Looking to take control of your monthly cash flow? Use our cash flow calculator to get a clear snapshot of your financial well-being — and discover how to improve cash flow with calculator insights. Designed specifically for U.S.-based small business owners, this tool helps you visualize income and expenses so you can make smarter decisions and avoid surprises in 2025.

This free cash flow calculator gives you a real-time snapshot of your business's finances. It tallies your cash inflows and outflows, calculates net cash, and shows your projected total cash at the end of the month. While it doesn't include personal finances or tax withholdings, it's a reliable way to understand how your day-to-day operations affect your bottom line.

Why it matters: 82% of small businesses fail due to cash flow problems. And 61% of business owners say cash flow has been a consistent challenge. The good news? Understanding your cash flow is the first step to managing it—and this free, interactive tool makes that easier.

Use Our Free Cash Flow Calculator To Understand Your Business Finances

Our cash flow calculator is built for simplicity, accuracy, and small business relevance. Whether you're navigating seasonal changes, a shift in customer demand, or just need a quick pulse on your finances, this interactive calculator helps break things down.

You'll enter basic income and expense figures — like sales revenue, subscriptions, loan payments, and payroll — and the calculator will display your net cash (income minus expenses) and total cash (your projected ending balance). It's a helpful tool for tracking monthly cash flow and identifying any red flags before they become emergencies.

Small business owners often find themselves short on reserves— 70% hold less than four months of cash. Many (38%) even dip into personal savings or credit to keep things running. This calculator gives you a snapshot of your current financial position, without needing to wade through spreadsheets or accounting jargon.

Use it to guide everyday spending, spot issues, or even start planning for financing if needed. And if you're already in a tough spot? Knowing your cash position is the first step to solving it.

