cash advances are typically funded within 24 to 48 hours after approval. Some MCA providers offer same-day funding for early applications. Eligibility focuses almost exclusively on sales volume, particularly credit and debit card transactions. Poor credit history or limited time in business rarely disqualifies you if your revenue meets the threshold.

Business Loan Approval Process

Traditional lenders conduct thorough reviews of your credit score, revenue history, and business plan. Banks and online lenders often request tax returns, financial statements, and projections. The application process can take several days to weeks before funding.

One comparison notes that online lenders typically fund in 1–3 days, while bank lines of credit often take 2–8 weeks to finalize. A business line of credit offers faster access once established, letting you draw funds as needed up to your approved limit.

Clarify Capital's Requirements

At Clarify Capital, we balance speed with responsible lending standards:

Minimum revenue. $10,000 monthly.

Time in business. At least six months.

Documentation. Business bank account and three months of recent bank statements.

Location. U.S.-based operations.

We review your bank statements to verify income and assess your capacity to handle repayment terms, helping you secure financing without unnecessary delays.

| Approval and Eligibility Comparison | ||

|---|---|---|

| Factor | Merchant cash advance | Traditional business loan |

| Approval speed | 24-48 hours | Several days to 3+ weeks |

| Minimum credit score | Often none required | Typically 600+ |

| Revenue requirements | $5K-$10K monthly sales | $10K+ monthly revenue |

| Time in business | 3-6 months | 6+ months to 2+ years |

| Documentation | Bank statements | Tax returns, financials, business plan |

Credit history matters significantly more for traditional loans. A credit score below 600 makes bank approval unlikely, though alternative lenders and online platforms offer more flexibility. Good credit opens doors to lower interest rates and better repayment terms.

Some business owners assume they can't qualify for a traditional loan and head straight to an MCA without exploring other options. That's often a costly mistake. Even with less-than-perfect credit, you might qualify for a small business loan with reasonable terms.

Impact on Cash Flow and Business Operations

Your repayment structure directly affects daily operations. Cash flow determines whether you can cover payroll, restock inventory, pay rent, and handle unexpected expenses — which makes your financing choice critical.

How Do MCA Payments Strain Working Capital?

Merchant cash advances pull funds from your business bank account daily or weekly through automatic withdrawals tied to credit card processing. During strong sales periods, these deductions feel manageable. But slow weeks create serious pressure.

Unlike traditional loans with fixed payments, MCAs don't pause during revenue dips. Automatic withdrawals continue regardless of sales performance, leaving less money for operating expenses. This often forces difficult choices: delay vendor payments, postpone payroll, or take out another MCA to cover the gap.

That last option creates MCA stacking — multiple daily withdrawals from different providers that compound cash flow strain. This debt cycle traps businesses in a pattern where they're working primarily to service debt rather than grow.

How Can Loans Provide Cash Flow Stability?

Traditional business loans offer predictable monthly installments that remain constant, regardless of whether you have record sales or a slow month. This fixed repayment schedule makes budgeting straightforward and removes daily uncertainty about available working capital.

Steps To Maintain Healthy Repayment

Maintaining control over your financing obligations requires planning and discipline. These steps help you stay on track regardless of which funding option you choose.

Calculate your actual costs before committing. Convert factor rates to APR so you understand what you're really paying.

Project your cash flow for the repayment period. Make sure you can handle payments during your slowest months, not just your best ones.

Avoid stacking multiple financing products. One manageable payment beats juggling several daily withdrawals.

Build a cash reserve. Even a small buffer helps you absorb slow periods without missing payments or taking on emergency financing.

Monitor your accounts regularly. Track when payments hit so you're never surprised by a depleted balance.

Predictable loan payments support stable growth. You can forecast your monthly obligations, which means you can plan investments, hiring decisions, and expansion moves with confidence. Variable MCA payments make long-term planning much harder.