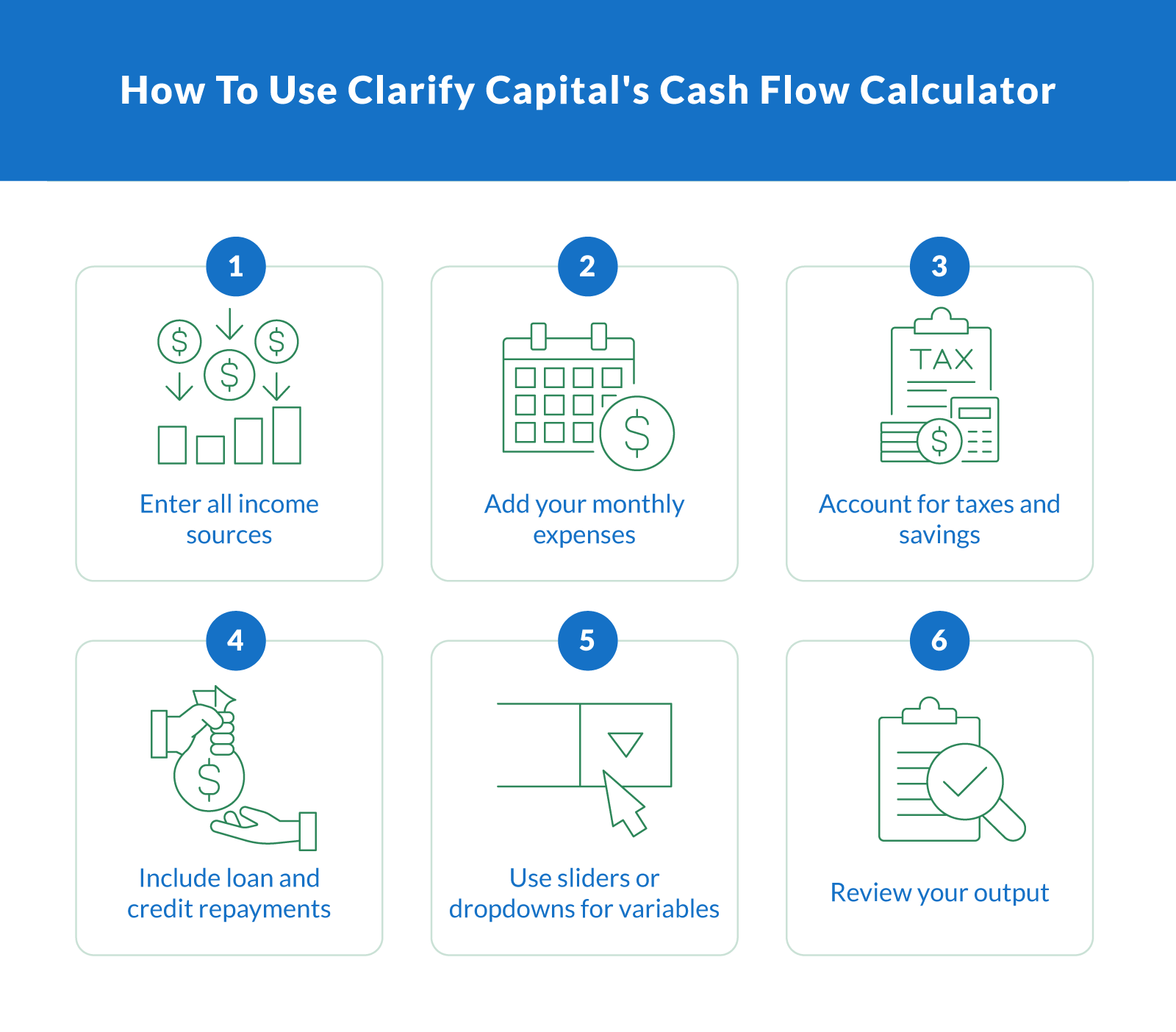

How To Use the Cash Flow Calculator

The process is simple, but accuracy is everything. By entering a few key data points, you'll get real-time insights into how your money moves. Here's how to get started:

Enter all income sources. List all forms of business revenue — this includes product or service sales, passive earnings, and any accounts receivable due within the month.

Add your monthly expenses. Separate recurring monthly expenses (like rent or payroll) from one-time purchases. Include every outgoing payment — even the smaller ones.

Account for taxes and savings. Add estimated tax payments, savings transfers, and scheduled deposits into savings accounts. These amounts impact how much cash is truly on hand.

Include loan and credit repayments. Factor in loan payments, credit lines, or any scheduled personal loan repayments. These commitments reduce free cash flow and affect solvency.

Use sliders or dropdowns for variables. Tools like this often let you adjust for interest rate changes or delayed income, like unpaid invoices. This lets you model different risk levels or economic shifts.

Review your output. Once your info is in, the tool calculates net cash (income minus expenses) and your projected total cash for the period. If that number is negative, it's time to rework spending or income strategies.

Why it matters: 45% of small business owners skip their own paychecks when money gets tight. This tool helps prevent that by revealing liquidity problems before they escalate.

Income Inputs: What To Include

Enter all predictable and passive income sources. This includes:

Sales revenue from goods or services

Rental income from property or equipment

Investment income, such as dividends or interest

Government aid, like grants or tax credits

Additional inflows, like child support or social security, if they're relevant to the business owner's budget

Avoid underestimating irregular income — it's better to list it and plan around variability.

Expense Inputs: What To Include

Break down your costs into two buckets — fixed and variable:

Fixed costs: Payroll, rent, subscriptions, and insurance

Variable costs: Utilities, inventory purchases, credit card fees, and seasonal marketing spend

Loan obligations: Include mortgage payment, recurring loan payments, and scheduled personal loan deductions

Taxes and reserves: Don't forget to add property taxes, annual license fees, or monthly savings targets

Being comprehensive here gives you the most accurate snapshot of how money leaves your business.

Interpreting Your Cash Flow Results

Once you've filled out the calculator, you'll receive a breakdown of net cash, total cash, and monthly performance. But what do those numbers actually tell you?

Positive cash flow means your business brings in more than it spends. You're in a healthy position to reinvest, hire, or build reserves.

Negative cash flow signals that outflows exceed inflows — a warning sign that can lead to missed payroll or late bills if left unchecked.

Break-even cash flow occurs when the money coming in matches the money going out. While stable, there's no cushion for unexpected expenses.

These results matter: 82% of small businesses fail due to cash flow issues.

Use the calculator output to spot trends, like chronic overspending or seasonal slowdowns. For example, if your net cash is consistently low in Q1, you may need to adjust payment terms or cut nonessential costs. If your total cash is high, that might be the right time to invest in growth initiatives or prepay debt.

This tool isn't just about reporting — it's a diagnostic that helps you improve cash flow with calculator insights and make better decisions moving forward.

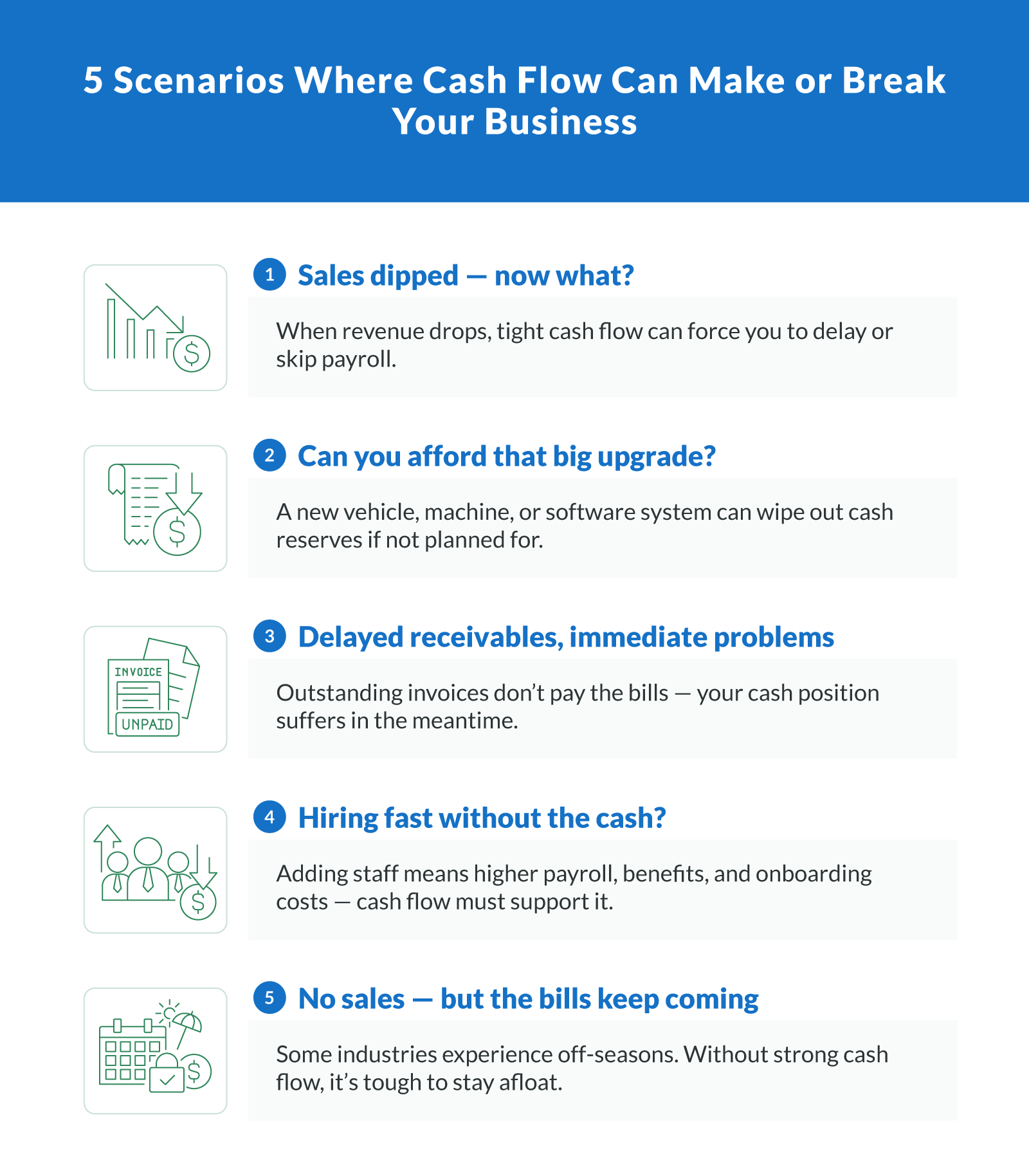

Advanced Scenarios and Forecasting With the Calculator

Your cash flow doesn't always follow a predictable pattern, especially in today's economy. That's why our tool is designed to help you model different business scenarios and prepare for fluctuations in real time.

Here's how to use it for forward-looking planning:

Seasonal shifts. Use past data to adjust income during slower months or peak seasons.

Team expansion. Adding staff? Factor in increased payroll, benefits, and onboarding expenses to see how it affects your cash position.

Large purchases or upgrades. Enter one-time equipment or inventory costs to preview the dip in cash flow from operations.

Revenue jumps. Planning a new service or product line? Estimate the increase in future cash flows and weigh it against added costs.

Adjust the calculator's fields to reflect new income, variable expenses, or changes in your rate of return on savings and investments. You can also include distributions or new revenue sources to see the long-term impact.

Thinking ahead helps small business owners avoid surprises and pivot quickly, starting with having the correct numbers in front of them.

FAQ About Using a Cash Flow Calculator

Have questions about how to get the most out of your results? Here are some answers to common small business cash flow concerns.

What Is a Cash Flow Statement, and How Does It Differ From a Cash Flow Calculator?

A cash flow statement shows your actual cash movement over a specific period — what came in, what went out, and your ending balance. A cash flow calculator, on the other hand, is a planning tool. It helps you estimate your future cash inflows and outflows to project your net cash on hand.