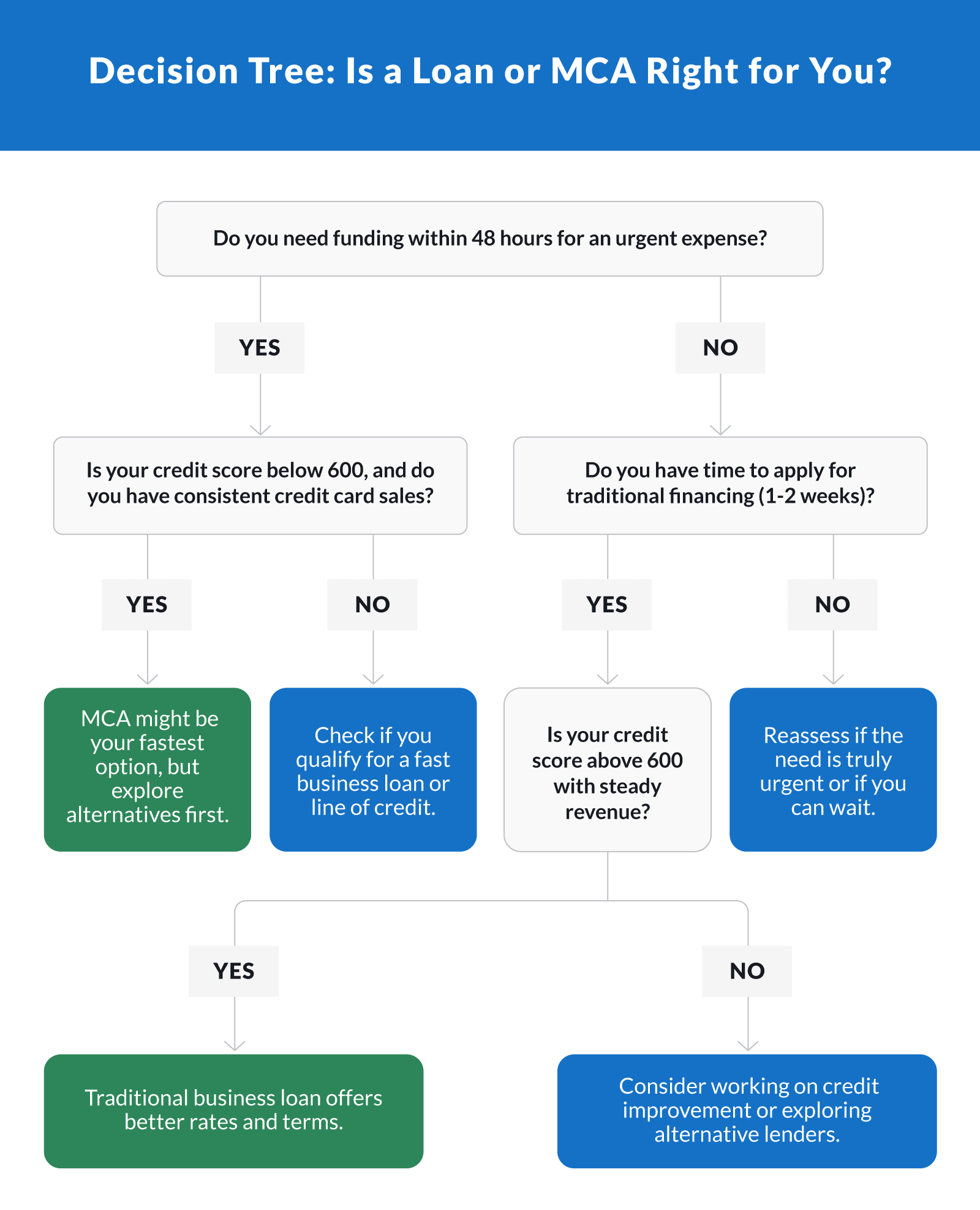

Which Financing Option Is Best for You?

Your business needs, credit profile, and revenue patterns determine which financing option makes sense. There's no one-size-fits-all answer, but understanding when each option works best helps you avoid costly mistakes.

When an MCA Might Work

Merchant cash advances fit specific scenarios — urgent cash needs with no time to wait, limited credit history that disqualifies you from traditional lenders, or very short-term gaps you can close quickly. Restaurants, retail stores, and businesses with high credit card sales sometimes use MCAs as emergency funding.

At the end of the day, it's best to treat MCAs as expensive, last-resort capital, not regular business financing.

When Does a Business Loan Make More Sense?

Traditional business loans suit growth planning, larger purchases, and situations where you can wait several days for approval. If you're expanding locations, buying equipment, or investing in seasonal inventory, a term loan or business line of credit typically saves thousands in financing costs.

Lower interest rates and structured repayment terms preserve more working capital for actual business operations. Good credit and stable revenue make qualification straightforward, and on-time payments build your business credit score for future borrowing.

Match Financing to Your Cash Flow

Businesses with consistent, predictable revenue handle monthly installments easily. If your income fluctuates significantly, you might consider MCA flexibility appealing, but that flexibility costs 40% to 150%+ APR.

A smarter approach is to secure a line of credit during strong periods to cover slower months or build cash reserves that eliminate emergency borrowing entirely.

At Clarify Capital, we help business owners compare these funding choices based on their specific circumstances. We've seen too many businesses struggle under MCA debt when better options existed. Our team takes time to understand your revenue patterns, growth plans, and financial situation to recommend the most appropriate financing path.

Ready to explore your options? Apply today and speak with a Clarify Capital adviser who can walk you through the best funding solution for your business needs.

FAQs for Merchant Cash Advance vs. Traditional Business Loan

Understanding the nuances between these financing types raises common questions. Here are answers to what business owners ask most frequently.

What Are Some Common Merchant Cash Advance Pitfalls To Avoid?

MCA stacking is the biggest danger. Taking multiple advances creates overlapping daily withdrawals that drain your account fast. Watch for factor rates above 1.4, hidden fees, and aggressive auto-withdrawal terms. Consider refinancing expensive MCAs into lower-interest bank loans. Clarify Capital advisers help business owners restructure MCA debt into more manageable term loans.

Can You Refinance a Merchant Cash Advance With a Loan?

Yes. Refinancing an MCA with a traditional loan reduces costs and improves cash flow. You'll switch from daily withdrawals at triple-digit APRs to predictable monthly payments at lower rates. Clarify Capital helps businesses consolidate expensive merchant cash advances into structured term loans with better repayment terms, freeing up working capital for operations.

Is a Merchant Cash Advance a Good Idea for a Small Business?

MCAs work as expensive emergency financing when you have no other options. They help when you need immediate cash, and poor credit blocks traditional approval. However, explore lower-cost options first, such as business lines of credit, term loans, SBA loans, or business credit cards. Reserve MCAs for genuine emergencies with clear repayment plans.

Michael Baynes

Co-founder, Clarify

Michael has over 15 years of experience in the business finance industry working directly with entrepreneurs. He co-founded Clarify Capital with the mission to cut through the noise in the finance industry by providing fast funding and clear answers. He holds dual degrees in Accounting and Finance from the Kelley School of Business at Indiana University. More about the Clarify team →

Related Posts