How Do I Use Financial Calculators Like This To Make Better Business Decisions?

Financial calculators help small business owners visualize their current and future financial position. By adjusting inputs like accounts payable, upcoming expenses, or revenue sources, you can simulate how those changes impact your net cash. It's a quick way to test strategies before you act.

How Can a Lender Use My Cash Flow Data?

A lender may look at your cash flow to determine your creditworthiness for products like a line of credit. Steady, positive cash flow shows that you can manage debt and cover new obligations.

What Role Does a Line of Credit Play in Managing Cash Flow?

A line of credit can help smooth over short-term gaps when expenses exceed revenue. It's especially useful during seasonal lulls or unexpected delays in accounts receivable.

What if My Business Consistently Shows Negative Cash Flow?

Consistent negative cash flow signals a deeper issue. You may be spending more than you're earning or not collecting payments quickly enough. The calculator can help you pinpoint the shortfall — whether in late invoices, excessive payables, or underperforming revenue streams.

Empower Your Business With Real-Time Financial Insights

Cash flow is the heartbeat of any small business. If you're not tracking it, you're flying blind. Our free cash flow calculator gives you the clarity you need to understand how money moves through your business, helping you stay ahead of expenses, plan for growth, and improve your overall financial health.

This tool was built for busy business owners. Whether you're evaluating a new investment, adjusting your personal finance goals, or simply trying to make payroll without stress, the calculator makes it easy to spot gaps and fix them fast.

Use the free calculator now and take the first step toward financial clarity in 2025. Need help managing cash flow or exploring funding options? Clarify Capital is here to support your next move.

Bryan Gerson

Co-founder, Clarify

Bryan has personally arranged over $900 million in funding for businesses across trucking, restaurants, retail, construction, and healthcare. Since graduating from the University of Arizona in 2011, Bryan has spent his entire career in alternative finance, helping business owners secure capital when traditional banks turn them away. He specializes in bad credit funding, no doc lending, invoice factoring, and working capital solutions. More about the Clarify team →

Related Posts